- ADA has surged by 23.8% over the past week.

- Cardano whales have bought 40 million ADA tokens in 48 hours.

Since hitting a low of $0.878, Cardano [ADA] has experienced a strong upswing to $1.119 hiking by 23.80% on weekly charts.

Since then, the altcoin has made a slight retrace on daily charts. In fact, as of this writing, Cardano was trading at $1.106. This marked a 1.23% increase over the past day.

The recent price pump has left analysts talking over what factors driving it. According to popular crypto analysts Ali Martinez, one factor driving ADA prices is increased buying pressure.

Cardano whales purchase 40 million tokens

In his analysis, Martinez observed that Cardano whales have been on a buying spree. As such, whales have bought over 40 million ADA tokens over the past 48 hours.

Source: X

When whales turn to purchasing an asset, it reflects bullish sentiment and their confidence in the market.

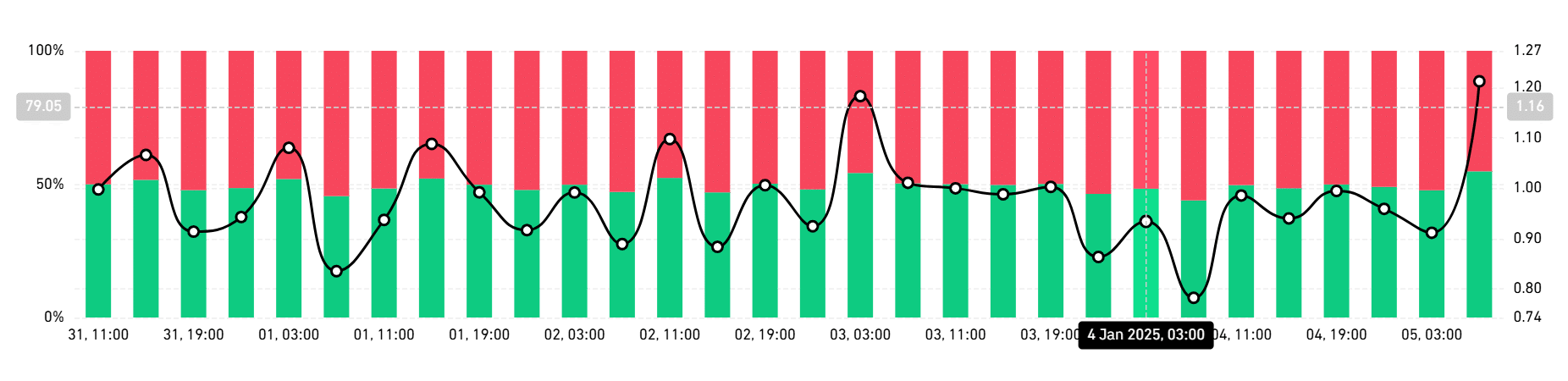

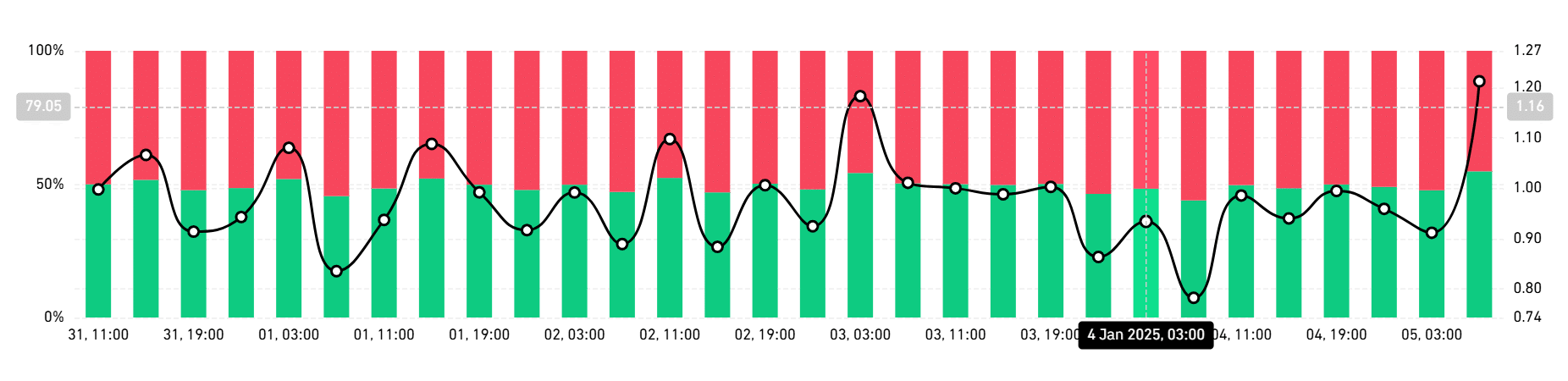

Notably, this demand for ADA is not an isolated case among whales only, but also retail traders are actively buying. Therefore, other market participants have been actively buying the altcoin since New Year’s Eve.

This is evidenced by the sudden upsurge in the Relative Strength Index (RSI) which has spiked from 39 to 62. When the RSI rises with that margin, it indicates strong buying pressure, implying buyers are dominating the market.

What ADA charts suggest

With increased buying activity from both whales and retailers, it shows ADA is well positioned for further gains.

According to AMBCrypto’s analysis, Cardano is seeing a strong upward momentum build amidst heightened demand.

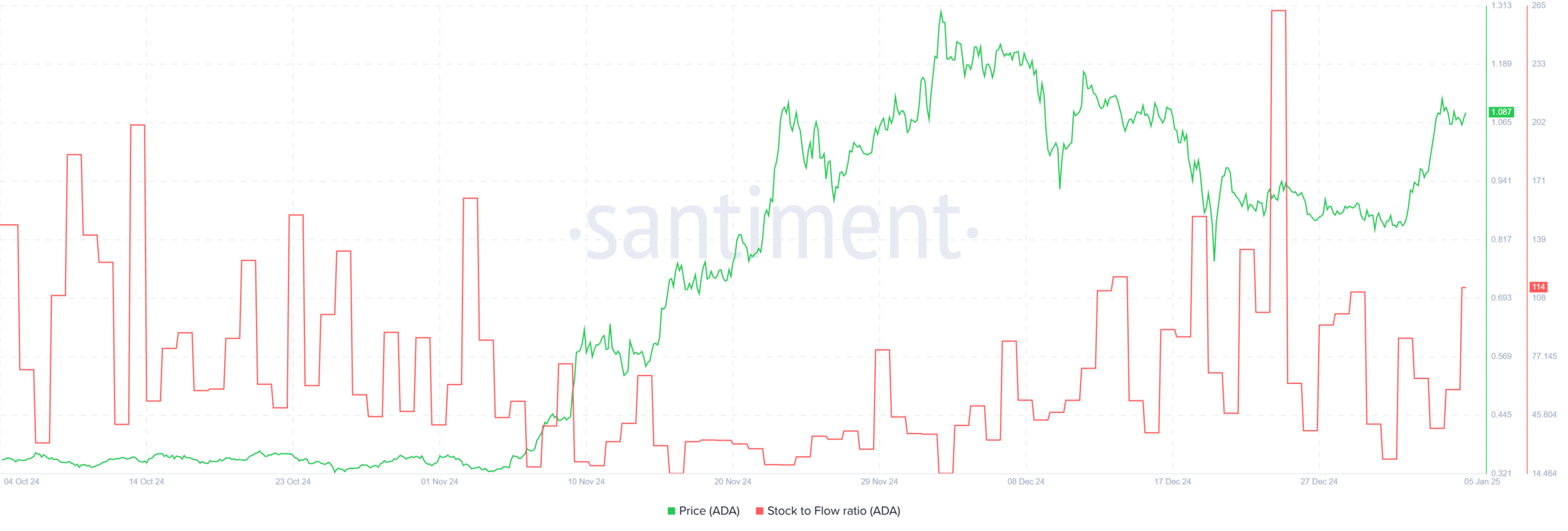

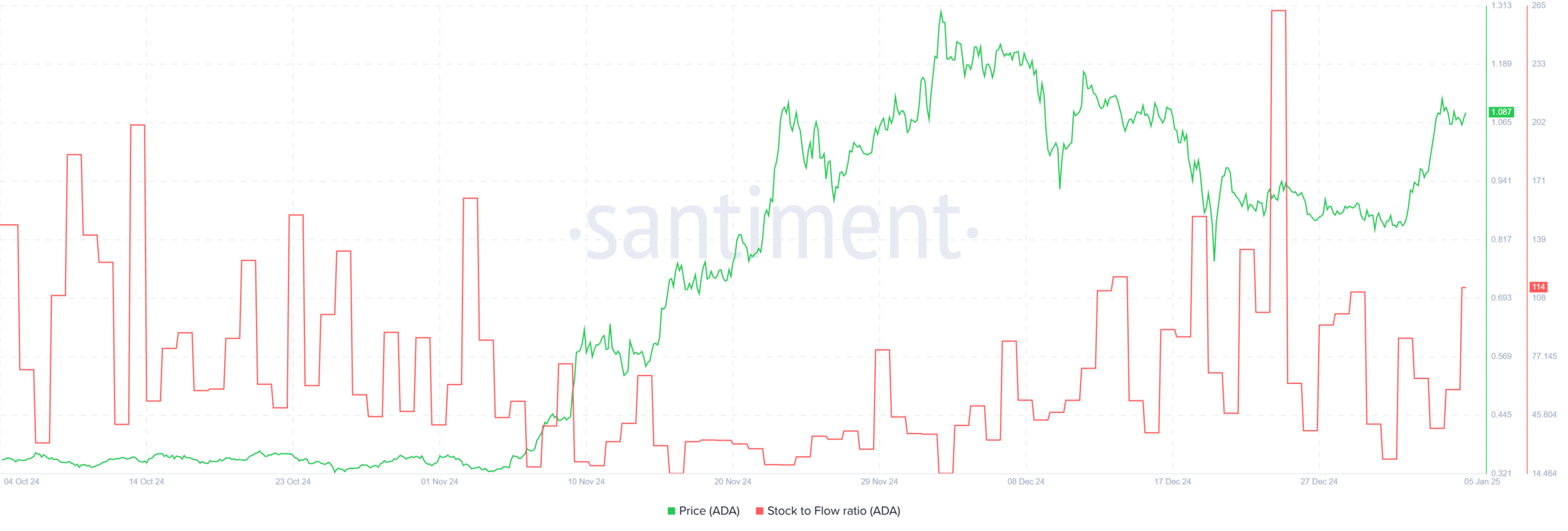

Source: Santiment

We can see increased demand through Cardano’s rising scarcity. This is evidenced by the rising Stock to flow ratio, which has risen to 133.7.

When SFR rises, it implies that ADA is becoming scarce, with demand outpacing supply. Often, a higher demand helps drive prices up.

Source: Coinglass

Additionally, this demand for the altcoin is especially dominant for long positions. As per the long/short ratio, 54% of traders are taking long positions.

When longs dominate the market, it means most traders are bullish and expect prices to increase.

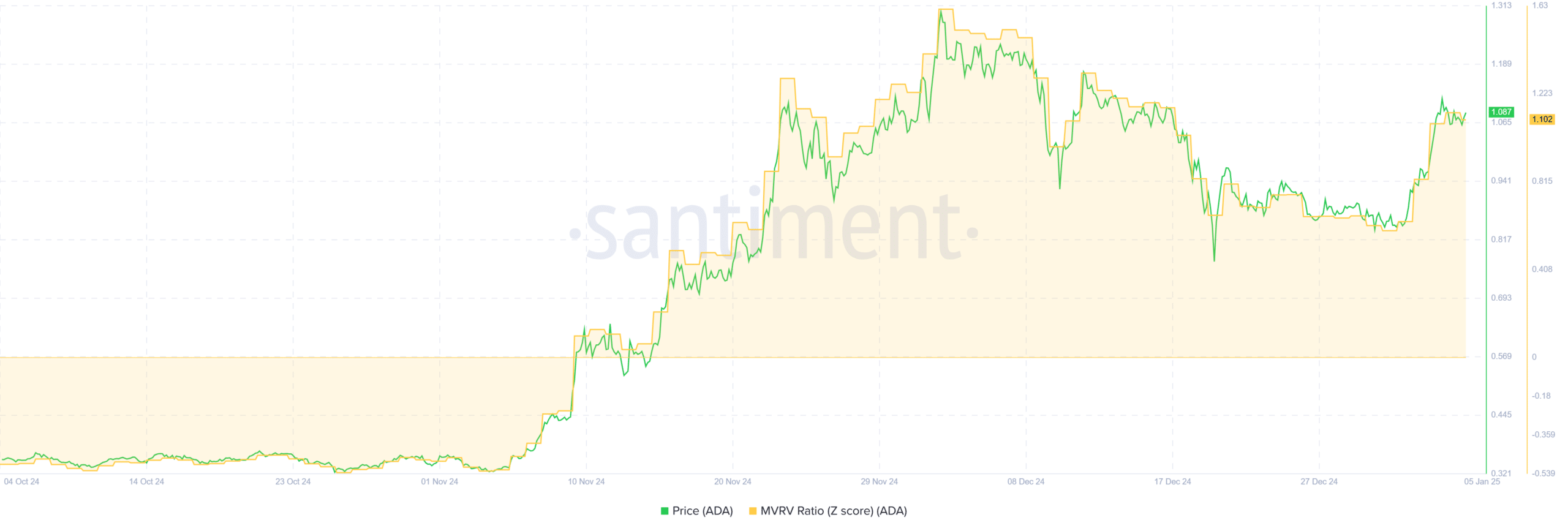

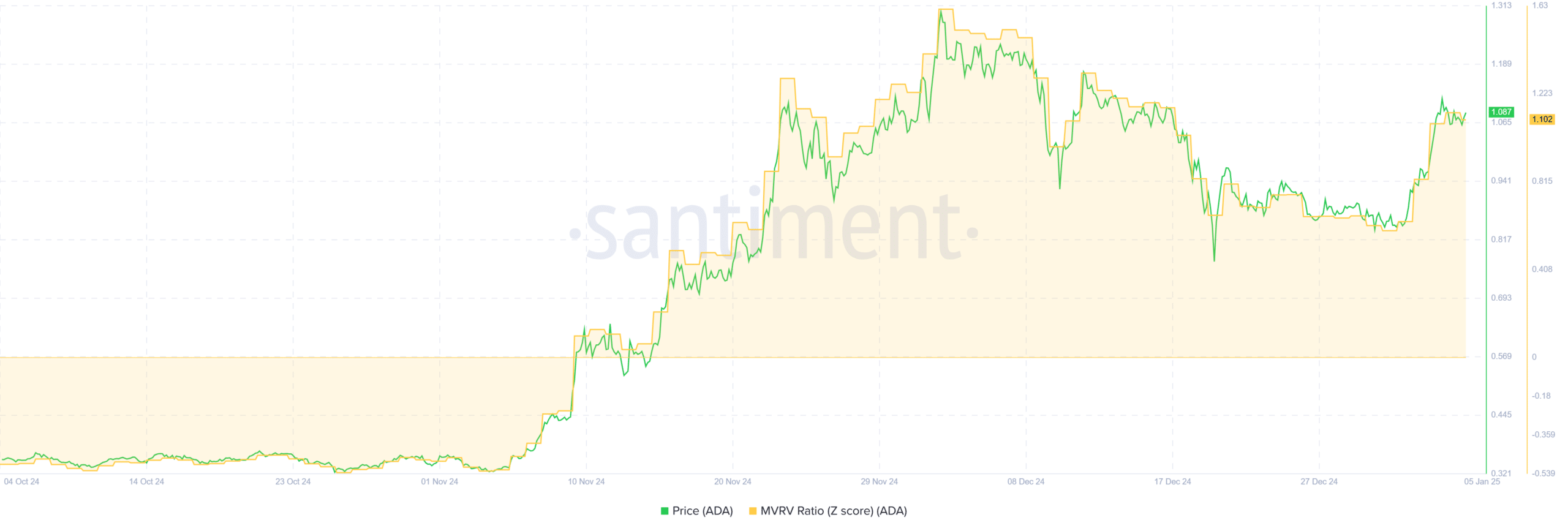

Source: Santiment

Finally, Cardano’s MVRV Ratio has settled at 1.1 implying low selling pressure. With MVRV at 1.1, it suggests that profit-taking pressure is relatively low.

At this level, the price has room to grow before it reaches overbought levels.

Simply put, amidst increased activity from both whales and retail traders, ADA’s momentum to the upside is growing. With positive sentiment, Cardano is well positioned for more gains.

Read Cardano’s [ADA] Price Prediction 2025–2026

Therefore, if buyers continue to dominate the market, ADA could reclaim $1.2 where it has faced multiple rejections and a breakout from here will push the altcoin to $1.5.

Conversely, if a market correction arises, the altcoin will dip to $0.89.