- Bitcoin’s surge back to $101K is fueled by large HODLers capitalizing on the dip.

- A new all-time high could be within reach, setting the stage for an exciting rally.

Bitcoin [BTC] is back at the critical $100K level, igniting intense speculation about its next big move. The market is divided: some see the recent surge as a sign of cautious optimism, fueled more by hype than solid fundamentals.

On the flip side, the increasing number of large HODLers suggests a strong accumulation phase, with many considering the current price as a potential bottom.

This sets the stage for a significant breakout as the new year excitement ramps up.

So, with the stakes higher than ever, can Bitcoin deliver on its promise of hitting a new all-time high by the end of Q4?

Bitcoin is showing signs of undervaluation

Several key factors are in play right now. On the internal front, volume data suggests Bitcoin is moderately undervalued, while the RSI remains neutral.

The MACD lines are close to a bullish crossover, and the CMF stays positive.

Externally, both economic and psychological dynamics are lining up, hinting that a bottom formation is underway.

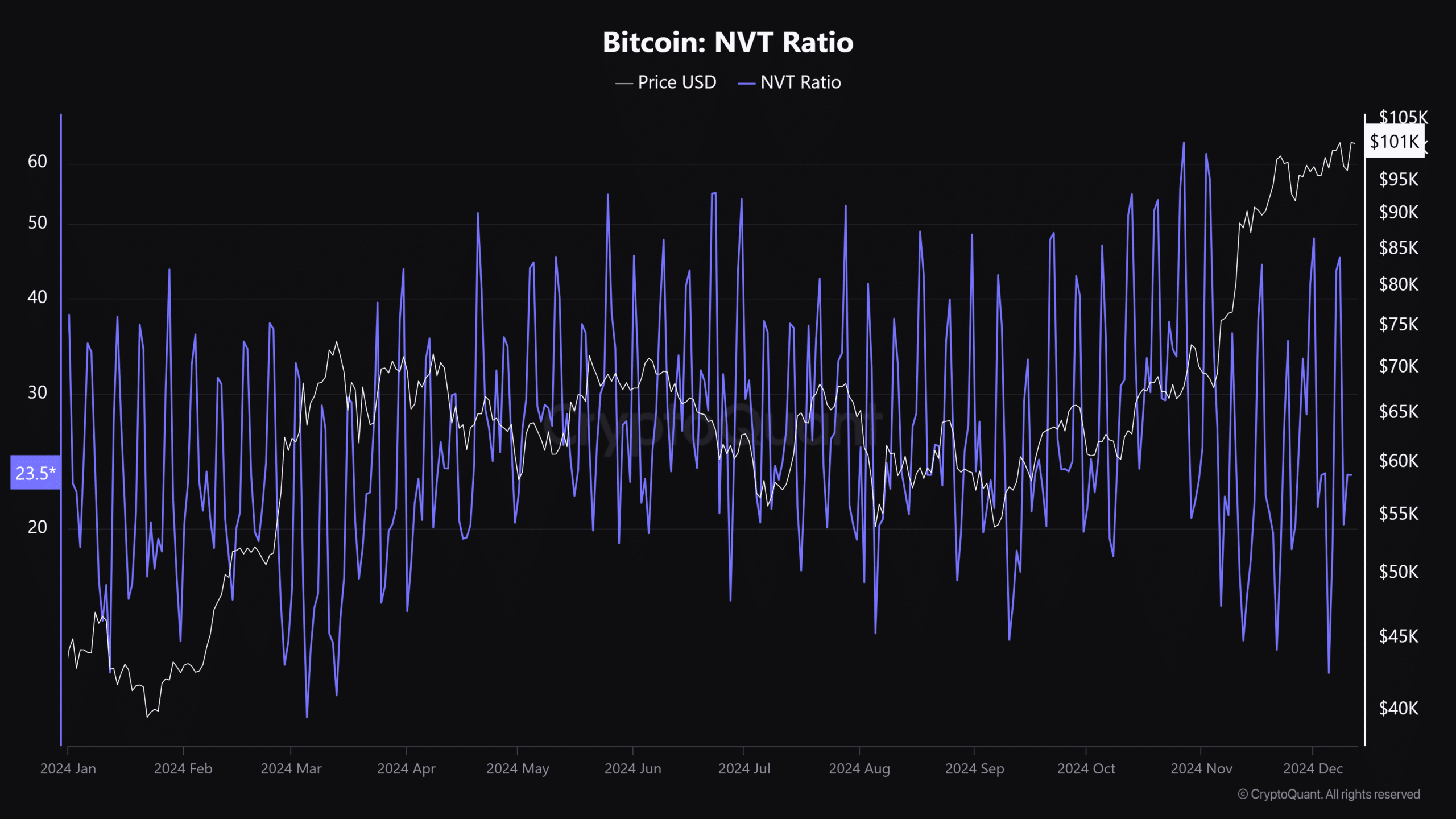

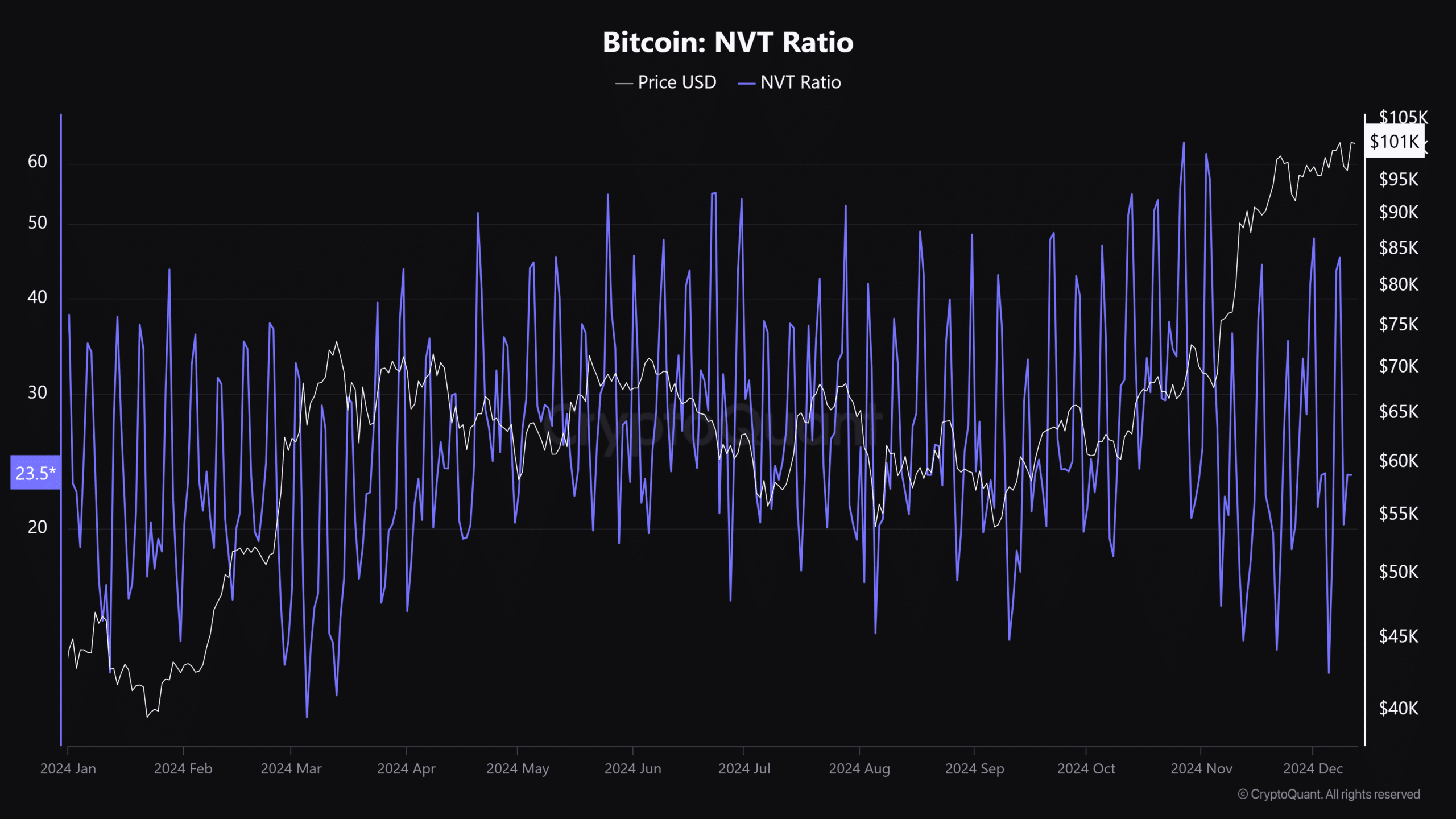

Historically, breakouts tend to follow when the network is undervalued—and right now, the NVT ratio is confirming this sentiment.

Source : CryptoQuant

With the NVT hitting a two-month low, Bitcoin’s price seems to be outpacing its network activity. This signals a potential buying opportunity, especially for large HODLers capitalizing on the dip.

But here’s the catch: whales have been actively scooping up every dip for the past two weeks, effectively preventing any major pullbacks.

However, despite their efforts, price movement has remained lackluster due to the overwhelming influence of high leverage in the derivatives market.

A confirmed bottom could set the stage to squeeze short positions – but this can only happen if whales and large HODLers continue to drive the buying momentum.

A strategy bulls must follow for Bitcoin’s surge

In the past 24 hours, Bitcoin surged back to the $101K mark after a week of sell-side pressure, triggering a massive short squeeze.

Over $170 million in short positions were liquidated, with the biggest order coming from Binance—a whopping $5.31M BTC/USDT.

What’s more, Open Interest (OI) has climbed nearly 6%, reaching $64 billion, as dominant holders bet on Bitcoin’s rise. This surge could be an ideal moment for investors to consider jumping in for a potential rebound.

Why? A recent correction forced long positions to close, but whales managed to keep the price from falling below $90K, neutralizing the pressure.

Read Bitcoin [BTC] Price Prediction 2024-2025

Now, with large HODLers and institutional players spotting Bitcoin’s undervaluation, the stage is set for a wave of shorts to get squeezed out.

If the big players keep scooping up the dips, a new all-time high could be just around the corner, ready to shatter expectations.