- BONK’s breakout targets a 271% rally—will buyers step in, or is another drop coming?

- Traders eye $0.0000091 support as analysts predict a potential bounce for BONK’s next move.

Memecoins have struggled in recent weeks, and BONK has been no exception, experiencing a -8.61% decline over the past seven days. However, recent price action suggested a possible shift in momentum.

BONK was trading at $0.00001584 at press time, with a 24-hour trading volume of $115.73 million and a market cap of $1.22 billion.

BONK breaks out of downtrend

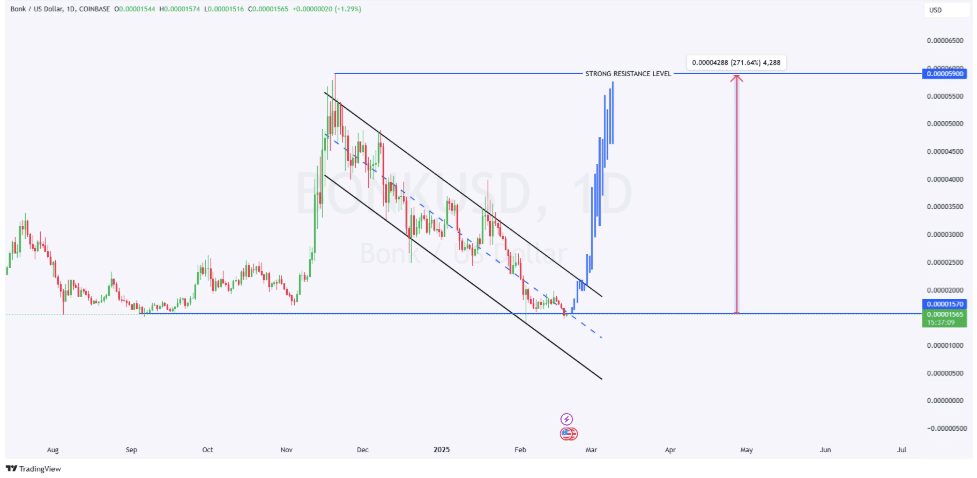

The BONK/USDT daily chart showed a breakout from a descending channel, which could signal a potential recovery.

The price had been trending lower, forming lower highs and lower lows, but has now moved above the channel’s upper trendline.

A key support level at $0.00001570 has provided a base for the price, preventing further declines. If momentum builds, BONK could aim for $0.00005900, which is marked as a major resistance zone.

This would represent a potential 271.64% price increase from the breakout level.

Source: TradingView

Indicators show early signs of strength

Technical indicators suggested that selling pressure may be easing.

The Bollinger Bands showed low volatility, with BONK trading near the middle band at $0.00001589. If the price moves above $0.00001816, it could confirm a trend reversal.

However, failure to hold current levels may lead to another test of $0.00001402 support.

Source: TradingView

The Relative Strength Index (RSI) was 32.38 at press time, moving away from oversold conditions. If it crosses above 40-50, it could indicate stronger buying interest.

Meanwhile, the MACD was nearing a bullish crossover, with the MACD line at -0.00000258 approaching the signal line at -0.00000279, suggesting that momentum could shift in favor of buyers.

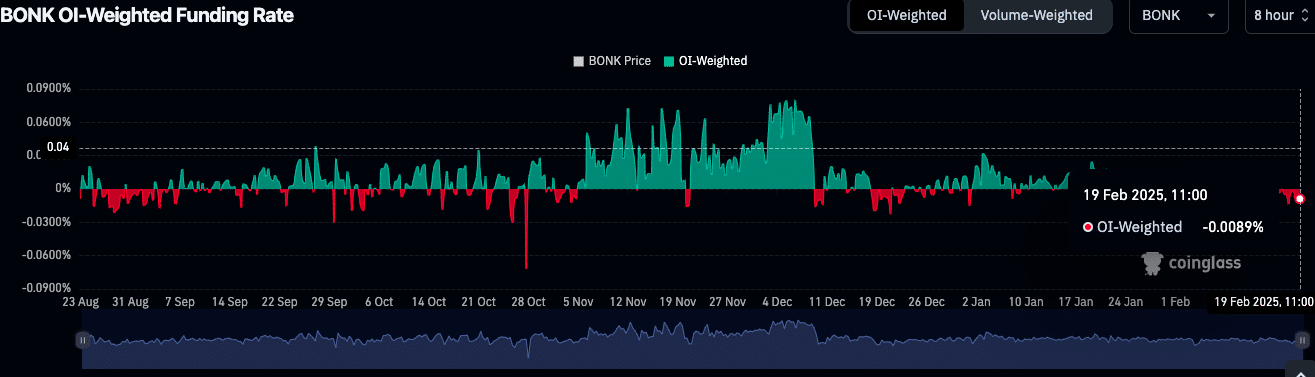

Funding Rate and market sentiment

Market data showed mixed sentiment among traders. According to Coinglass, BONK’s trading volume has increased by 4.66% to $25.29 million, while Open Interest was up 4.30% to $9.86 million.

The OI-Weighted Funding Rate was at -0.0089%, meaning that short positions were paying long positions. So, traders should remain cautious, but a shift into positive funding could indicate renewed bullish sentiment.

Source: Coinglass

Key support needed for potential bounce

Despite recent losses, analysts are monitoring BONK’s $0.0000091 support level, last tested in February 2024. Crypto analyst gnarleyquinn suggested that if BONK holds this zone, it may present an ideal buying opportunity.

Ali Martinez echoed similar sentiments, stating,

“If BONK maintains this support level, a potential bounce could follow.”

Traders will be watching closely to see if this recovery can gain traction.