- Ethereum is closely mirroring Bitcoin’s movements, making it increasingly susceptible to a potential correction.

- With whales continuing to dominate, keeping a close eye on their daily actions will be crucial.

Bitcoin [BTC] has surged nearly 3% in the past 24 hours, reaching a fresh all-time high of $106,488. As the New Year kicks off, momentum is clearly building.

Not to be outdone, Ethereum [ETH] is making its own move, inching toward its yearly high of $4,000. Traditionally, ETH has mirrored BTC’s moves, but with shaky hands and overleveraged positions in the market, some are questioning if Bitcoin’s latest surge signals an approaching top.

If so, could this be the moment when ETH breaks away from BTC’s shadow? With the market maturing, is a divergence between the two now more possible than ever?

Bitcoin is still in charge of Ethereum

2024 is coming to a close, and looking back, it’s been a year of major milestones for Bitcoin. In the first quarter alone, Bitcoin surged from $49,710 to an all-time high of $73,000 in just 30 days.

Ethereum didn’t sit on the sidelines either. During the same period, ETH also broke past $4K, reaching levels not seen since 2021. But here’s the catch: Just as Bitcoin hit its peak, ETH followed.

In just one week, ETH plunged to around $3,100, with daily drops reaching up to 10%.

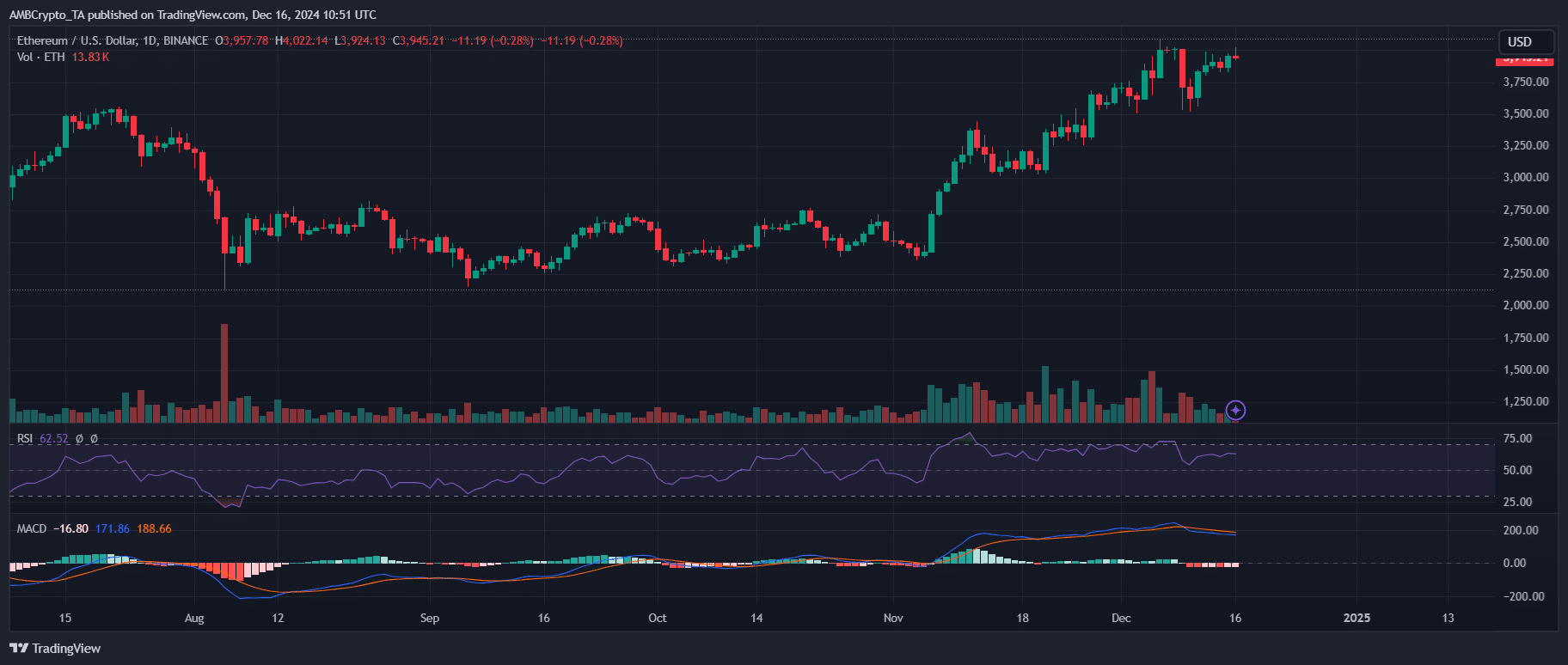

Source : TradingView

Fast forward to now, and an interesting development has caught AMBCrypto’s attention. On the daily chart, while Ethereum’s price action has continued to mirror Bitcoin’s moves, its price swings—both ups and downs—have become increasingly sharp and volatile.

Therefore, reclaiming $4K won’t be an easy feat for Ethereum. The initial pump will likely come from Bitcoin, but holding that price and flipping it into solid support is proving to be a challenging task.

In this scenario, a ‘healthy’ pullback seems likely to flush out weak hands. Additionally, the buying pressure on various premiums hasn’t surged, suggesting that either capital is flowing into Bitcoin or FOMO hasn’t fully kicked in yet.

Unless this trend reverses, Ethereum will likely continue to experience volatility on its daily chart, with sharp price swings making it hard to predict a clear direction in the short term.

Whales are pulling the strings on ETH

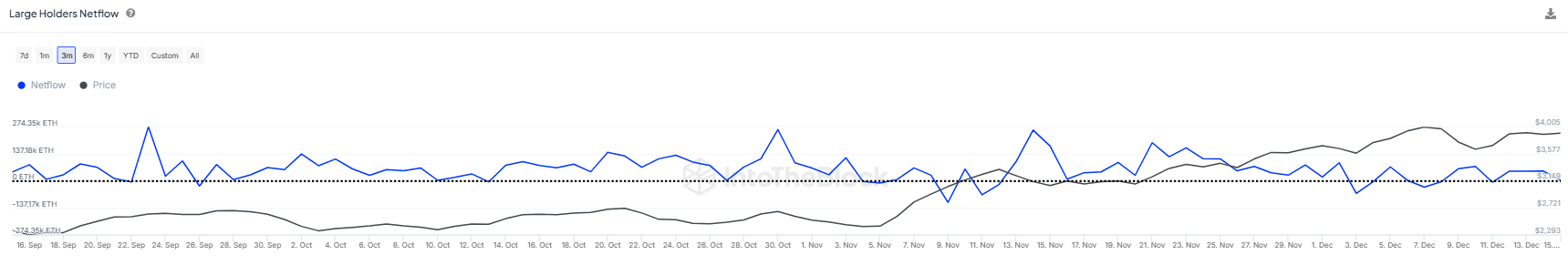

AMBCrypto has uncovered a significant development that could impact Ethereum both in the short and long term. The concentration of Ethereum held by whales has reached 44%, bringing it dangerously close to the 47% held by retail investors.

Whales typically manipulate the market by buying at the bottom and selling at a premium, but over the past 90 days, their orderbook has shown growing inconsistency.

Source : IntoTheBlock

The impact on Ethereum was evident: for two consecutive days, these whales deposited 40K ETH into exchanges when ETH reached $4,000 on December 6th — the same day Bitcoin surpassed $100K for the first time.

This led to a sharp 7% drop in ETH the following day. While these whales have been accumulating ETH, they’ve expertly timed the “dip,” only to cash out just before Ethereum could break critical psychological targets, executing a textbook manipulation strategy.

Read Ethereum (ETH) Price Prediction 2024-25

With all these factors at play, a pullback seems more and more likely. Analysts are predicting a Bitcoin correction, which would likely drag Ethereum down too.

However, if FOMO takes over again, both retail and big players could seize the opportunity to buy the dip at $3,700, where 4.6 million tokens were previously scooped up.