- The bearish wedge pattern and negative funding rates signal a potential downside for BNB.

- Derivatives activity surges, but mixed signals keep traders cautious about BNB’s next move.

Binance Coin [BNB] is under pressure as it forms a rising wedge pattern on the weekly chart, a technical structure often signaling bearish outcomes. This pattern, combined with mounting resistance levels, raises questions about its ability to hold its ground.

At press time, BNB was trading at $676.54, marking a 2.38% decline in the last 24 hours. Therefore, the token’s price action is at a pivotal point, and traders are bracing for its next move.

Will it break down and confirm a broader bearish trend, or can it defy expectations?

BNB price action analysis: A critical test for support

The rising wedge pattern on the weekly timeframe indicates that BNB’s price momentum is weakening. Additionally, the failure to push beyond key resistance levels has created market uncertainty.

As a result, traders are closely watching the $609.6 support level, which could act as a short-term safety net. However, if selling pressure continues to grow, BNB could experience an accelerated decline.

Source: TradingView

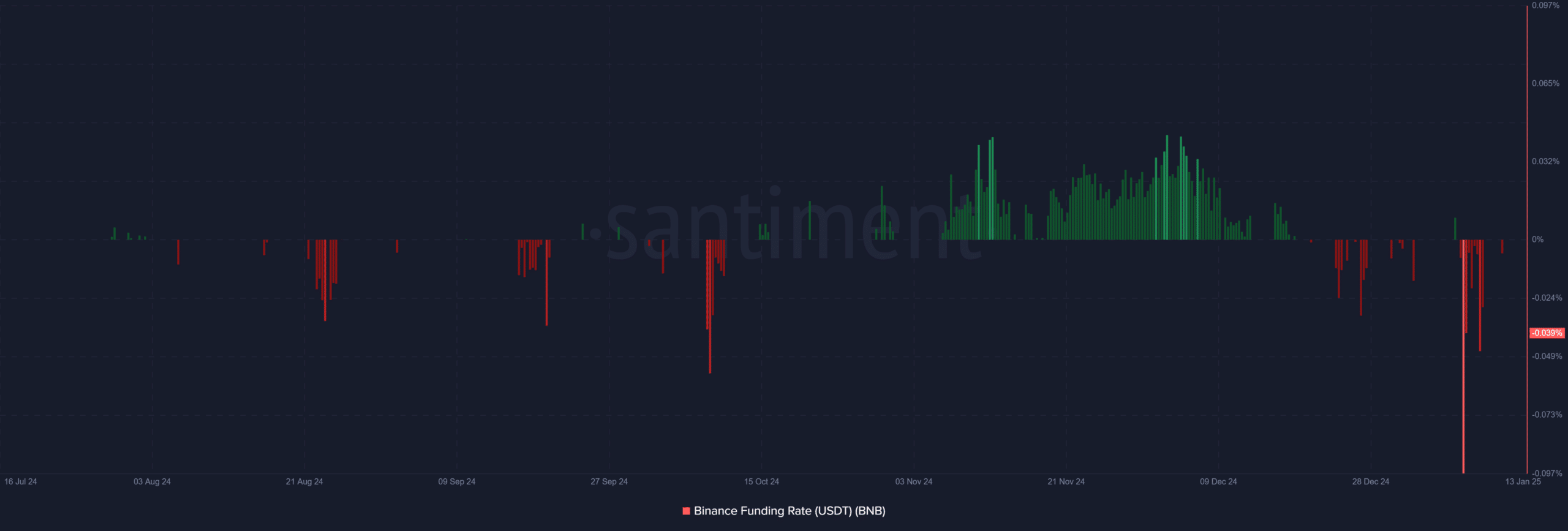

Binance funding rates: Bearish sentiment intensifies

BNB’s funding rates on Binance are currently negative at -0.0389%, signaling an increase in short positions. This development highlights a shift in market sentiment, with traders expecting further price declines.

Moreover, prolonged negative funding rates often lead to additional downside momentum. However, the possibility of a short squeeze remains if bullish traders regain control.

Source: Santiment

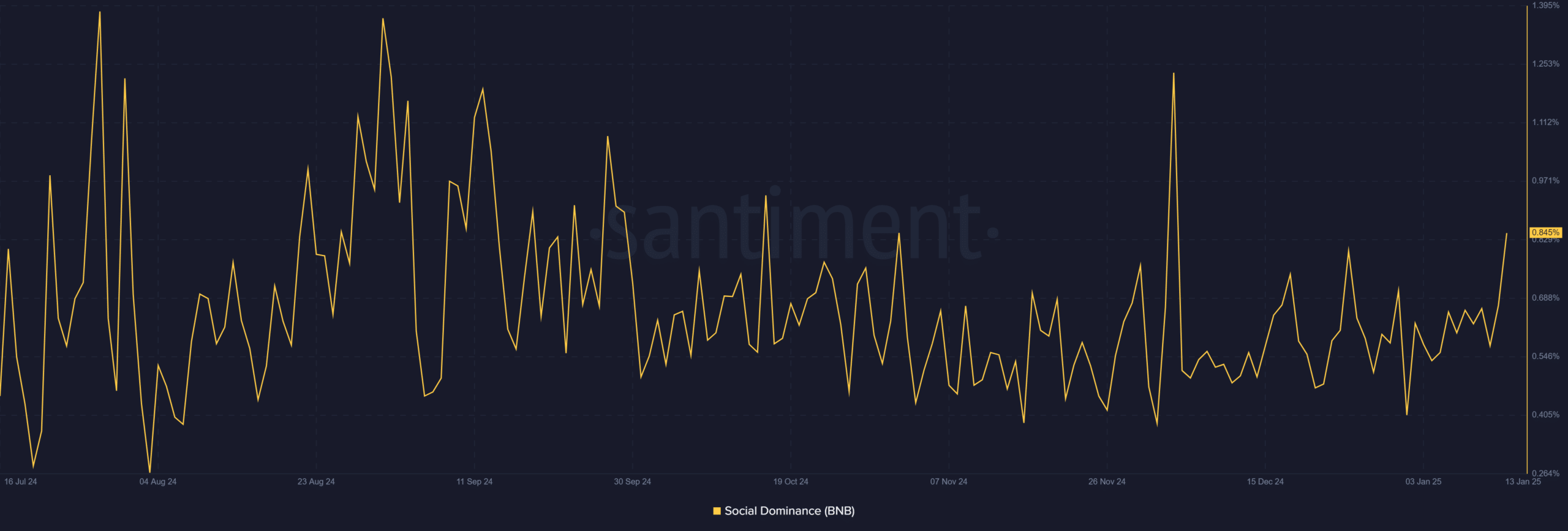

BNB social dominance: Attention reaches new heights

Social dominance for BNB has surged to 0.845%, the highest level recorded in recent months. This sharp increase suggests that the market is closely monitoring its price movements.

Heightened social activity often leads to increased speculative trading, potentially amplifying volatility. However, it remains unclear whether this attention will drive renewed buying or deepen the bearish outlook.

Source: Santiment

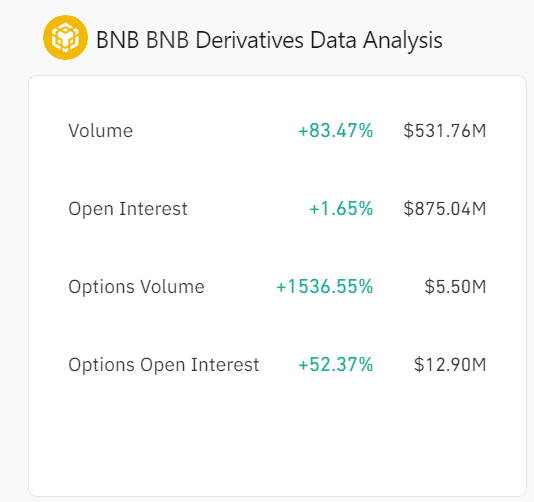

BNB derivatives data: What the numbers reveal

The derivatives market shows a mixed picture, with trading volume up by 83.47%, reaching $531.76 million. Additionally, options volume skyrocketed by 1536.55%, while open interest rose by 1.65%.

These numbers indicate growing trader involvement, likely in anticipation of a significant price movement. However, the negative funding rates counteract these positive metrics, suggesting that caution dominates the market.

Source: Coinglass

Read Binance Coin’s [BNB] Price Prediction 2024–2025

BNB is under mounting pressure as bearish signals dominate both technical and market metrics. The rising wedge pattern, negative funding rates, and increased social activity suggest a looming breakdown.

While derivatives data hint at trader optimism, the overall outlook remains bearish. Therefore, a deeper correction seems likely unless BNB can reclaim momentum and invalidate bearish patterns.