- At the time of writing, Cardano had a bullish long-term outlook

- Past month’s range formation offered swing traders plenty of opportunities

Cardano [ADA] saw high lower timeframe volatility over the past couple of days. The psychological resistance level at $1 lined up well with the range formation ADA has traded within for a month.

The rejection from this resistance zone meant that a price dip would be likely in the coming days. And yet, it could offer a buying opportunity for those with bullish conviction.

Multiple timeframe analysis outlines key Cardano levels to buy and sell at

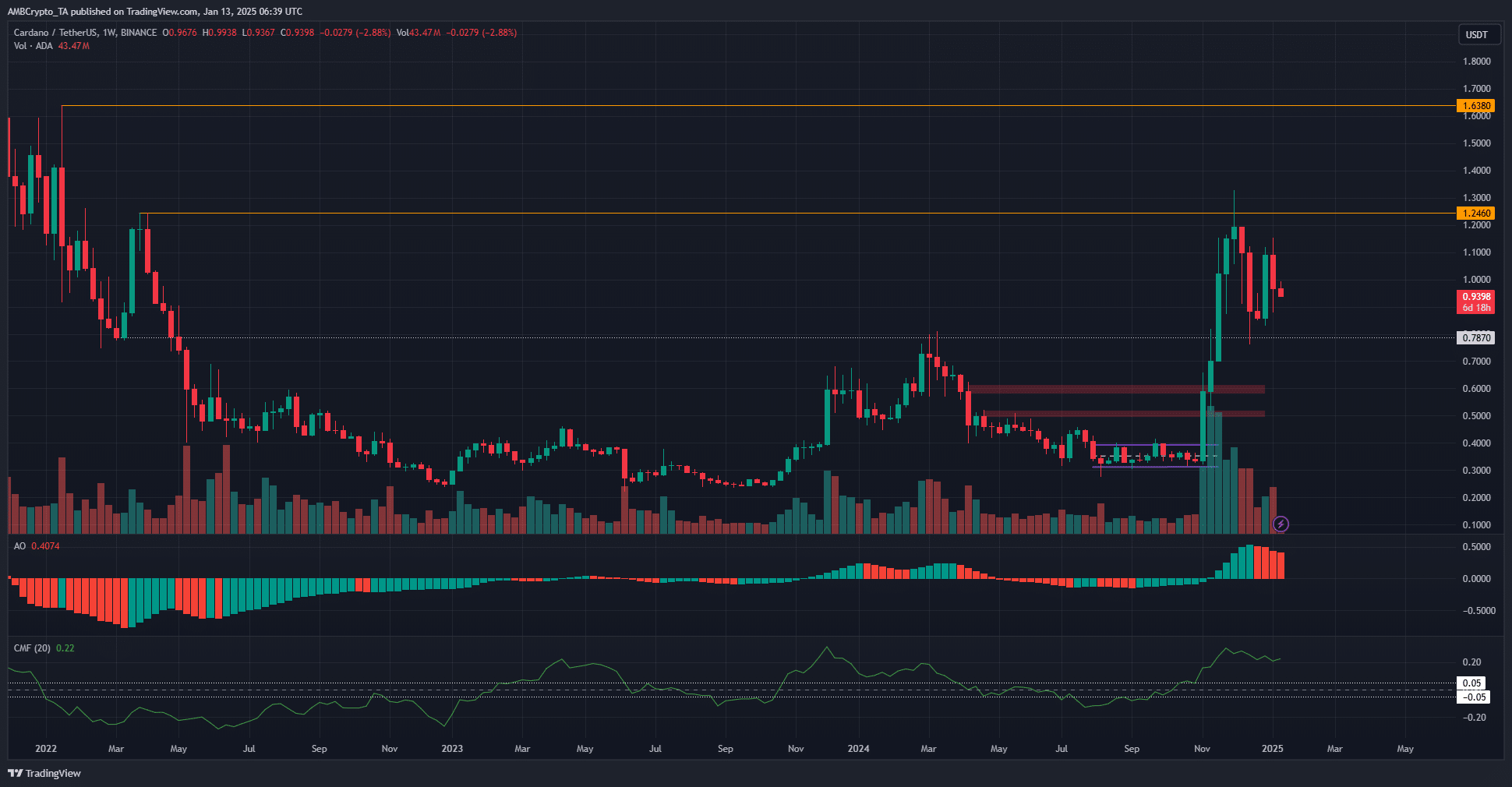

Source: ADA/USDT on TradingView

The weekly timeframe revealed a strongly bullish outlook for Cardano. The resistance at $0.787 had been breached and retested as support. At press time, the $1-area presented a challenge to the buyers.

In January 2022, the $1.04-$1.14 area formed a local resistance, as did the $1.246-level. In the coming weeks, these would be key resistance areas for ADA bulls. However, the momentum was on their side, based on the Awesome Oscillator readings. The CMF also highlighted significant capital inflows in recent weeks.

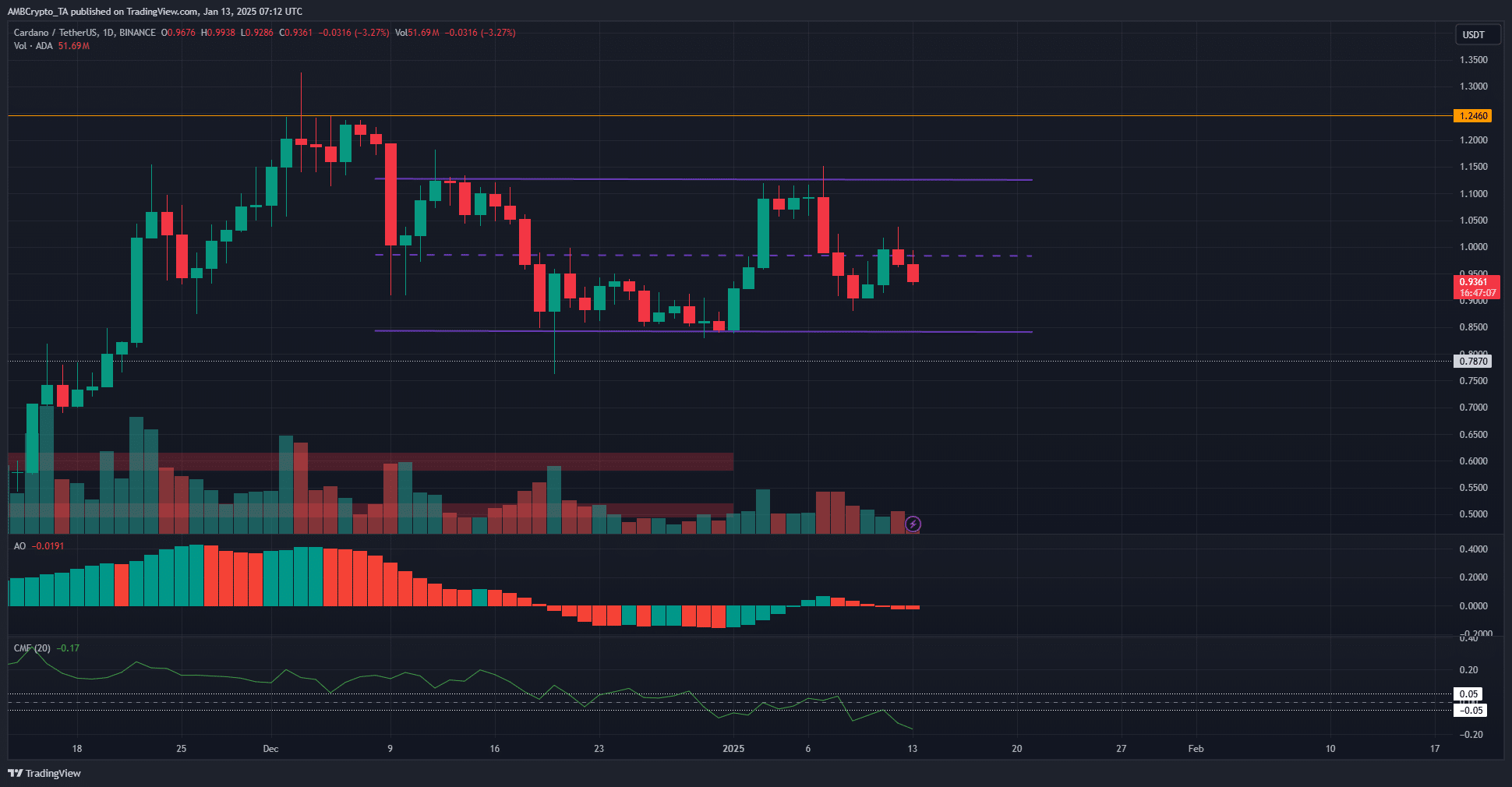

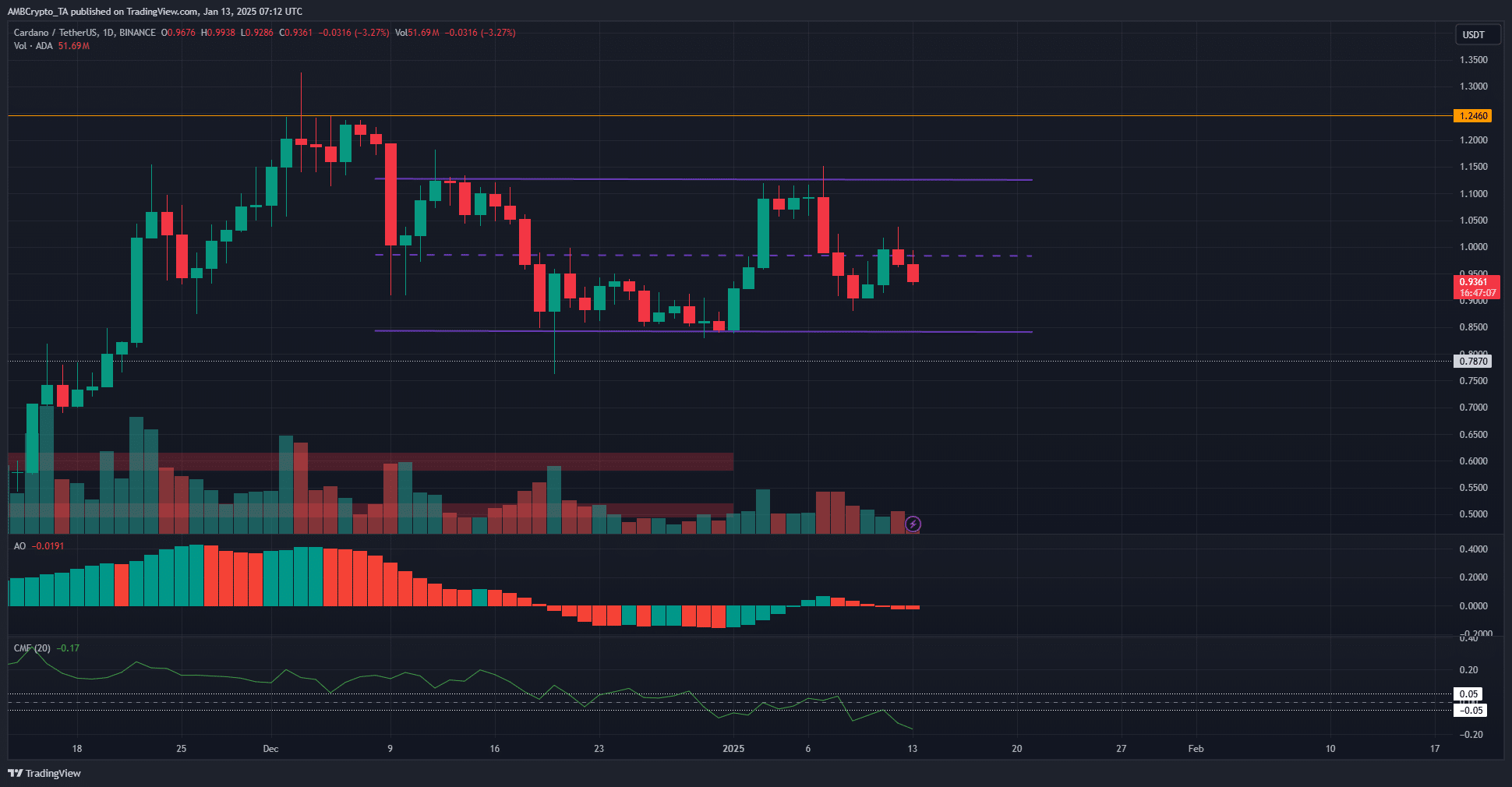

Source: ADA/USDT on TradingView

On the daily timeframe, a range formation was spotted. Highlighted in purple, it extended from $0.84 to $1.12, with the mid-range level at $0.98. The mid-range level has served as both support and resistance over the past six weeks, which made the range formation more credible.

Below the range lows was the higher timeframe support at $0.787. Due to Cardano’s rejection at the mid-range level in recent days, a move towards $0.84 and as deep as $0.78 would be possible in the coming days.

The CMF on the daily was at -0.17, highlighting intense selling pressure. The Awesome Oscillator also formed a bearish crossover. Together, they supported the idea that a move to the range lows was imminent.

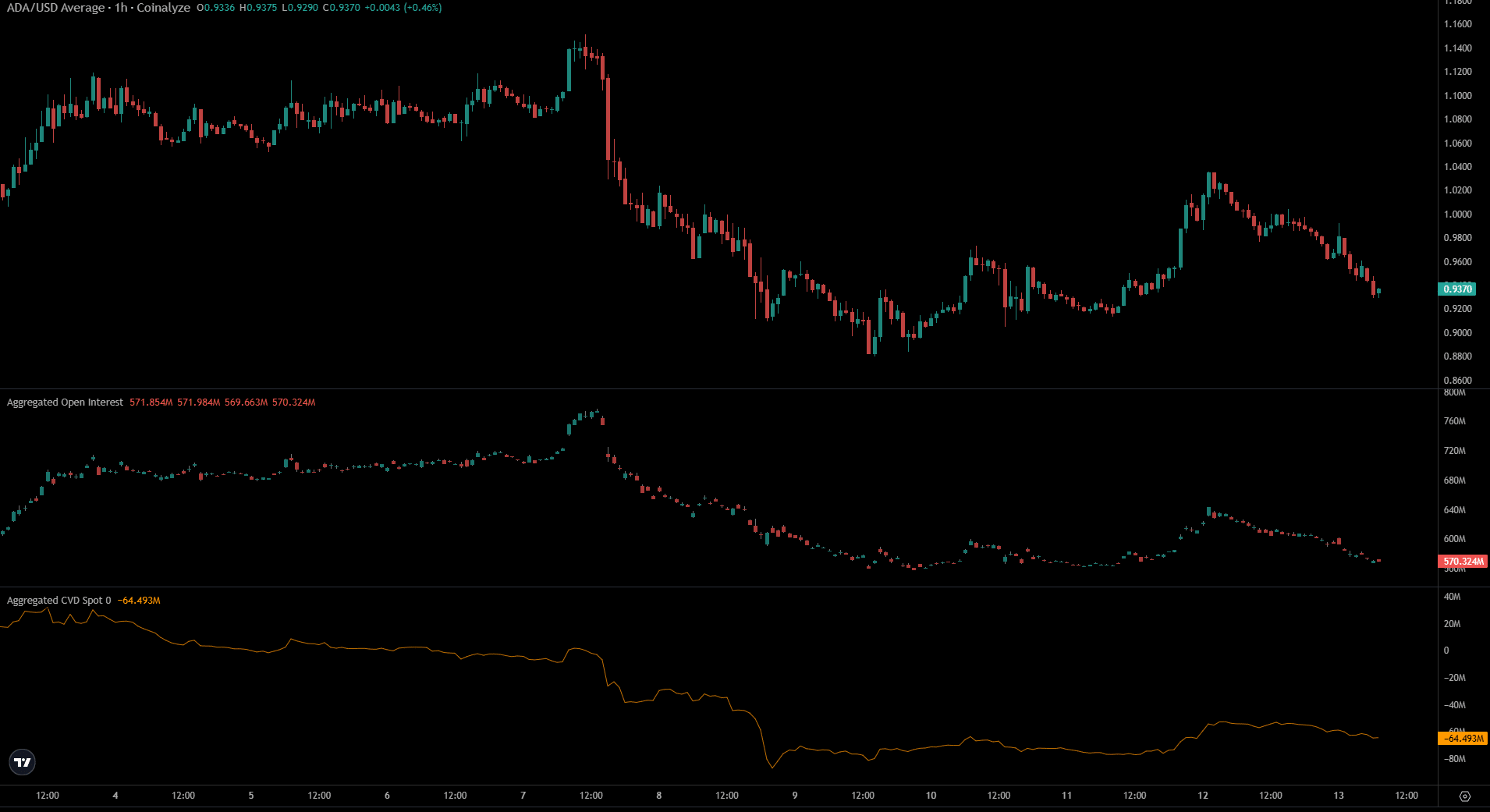

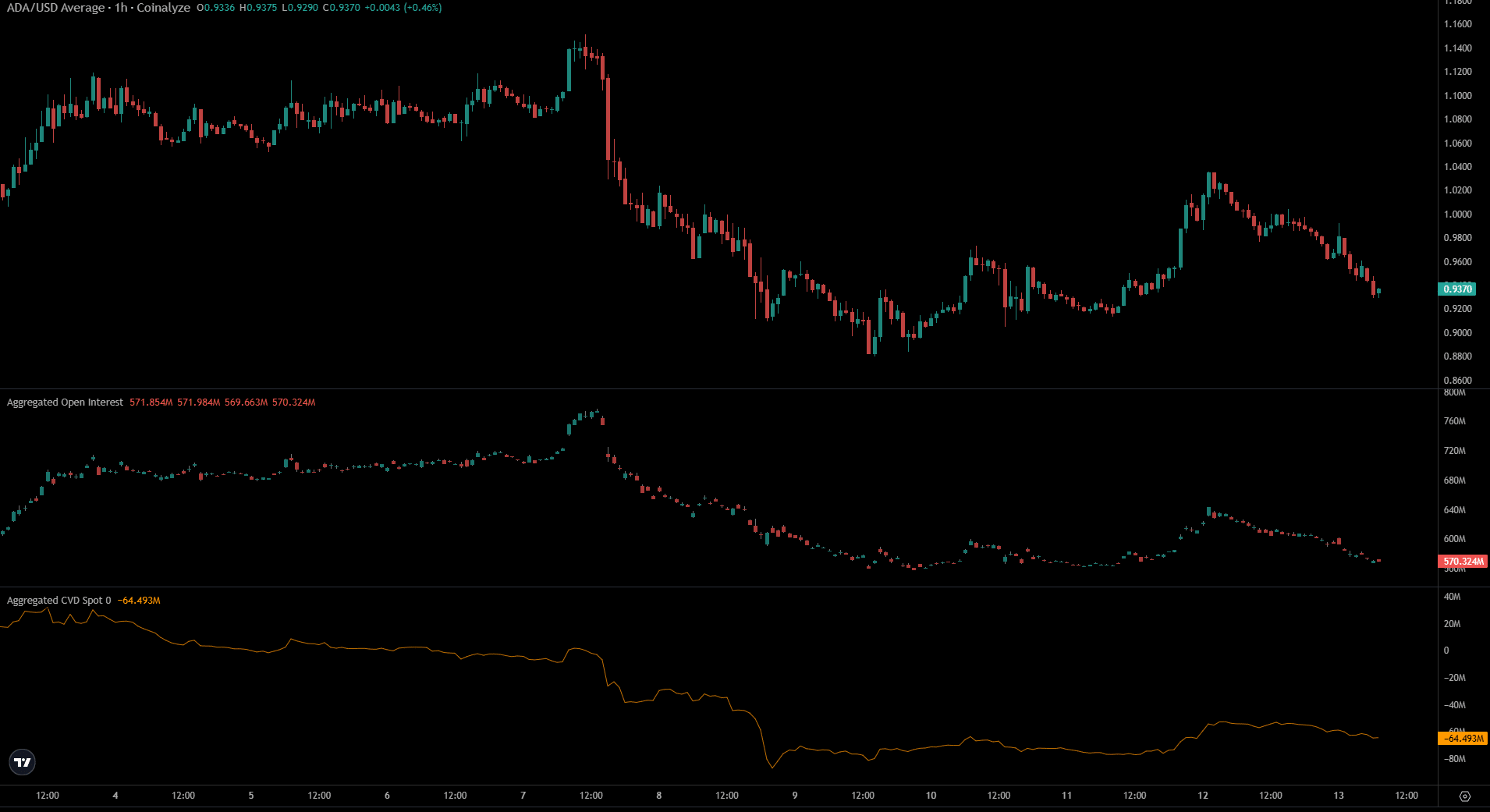

Source: Coinalyze

Zooming in to the lower timeframes, AMBCrypto observed that the short-term sentiment was bearish. The Open Interest has steadily slid lower over the past 36 hours too. This reflected wariness in the speculative markets. The spot CVD also moved lower slightly, but picked up from the past week.

Read Cardano’s [ADA] Price Prediction 2025-26

Overall, the higher timeframes meant that investors shouldn’t be shaken out by the lower timeframe volatility. A drop to $0.84 or lower would likely present a good buying opportunity. Over the next few months, a push past $1.246 would be a signal of another strong price move for Cardano.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion