- Bitcoin hits $106K amid Trump’s Bitcoin reserve proposal.

- Federal Reserve’s rate cut could boost Bitcoin demand.

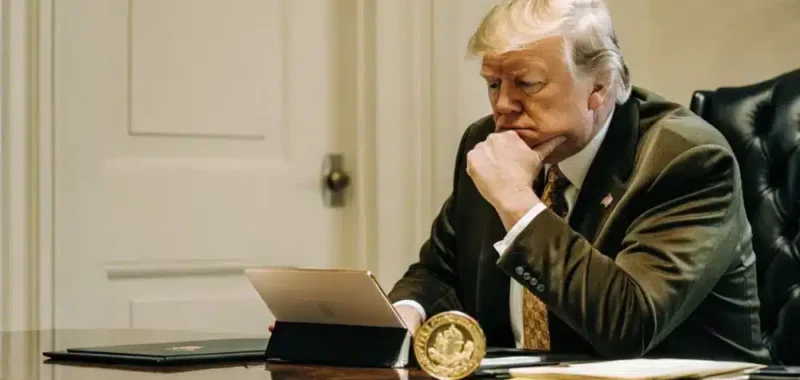

President-elect Donald Trump’s proposal to create a U.S. strategic Bitcoin [BTC] reserve has caused a stir in the cryptocurrency market.

With this proposal, Trump has captured the attention of investors, igniting optimism about Bitcoin’s future.

On the 15th of December, Bitcoin reached a new milestone, surpassing $106,000 and peaking at $106,488 before stabilizing at $104,518.

The significant price surge follows increasing investor interest, driven by the possibility that Bitcoin could soon become a part of U.S. national reserves.

Trump’s Bitcoin proposal impact

Financial analysts are closely monitoring Bitcoin’s potential for further growth, especially in light of Trump’s proposal.

Experts predict that Bitcoin could hit $150,000 by the end of 2025, driven by a combination of institutional adoption and favorable regulatory changes.

Martin Leinweber of MarketVector Indexes highlighted historical trends, including post-presidential election rallies and Bitcoin’s “halvings,” which reduce the mining reward and can lead to a supply-driven price surge.

However, caution is advised, as experts like Tom Lee from Fundstrat Global Advisors acknowledge that Bitcoin’s path could involve volatility, with short-term declines possible before any substantial gains are realized.

World Liberty Financial expands reach in market

In addition to his proposal for a Bitcoin reserve, Trump’s crypto-backed project, World Liberty, is making notable strides in the market.

Recently, the project executed a significant transaction, swapping 250,000 USDC for the ONDO token, which is associated with Ondo Finance.

This move is part of World Liberty’s broader strategy to increase its presence within the cryptocurrency ecosystem.

Along with this large transaction, World Liberty has executed several smaller trades involving USDT and ETH, showing active participation in the market.

Global economic shift

If the U.S. moves forward with adopting Bitcoin as a reserve asset, it could have a profound impact on global economic policies.

Bitcoin’s integration into national reserves could set a precedent for other countries to follow, leading to broader adoption and recognition of cryptocurrencies in the global financial system.

This shift could affect international trade, currency valuations, and the traditional financial ecosystem, positioning Bitcoin as a more stable and widely accepted asset.

As Bitcoin transitions from a speculative investment to a reserve-backed asset, its role in the global economy would likely be solidified.