- ADA has dropped 9% in the last seven days.

- Major whales have accumulated despite the drop.

Cardano [ADA] has had a turbulent week, losing over 9% of its value amidst broader market bearishness and a lack of significant catalysts. Despite this decline, an intriguing development has surfaced: whale accumulation is rising.

This raises a critical question—could large investors be laying the groundwork for a price rebound?

Price performance and technical analysis

Cardano’s price performance has faced significant challenges over the past week. After multiple failed attempts to break through the $1.12 resistance level, the token now trades at $1.10, reflecting a marked decline.

Source: TradingView

Technical indicators show a more nuanced picture. The Relative Strength Index (RSI) is at 58.66, indicating a neutral position that suggests potential momentum if buying pressure increases.

Furthermore, ADA remains above its 200-day moving average, around $0.77. Historically, this level has acted as a critical floor for bullish momentum.

ADA recently formed a golden cross, where the 50-day moving average crossed above the 200-day moving average. However, the failure to break resistance at $1.12 raises questions about whether the token can sustain upward movement in the short term.

Cardano whale accumulation: A potential contrarian signal?

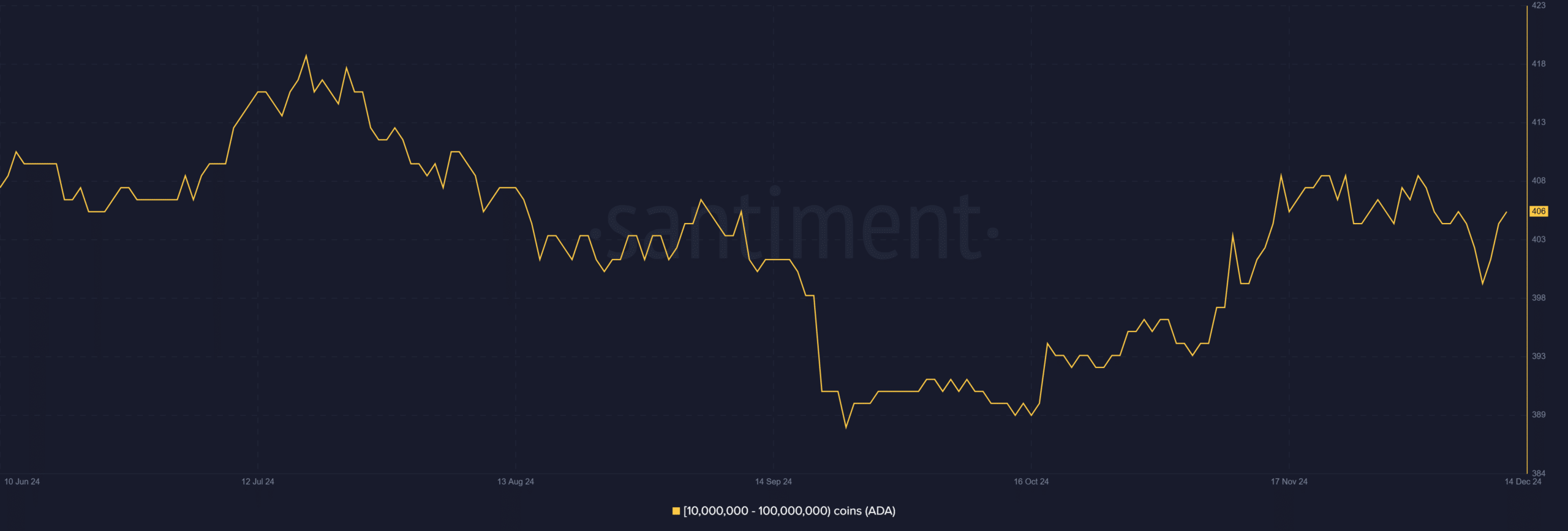

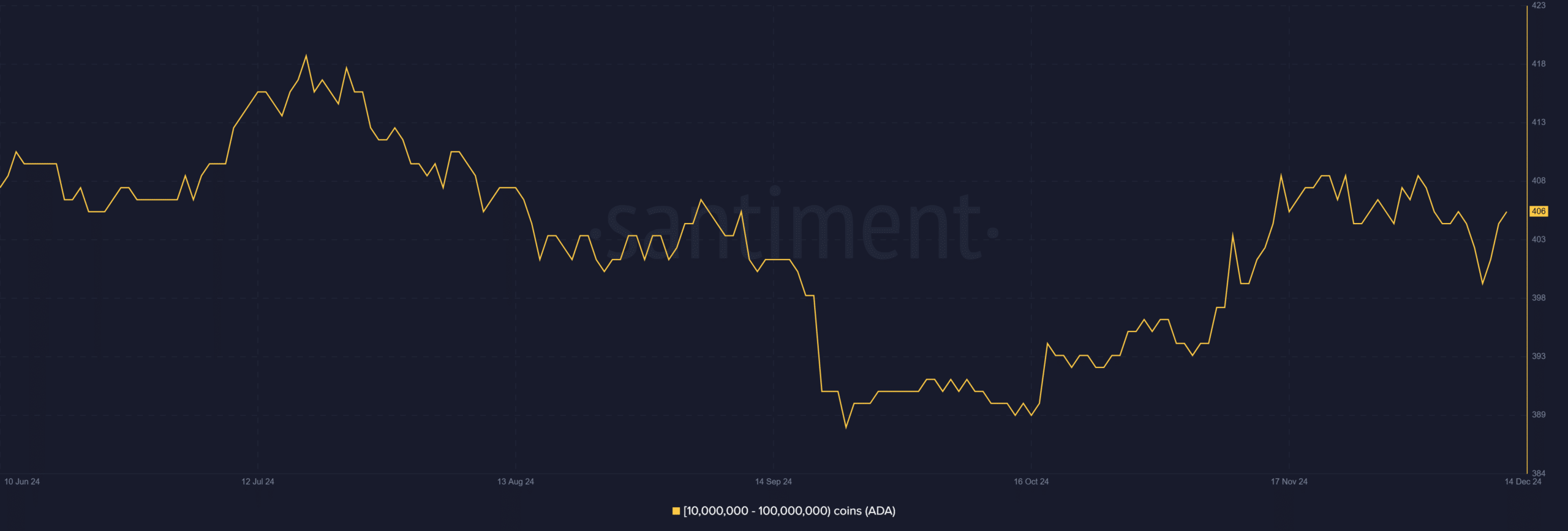

While price trends have been underwhelming, on-chain data reveals a different story. Whale accumulation has surged recently, with wallets holding between 10 million and 100 million Cardano significantly increasing their balances.

Source: Santiment

According to Santiment, these large holders now account for one of the highest accumulation levels in recent months.

Such behavior is often interpreted as a bullish signal, as whales typically accumulate during perceived market lows in anticipation of future price gains. Their actions suggest confidence in ADA’s long-term potential, even as short-term price dynamics remain bearish.

Active address trends and retail sentiment

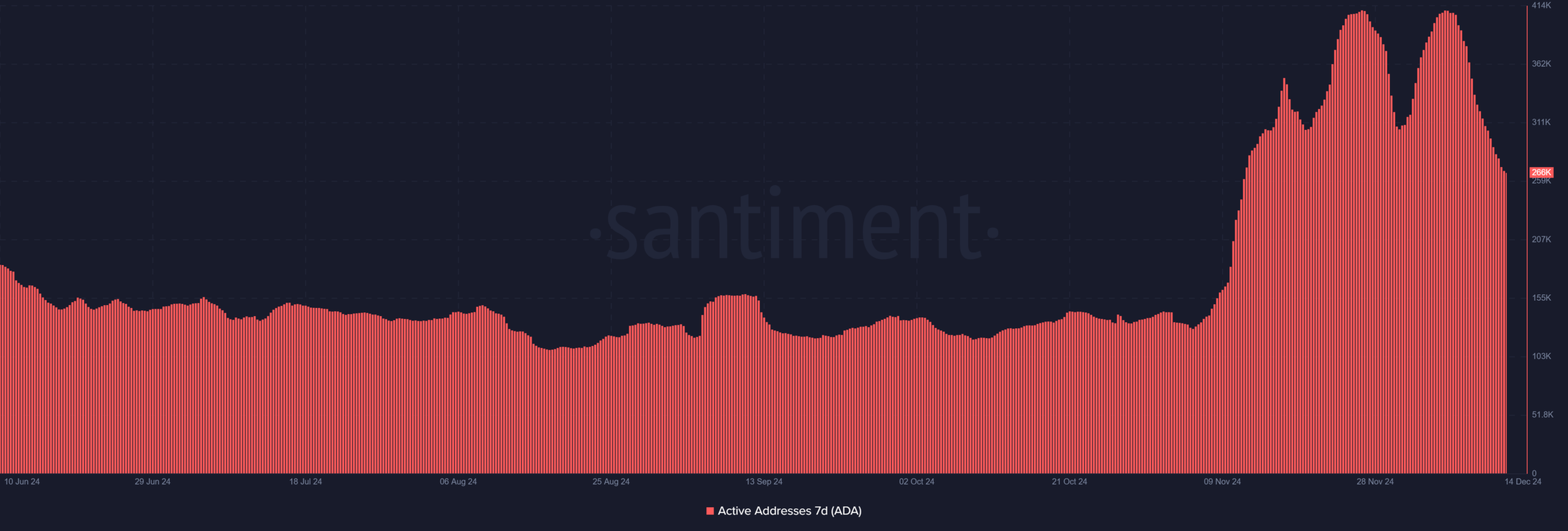

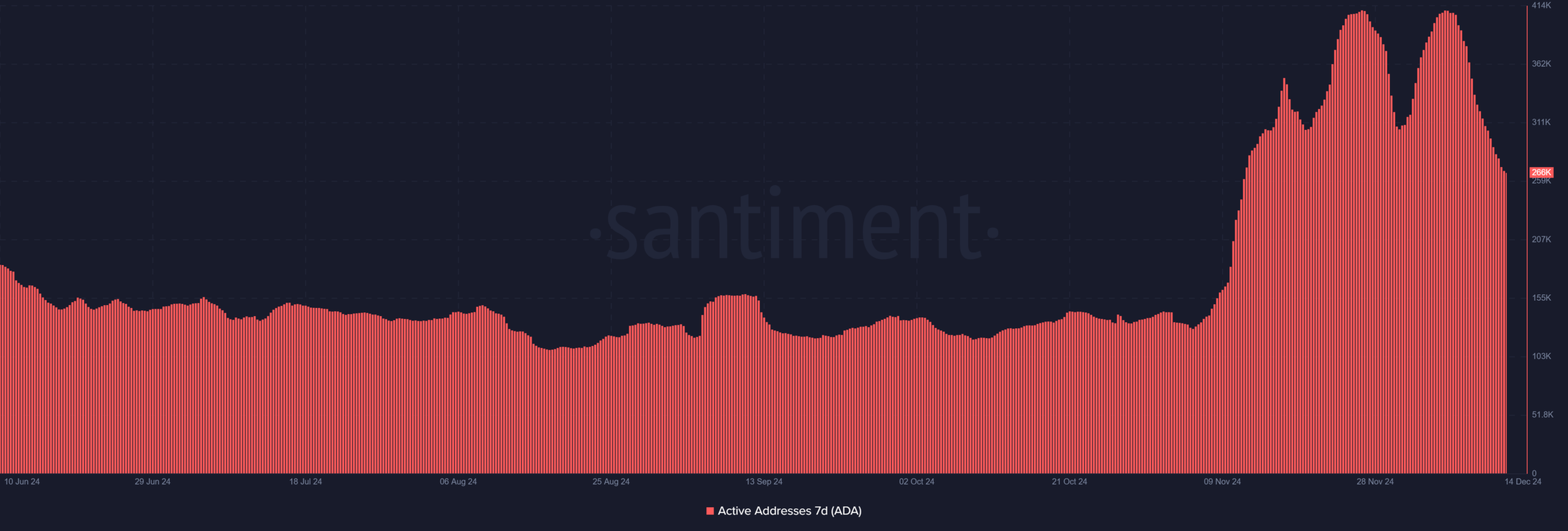

In contrast to whale activity, retail engagement is declining. The seven-day active address count spiked significantly in late November and has since fallen to approximately 266,000.

This decline indicates reduced activity from smaller investors, who have historically played a vital role in ADA’s price surges.

Source: Santiment

The divergence between growing whale accumulation and shrinking retail participation highlights an important shift in market dynamics. Whales may be positioning themselves for a potential recovery, while retail investors remain cautious amid broader market uncertainty.

What next for ADA?

Cardano’s current situation is a delicate balance between conflicting signals. On one hand, sustained whale accumulation could eventually spark a price rebound, especially if retail interest resurges.

In this case, ADA could break through the $1.12 resistance level and potentially target $1.20 or higher.

On the other hand, continued lack of retail engagement and further rejections at key resistance levels might result in deeper losses. If bearish pressure persists, ADA could test the next major support level around $0.90, a historically significant zone.

– Realistic or not, here’s ADA market cap in BTC’s terms

ADA’s performance over the past week reflects a market at a crossroads. While the token’s decline underscores the challenges of broader bearish conditions, the steady increase in whale holdings provides a glimmer of hope for a potential reversal.

Whether ADA is on the brink of a rebound or faces further corrections depends on how these factors play out in the coming days.