- Bitcoin’s fear and greed index shows optimism.

- BTC price action and MVRV Z-Score all point up.

Bitcoin [BTC] could be in for a dramatic ride with the US Presidential elections, but the result will hugely influence its movement.

Historically, BTC has shown significant price action movements around election periods, and this time could follow a similar trend.

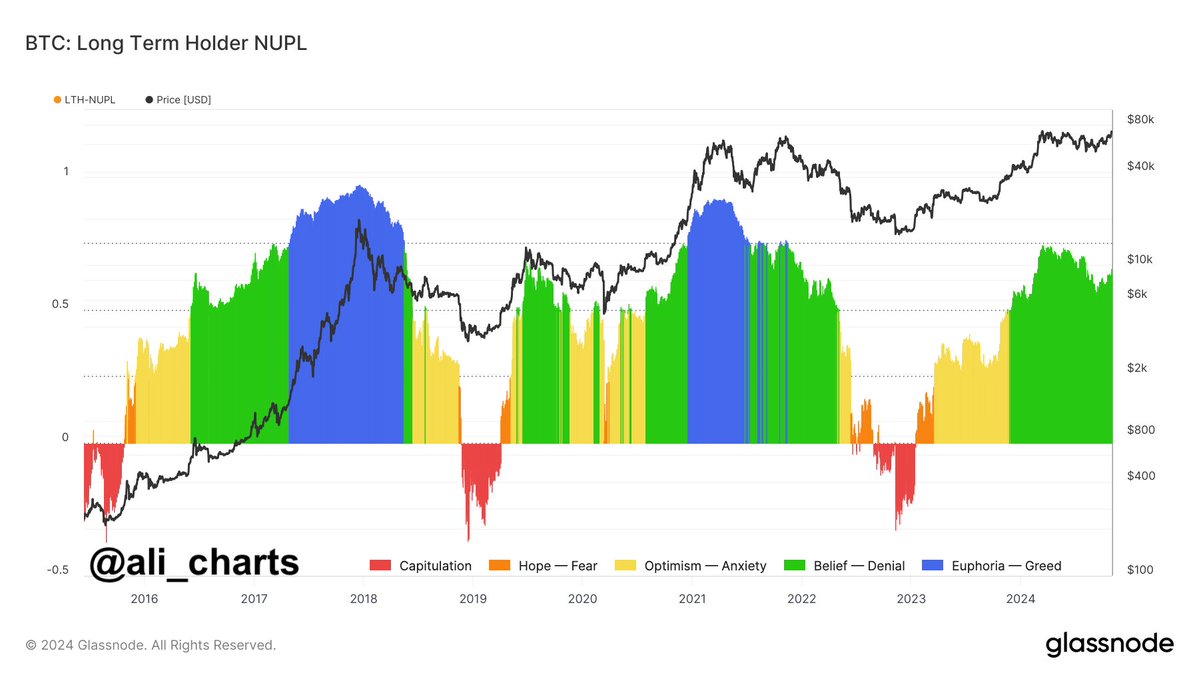

Bitcoin levels of Fear and Greed Index was at belief as of press time, suggesting price might rally due the influence of US election outcomes on crypto markets.

The US elections have consistently impacted cryptocurrencies like Bitcoin. As one of the world’s largest economies, the United States plays a crucial role in market liquidity.

Source: Glassnode

Over the last three elections, Bitcoin’s price responded positively, with traders anticipating optimistic gains amid political changes.

Should Donald Trump win over Kamala Harris, many analysts believe BTC would rally even more intensely, driven by expectations of a pro-crypto approach. Though a Harris win might still support BTC, the upside could be more modest in comparison.

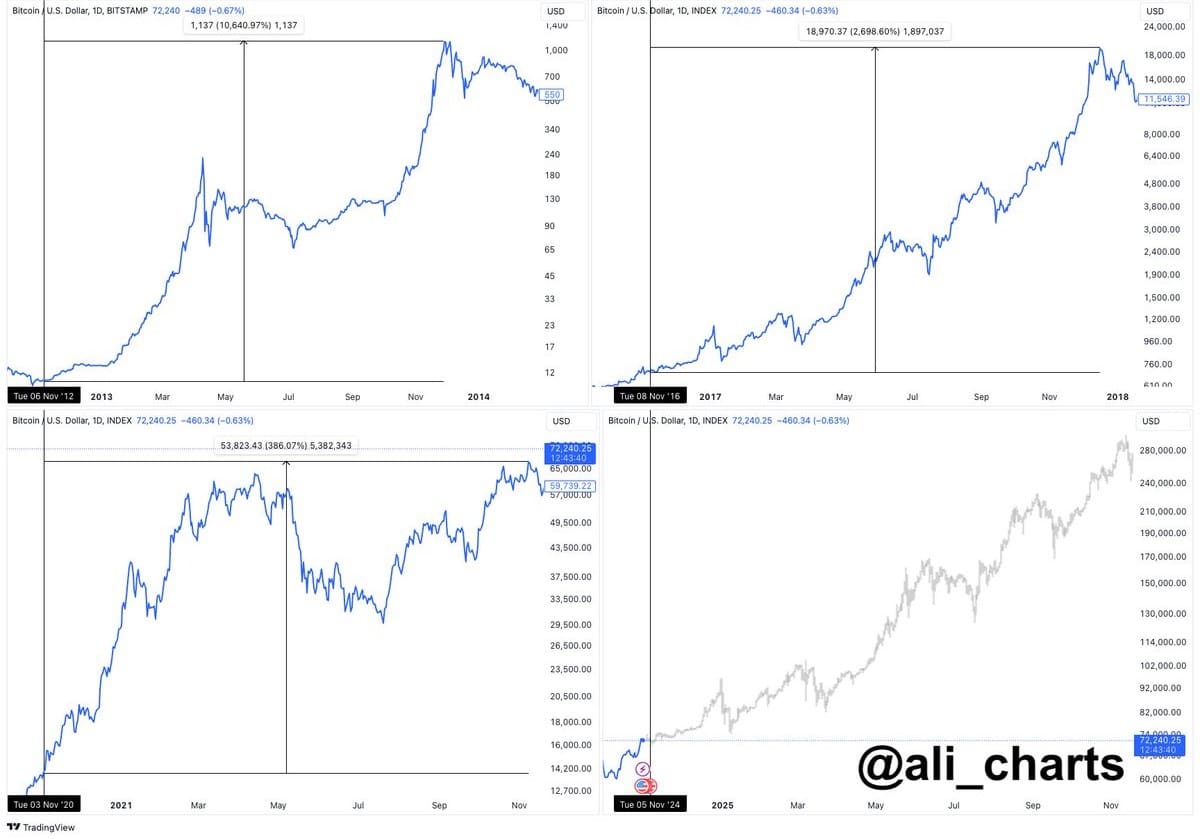

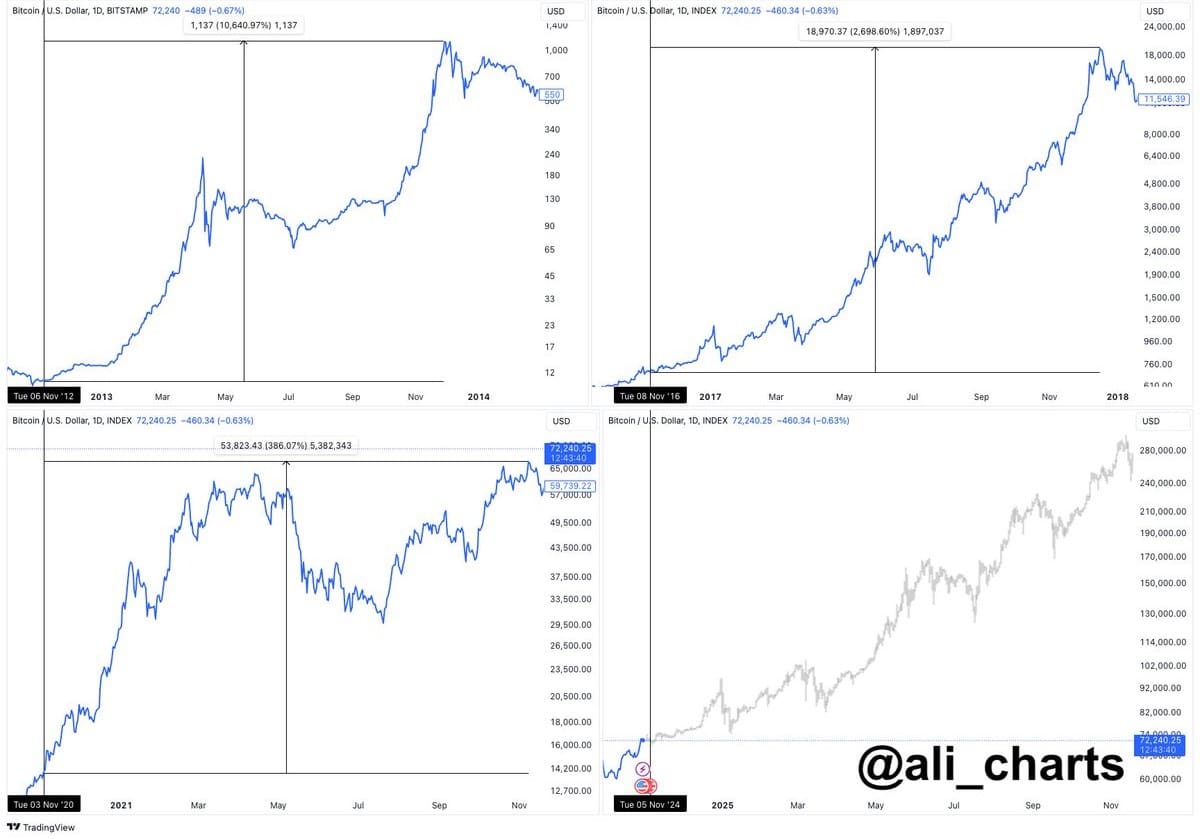

Historical BTC price action and MVRV Z-Score

Examining previous election cycles offers insight into Bitcoin’s potential performance. The 2012 election saw Bitcoin surge by over 10,000%, while the 2016 election brought gains of 2,698%, and the 2020 election boosted BTC by 386%.

While each election year saw successively smaller returns, Bitcoin remains highly likely to react to the election’s outcome.

With political discourse around Bitcoin and cryptocurrencies becoming more prominent this cycle, BTC might experience even higher volatility.

Source: Ali/X

A Trump victory could encourage greater parabolic moves, while a Harris win would likely still result in gains, albeit at a slower pace.

In terms of Bitcoin’s valuation metrics, the MVRV Z-Score currently points to significant upside potential. This score measures market cap against realized cap, helping to assess if BTC is overvalued or undervalued.

With the MVRV Z-Score near 2, BTC still has room to climb toward 6, a level where profit-taking by long-term holders could lead to a correction.

Source: X

Historically, this metric has served as a reliable indicator for spotting BTC’s tops, and the current readings suggest BTC hasn’t yet reached peak levels.

Traders following the metric believe BTC could continue its upward trajectory as buying pressure builds.

Active addresses momentum

Technical indicators also favor a potential rally. The 30-day moving average recently crossed above the 365-day moving average, creating a “golden cross,” a bullish signal often associated with strong upward momentum.

This crossover, coupled with increasing transaction volumes—nearly double those of the 2021 cycle—indicates growing market activity and buying interest.

However, if the 30-day moving average fails to maintain its position above the 365-day moving average, BTC’s price trend might stall, resembling the mid-2021 phase when momentum faded.

Read Bitcoin (BTC) Price Prediction 2024-25

Bitcoin’s price stands poised to make significant moves in response to the election’s outcome. While the broader trend suggests optimism, investors should remain cautious, as market conditions could shift quickly.

With volatility likely to increase, Bitcoin’s path forward would largely depend on the political landscape and continued investor interest.