- Aptos showed strong bullish momentum with whale activity driving price action

- Positive funding rates and short liquidations continue to support APT’s uptrend

Aptos [APT] has been attracting attention with its recent price movements, signaling strong momentum for the cryptocurrency. The token has shown signs of bullish behavior, intriguing both day traders and long-term holders alike.

The real question remains – Can APT continue its upward climb, or will the market correct itself?

APT price action – Is a breakout imminent?

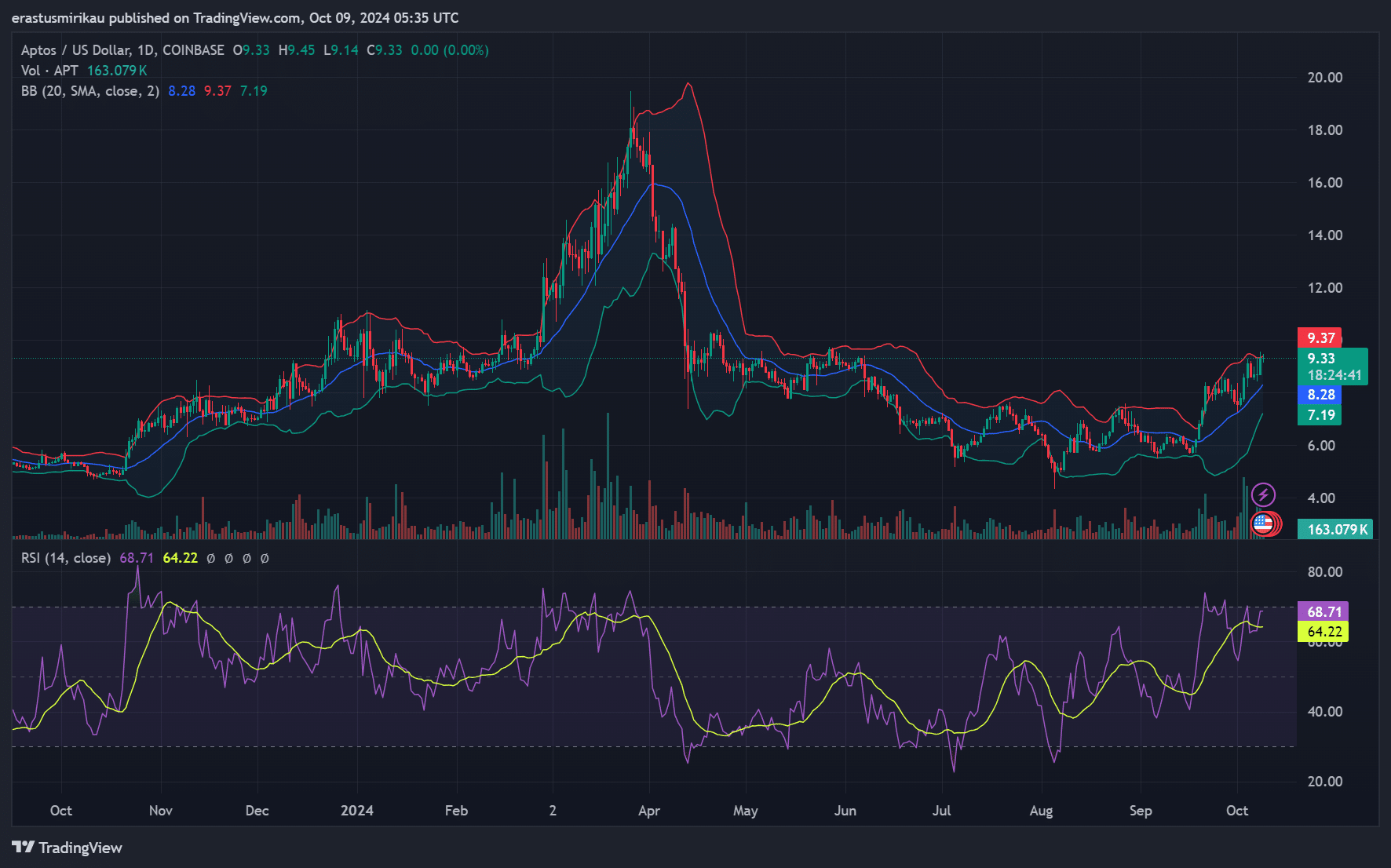

At press time, Aptos was trading at $9.32, up 4.78% in the last 24 hours. APT has hiked steadily on the charts over the past few days, with the price climbing as high as $9.45 too.

However, the RSI had a reading of 64.22, indicating that the token may be approaching overbought territory now.

Additionally, the Bollinger Bands indicated greater volatility, which could lead to further swings in either direction. Therefore, traders should closely monitor these levels as APT may either push past the $9.45 resistance or see a near-term pullback.

Source: TradingView

APT whale activity and social dominance – A key driver?

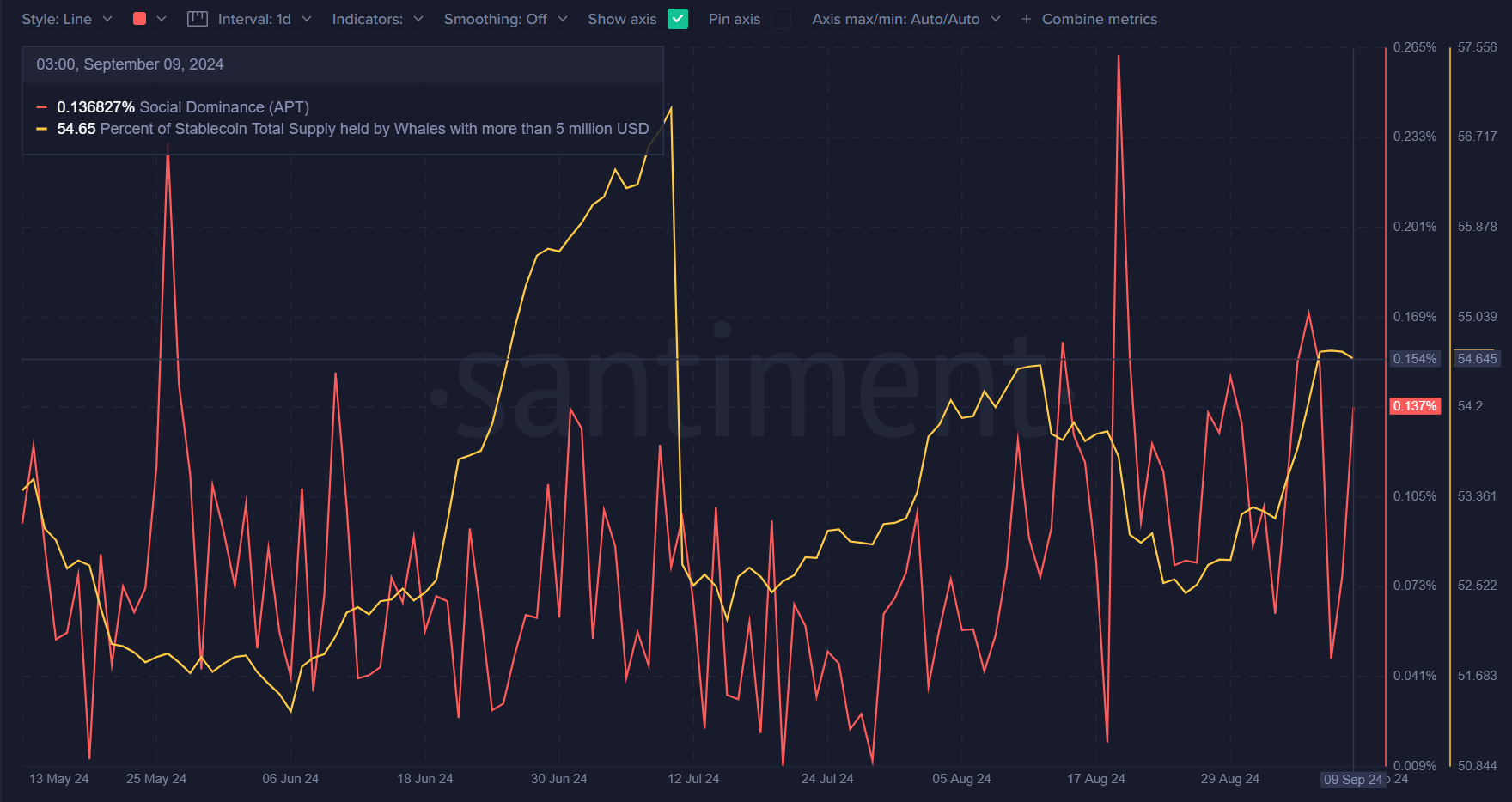

Whale involvement remains a key factor in Aptos’ bullish momentum. At press time, 54.65% of the token’s total stablecoin supply was held by whales with more than $5 million, indicating that large holders have been driving much of the price action.

However, social dominance was relatively low at 0.137%, suggesting that Aptos is yet to fully capture broader market attention.

Consequently, any hike in social dominance could provide additional support for the token’s upward movement.

Source: Santiment

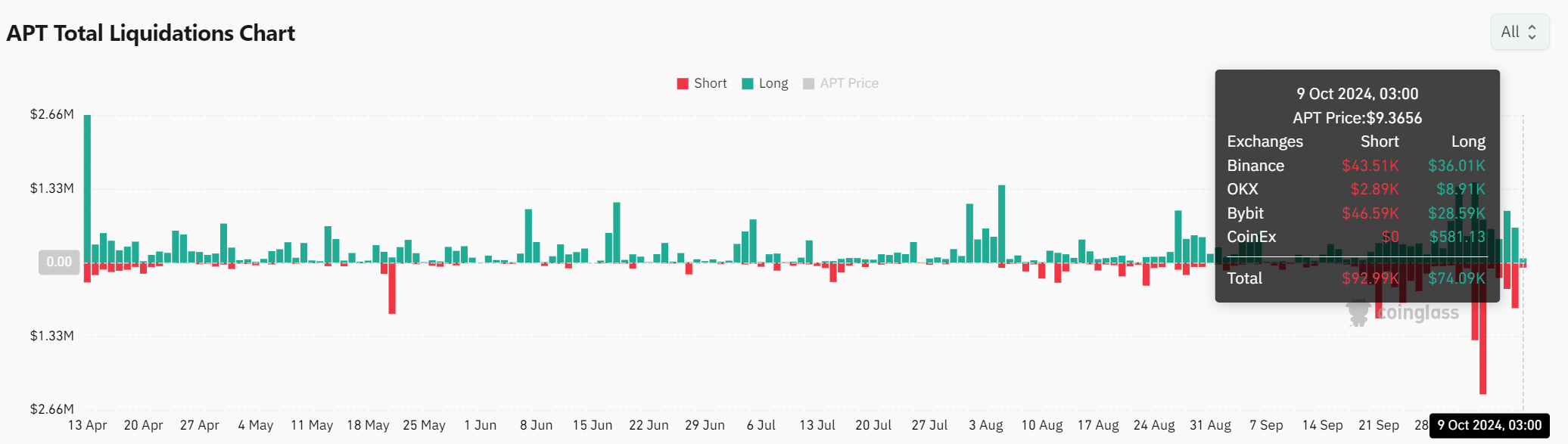

Liquidation levels – Can bulls maintain control?

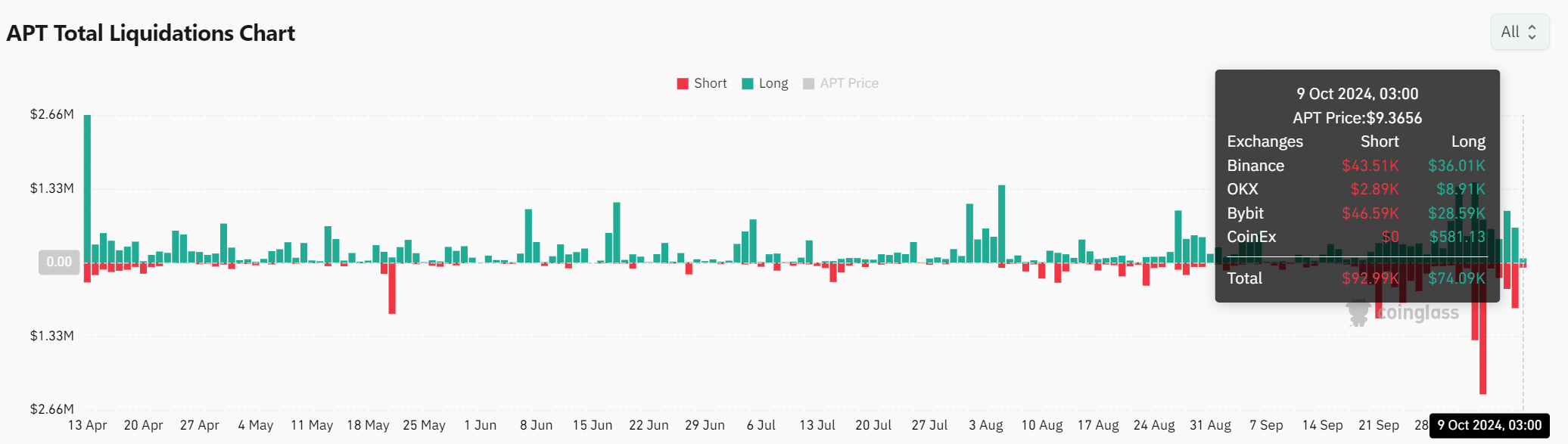

In the derivatives market, the liquidation data revealed that bulls have been gaining control. At the time of writing, long liquidations were at $74.09k and short liquidations at $92.99k. Therefore, short positions are being hit harder – A sign that bears are struggling to maintain their positions.

Additionally, this wave of short liquidations is further reinforcing the market’s bullish sentiment, pushing APT higher. However, sudden changes in liquidation patterns could still affect the market, so traders should stay alert.

Source: Coinglass

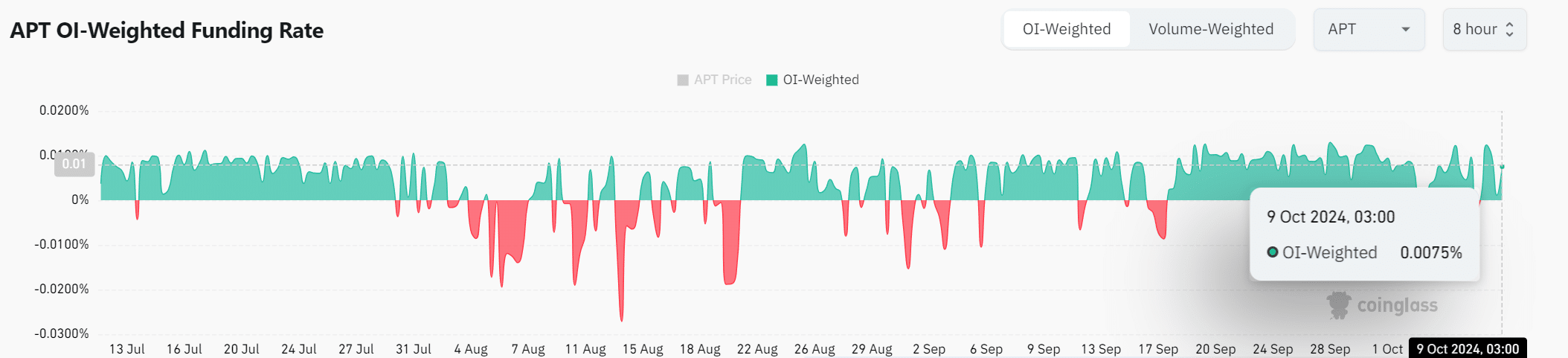

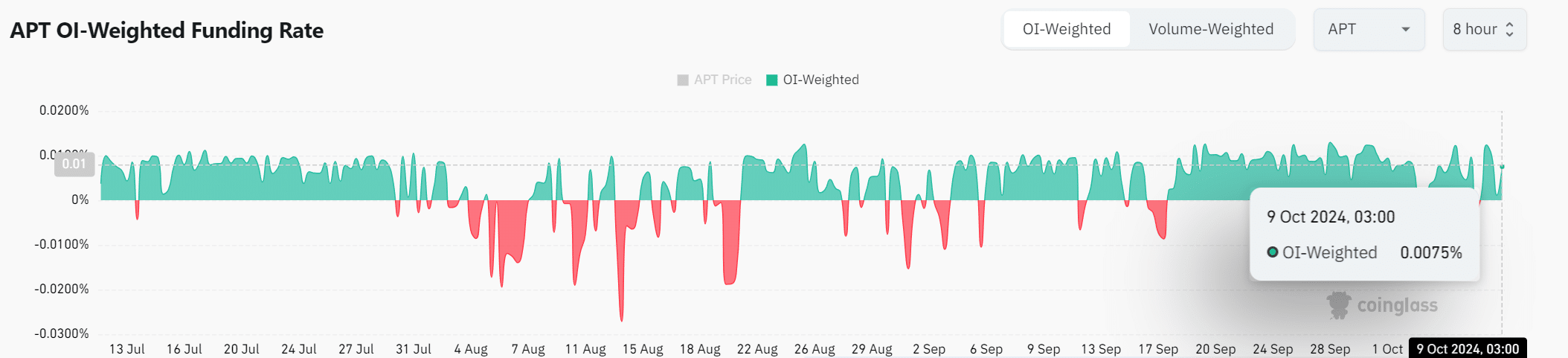

APT funding rates – Is the market still bullish?

Finally, the OI-weighted funding rate for Aptos remained positive with its value at 0.0075% on 9 October. This highlighted that traders are still willing to pay premiums to maintain long positions, reinforcing the ongoing bullish sentiment.

However, any significant shift in the funding rate could signal a change in sentiment and result in increased volatility.

Source: Coinglass

Read Aptos’ [APT] Price Prediction 2024-25

Ultimately, based on the prevailing price action, whale activity, liquidation levels, and funding rates, Aptos appears set to maintain its bullish momentum. Therefore, APT will likely continue its climb, with resistance at $9.45 being the next critical level to watch.

However, traders should stay cautious, as shifts in sentiment or whale behavior could lead to a market correction.