- Whale activity suggested growing confidence, as larger investors were mostly holding their positions.

- In contrast, retail investors may slow down the rally by selling off, which could delay further upward momentum.

Injective’s [INJ] bullish trend seems set to continue, with the asset gaining 49.15% in the past week and showing another 16.09% increase in the last 24 hours alone.

However, for INJ to reach the $53 target, the rally will require a significant short-term support level to stabilize against selling pressure from retail investors.

While some smaller holders lost confidence, whales remained optimistic. But for this confidence to translate into further gains, the market needs strong support in the short term.

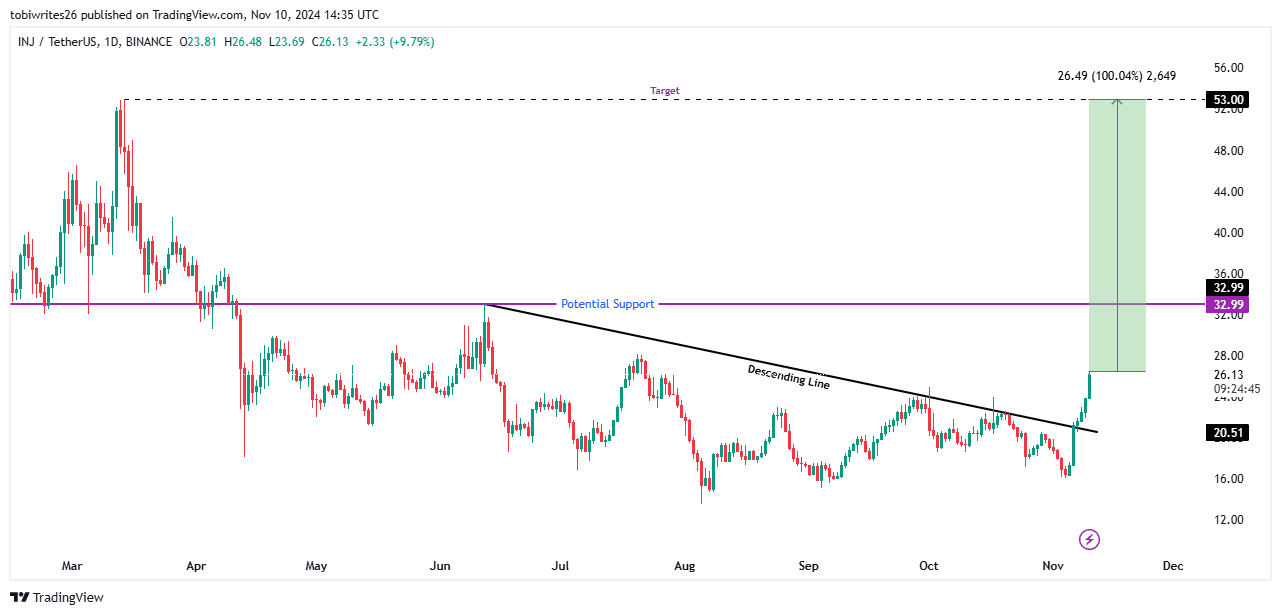

Injective: Roadmap to a 102% gain

At press time, INJ seemed positioned for a potential rally, with a path that could bring it back to its March 2024 high of $53.00.

The recent upswing follows INJ’s breakout above a descending trendline on the chart—a move that has typically led to price rallies.

This initial breakout could drive INJ to a peak of $32.99, marking a 25.3% gain from its current price.

If INJ can sustain trading above the $32.99 level as a new support, as it has in past rallies, the asset could see an additional increase, totaling a potential 100.04% gain.

Source: TradingView

This support level has previously acted as a strong rally catalyst and may enable INJ to target $53.00 once again.

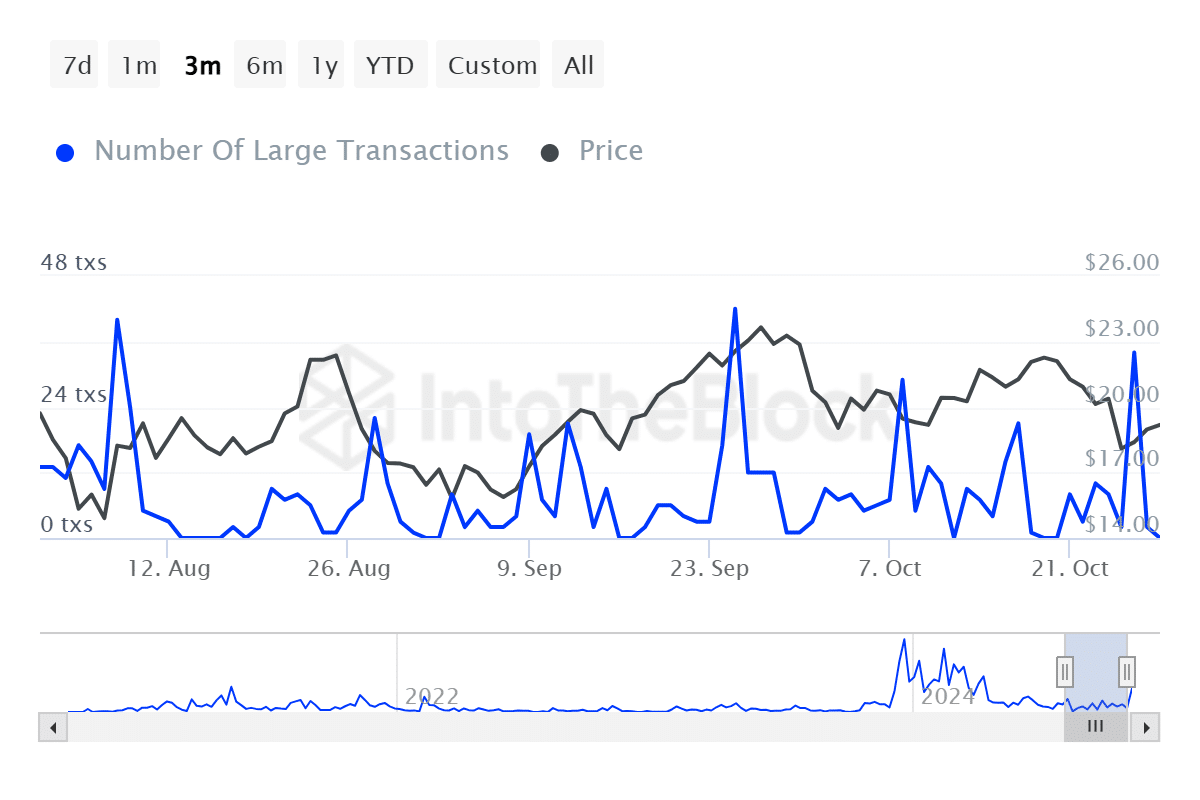

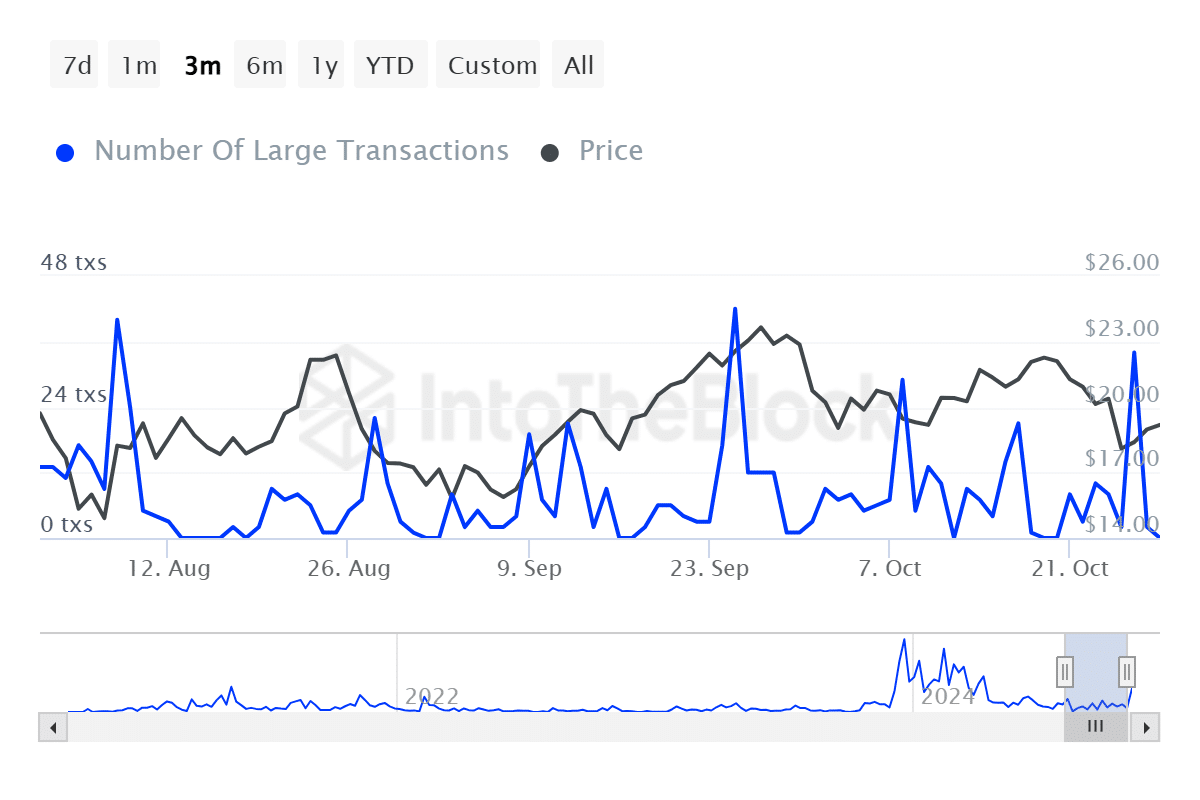

Whales pause selling as…

Whale activity has slowed, with large holders pausing their selling after a significant decline in sales activity that recently resulted in profit gains.

Whales—key players holding up to 1% of an asset’s total supply—have considerable influence on price trends.

A noticeable drop in large transactions typically signals that whales are holding, rather than selling, their positions.

Source: IntoTheBlock

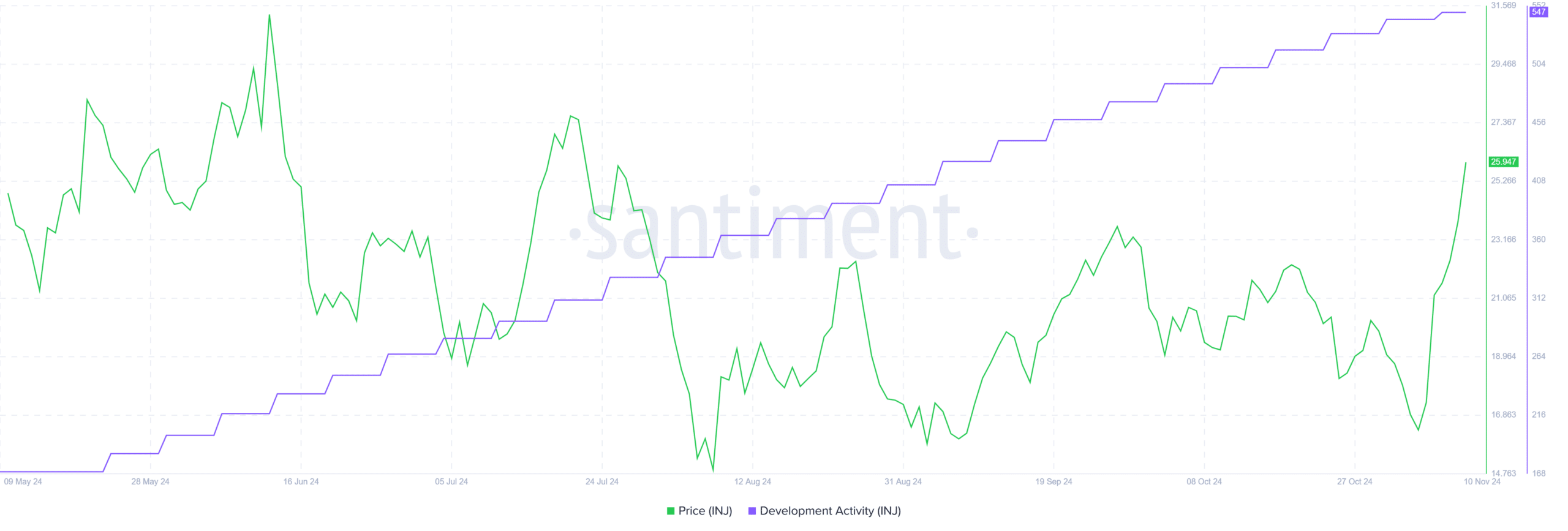

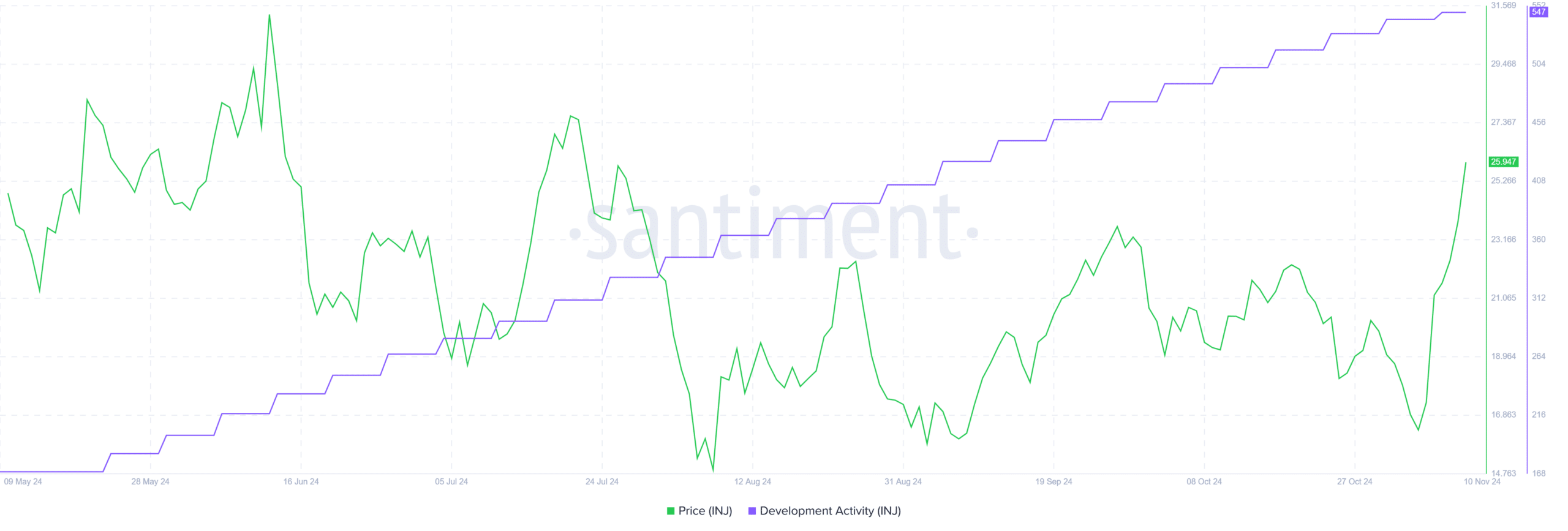

This shift appears tied to a recent surge in development activity, which has reached an all-time high at the time of writing.

Increased development efforts often boost asset sentiment, as they reflect active improvements within the ecosystem, potentially driving prices higher.

Source: Santiment

If both whale holding patterns and development activity maintain this upward momentum, INJ could reach a short-term target of $32, setting the stage for further gains.

Retail selling could delay INJ’s rally

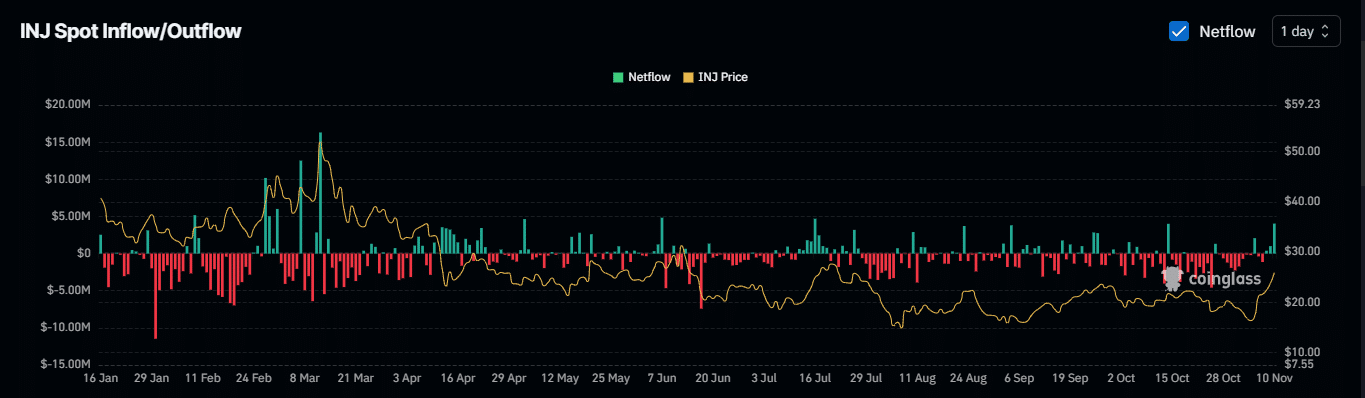

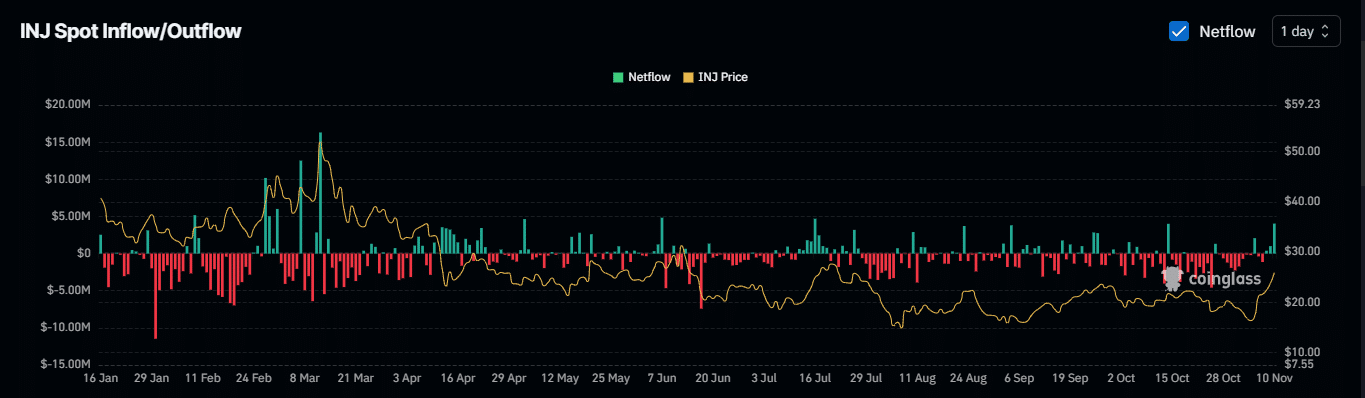

Data from Coinglass indicates increased selling activity among retail traders, reflected by a positive exchange Netflow.

In the last 24 hours, there has been a significant inflow of INJ into exchanges, surpassing outflows.

Read Injective’s [INJ] Price Prediction 2024–2025

This trend suggests that retail traders are starting to take profits, with over $4 million moved into exchanges for potential selling.

Source: Coinglass

If retail selling continues at this pace, it could slow down INJ’s rally momentum, potentially impacting its upward trajectory.