- Bitcoin’s long-term realized cap impulse neared historical support, signaling a potential major market pivot.

- Sentiment remained neutral as long-term holders face a key decision that could define Q2’s direction.

Bitcoin [BTC] is at a pivotal juncture. As one of its most telling long-term metrics approaches a historically significant level, the market finds itself holding its breath.

The days ahead may set the tone for what’s to come — whether as the base of a fresh rally or the edge of a deeper slide.

What does the data say?

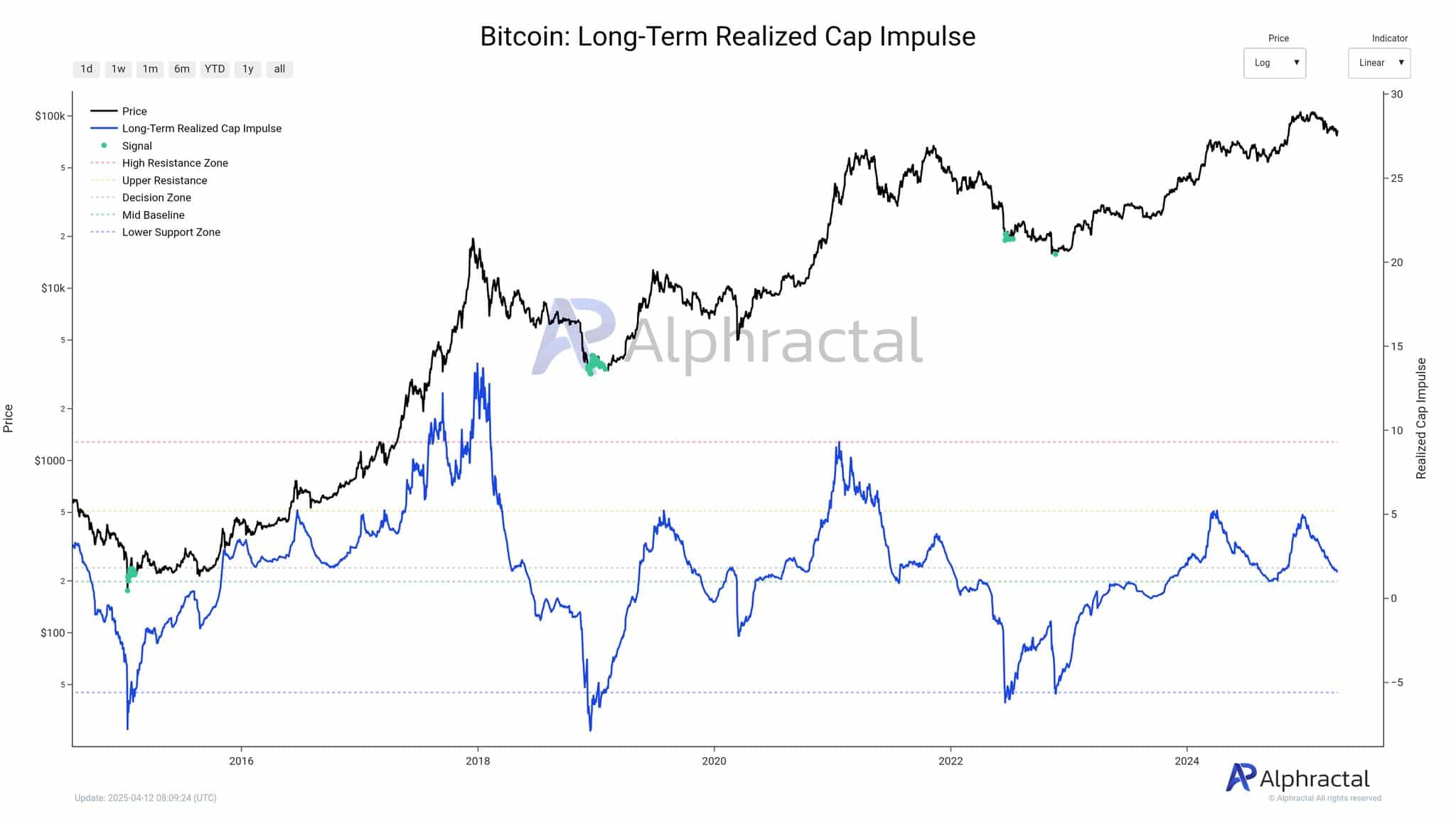

The long-term realized cap impulse is a key metric for gauging the conviction of long-term Bitcoin holders.

This metric evaluates the momentum of realized capitalization, which reflects the movement of coins based on their most recent transaction price and is adjusted for long-term trends.

Historically, when this impulse reaches its lower support zone, it has aligned with significant turning points in Bitcoin’s price.

Source: Alphractal

At press time, the impulse sits at a level that previously preceded significant market recoveries in 2019 and late 2022. This pattern suggests that long-term holders are entering a critical decision window.

Either they remain firm, or the broader market narrative may begin to shift.

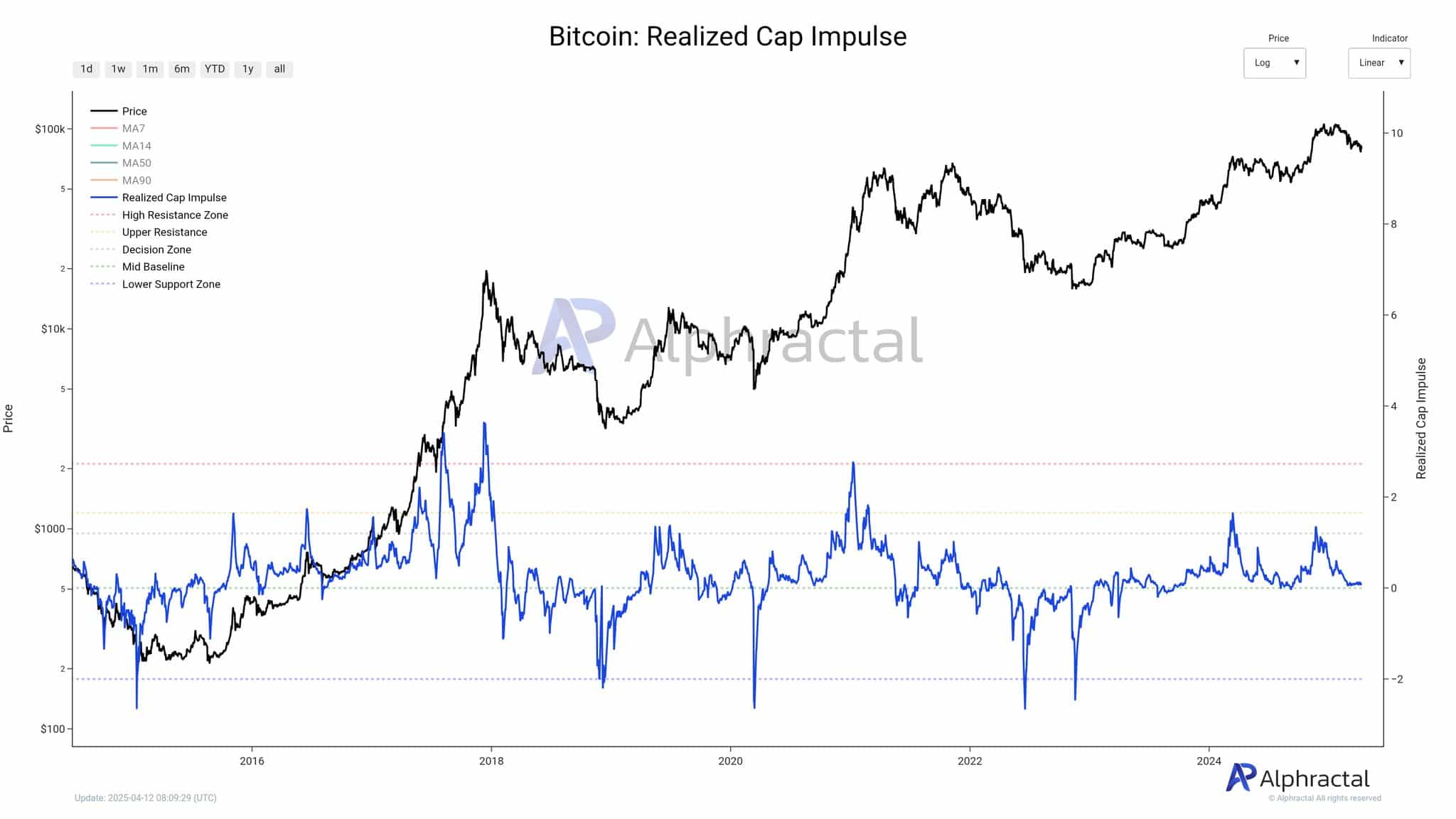

Support bounce or structural breakdown?

The current setup presents a binary outcome. If Bitcoin manages a positive bounce from this support zone, it could signal that long-term holders are maintaining their positions, laying the groundwork for renewed accumulation and upward momentum.

Source: Alphractal

However, a breakdown at this level could signify a loss of confidence among the market’s most resilient participants—those who usually absorb selling pressure rather than add to it. Such a shift might trigger a more pronounced correction.

Considering the long-term impulse’s track record of anticipating macro reversals, its next movement could define the trajectory for the upcoming quarter.

Bitcoin: Sentiment on the edge

At press time, the fear and greed index stood at 45, indicating a cautiously neutral sentiment—leaning toward fear but stopping short of capitulation. This reflects a market characterized by uncertainty while remaining responsive to potential catalysts.

The sentiment reading mirrors the indecision visible on the long-term impulse chart, underscoring that Bitcoin is nearing a critical decision point.

Historically, sentiment often trails structural metrics, suggesting the current calm could precede a significant directional shift. Whether this shift turns bullish or bearish will largely depend on the behavior of long-term holders during this pivotal moment.