- Wormhole’s breakout and retest at $0.277 set the stage for a potential rally.

- Market sentiment strengthened as Open Interest rose, despite mixed technical signals.

Wormhole [W] has shown remarkable resilience, breaking out of its extended downtrend and retesting $0.277 as a solid support level.

This bullish confirmation has set the stage for potential upside, with Wormhole now targeting a critical resistance at $0.362. At press time, Wormhole was trading at $0.3197, reflecting a 2.64% dip in the last 24 hours.

However, the overall sentiment remained optimistic as traders focused on whether Wormhole can breach this resistance and aim for higher levels like $1.0084.

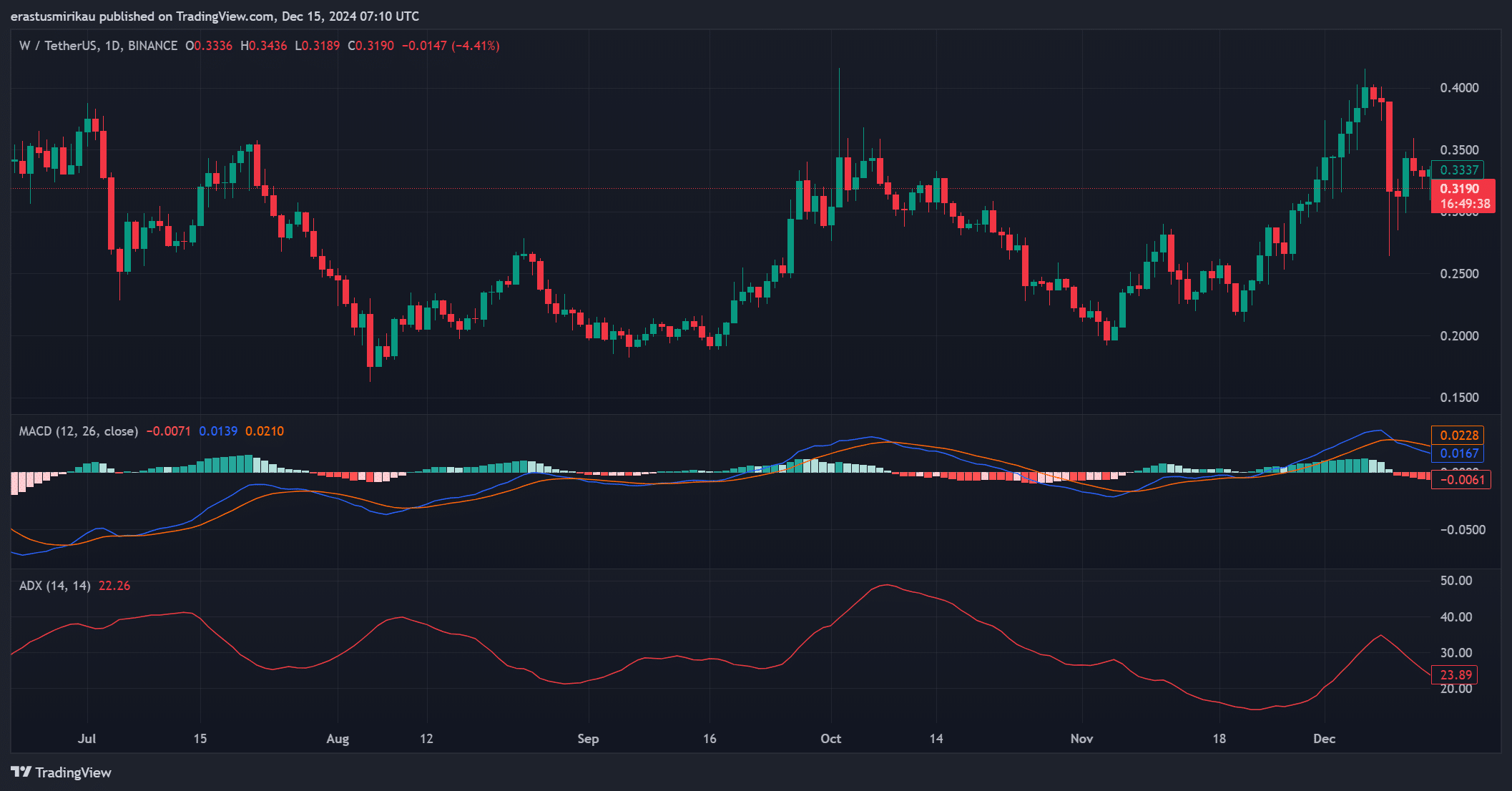

Wormhole price movement and key resistance

Wormhole’s price action highlighted its potential for further bullish momentum. The breakout above the descending trendline, followed by a successful retest at $0.277, underscored growing confidence among investors.

However, the $0.362 resistance is a key hurdle that must be cleared to confirm the rally’s strength. Surpassing this level could open the path toward the $1.0084 target, which aligns with its next significant resistance zone.

On the other hand, failure to break above $0.362 could result in consolidation, with $0.277 continuing to act as a pivotal support.

Therefore, the next sessions are critical in determining whether $W will extend its gains or retrace to retest its support levels.

Source: TradingView

What do technical indicators suggest?

The technical indicators present a mixed outlook. The MACD revealed a mild bearish divergence as the MACD line falls below the signal line, indicating a potential slowdown in momentum.

However, the ADX read 22.26, suggesting moderate trend strength.

Therefore, if Wormhole successfully breaks above $0.362, it could reinvigorate the uptrend and push the ADX higher, confirming stronger momentum in the rally.

Source: TradingView

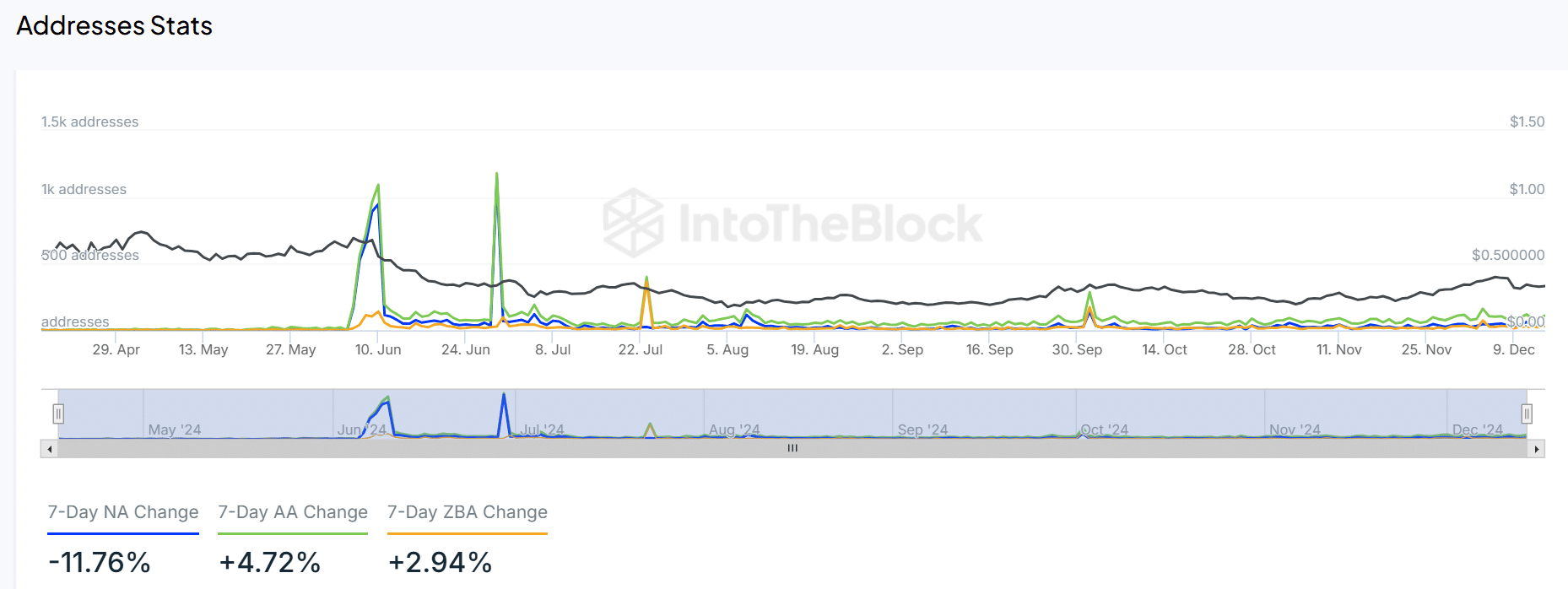

Wormhole address stats and network engagement

On-chain data provides additional insights into Wormhole’s activity. Active addresses have risen by 4.72% over the past week, reflecting steady engagement among existing users.

However, new addresses have dropped by 11.76%, signaling challenges in attracting fresh participants to the network.

Therefore, while the current community remains active, expanding engagement is vital for sustaining long-term growth.

Source: IntoTheBlock

Liquidation data and market sentiment

Liquidation data indicates a positive sentiment among traders, according to Coinglass analytics. Long liquidations amounted to $42.17K compared to $34.59K in shorts, demonstrating optimism about Wormhole’s recovery.

Furthermore, Open Interest has risen by 5.97% to $70.62M, signaling increased market activity and the potential for higher volatility in the near term.

Source: Coinglass

Wormhole can sustain its breakout and aim for $1.0084, but clearing $0.362 is crucial for confirming its bullish momentum.

Is your portfolio green? Check out the W Profit Calculator

A decisive break above this resistance would solidify trader confidence and pave the way for significant price expansion.

However, failure to surpass this level could lead to sideways movement or a retest of $0.277, which remains a key support.