- Binance Smart Chain experienced a surge in active addresses, indicating increased activity.

- Additionally, the supply of BNB on exchanges has been gradually decreasing, which could lead to a supply squeeze.

Despite the recent developments in network activity, Binance Coin’s [BNB] growth has been relatively slow compared to other top market-cap tokens. Over the past month, it achieved a 29.65% gain, but this pales in comparison to the performance of other leading assets.

On a daily scale, BNB has dropped by 4.85%, pointing to potential weakness.

While current growth appears sluggish, analysis by AMBCrypto suggests that BNB has room for further upside, with expectations of continued price appreciation.

Gap in network activity despite growth

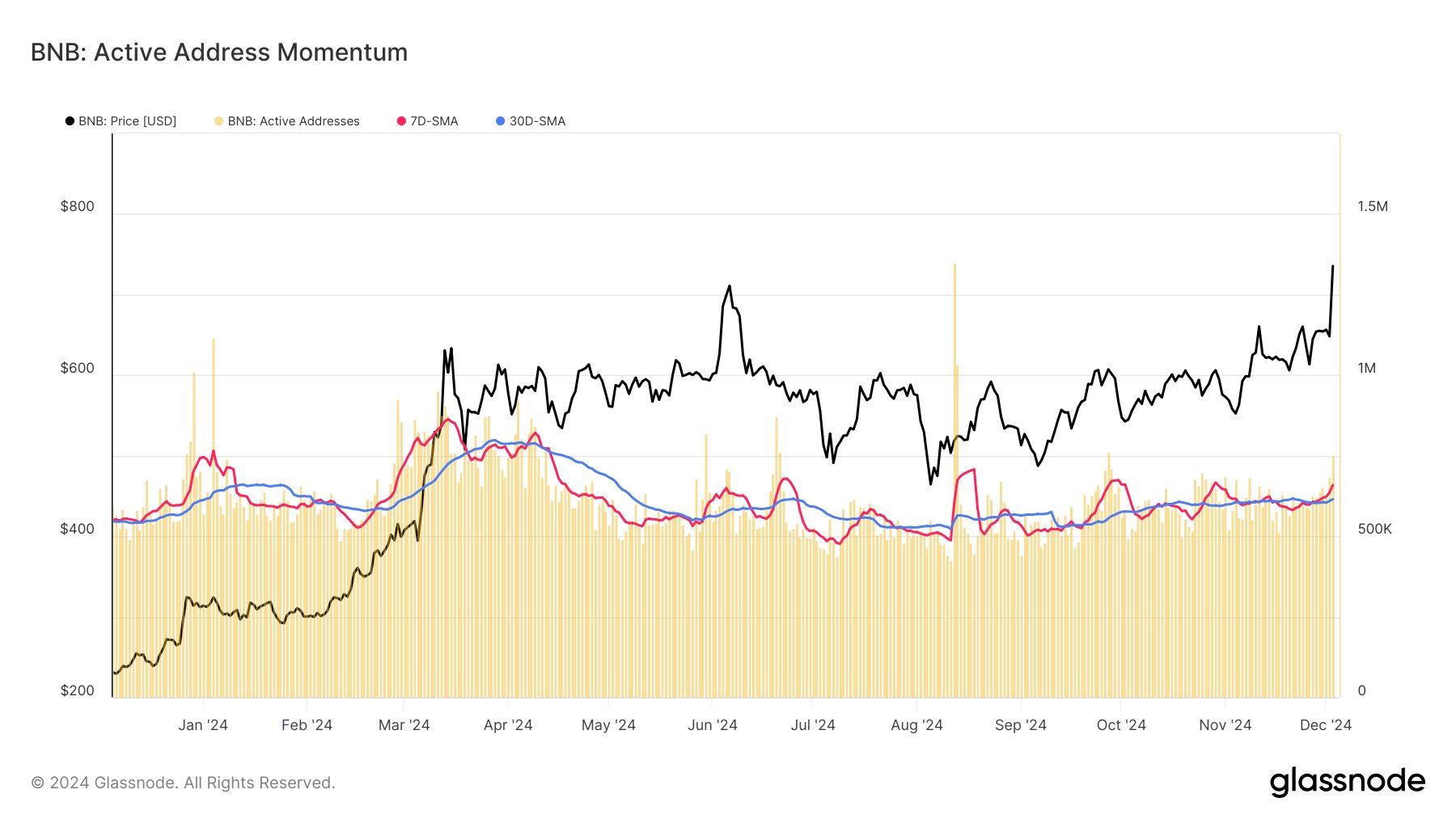

Recent data from Glassnode reveals a spike in the number of active addresses on the Binance Smart Chain (BSC), reaching 751,000. This uptick signals potential for further asset price movement.

Active addresses measure the number of participants engaged in transactions such as buying, selling, or other activities on the BSC.

Source: X

Glassnode noted that this growth is promising, stating:

“It indicates an expansion in on-chain activity, stronger fundamentals, and increasing network utilization.”

While this rise in activity suggests demand for BNB, the blockchain’s native token, and could lead to a price surge, the rally is far from complete based on historical patterns.

During the 2021 bull market, BNB Chain reached an all-time high of approximately 1.5 million active addresses.

If the current market follows a similar trend, BNB could potentially see a 100% price increase from its current levels, as reflected in the gap between active address milestones.

Is a supply squeeze on BNB imminent?

A supply squeeze on BNB may be approaching—a situation where surging demand meets a falling supply of the asset, creating upward price pressure.

As of now, there has been a significant negative exchange netflow for BNB. Over the past 24 hours, the netflow stands at negative $729,340, while the 7-day figure is negative $1,850,000.

This indicates that more BNB is leaving exchanges than entering, reducing the available supply.

If this trend continues, the declining supply of BNB on exchanges, coupled with increasing demand, could trigger a notable price surge for the asset.

Supporting indicators for a bullish trend

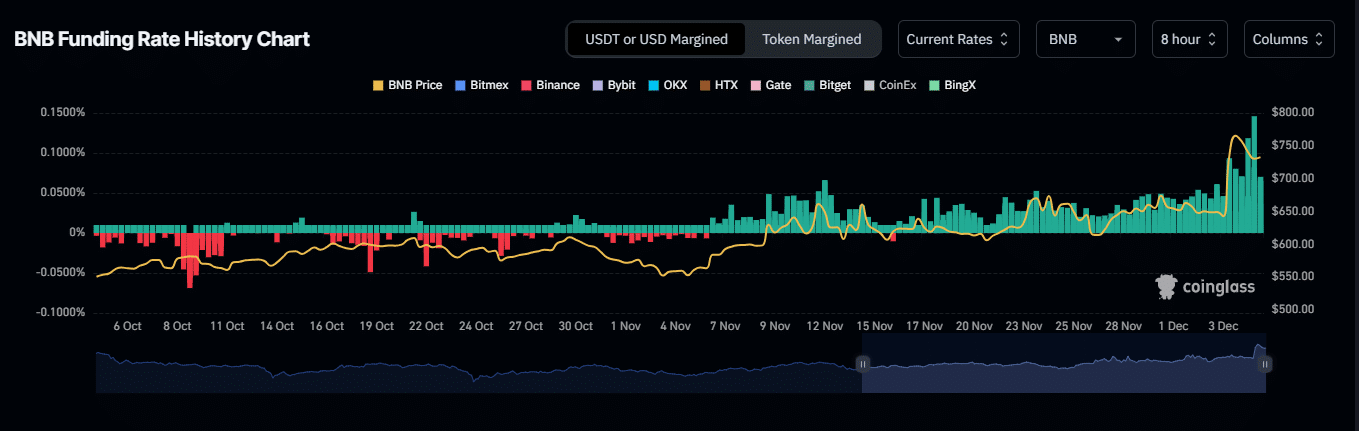

BNB’s funding rate has shown significant growth in recent days, signaling the potential for an upcoming market rally.

As of now, the funding rate stands at 0.0650%, a positive figure indicating that long traders are actively supporting the market by periodically funding it to maintain price stability.

Source: Coinglass

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Additionally, the OI-weighted funding rate, which combines funding rates with open interest to assess market sentiment and leverage, remains in the positive zone and has been rising. This suggests a strong likelihood of an upward price movement for BNB.

With multiple factors aligning—rising active addresses, historical patterns, and derivative metrics—BNB seems ready for a potential price surge.