- Monero’s focus on privacy — a double-edged sword — has been its greatest strength and deterrent to price appreciation

- XMR has shown resilience in the spot market despite recent delisting from major exchanges

The prices of most cryptocurrencies pulled back late on Tuesday, led by Bitcoin (BTC), which slipped below $59,000. Ethereum (ETH) posted more pronounced losses though, crashing below $2,500 by daily close. The market remained red 24 hours later, even as most cryptocurrencies attempted to find stability after the unexpected sell-off.

Toncoin (TON), for instance, was changing hands slightly higher on Wednesday than its price on 27 August. However, it remained subdued from the massive slide triggered by news of the arrest of Telegram’s founder – Pavel Durov.

Besides Toncoin, however, the tech founder’s arrest has put a spotlight on privacy-focused crypto projects. Particularly those that emphasize anonymity and security like Monero (XMR).

Can Monero (XMR) benefit from the social buzz?

Monero has undergone several network upgrades to enhance the network’s efficiency and improve privacy. However, these milestones have not translated into any decent price gains.

XMR’s price action has been relatively stagnant, with low trading volumes reported on major exchanges – A sign of reduced investor interest.

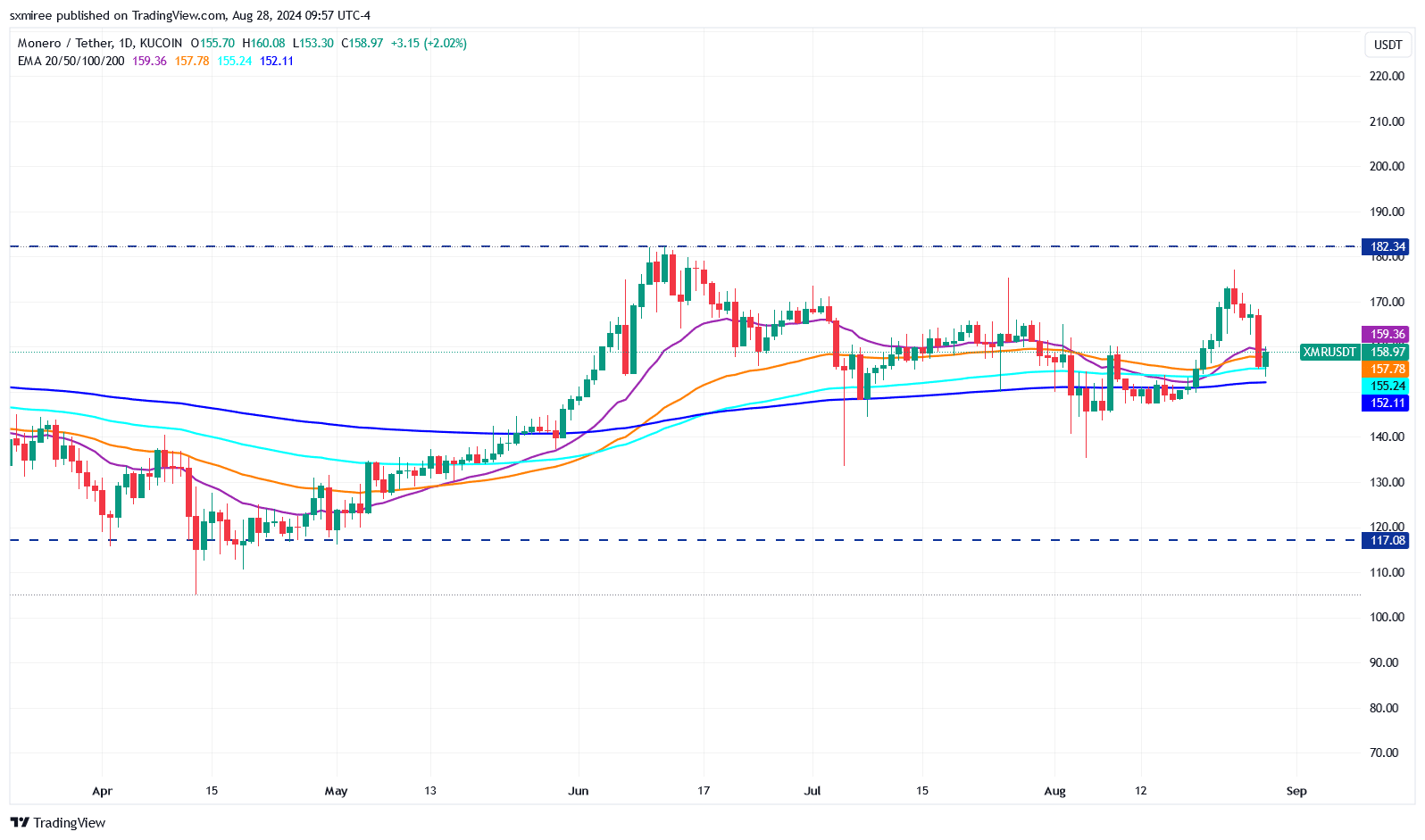

Source: TradingView

Over the last four months, Moreno’s (XMR) price has been muted between $117 and $182, failing to break out significantly despite sector-wide market rallies. This can be confirmed by the XMR/USDT 200-day simple and exponential moving averages trending on a fairly straight line over this period.

XMR was, at the time of writing, hovering above the 20-, 50- and 100-day EMAs, confirming strength around its prevailing price range.

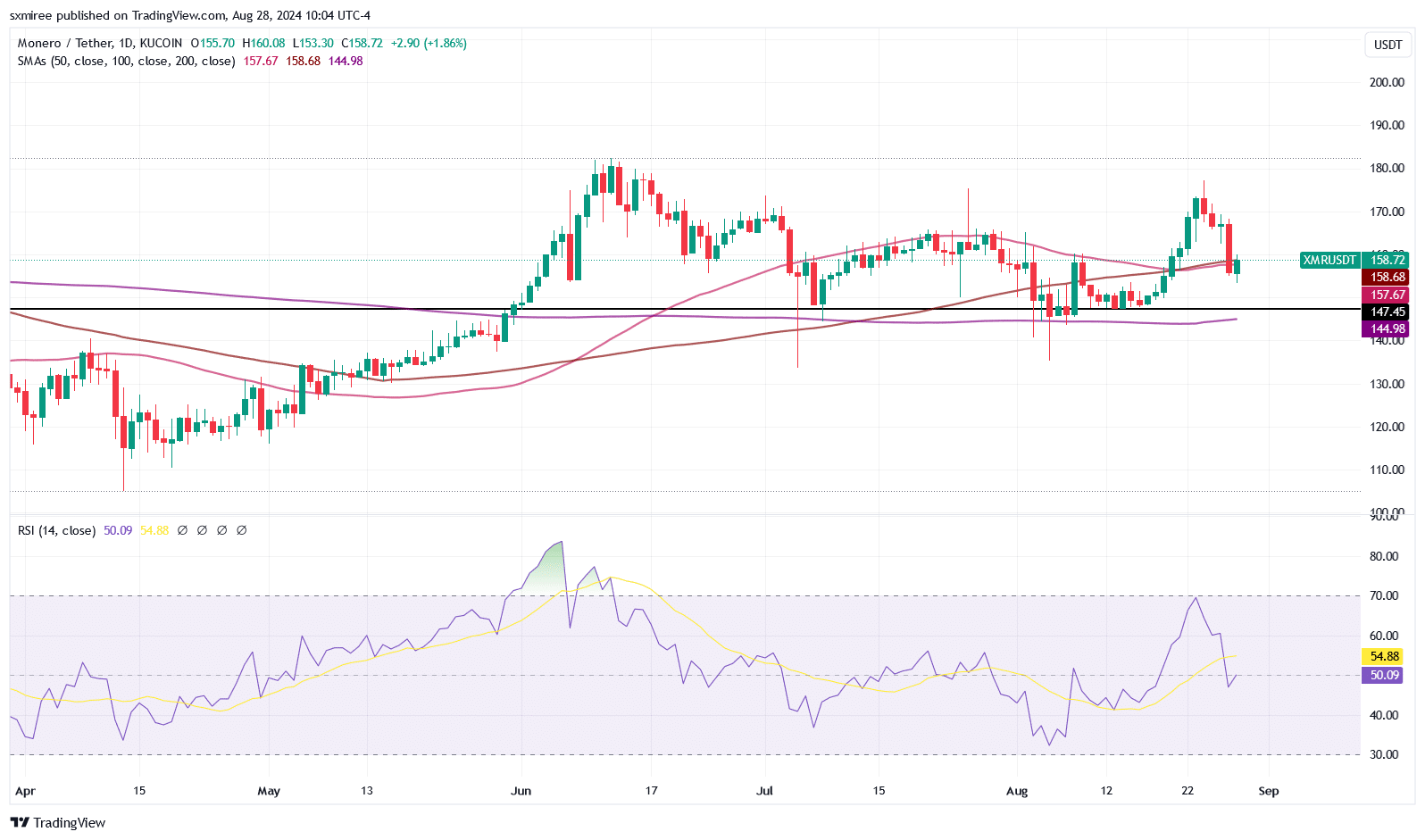

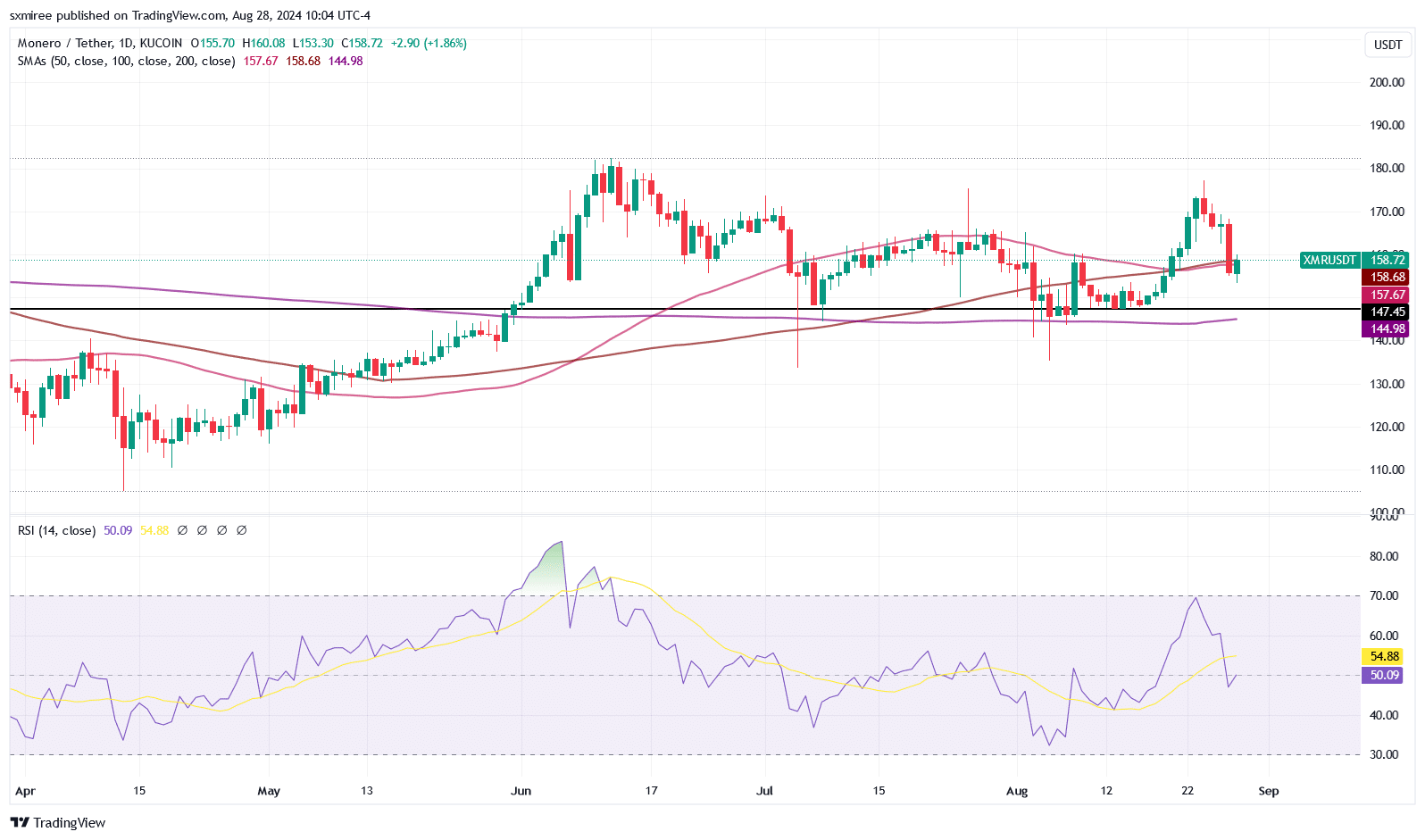

Source: TradingView

The pair, however, risks a slide to lows of around $147 in the near term if XMR drops below its 50- and 100-day SMAs on the daily chart.

Hurdles outside the market

Despite its unique proposition, XMR has faced several challenges in the market, struggling to gain value and mainstream acceptance.

For starters, Monero’s privacy features, which allow users to obscure transaction details, have drawn the attention of regulatory authorities around the world. Several exchanges and centralized platforms, including Bittrex and ShapeShift, have removed XMR from their listings in recent years. This, thanks to anti-money laundering (AML) and know-your-customer (KYC) compliance issues.

In February, Binance announced it would be delisting XMR and has been finalizing the move this month. Kraken also issued a notice in June communicating the delisting of XMR in Ireland and Belgium. These setbacks have limited XMR’s availability and liquidity on major trading platforms, hampering its price growth.

Monero’s utility has also been its Achilles Heel, hindering broader adoption. Its association with illicit activities has negatively affected its reputation, resulting in weakened appeal among institutional players and mainstream users.

Is Monero (XMR) still worth exploring?

While the recent focus on privacy could renew interest in Monero (XMR), hurdles remain in navigating regulatory landscapes, increasing adoption, and altering market perception.

Still, Moreno (XMR) has displayed resilience by recovering from delisting blows this year. This unyielding relentlessness and upcoming ecosystem developments could still set it up for long-term success.