- There has been a significant fall in BTC outflows after hitting a new withdrawal point

- Liquidity inflows into Coinbase correlated with investors’ buying action in the spot market

Bitcoin, the world’s largest cryptocurrency, is continuing to trade at levels well below its all-time highs. In fact, losses can be seen across the board, with the cyrpto valued at just over $81,000, at press time, after a 24-hour decline of almost 2%.

Now, with Bitcoin trading close to its critical support levels on the chart, spot traders have gradually begun to accumulate the asset. Hence, it’s worth analyzing other factors to determine whether BTC will see a price pump in the coming days or not.

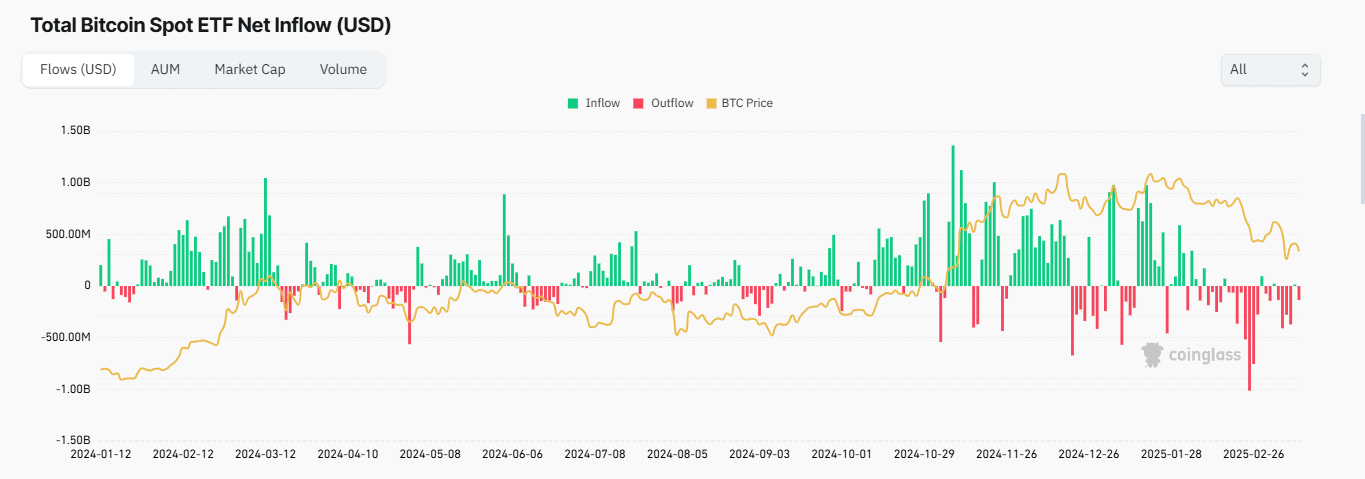

Spot ETF outflows slow down

Recent data revealed a significant fall in BTC outflows from exchange-traded funds (ETFs) over the past month.

At the time of writing, after Bitcoin peaked with outflows of $1.01 billion on 25 February – with total Bitcoin sales of $2.039 billion between 25-27 February 25 – investor selling pressure cooled down.

In the last 24 hours alone, $135.20 million was withdrawn from the market, with assets under management at $97.62 billion – A significantly high amount.

Source: Coinglass

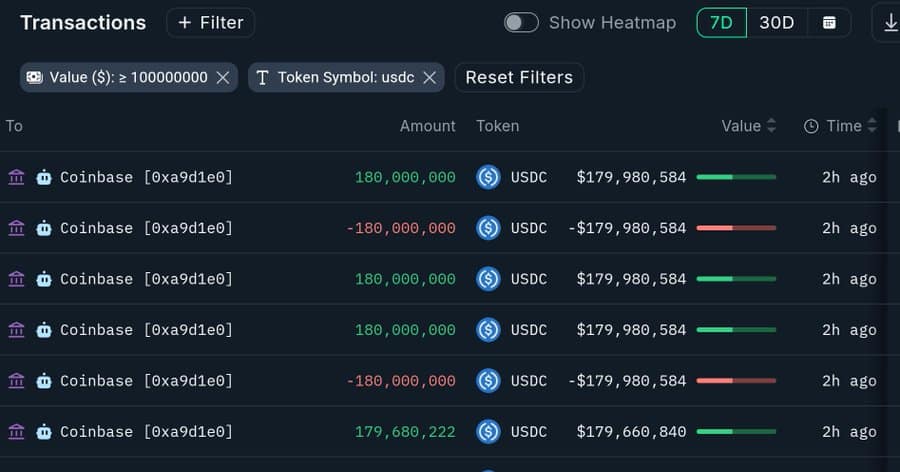

While selling in BTC Spot ETFs has slowed down, there have been massive liquidity inflows into Coinbase.

Over the last seven days alone, inflows have totaled 719 million USDC. Such a large inflow into a cryptocurrency exchange, while price remains stagnant, is a sign of ongoing accumulation. This would also suggest that participants are buying in anticipation of a rally.

Source: Nansen

A look at Bitcoin’s exchange netflows on Coinglass confirmed this buying activity. Especially as spot traders purchased approximately $57 million worth of BTC in the last two days, turning exchange netflows negative.

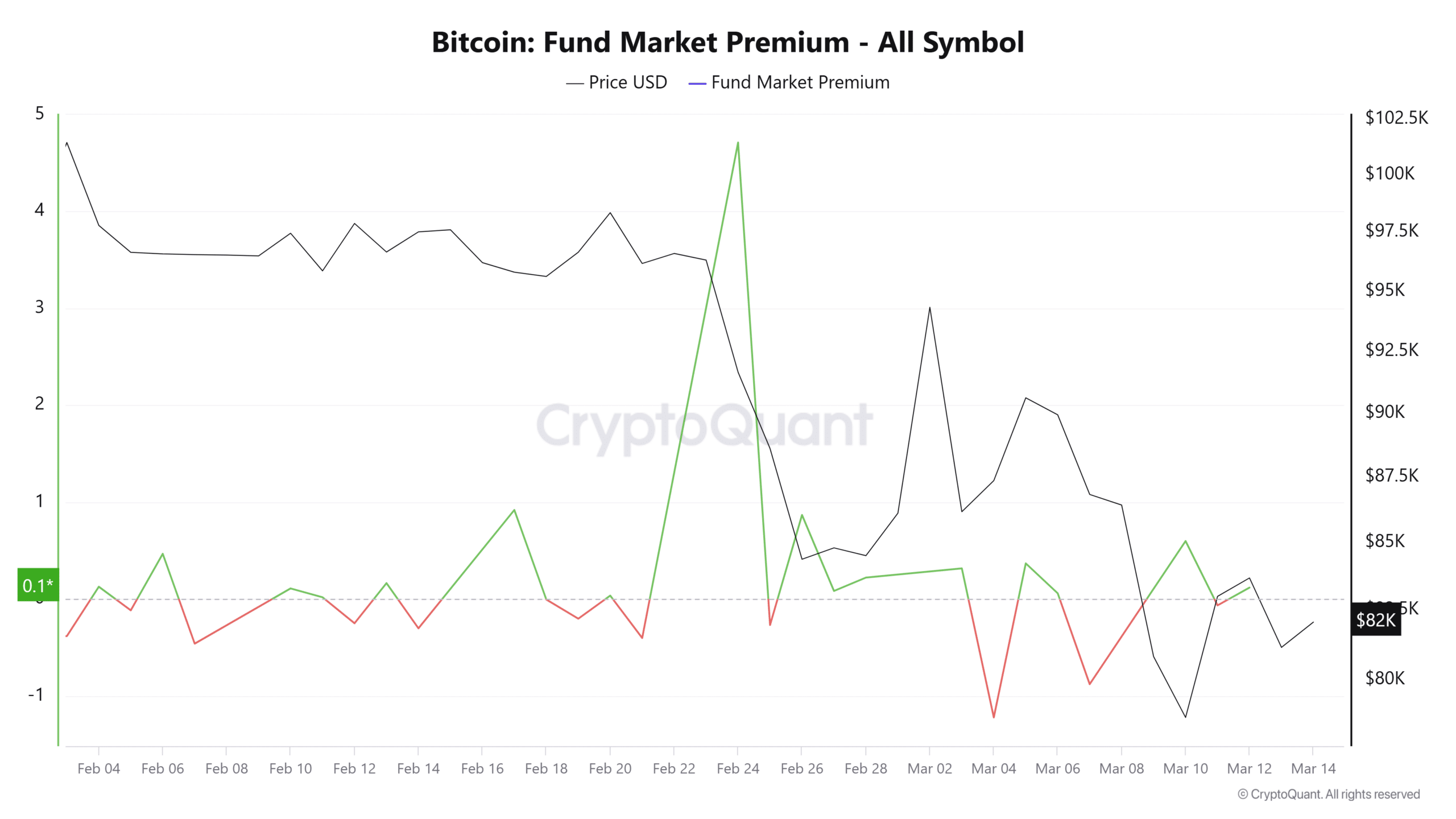

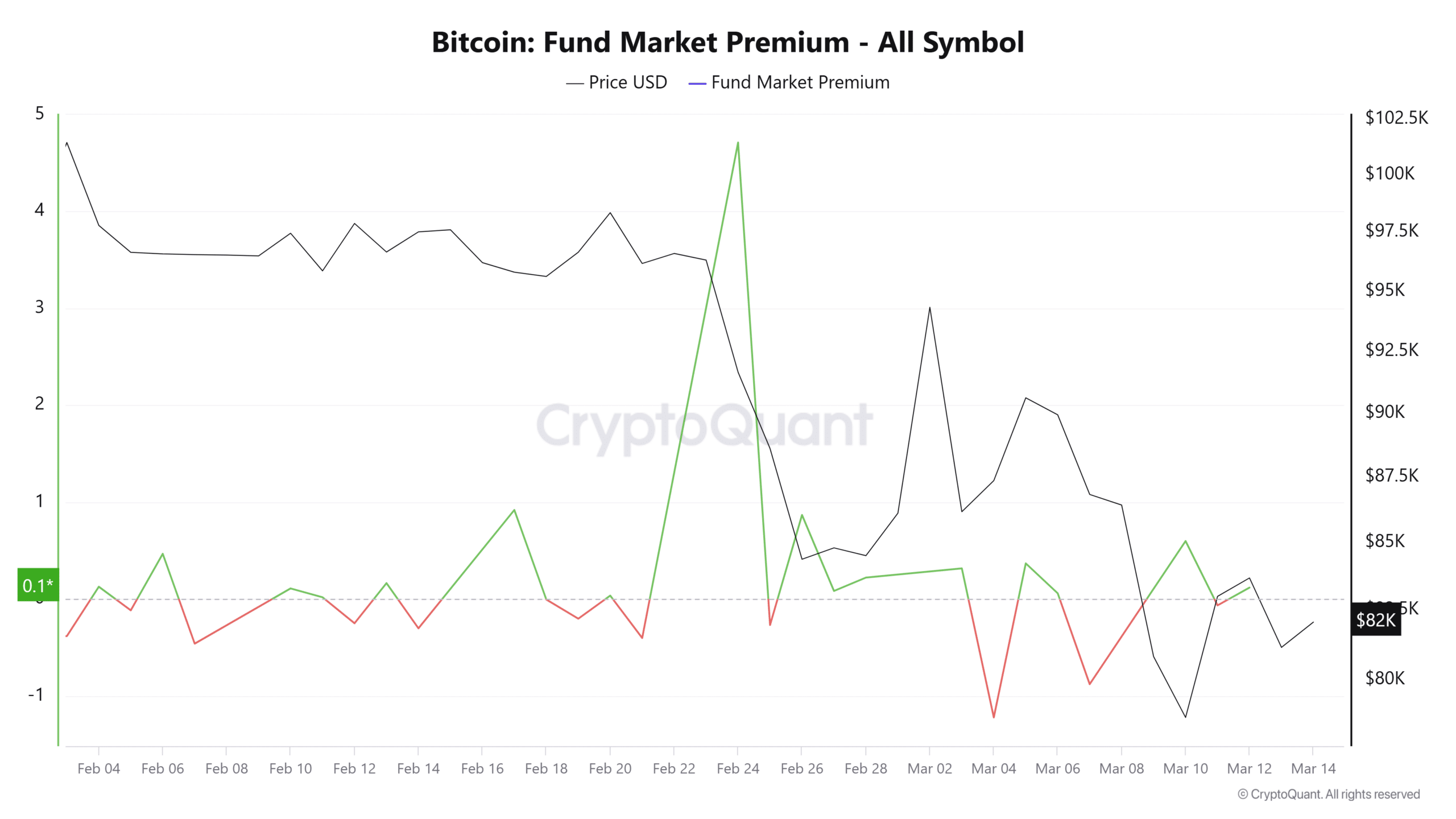

Negative netflows mean that traders are buying an asset. Institutional investors seemed to share a similar sentiment, as the funds market premium turned positive. It had a reading of 1.03, at press time.

Source: CryptoQuant

Here, it’s worth pointing out that the funds market premium measures institutional demand and supply for BTC.

A reading above 1 indicates buying, while a negative reading confirms selling.

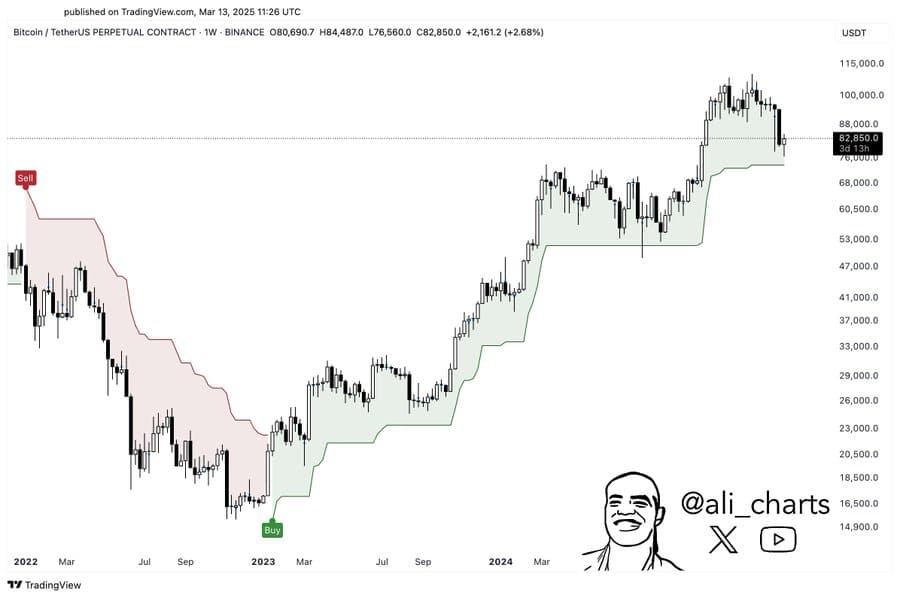

Weekly support remains a key factor

While Bitcoin has been regaining strength in the market, hinting at a possible rally, market sentiment could shift. If this happens, the next notable support level would be at $74,000.

Source: TradingView

This support level has held firm since January 2023 and has been a foundation for market rallies. If the price reacts positively and trends higher from this level, it could signal a major Bitcoin rally. However, a breach of this support could indicate high bearish sentiment, leading to further price declines.

For now, the market remains well-positioned for an upswing, provided bullish sentiment continues to dominate.