- Bitcoin surged to $94,000 and hit a new ATH, following Donald Trump’s presidential election victory.

- As both short- and long-term drivers converge, Bitcoin’s rally faces questions of sustainability.

Bitcoin [BTC] reached a new all-time high, surpassing $94,000 on the 19th of November, extending its remarkable rally that began after Donald Trump’s presidential election victory.

The king coin has surged nearly 35% from around $70,000 on election night.

Short-term catalysts behind the Bitcoin ATH

Source: TradingView

Bitcoin’s surge to an ATH of $94,000 — the coin’s price had dropped to the $92,000 mark at press time — has been driven by a confluence of short-term factors.

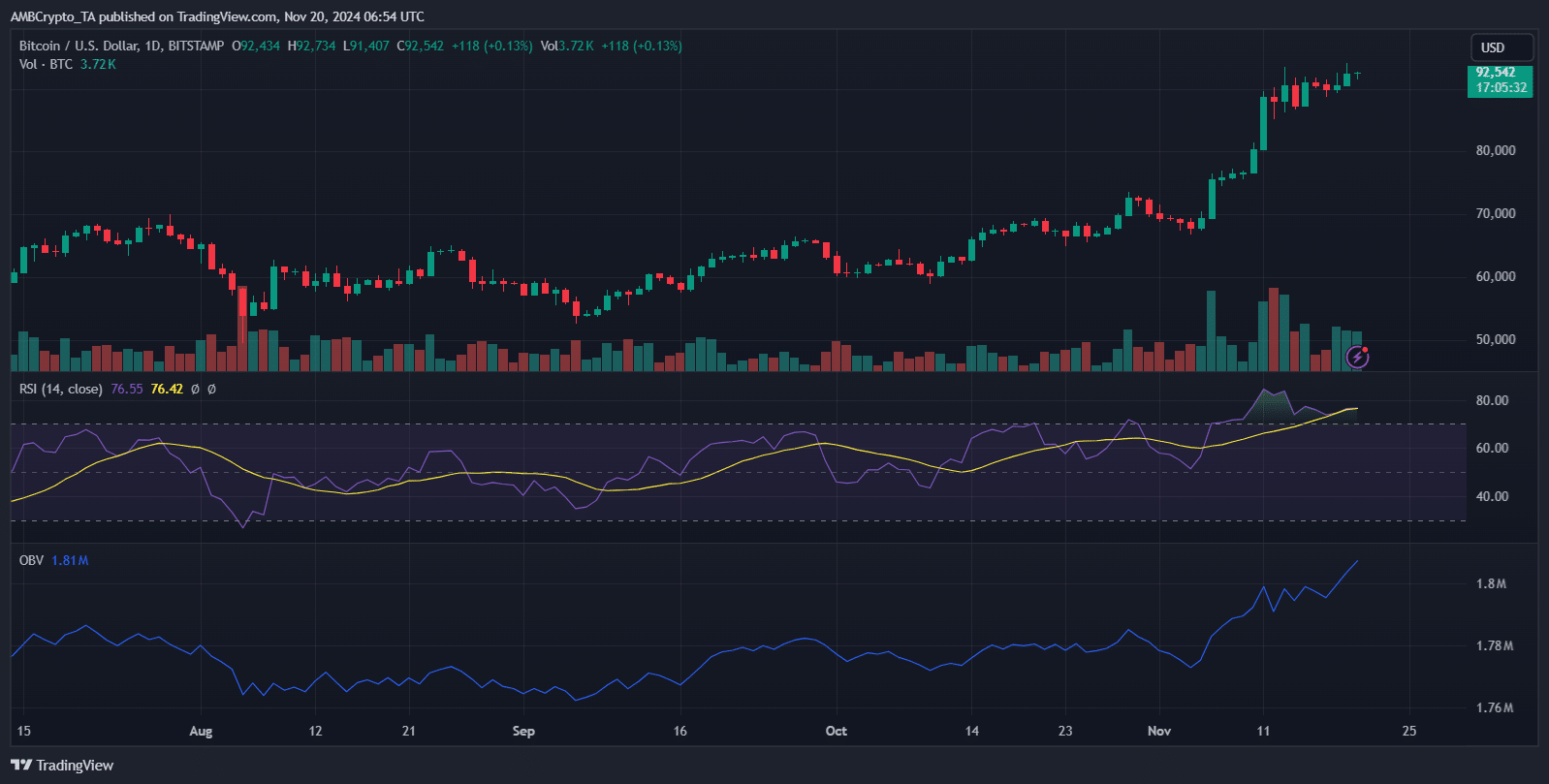

The RSI climbed to 76.74, signaling strong bullish momentum yet entering overbought territory, suggesting potential caution for traders.

OBV has risen sharply, reflecting sustained accumulation by large players, while trading volumes have remained robust, highlighting increased market activity.

Media attention has played a pivotal role, with the presidential election sparking renewed interest in cryptocurrencies as speculative assets.

The combination of increased mainstream visibility and institutional demand has fueled market enthusiasm.

Speculation surrounding Bitcoin as a hedge against potential macroeconomic instability under Trump’s presidency has further amplified its rise.

Additionally, whale activity in the market has been notable in the last few weeks, with large buy orders providing a foundation for the rally.

However, with RSI approaching critical levels, traders may need to watch for consolidation or short-term corrections.

Long-term drivers of Bitcoin’s growth

While short-term catalysts have fueled Bitcoin’s recent surge, long-term factors have steadily supported its ascent.

Over the past two months, institutional investments have surged, with asset managers like BlackRock increasing exposure to Bitcoin-backed ETFs, signaling growing mainstream acceptance.

Corporate treasuries, including Tesla’s, have bolstered holdings as Bitcoin solidifies its status as a digital store of value.

Adoption has also expanded, with major payment platforms integrating Bitcoin into retail transactions.

Notably, during the presidential election, speculation around Trump’s policy stance on crypto regulation reignited interest.

Additionally, reports of Trump Media & Technology Group’s discussions to acquire the Bakkt platform have amplified market optimism.

This potential acquisition is seen as a move to integrate Bitcoin into mainstream financial and media ecosystems, further legitimizing its role in global markets and sustaining bullish sentiment.

What’s next for BTC?

As Bitcoin basks in its historic rally, potential challenges lie ahead. Regulatory responses are expected to take center stage, with global policymakers likely to scrutinize the cryptocurrency’s rapid ascent.

Trump’s administration could influence crypto regulations, either bolstering adoption or dampening sentiment depending on its approach.

Meanwhile, market corrections are also on the radar. With the RSI in overbought territory and whale-driven momentum at risk of cooling, short-term pullbacks are a possibility.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Many analysts have suggested that $90,000 could serve as a key support level, but any breach may spark a deeper correction.

However, Bitcoin’s long-term fundamentals remain robust, providing a strong foundation for continued growth, even amidst short-term volatility.