- At press time, token was trading off a major support level and had breached a descending trendline

- On-chain metrics indicated strong accumulation of SUI by traders, which could drive its price higher

SUI’s price charts pointed to an impressive performance over the past month, recording gains of 16.6%. At press time, SUI seemed to have entered another rally, climbing by 18.57%. This uptick drove its trading volume up by 93.54% to $1.1 billion.

The aforementioned uptick can be interpreted to be a sign of strong market interest. Also, it might allude to the potential for sustained upward momentum.

SUI presents bullish prospects

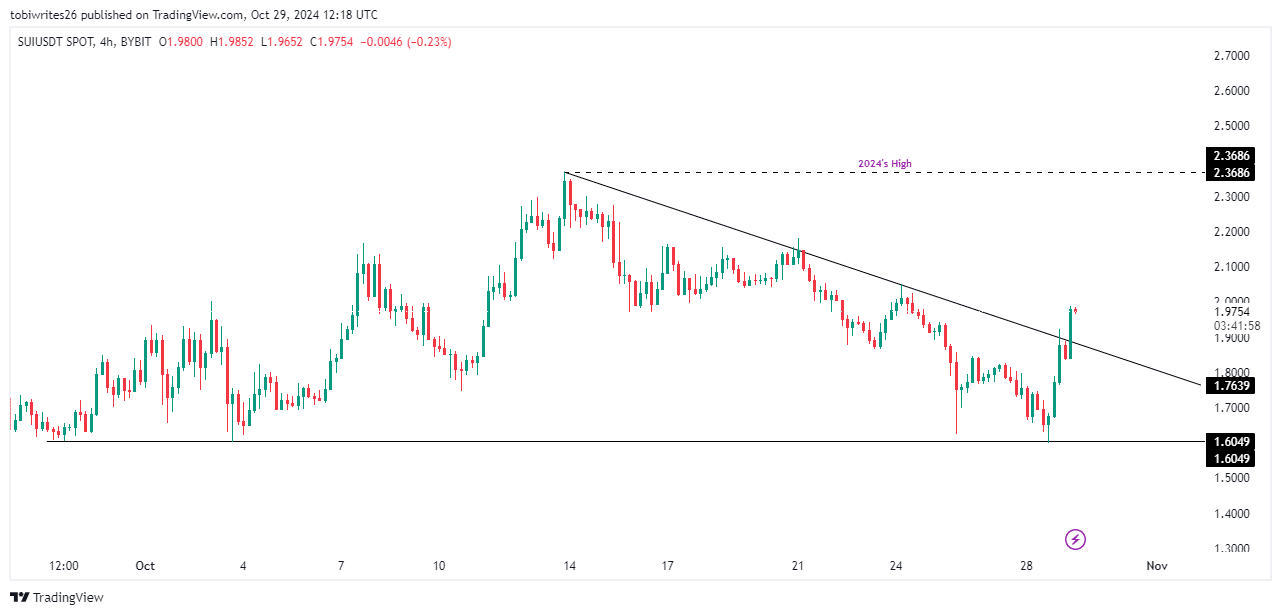

According to the 4-hour chart, SUI was in bullish territory at press time, as confirmed by a break above the descending trendline that began forming on 13 October. This rally was driven by a rebound from the support zone at $1.6049.

If the rally continues upwards, SUI could climb as high as $2.3686, marking its October high and the peak trading level for 2024.

Source: Trading View

However, if downward pressure resumes, SUI may retreat, potentially extending the descending trendline pattern.

Trader activity signals strong buy for SUI

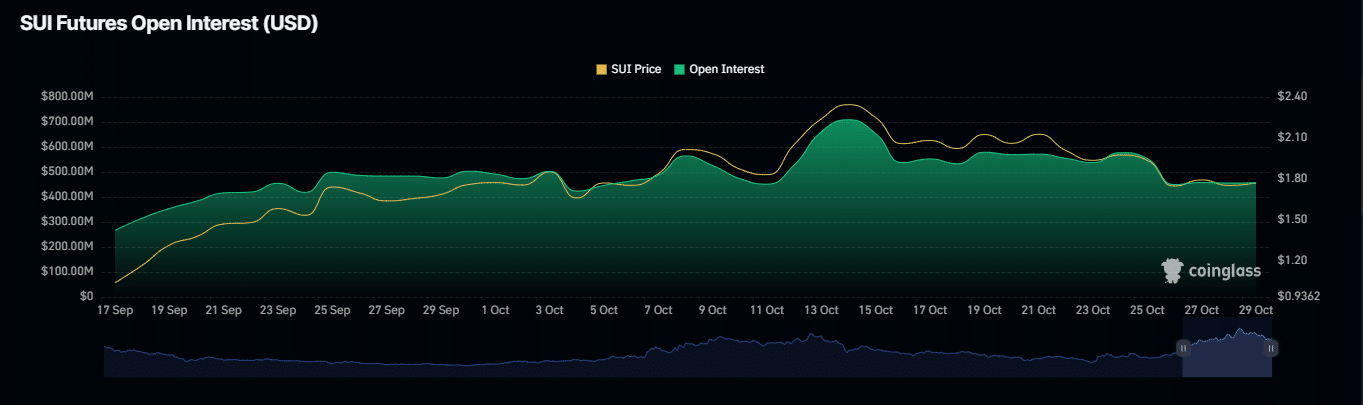

On-chain analysis by AMBCrypto indicated that SUI is likely to maintain its uptrend, with no imminent signs of a reversal. Data from Coinglass, including Open Interest and liquidation metrics, further supportED the potential for sustained upward movement.

Open Interest, which represents the total value of active Futures contracts, rose by 17.22% – Hitting $519.50 million. This hike pointed to high demand for long positions, reinforcing bullish sentiment and pointing to the potential for sustained price gains.

Additionally, over $4.14 million in SUI short positions were liquidated over the past 24 hours as the market moved against those betting on a price decline.

Source: Coinglass

The combination of rising Open Interest and short liquidations strongly suggested that SUI’s uptrend could see huge momentum in the next few trading sessions.

Liquidity flow’s findings

Finally, the Chaikin Money Flow (CMF) indicator, which tracks accumulation and distribution based on liquidity flow, implied ongoing accumulation for SUI.

With the CMF in the positive zone with a reading of 0.13, it indicated that SUI’s price may continue rising, potentially surpassing its 2024 high.