- Exec believes that BTC could surge above $110k if a likely macro shift happens

- Short-term sentiment has remained cautious, while valuation models flashed mixed signals

Bitcoin [BTC] shed 12% of its value over the past week, extending its decline to a new low of $74k on Monday amid Trump tariff woes and macro uncertainty. This was about a 30% drawdown from its all-time high (ATH) of $109.5k.

However, Quinn Thompson, founder of crypto hedge fund Lekker Capital, believes that BTC could print a new ATH in 2025. Citing his previously accurate prediction, Thompson added,

“Me: Calls Trump win early 2024. Calls BTC 100k in summer 2024. Calls BTC correction to low 80Ks since late December 2024…BTC > 110k in 2025.”

He also said that the macro narrative could shift positively, citing upcoming tax cuts and deregulation.

Short-term fears persist

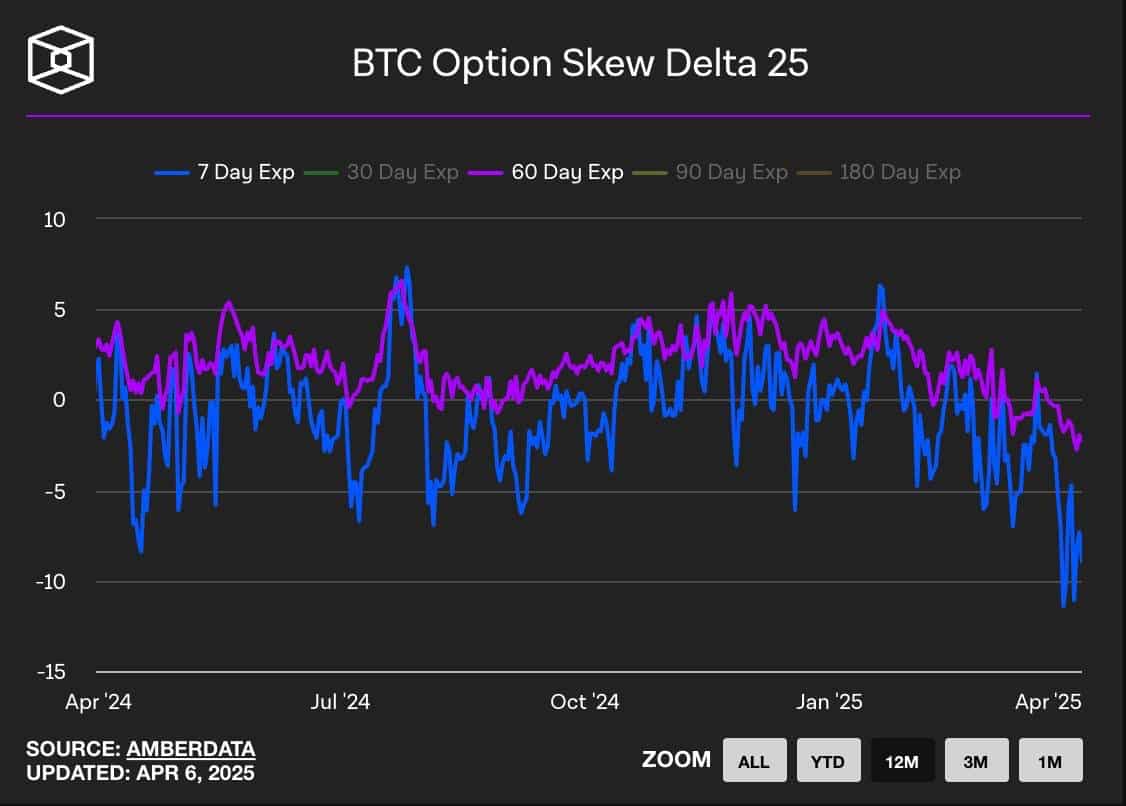

Despite the mid-term positive outlook, traders’ positioning has been cautious in the short term. In fact, Kelly Greer of Crucible Capital noted that Options have been hedging heavily against downside risks, as shown by the premium for puts (bearish bets). She stated,

“Potection is the most in demand that it’s been in 12 months across maturities, most pronounced in 1 week. Gamma is peak negative – will exacerbate volatility.”

Source: The Block

The Skew Delta 25 indicator tracks the demand for puts or calls (bullish bets) over days, weeks, or months.

By extension, it paints traders’ future expectations and market sentiment. Negative readings indicate heavy demand for puts (negative sentiment), while positive values or higher calls allude to bullish sentiments.

According to Amberdata’s Greg Magadini, the premium for puts suggested that short-sellers may be best positioned for gains in the short term. Magadini stated,

“Short-dated options have seen even more puts premium…I think opportunity favors crypto shorts (the laggard theory) as opposed to longs right now (the safe haven theory).”

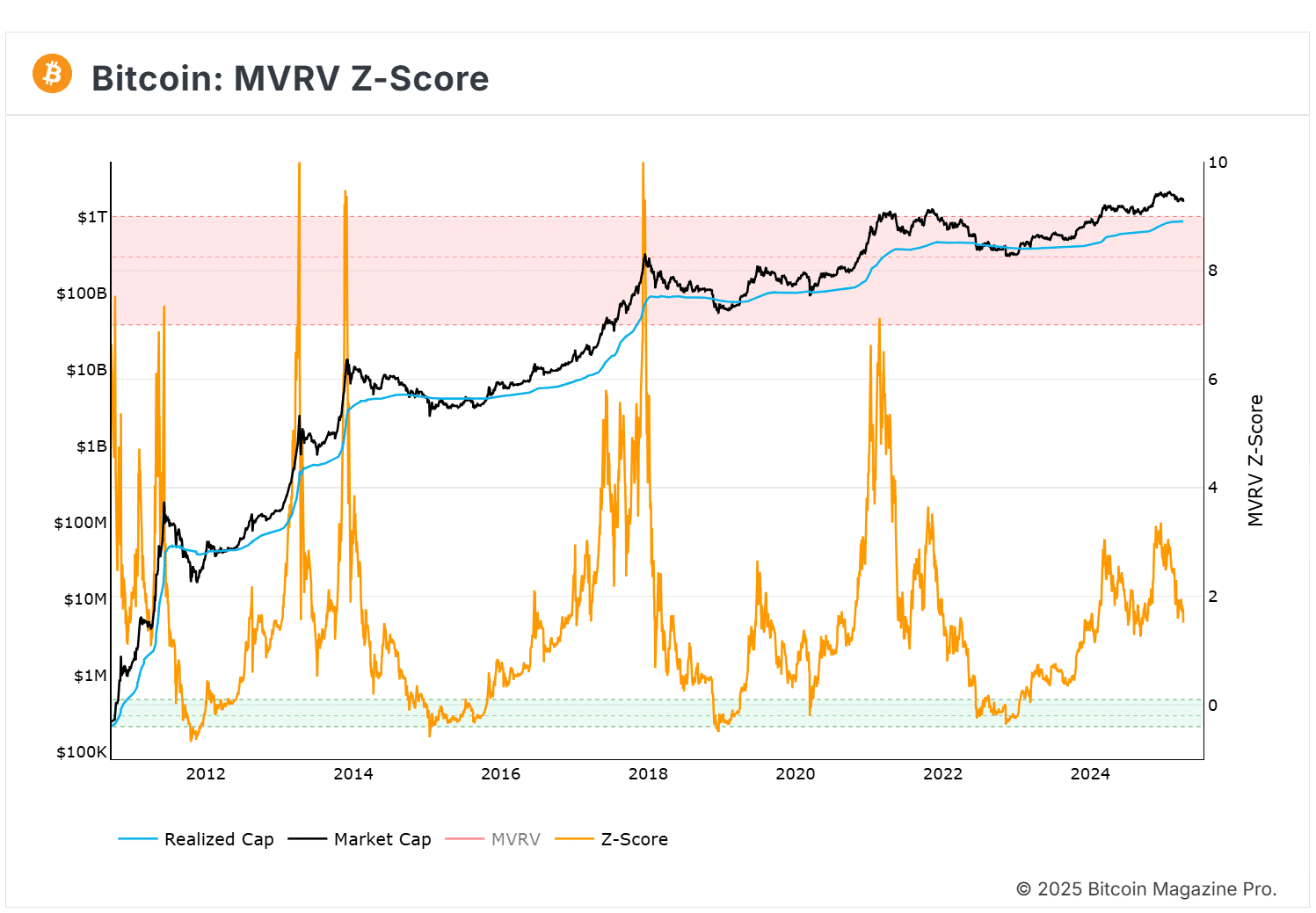

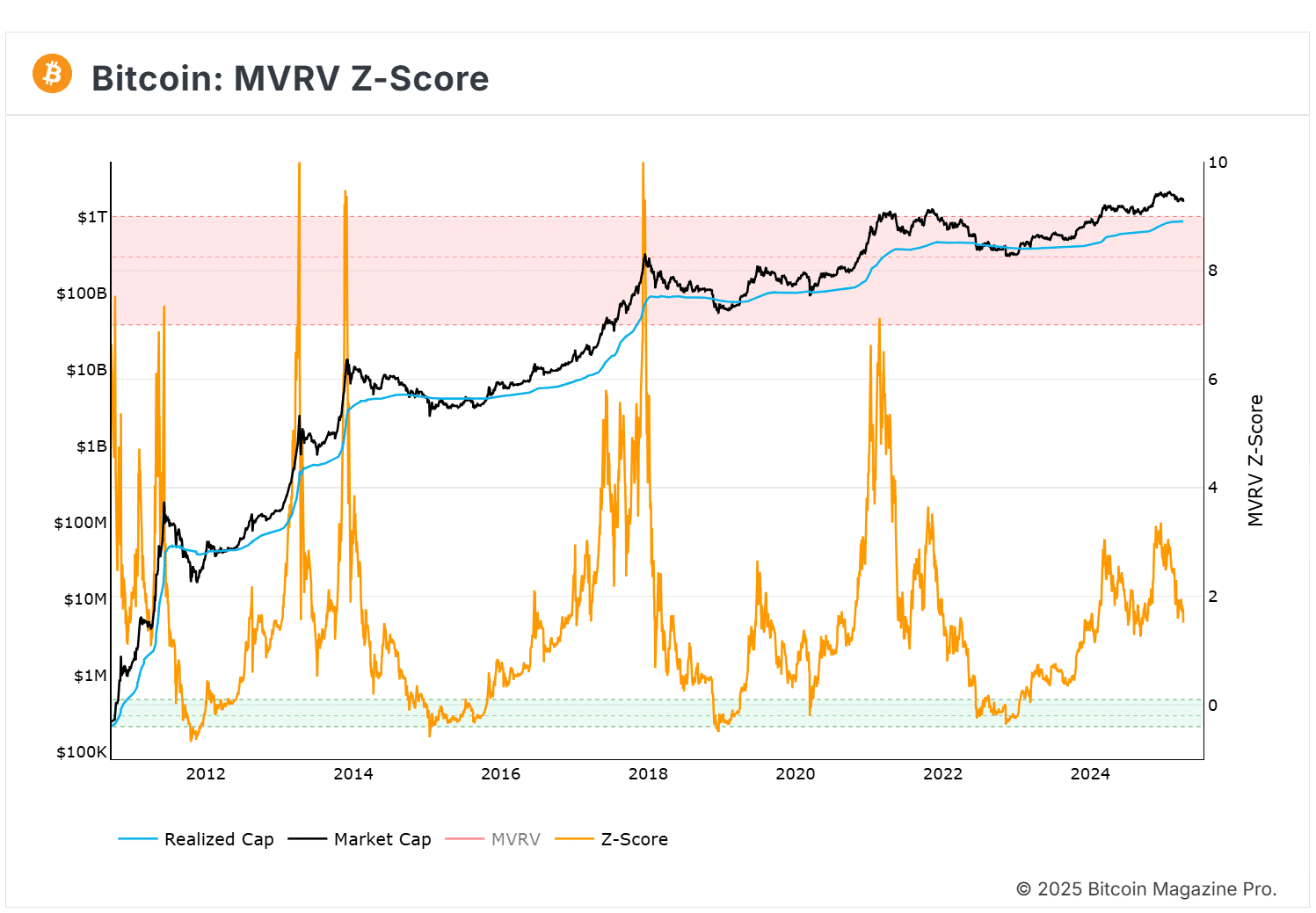

From a valuation perspective, BTC’s status might be mixed. The slow capital inflows, as per the realized cap, suggested that the king coin might be entering a bear market.

However, on another valuation model – the MVRV-Z score – BTC hit a local top. On the same, it seemed to be cooling towards the level seen last September. Simply put, Bitcoin might be relatively cheap at its current value.

Source: BM Pro