- BNB’s breakout from the falling wedge pointed to a potential rally toward $800.

- On-chain activity and derivatives data reinforced bullish sentiment despite slowing development contributions.

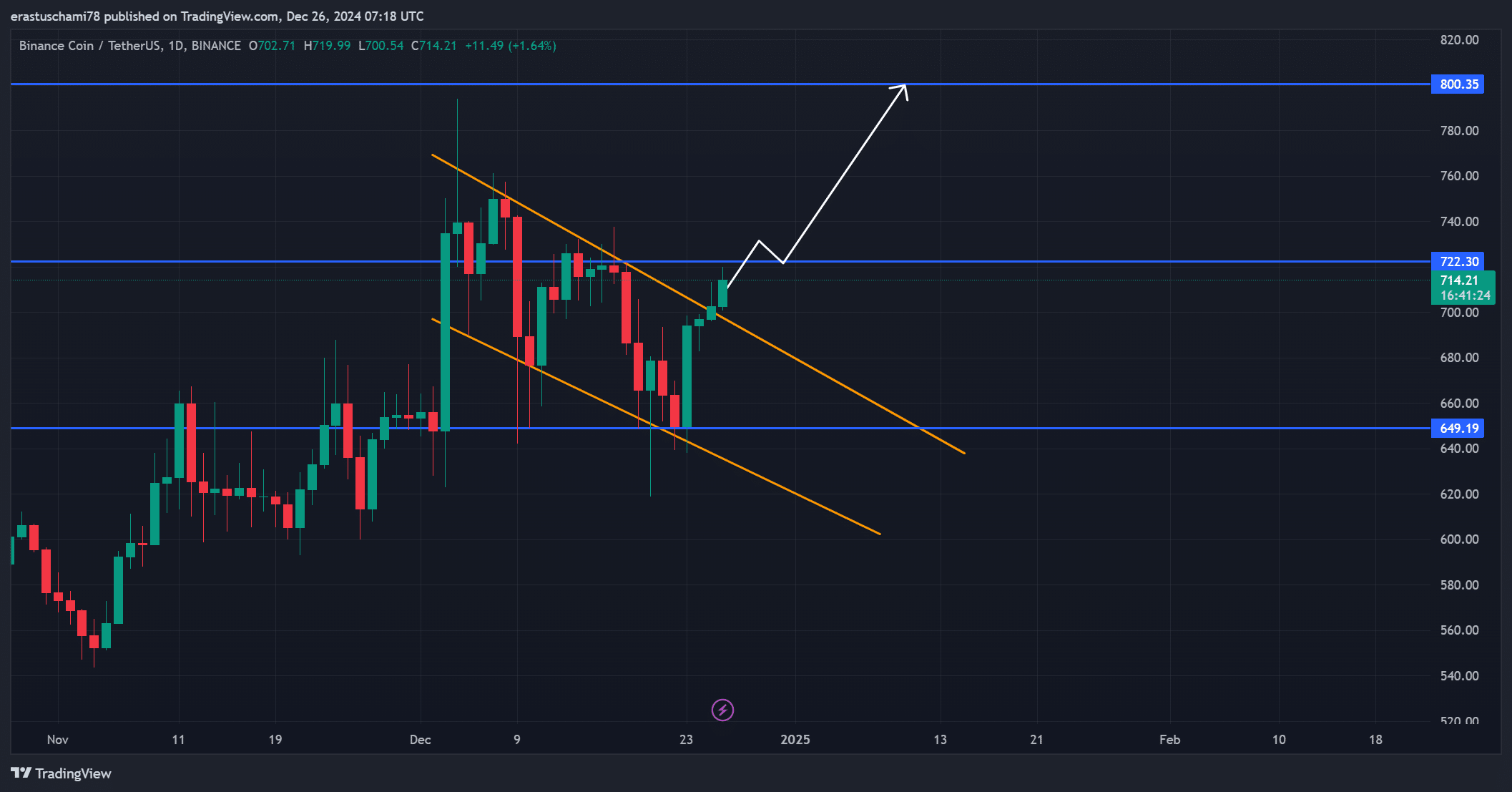

In a major development, Binance Coin [BNB] has surged above its falling wedge pattern, which often signals a bullish reversal. At press time, BNB was trading at $712.51, reflecting a 1.24% increase over the past day.

This breakout has sparked renewed optimism among traders, with the next crucial resistance level at $722. A sustained push beyond this level could set the stage for an ambitious climb toward $800.

However, as market conditions remain volatile, questions arise about BNB’s ability to maintain this momentum.

BNB price movement hints at bullish potential

BNB’s price action has been impressive, recovering steadily from its consolidation phase. The breakout from the falling wedge has given traders hope for a bullish continuation.

A move above $722 would not only confirm the trend but could also attract additional buying interest, driving the price toward $800.

However, if BNB struggles to hold above $722, it risks revisiting the $649 support zone. This makes the next few trading sessions pivotal in determining whether the rally can be sustained.

Source: TradingView

Growing on-chain activity supports optimism

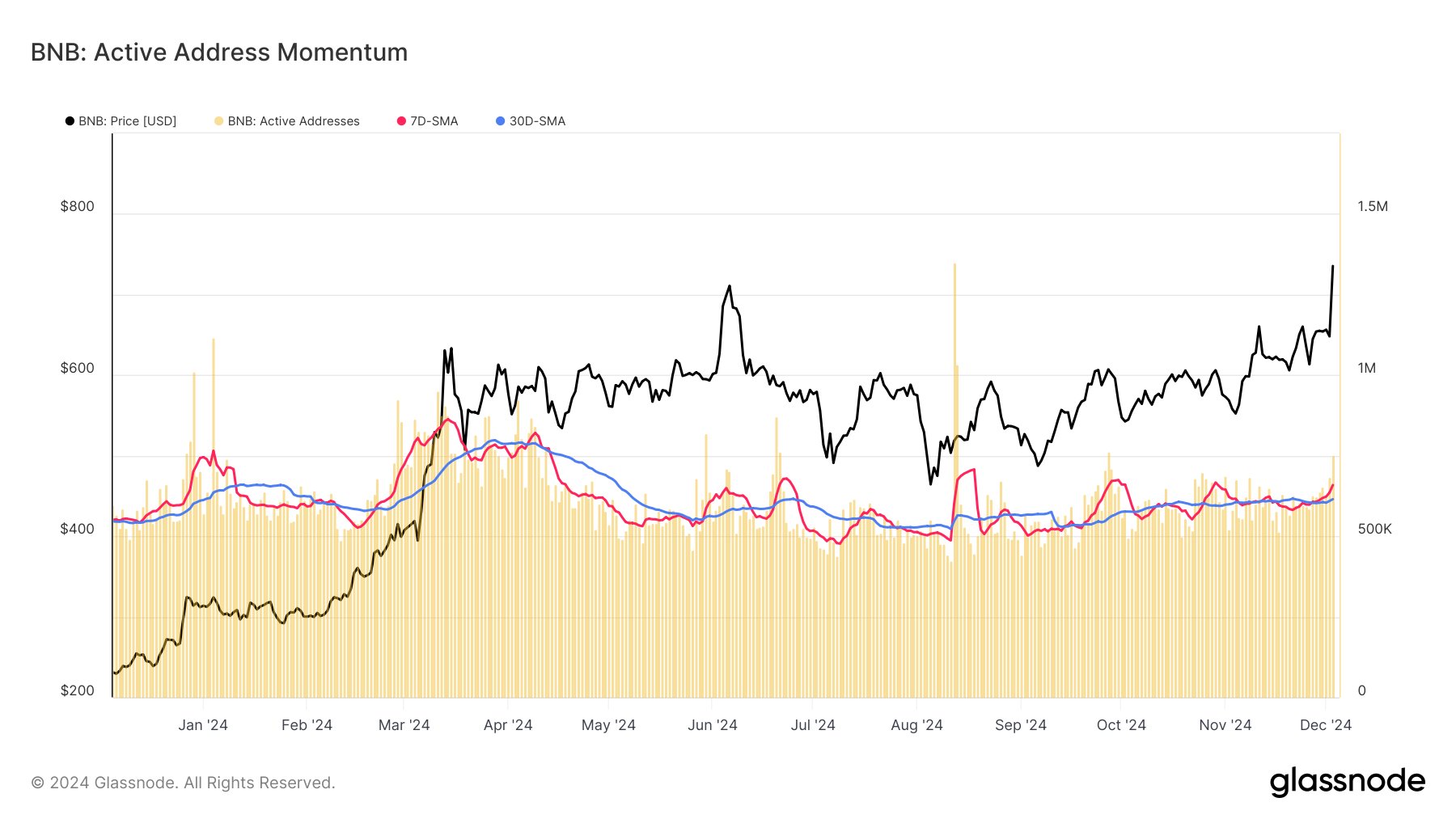

The BNB Chain has seen its active addresses rise to 751,000, a clear indication of increasing network engagement.

Active address momentum, defined by the crossover of short- and long-term averages, suggests growing investor interest in BNB.

This uptick in activity reflects not only a potential improvement in fundamentals but also an expanding user base.

However, maintaining this level of on-chain activity is essential to support further price gains. Therefore, consistent growth in active addresses will be a key factor to monitor in the coming weeks.

Source: Glassnode

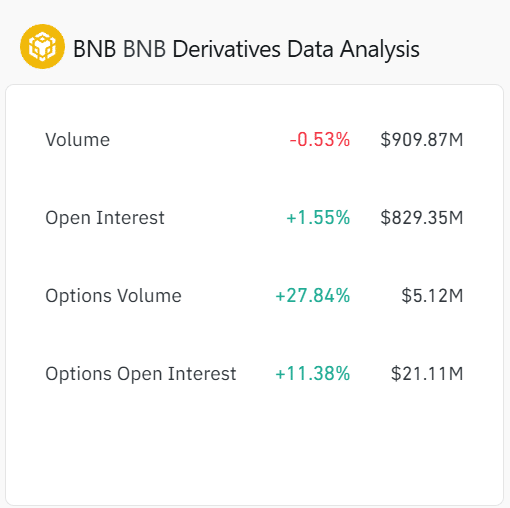

BNB derivatives data adds to the bullish sentiment

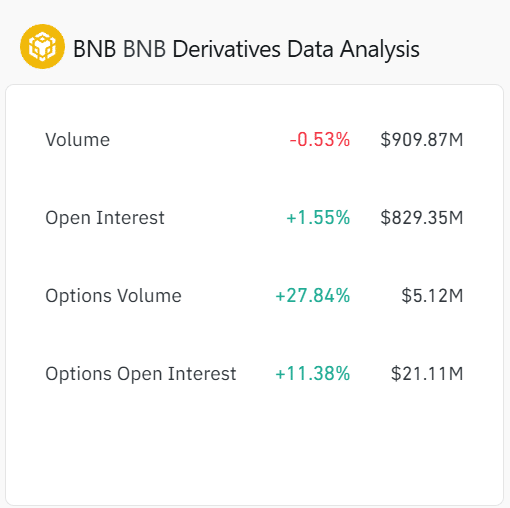

BNB’s derivatives data pointed to growing confidence among traders. Open Interest has risen by 1.55% to $829.35 million, signaling increased participation in the market.

Furthermore, Options volume has spiked by 27.84%, reaching $5.12 million, indicating heightened interest in future price movements.

However, the slight decline in overall volume by 0.53%, suggesting that some traders remained cautious.

Therefore, while derivatives data supports the bullish case, it highlights the need for sustained market participation to confirm the trend.

Source: Coinglass

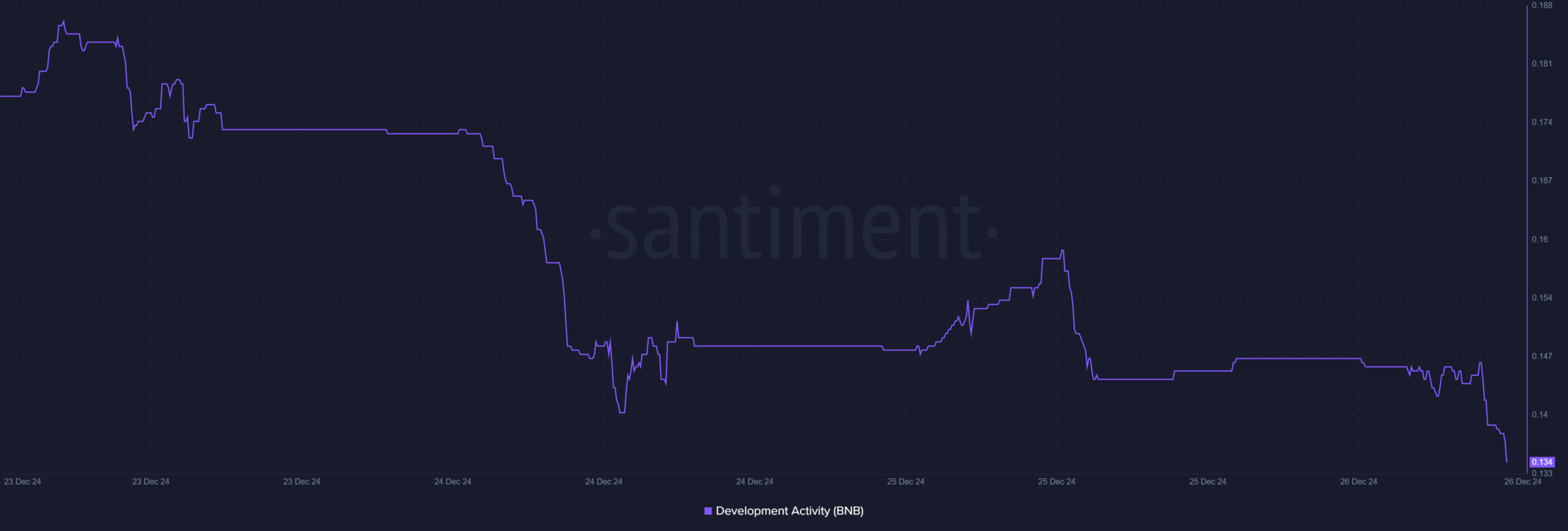

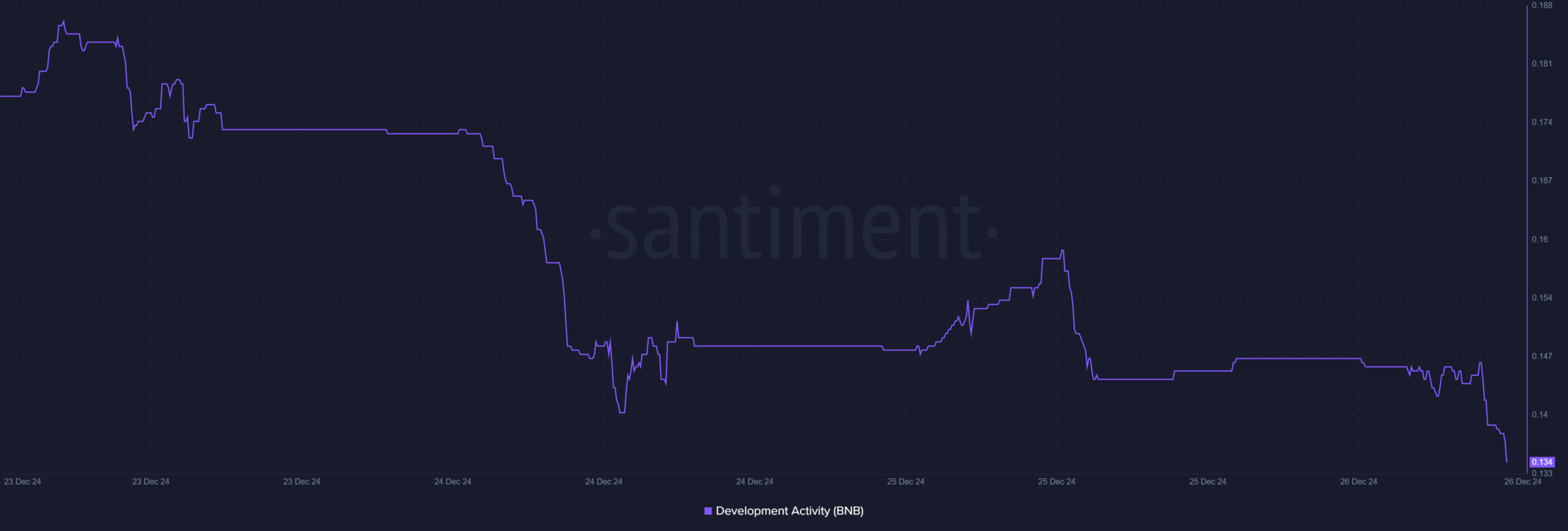

Development activity remains subdued

Despite bullish price action, BNB’s development activity has slowed, with the score dropping to 0.134. This decline reflects reduced developer contributions, which may impact innovation on the network if it continues.

However, short-term price movements are unlikely to be heavily influenced by development activity. Nevertheless, long-term investor confidence may require renewed developer engagement.

Source: Santiment

Read Binance Coin’s [BNB] Price Prediction 2024–2025

BNB’s breakout above its falling wedge pattern is a strong bullish signal. If it clears $722 and maintains growing on-chain activity, the rally could extend toward $800.

However, failure to sustain these metrics may cap its gains, making the next resistance level critical.