- Stablecoins are a vital component of crypto markets

- Trends in exchange reserves can give clues about market sentiment and wider price trends

Stablecoins are essential to facilitating a seamless crypto experience. It is a hedge against volatility since it is pegged to fiat and maintains its value. Stablecoins provide liquidity to the markets and eases complex activities such as lending, borrowing, and smart contract deployment in DeFi.

It is also one of the harbingers of a bull run. Rising stablecoin amounts on-chain are a sign of greater adoption and participation, reflecting demand. This was made apparent by the steady minting of stablecoins such as Tether (USDT) and USD Coin (USDC).

Confirmation of a bull run?

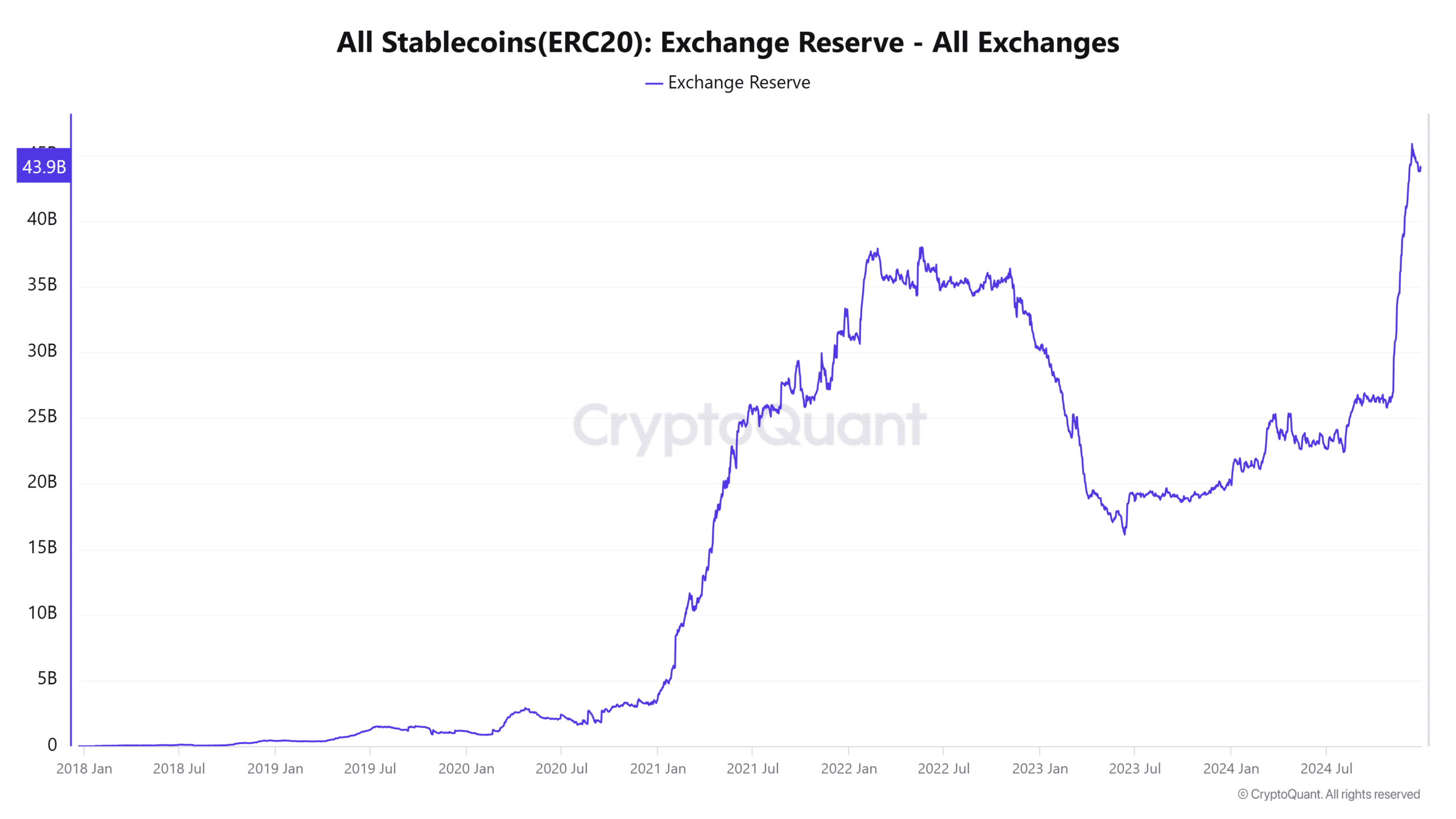

Source: CryptoQuant

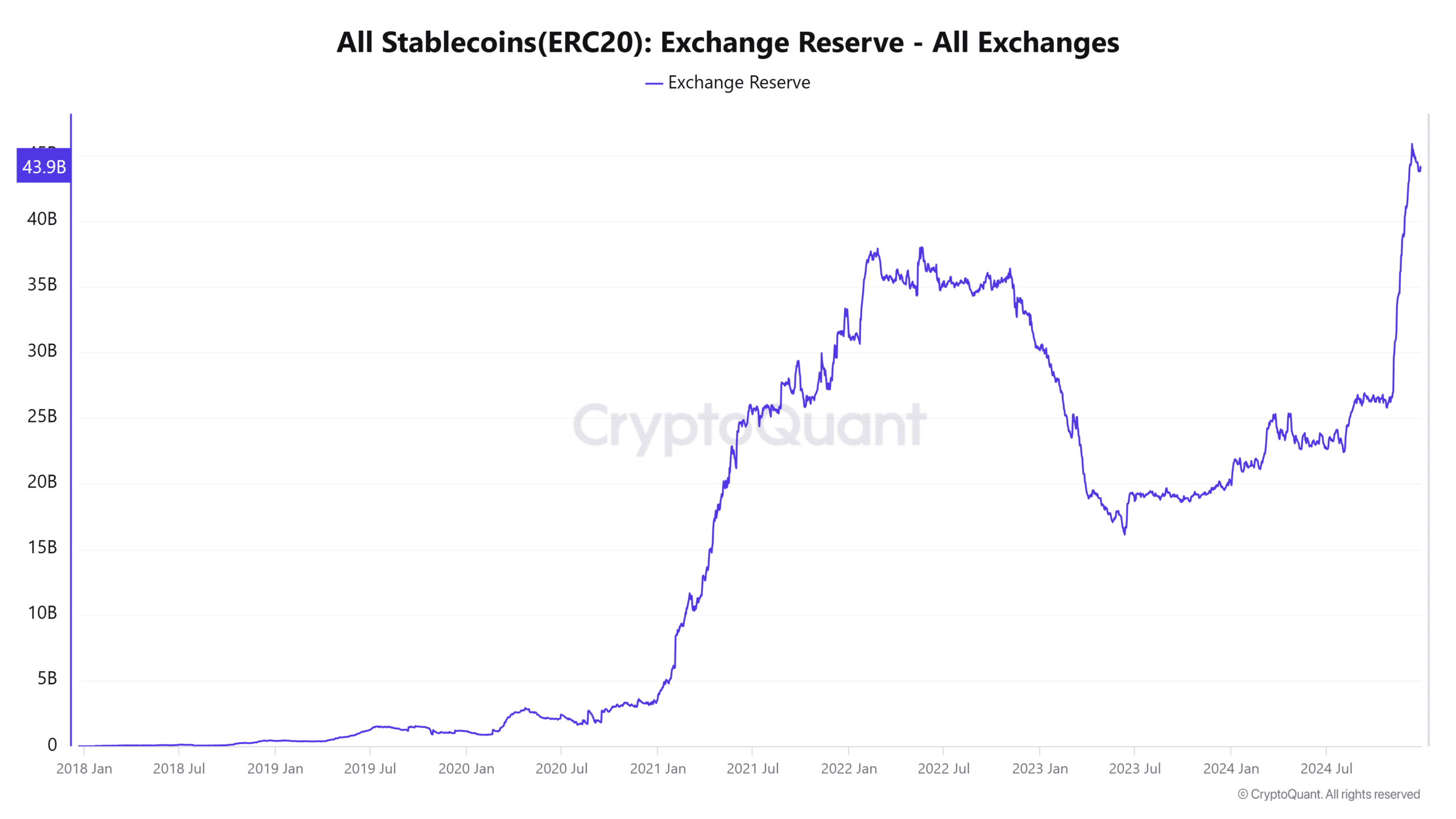

Binance, the world’s largest crypto exchange by volume, has $29 billion in USDT and USDC reserves – The two largest stablecoins. In a post on CryptoQuant Insights, analyst CrazzyyBlockk highlighted the leading exchange’s growing stablecoin reserves.

The implications seemed to be strongly bullish. Binance’s reserves ensure seamless transfers between crypto and fiat, and its deep liquidity gives traders and investors the confidence to buy and sell large quantities of crypto assets.

Source: CryptoQuant

However, it weren’t just the USDT reserves on Binance that were growing. The total stablecoin reserves on all popular exchanges have been trending upwards. From 24 October to 27 December, exchanges’ stablecoin reserves have expanded from $25.7 billion to $44.1 billion.

The last time such a swift, decisive uptick occurred was back in December 2020 – January 2021. This uptrend lasted till early 2022, heralding the previous bull run. A similar scenario is playing out now. Influx of stables to reserves is generally seen as dry powder that would fuel the next price expansion.

Total market cap projections for 2025

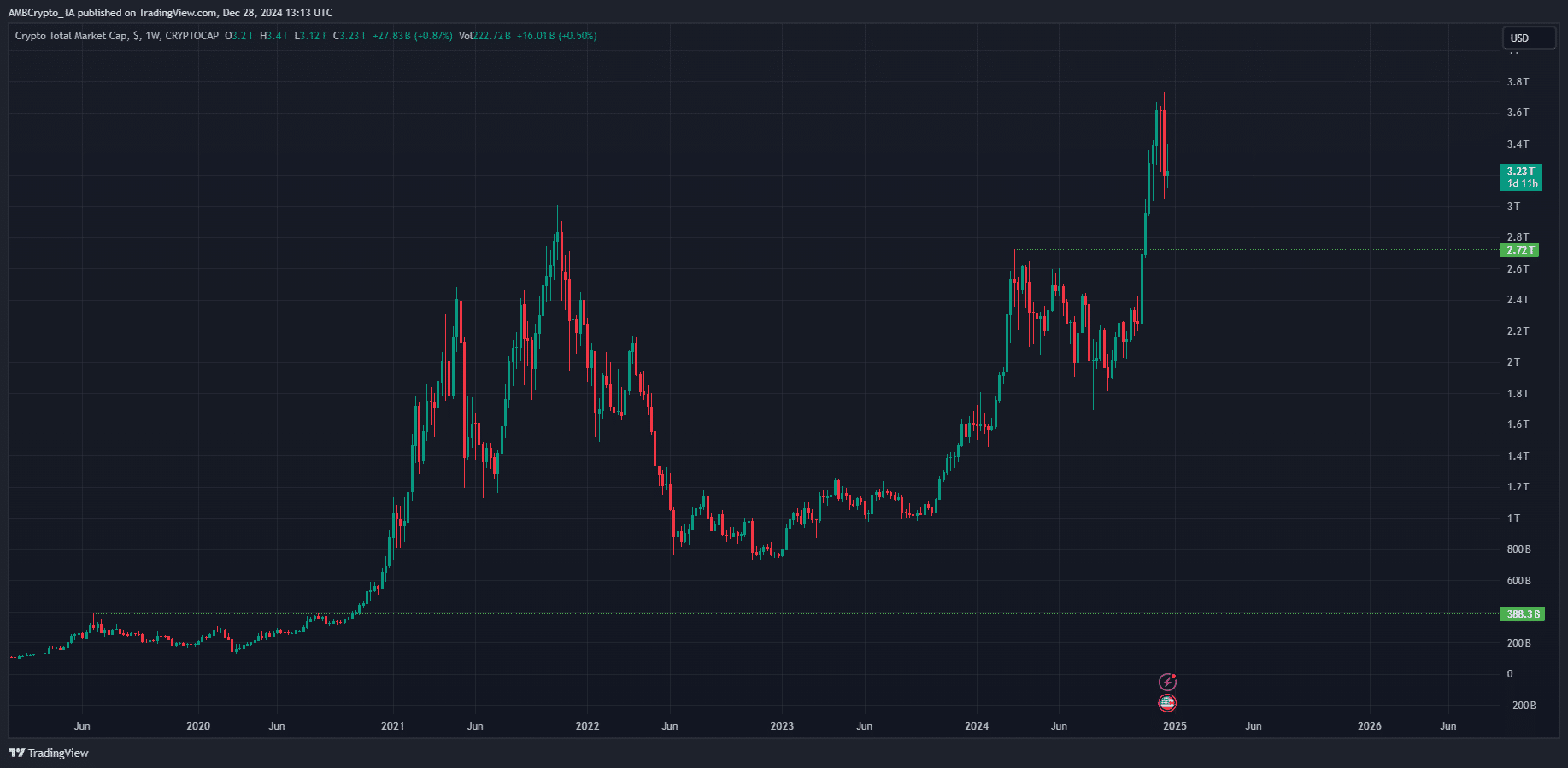

Source: TOTAL on TradingView

In early November 2020, the total crypto market cap surpassed the local high at $388 billion. Over the next year, it rallied by 685% to hit a high of $3.01 trillion. Fast forward to 2024 and a new all-time high has been established.

If another 500%-600% rally materializes, it would teleport the total crypto market cap to $16.8 trillion – $19.5 trillion. If Bitcoin has a roughly 50% market dominance, that would put its market cap around the $8 trillion-mark.

Is your portfolio green? Check the Bitcoin Profit Calculator

This would see a $400k price for Bitcoin. Regardless of whether these lofty price targets are met, the conclusion remains the same.

Another bull run is in play right now. And, the market is playing guessing games with new price targets.