- Pepe saw spikes in social volume and price some days ago.

- There has been a retracement, and it is now trending negatively.

Pepe [PEPE] recently experienced a significant social volume increase, coinciding with a price spike.

However, the surge in activity has started to retrace, reflecting a pattern that has played out in the last 24 hours as both the social buzz and price begin to cool off.

Pepe’s social volume and price surge

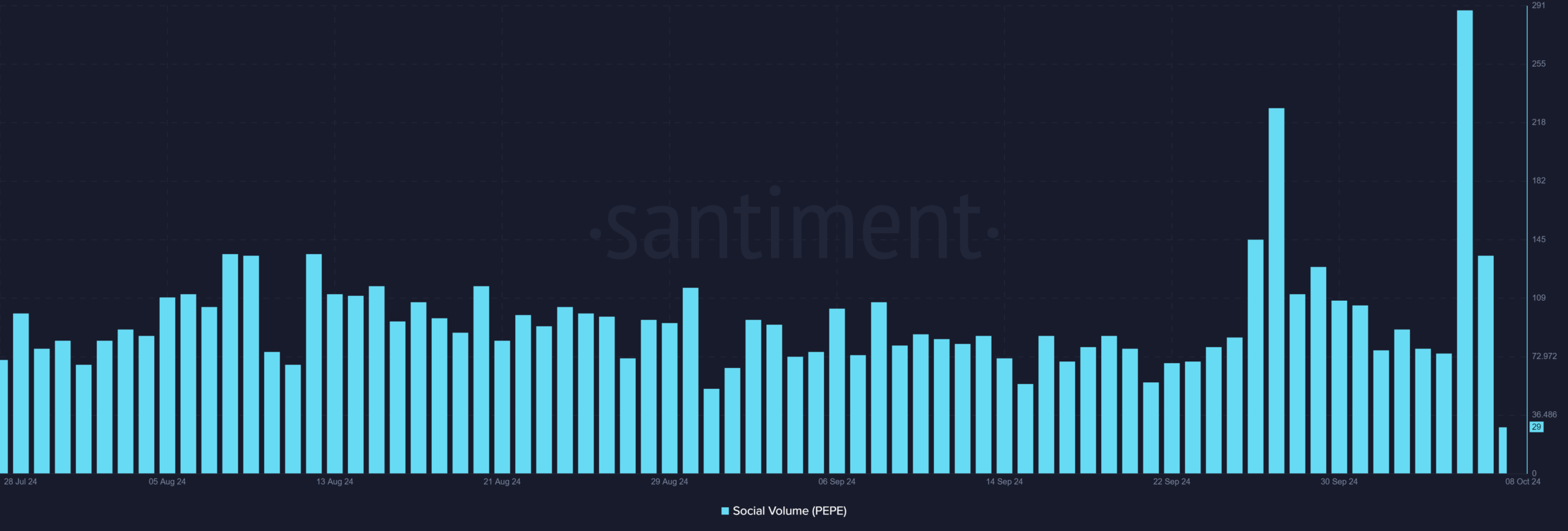

According to data from Santiment, Pepe’s social volume spiked on the 6th of October, reaching 289, the highest level seen since June.

This spike indicated heightened discussions about Pepe across social media platforms. The price initially responded positively, with Pepe seeing a 9.41% increase, jumping from around $0.000009 to $0.00001.

Source: Santiment

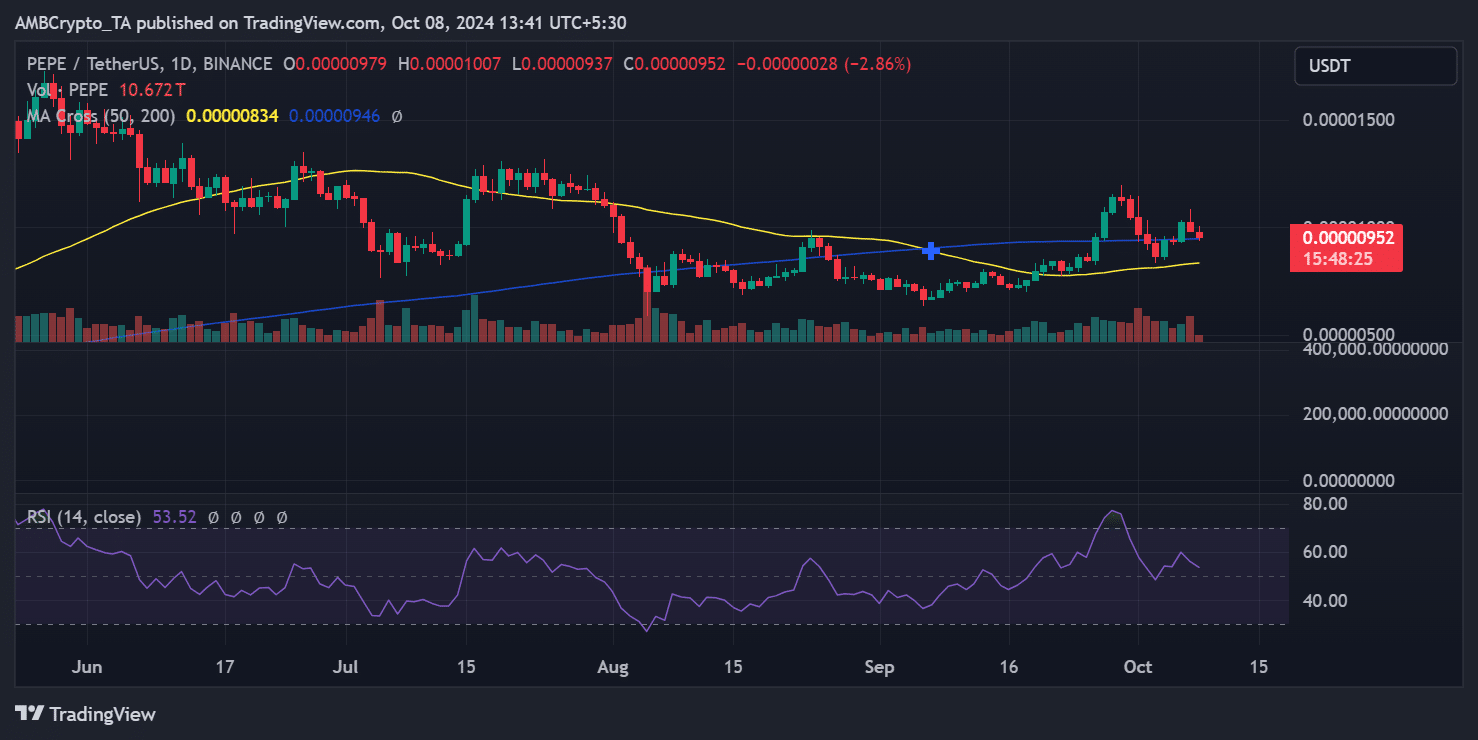

This surge pushed the price above its 200-day moving average, a key resistance level. However, the excitement has been short-lived, as the price typically retraces after social media buzz fades.

Pepe price retracts after spike

Following the brief rally, Pepe’s price has begun to retract. Over the last 24 hours, Pepe saw a 4.20% decline, sending its price down to around $0.0000098.

As of press time, the memecoin was trading at approximately $0.0000095, representing an additional 2.8% drop.

Source: TradingView

Despite the price decline, Pepe’s Relative Strength Index (RSI) remains above the neutral line, indicating it is still in a bullish trend for now.

However, if the price continues to decline, the RSI could shift into bearish territory, signaling further downward movement in the current trading session.

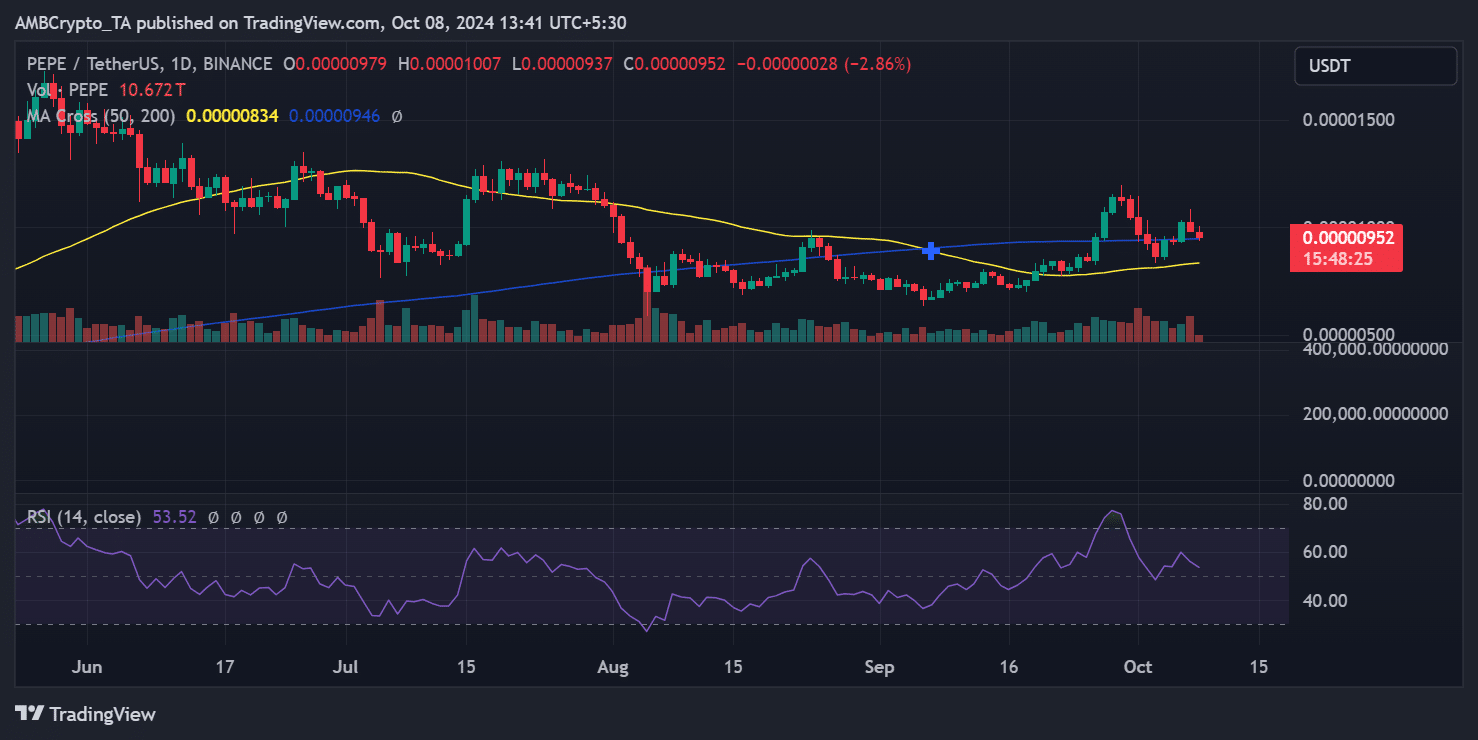

Volume declines, but sentiment stays positive

Pepe’s trading volume also spiked alongside its social volume and price. The volume surged from $900 million to over $1.2 billion and then to $1.3 billion as the price dropped in the latest trading session.

At press time, the volume had slightly decreased to $1.2 billion.

Source: Santiment

Is your portfolio green? Check out the Pepe Profit Calculator

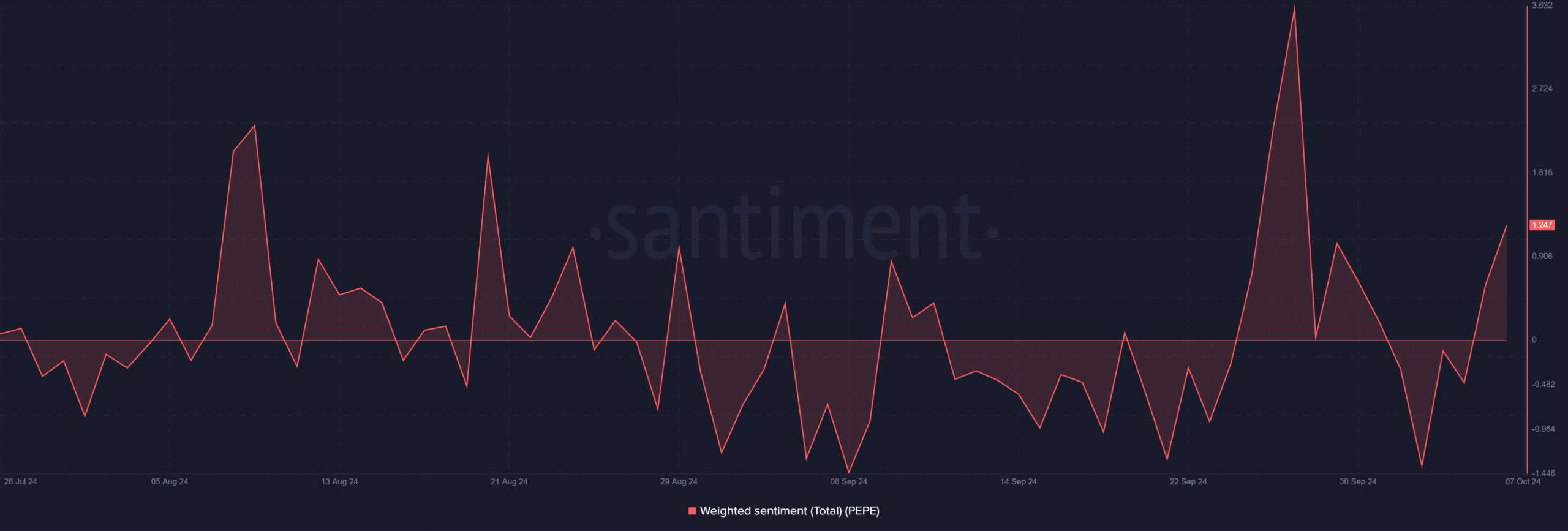

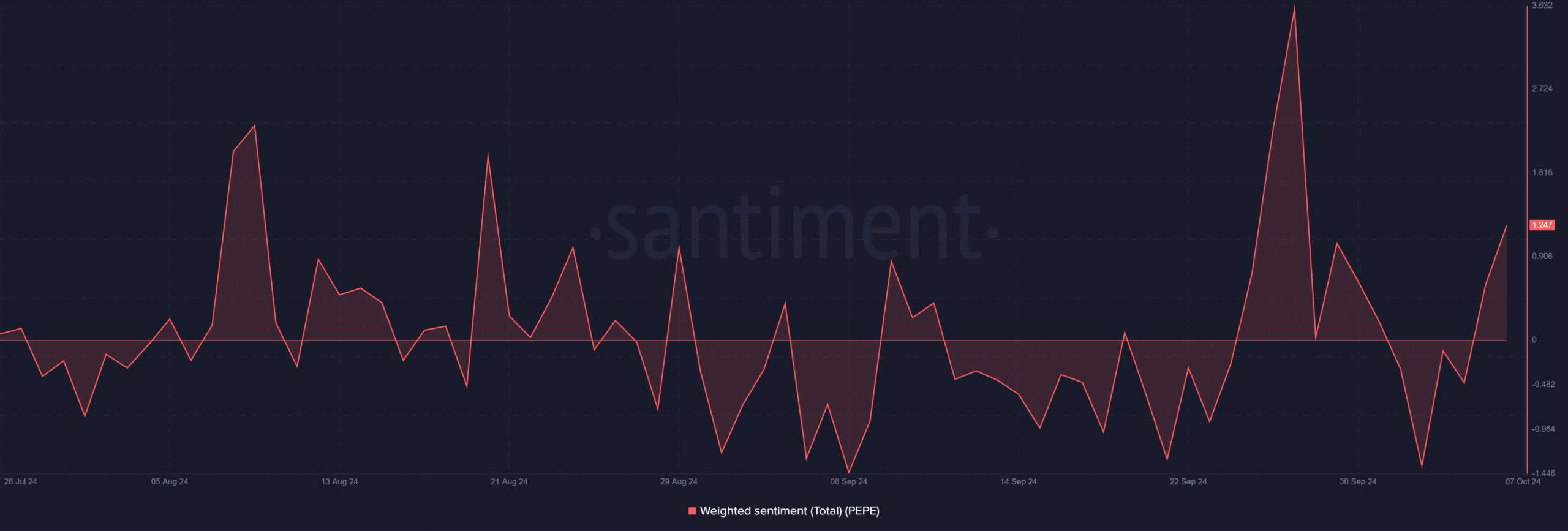

Despite the declining price, Weighted Sentiment around Pepe remains positive. Analysis shows sentiment is at 1.2%, suggesting there are still more buyers than sellers in the market.

This also indicated that long positions continues to dominate, even as the price retraced.