A week before the U.S. election, the crypto market is, surprisingly, in a greedy state. Well, thanks to the anticipation of Donald Trump’s win – Polymarket shows a 67% chance of Trump’s success as opposed to the 33% odds of Kamala’s win.

Whichever way the results go, analysts forecast volatility to be the major concern in November. More than Bitcoin, memecoins will experience rapid price shifts; evidence of which seems to be present in the current market condition.

According to AMBCrypto’s October 2024 Crypto Market Report, dogwifhat (WIF) soared 42x year- to-date, PEPE increased by 482% since January, and POPCAT saw a staggering 17,000% gain. In total, memes rallied more than 1,000% in Q1 2024, outpacing all other sectors of the crypto market. And with the talk of “Memecoin Supercycle,” these joke-coins took investors’ attention in October as well.

What about Bitcoin and the altcoins?

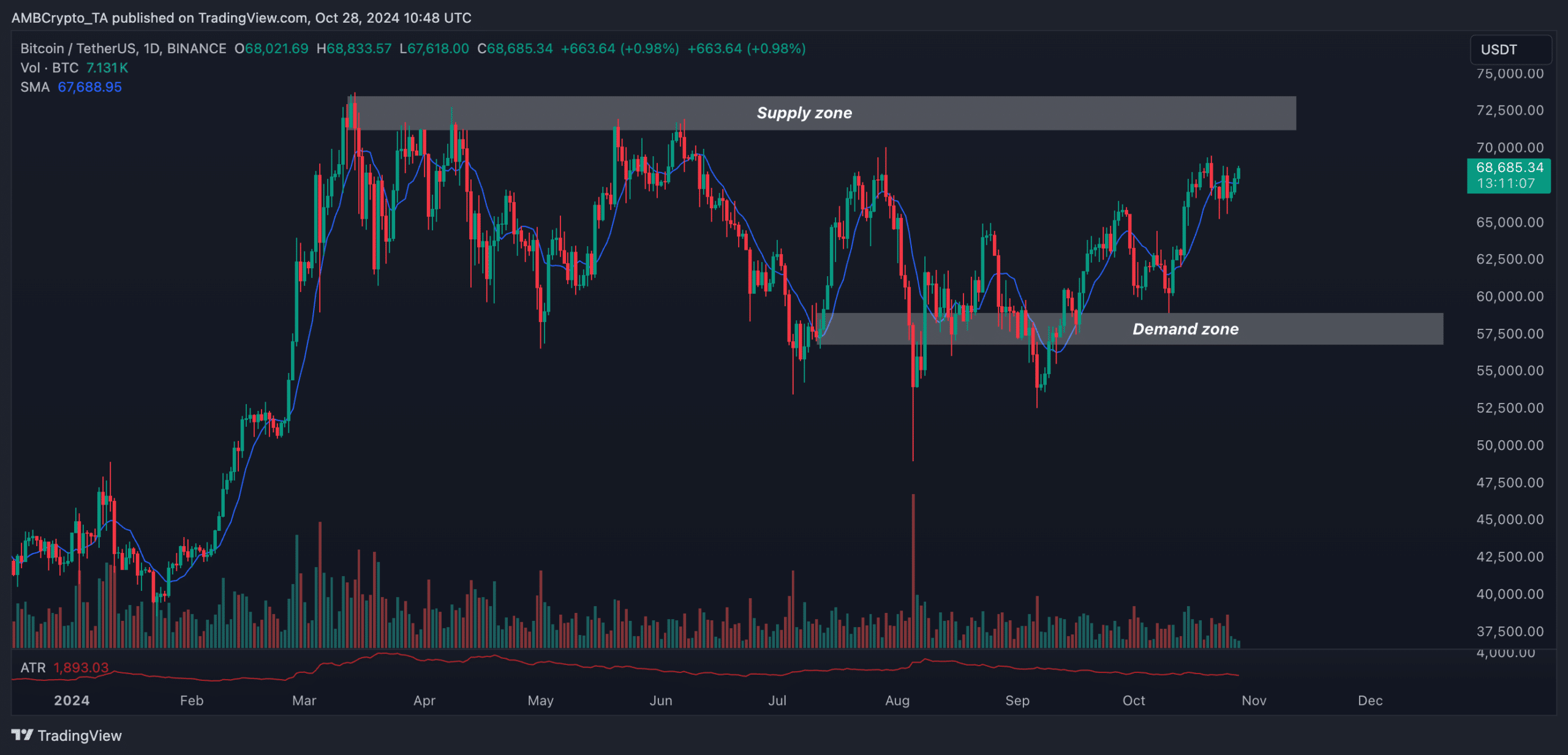

From August 2024, BTC has seen higher highs and higher lows forming on its daily chart. The momentum has been majorly in favor of buyers, but falling trading volume in October remained a matter of concern.

Source: TradingView

At press time, BTC was trading at $68,671, trying to approach the supply zone at $72,000. If BTC breaks above this area with strong volume, it could signal a bullish continuation.

However, the bullish momentum looked weak and traders remained cautious, at the time of analysis. On the downside, the demand zone near $57,500 provided good support, reflecting high interest from buyers.

Meanwhile, the reading of the Simple Moving Average (SMA) indicated an upward trend, supporting the recent bullish momentum. And the Average True Range (ATR) hinted at a relatively moderate volatility.

All this goes to show that investors are heavily expecting BTC to cross the all-time-high mark post U.S. election – Something that AMBCrypto’s report talks about in great detail.

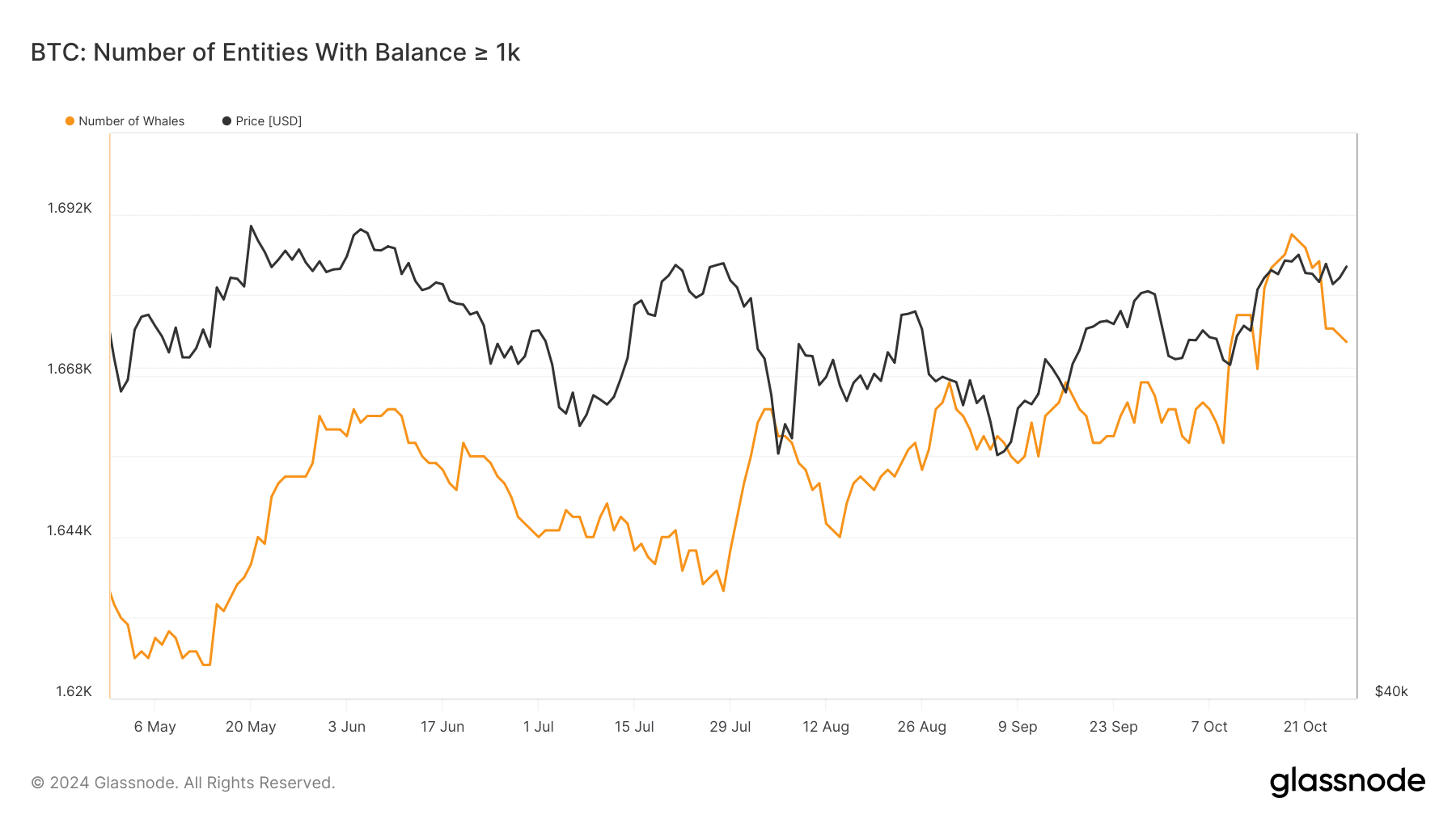

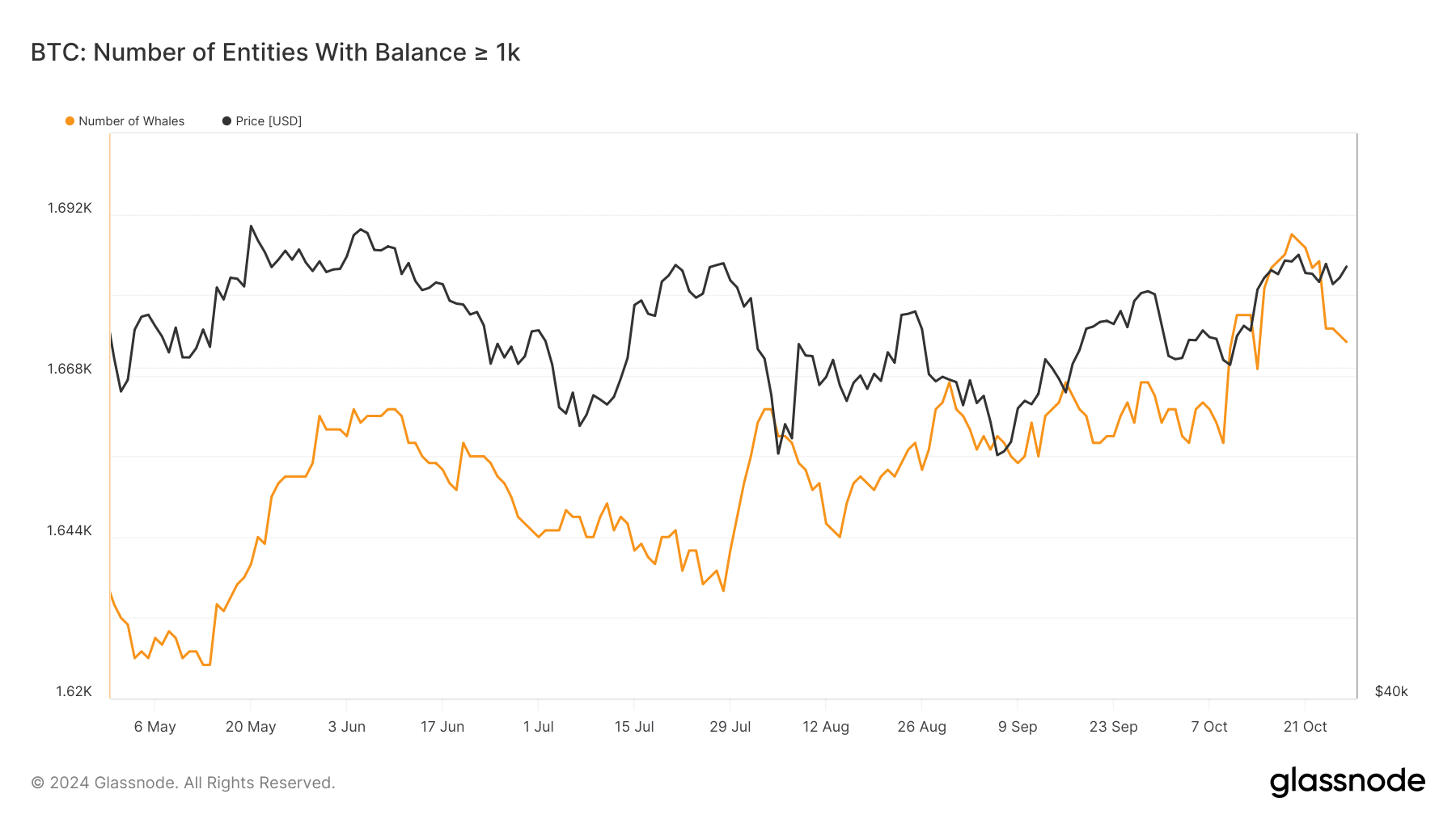

Interestingly, the number of whales remained relatively high in October and the exchange inflow volume came down considerably. This revealed that the big-pocketed investors believe BTC is undervalued and is poised for a significant bullish breakout in the near-term.

Source: Glassnode

Altcoin of the month – Uniswap?

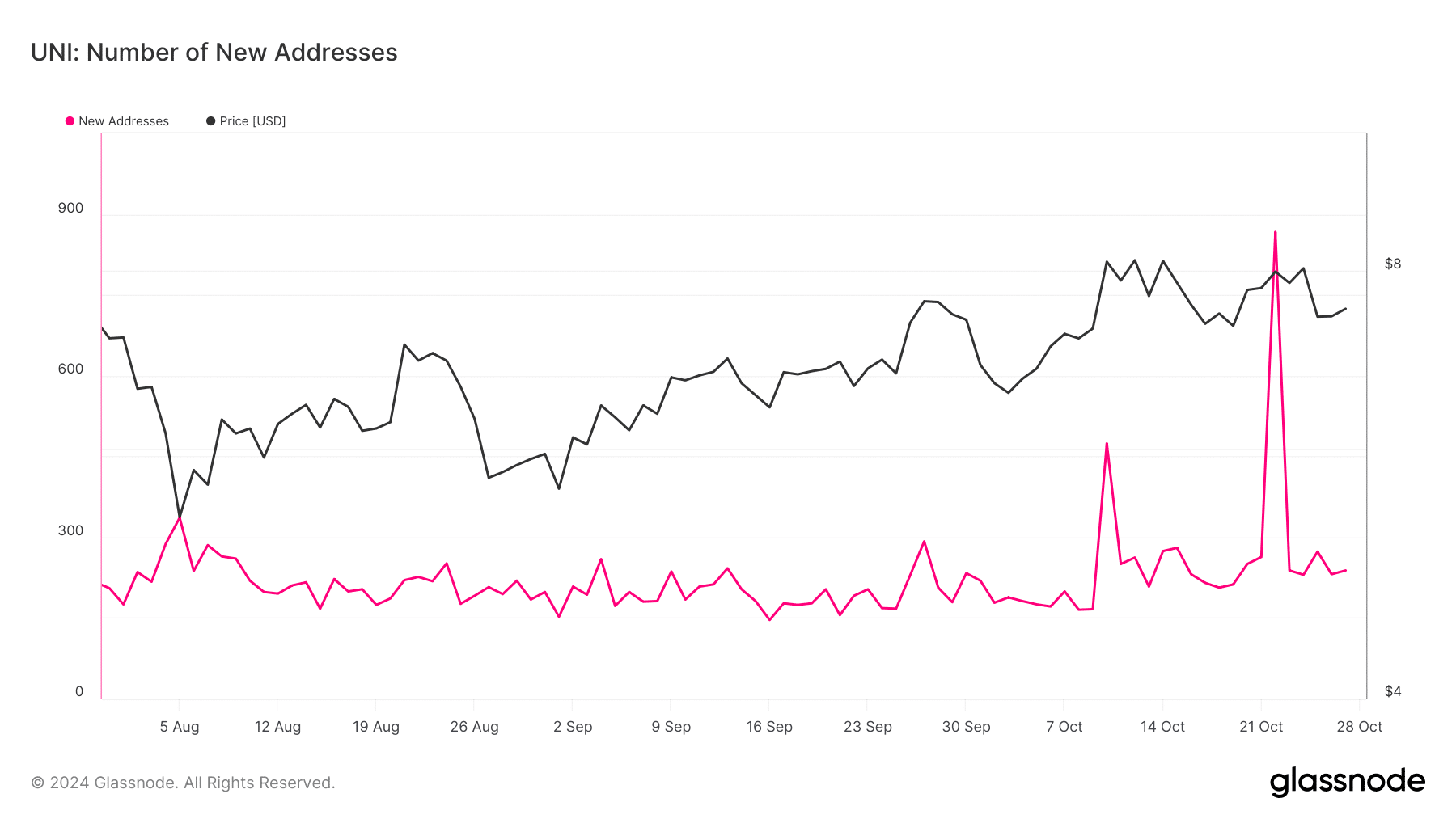

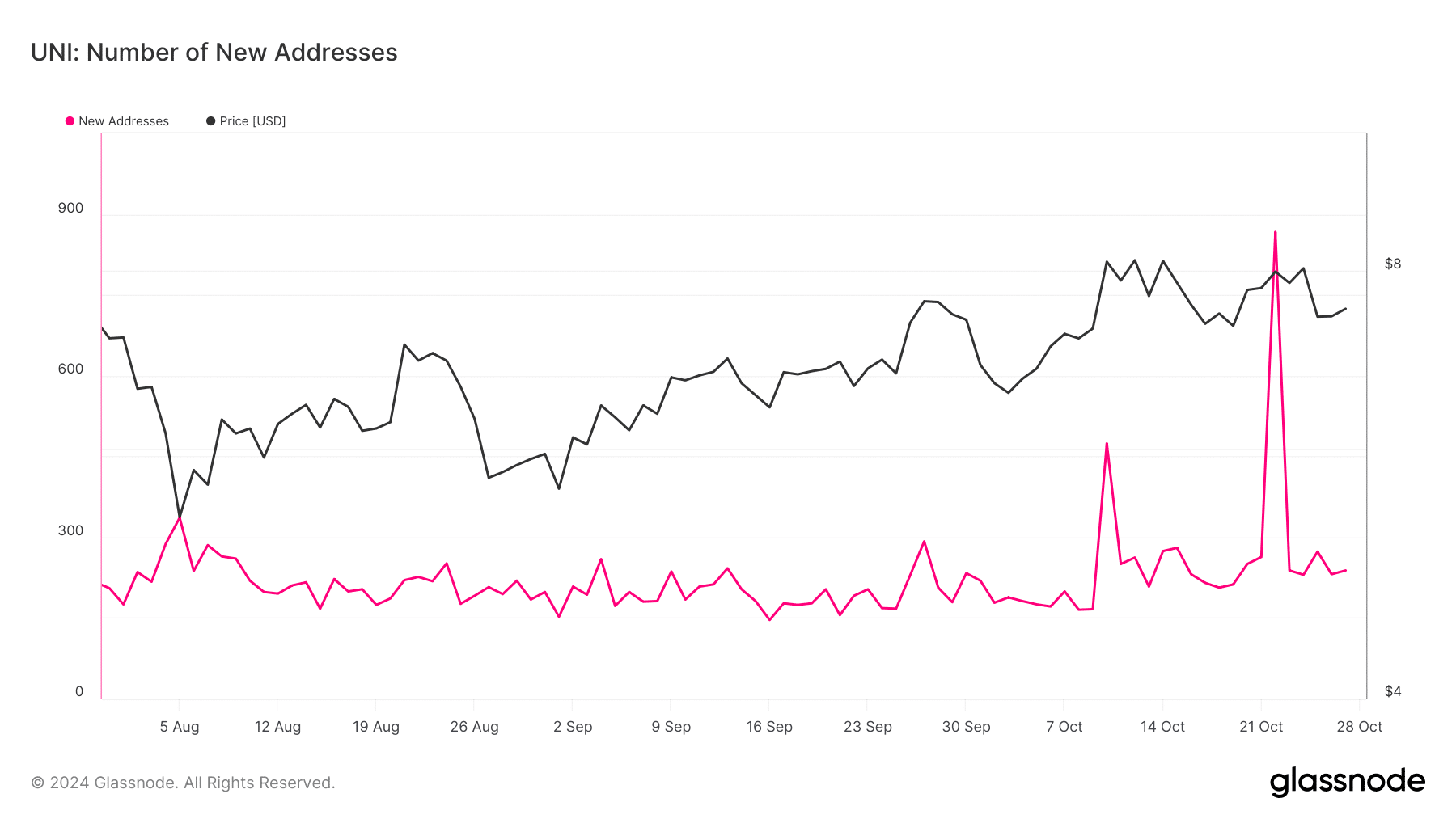

As per the AMBCrypto monthly market report, Uniswap’s October announcement of “Unichain,” its upcoming Layer-2 superchain, and its planned migration to this new network, sparked considerable worry within the market and community. The central concern was the potential fragmentation of liquidity across multiple chains.

Many feared that this move would fragment liquidity by diverting trading activity away from Ethereum and other networks and potentially harming the overall ecosystem.

In the wake of this development, many investors rushed to buy UNI tokens. Consequently, the new address metric saw a sharp spike only to fall back later.

Discover AMBCrypto’s October 2024 crypto market analysis

Explore AMBCrypto’s October 2024 Crypto Market Report for a comprehensive analysis of the latest trends driving the crypto space. This month’s highlights include:

- Bitcoin’s bull flag breakout: BTC breaks key resistance, hinting at a potential bull cycle.

- Memecoins lead the charge: A surge in memecoins, with GOAT skyrocketing to new highs.

- Ethereum’s bullish momentum: ETH sentiment strengthens ahead of the Pectra hard fork.

- Uniswap’s liquidity concerns: The announcement of Unichain raises liquidity fragmentation fears.

- NFTs continue downtrend: NFT markets face further declines, marking a challenging quarter.

Download the full report here.