- Altcoin recently dipped into a key support zone, a move largely attributed to whale investors offloading substantial holdings

- Analysis of the Bull-Bear ratio suggested that the ongoing price decline will be short-lived

After a challenging period marked by a sharp drop and poor performances over the past week, AVAX has begun to recover. In fact, at the time of writing, its momentum had pushed its daily gains to 13.28% – A sign of renewed market interest.

However, questions remain about the sustainability of this rally. Hence, AMBCrypto examined whether AVAX still has upside potential in the days ahead.

Support level drives AVAX’s recovery

A recently identified support level by IntoTheBlock has served as a major catalyst for AVAX’s upward trajectory, boosting its 24-hour momentum. The support level, precisely at $41, has been pivotal for the altcoin’s bullish trend.

Especially since it encompasses over 150,000 addresses holding 8.93 million AVAX.

Source: X

Such levels play a vital role in price movements, as they attract significant buying interest. Buyers often see these levels as opportunities to secure the asset at favorable prices, fueling potential rebounds.

Recent market activity also revealed that after AVAX traded down to this level at $41.32, it formed two bullish candles. The price has since surged to $50.08, marking an important recovery after its prior decline.

Whales’ sell-offs create opportunities for AVAX rally

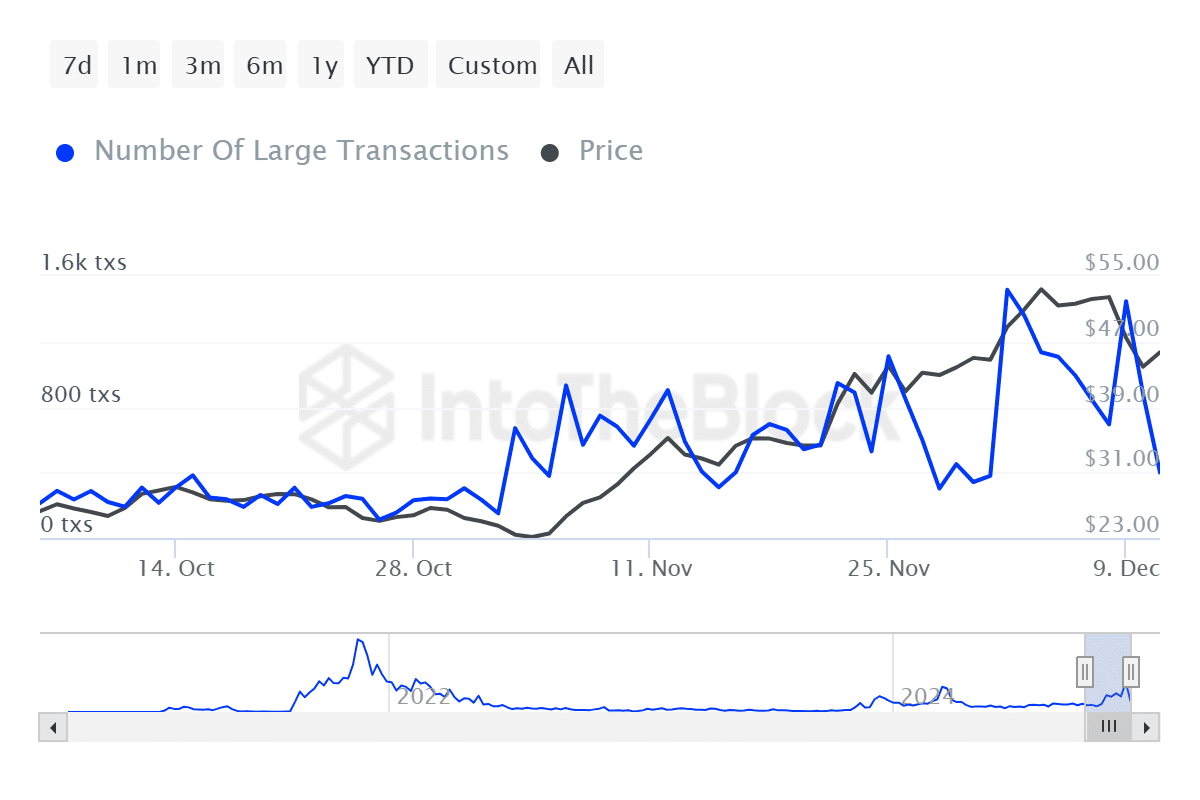

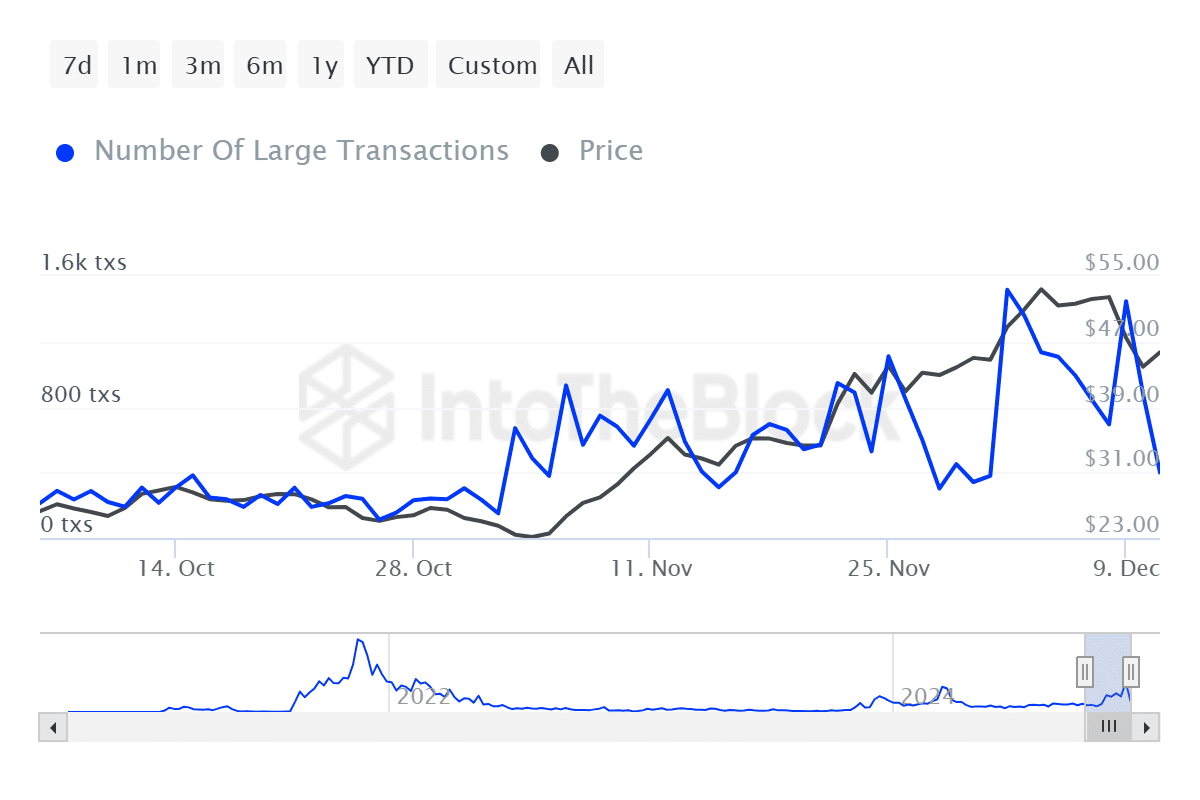

The recent drop in AVAX to the $41 support level was driven by large holders — known as whales — who collectively own up to 1% of the token’s supply and have been selling heavily.

This wave of sell-offs began on 9 December, with transactions peaking at 1,450 before plummeting to just 400 in the last 24 hours. During this period, 3.53 million AVAX worth $161.12 million changed hands – A sharp decline from the $1.54 billion recorded on 9 December.

Source: IntoTheBlock

While whales have been selling, retail traders and smaller investors have been actively buying at higher prices. This shift has helped AVAX regain some momentum.

The prevailing market dynamic sets the stage for a potential rally. If whales resume accumulating AVAX, it could trigger a major price surge, pushing the asset to new highs.

Market outlook remains bullish

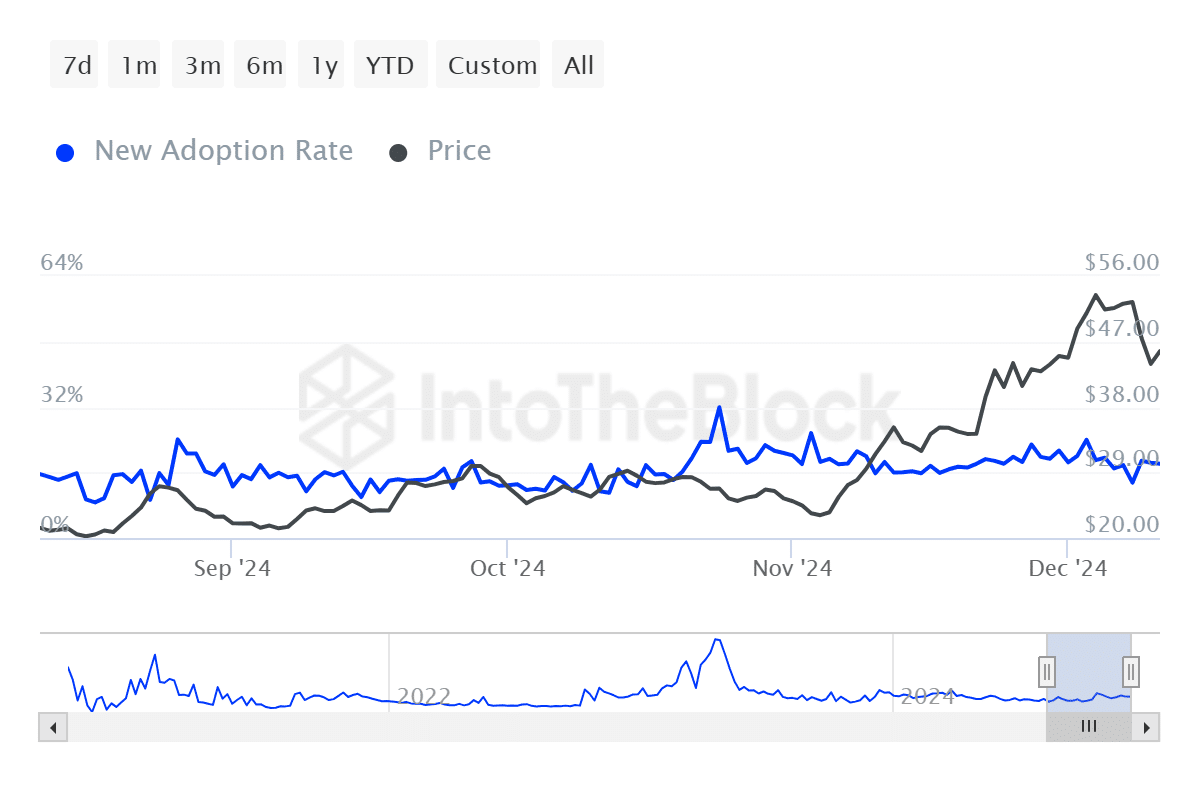

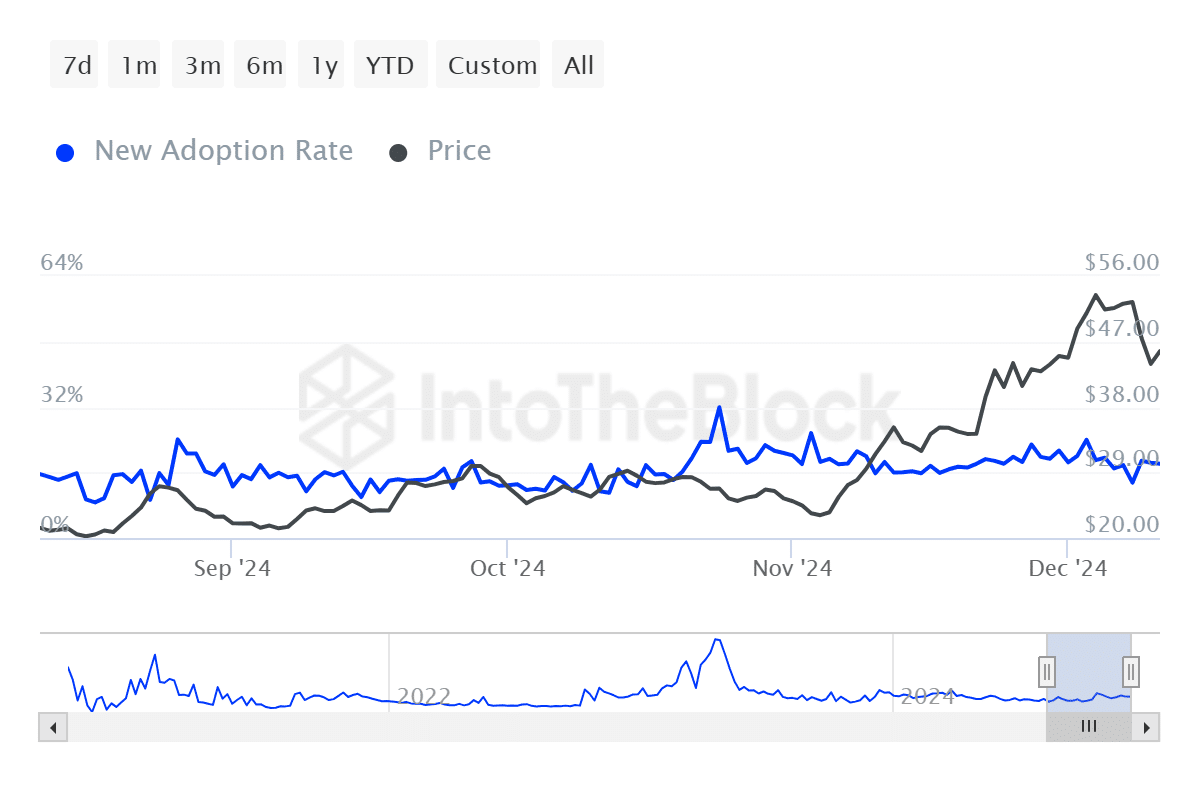

Finally, data from IntoTheBlock revealed a slight edge for bulls in the market, with 117 bulls compared to 115 bears. Although this disparity is minimal, it seemed to favors sustained bullish momentum.

Additionally, AVAX has seen steady growth in adoption, with a 30-day average increase of 18.34%. This metric, which tracks the number of new addresses making their first transactions relative to active addresses, indicates rising retail interest.

Source: IntoTheBlock

This growing adoption has supported recent price movements, reflecting greater participation from retail investors.

If whales resume purchasing and key metrics maintain their current trends, AVAX could see a significant price surge soon.