- BRETT’s price declined despite a bullish breakout.

- Almost half of global addresses holding Brett are making money.

Brett [BRETT], a popular Base-based memecoin, has recently broken out of consolidation and successfully retested its support levels.

However, as of press time, it was struggling to push higher, potentially due to slow weekend market activity.

Despite this, there is optimism that the price action will resume its upward momentum, given its strong position and recent performance.

Over the past seven days, BRETT has climbed 15%, and in the last 30 days, it has gained 31%, with top holders dominating the market. This suggests growing interest as the final quarter of the year unfolds.

BRETT price prediction

Brett’s recent price action, following its breakout from a wedge consolidation pattern, shows potential for further gains once weekend trading activity picks up.

Since it is the main memecoin on Base, it is poised to benefit from a significant portion of liquidity from this ecosystem.

Additionally, the weekly chart has shown a large wick, indicating strong buying pressure for BRETT, which could push the price higher once trading volume increases.

Source: TradingView

Profitability and volume

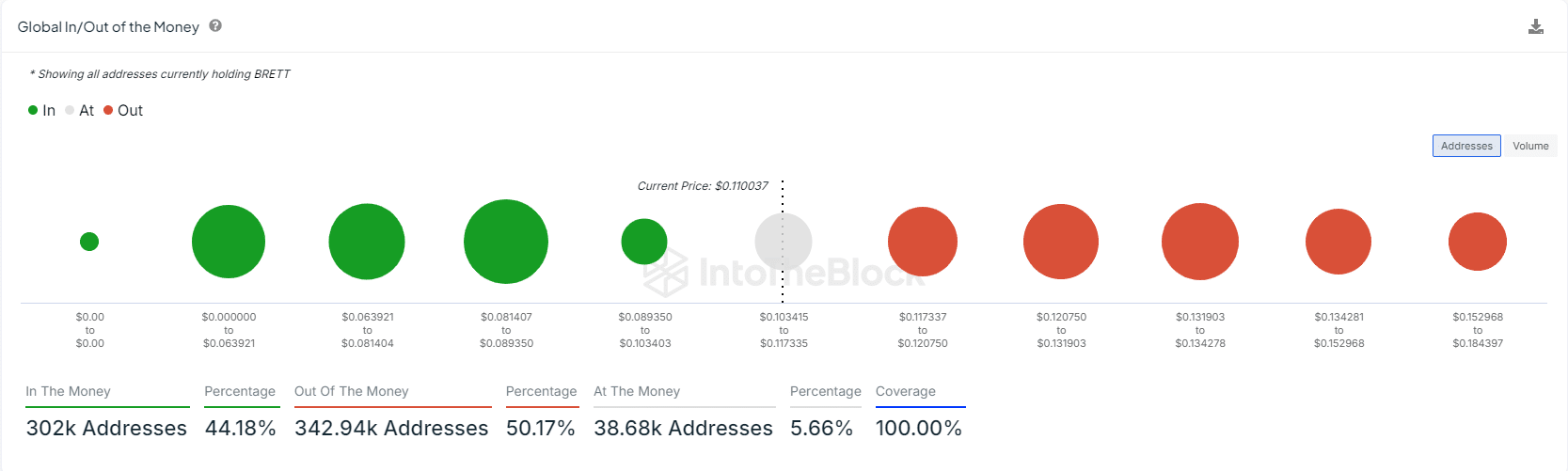

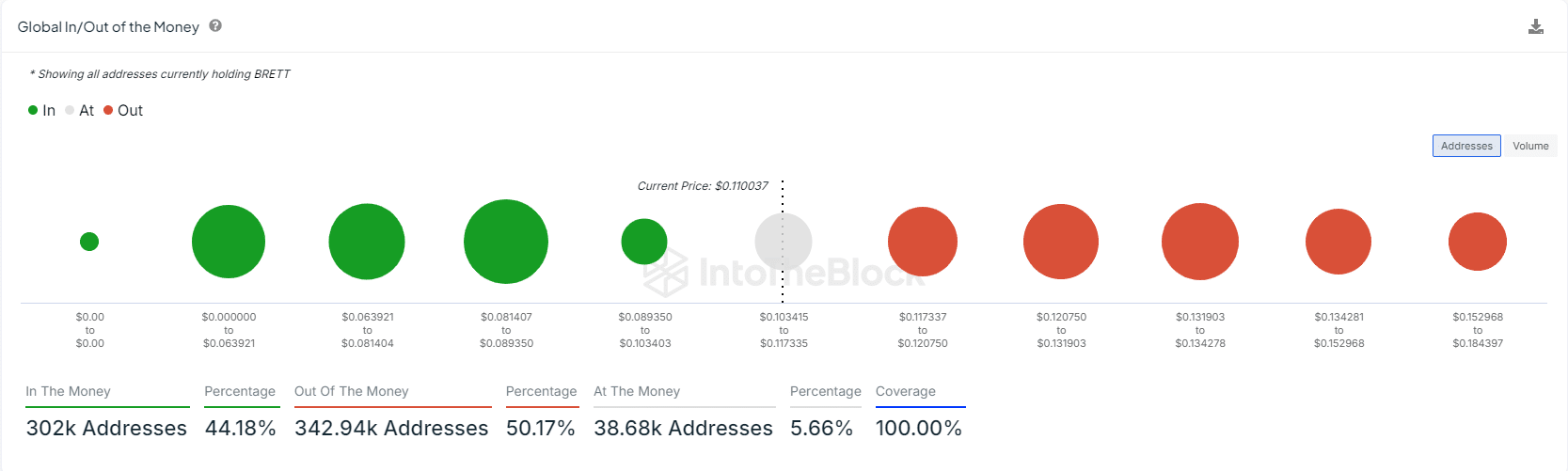

Looking at the In/Out of the Money, 44.18% of traders holding the memecoin were in profit, with the most profitable addresses in the price range of $0.081407 to $0.089350.

This equates to 302,000 addresses that are in the money, while 50% of traders are out of the money, representing 342,000 addresses. About 6%, or 38,000 addresses, are currently trading at breakeven.

With a total supply of 9.91 billion tokens and a maximum supply of 10 billion, BRETT’s tokenomics remain attractive for investors looking for long-term growth.

As the largest memecoin on Base, Brett enjoys significant market participation.

Source: IntoTheBlock

Brett’s market activity continues to gather momentum, with the market cap reaching $1.1 billion and the 24-hour trading volume rising to $85.5 million, a 12.4% increase as per CoinMarketCap.

The volume-to-market cap ratio stood at 7.7%, reflecting a healthy liquidity flow. This ratio indicated that Brett had controlled and sustainable liquidity, establishing it as a stable asset in its category.

As markets are expected to regain momentum after the weekend, it is positioned for a potential surge, driven by growing interest.

Read Brett’s [BRETT] Price Prediction 2024–2025

Brett’s recent consolidation breakout and retest provide a solid foundation for future growth as investors closely watch whether the price action will trend higher.

With positive market indicators and strong liquidity, BRETT could continue to trend higher, especially as market activity resumes.