- Altcoin funding rate has hit a 9-month high, making the recent 3-month pump leverage-driven

- In the current market context, long liquidations could be triggered, keeping investors on the edge

Over the last 30 days, a select pool of altcoins have significantly outperformed Bitcoin, with Hedera (HBAR) alone posting an impressive 500%+ surge. While the current altcoin rally is significant, caution is necessary.

Especially since the 30-day funding rates for perpetual futures, which has jumped to 4%-6% per month, indicated high leverage usage.

This is important since historical data revealed that rapid price surges and rising funding rates often precede corrections. For example, after a similar surge in January, a 15% correction followed.

Now, although there is no immediate threat of cascading liquidations, volatility is expected to persist. And, the market will need to absorb these high levels of leverage carefully.

Investors should remain cautious as corrections could occur, especially if broader market conditions or investor sentiments shift.

The high altcoin funding rates could cost millions

The 30-day funding rate for perpetual futures surged, with bulls paying 4% to 6% per month to maintain leveraged positions, according to CoinGlass data.

Source : Coinglass

While manageable during strong uptrends, these costs can quickly erode margins if prices stagnate or decline. Even experienced traders can only tolerate these high fees for so long.

This comes as an emerging trend is separating altcoins into their own asset class, causing low-cap alts to trend even during bear cycles. This shift makes sense, given their lower cost and the “higher risk, higher reward” appeal.

Notably, two high-cap alts, XRP and Cardano [ADA], have made significant gains over the past month, with each surging by nearly 300% and reclaiming the $1 threshold. This makes their rally more vulnerable to sudden swings.

However, the attached chart revealed that while current funding rates for ADA and XRP stand out compared to the last six months, they remain below their 12-month highs. If history is taken into account, this would suggest that these altcoins may still have room for additional leverage-driven growth.

In fact, a recent report revealed that an altcoin season has already begun, with nearly 40 altcoins outperforming Bitcoin.

Combined with their funding rates, this momentum could prompt some to pull back, while others may seize the opportunity to capitalize on the ongoing bull run.

Tight liquidity could present a major challenge

For context, in liquid markets, there is both high supply and demand for a given asset, making it easier to find and match buyers with sellers.

However, given the current market conditions, most liquidity focuses on Bitcoin as traders fluctuate predictions while attempting to identify its next resistance point.

This presents a major challenge for altcoins, as they struggle to build a solid customer base. Bears could take advantage of this using high leverage to initiate a long squeeze.

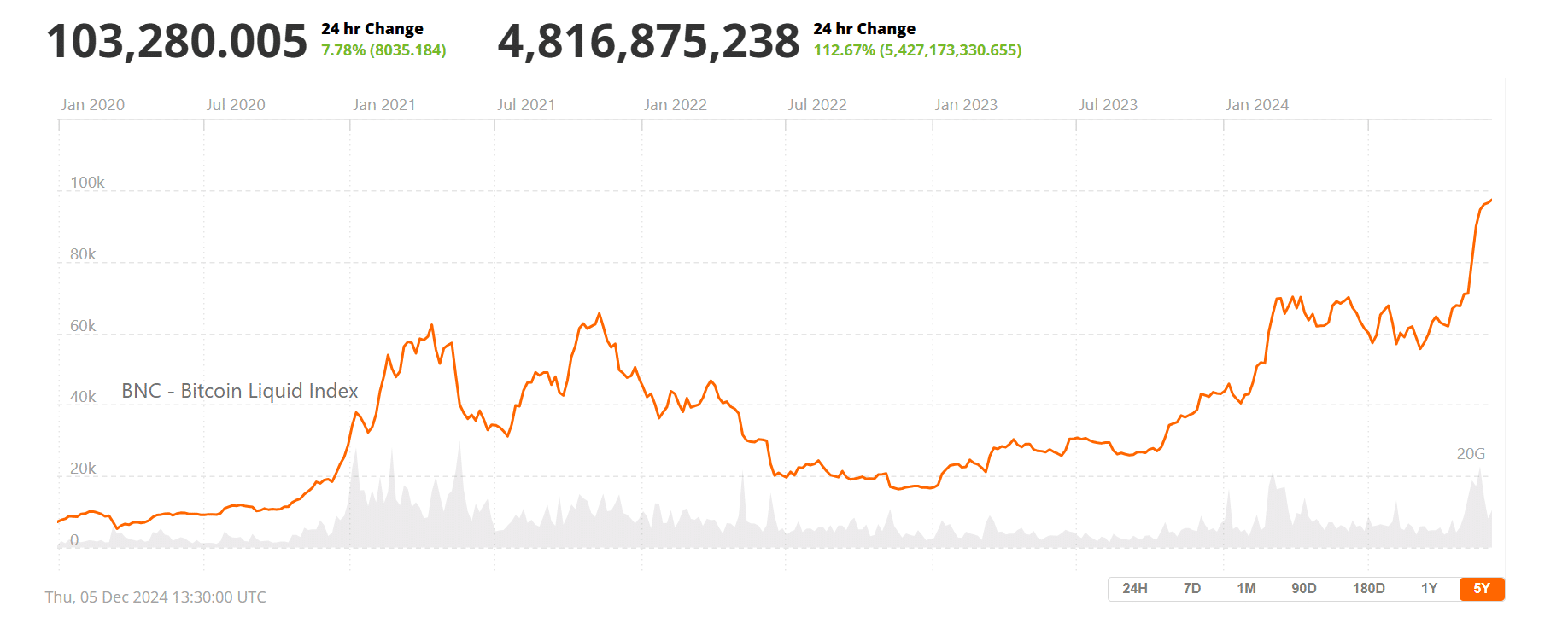

Source : BraveNew.Com

As can be seen in the chart above, Bitcoin’s liquidity index reached a 5-year high after it hit $100k following an 8% hike in 24 hours.

Read Ripple’s [XRP] Price Prediction 2024-2025

What this meant was that a significant portion of investors have been allocating funds into BTC, diverting liquidity away from altcoins. This can be evidenced by XRP’s nearly 6% decline over the same period.

Therefore, caution is advised. If this trend persists, high funding rates could trigger a long-liquidation cascade. Particularly if short-sellers dominate the derivatives market.