- The FOMC minutes for the July 30-31 meeting revealed that a vast majority of Fed officials agreed to an interest rate cut in September.

- Bitcoin briefly reclaimed $61K following the news, as Open Interest surged by nearly $2 billion.

The Federal Open Market Committee (FOMC) released its highly-anticipated minutes for the July 30-31 meeting.

The minutes removed any doubt of interest rate cuts in September, with a vast majority of Federal Reserve officials agreeing that inflation has eased.

Such macroeconomic data tends to stir price moves across the crypto market. Most top ten coins by market capitalization saw small bouts of volatility, with Bitcoin [BTC] breaking the psychological level of $60,000.

First Fed rate cut since 2020

Per the minutes of the July 30-31 meeting, most Fed officials are supporting an interest rate cut in September. Some members were also willing to support a 25 basis point cut during the July meeting.

The minutes read,

“The vast majority observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting.”

The officials further noted that while inflation remained elevated, it had reduced significantly and was on track to reach the 2% target. Other economic indicators such as the labor market were also strong.

The cut will mark the first time the Federal Reserve has abandoned money-tightening measures since 2020.

69% of investors on the CME FedWatch Tool also anticipate the same drop. However, 30% of investors anticipate a steeper cut of 50 basis points.

Bitcoin jumps on “dovish” minutes

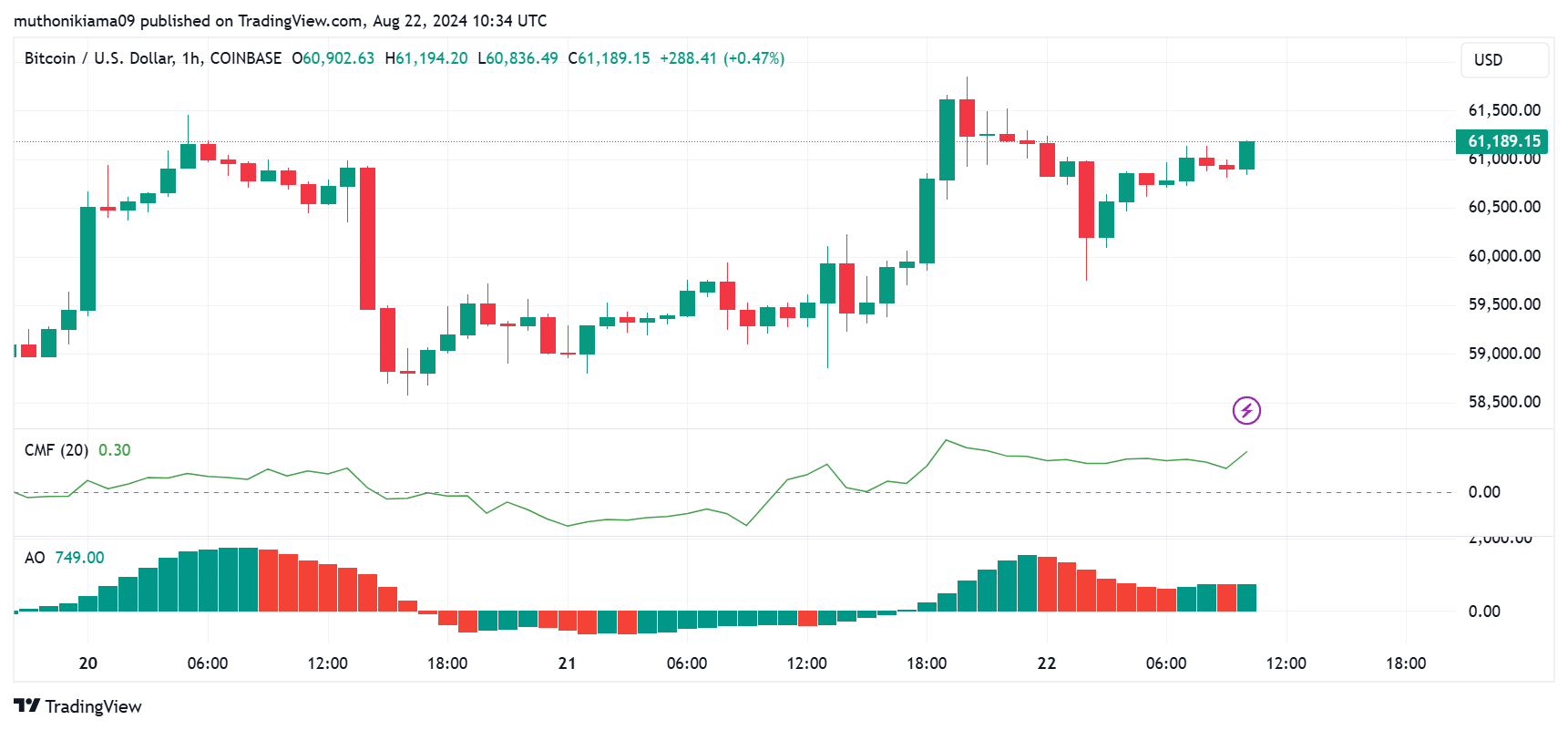

Bitcoin has jumped by 2.6% to trade at $61,189 before falling down to $60,890.81 at the time of writing. BTC’s trading volumes have also spiked by 26% per CoinMarketCap data, as market interest around the coin grew.

The spike comes amid a rise in buying pressure, as seen in the Chaikin Money Flow (CMF) index.

The CMF was in the positive region at press time, spiking significantly on the 22nd of August, coinciding with the FOMC minutes release.

Source: TradingView

Nevertheless, the uptrend remained weak, as seen in the Awesome Oscillator (AO). The AO was positive on the hourly chart and also shifted green at press time.

While this indicates an uptrend, more confirmation is needed to confirm its strength.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Data from Coinglass also showed a nearly $2 billion increase in Open Interest from around $30 billion on the 21st of August to $32 billion at press time.

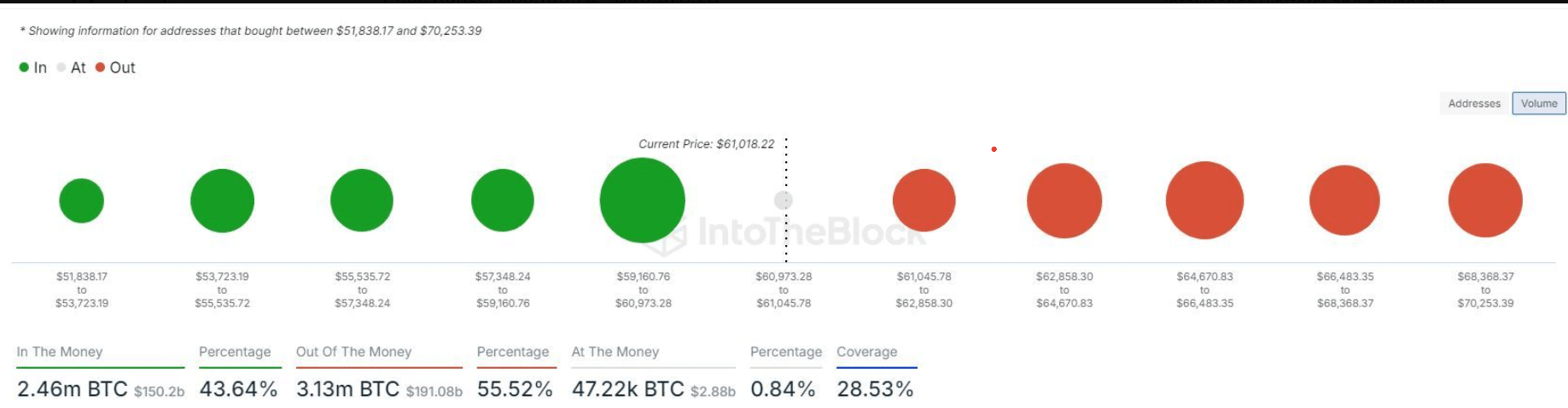

Bitcoin’s key resistance continued to lie at the $64K-$66K range, as a majority of coins were bought at these levels per IntoTheBlock data. Therefore, sellers might emerge once BTC approaches this price range.

Source: IntoTheBlock