- The altcoin sector sell-off pushed the funding rates to healthy levels for a rebound.

- But BTC dominance strengthening was a risk factor for the continued rally.

After a remarkable rally, the altcoin sector saw its first major shake-out since the US elections.

With the massive sell-offs in the past two days, unnerved investors are raising key questions like – Is the altcoin season momentum sustainable?

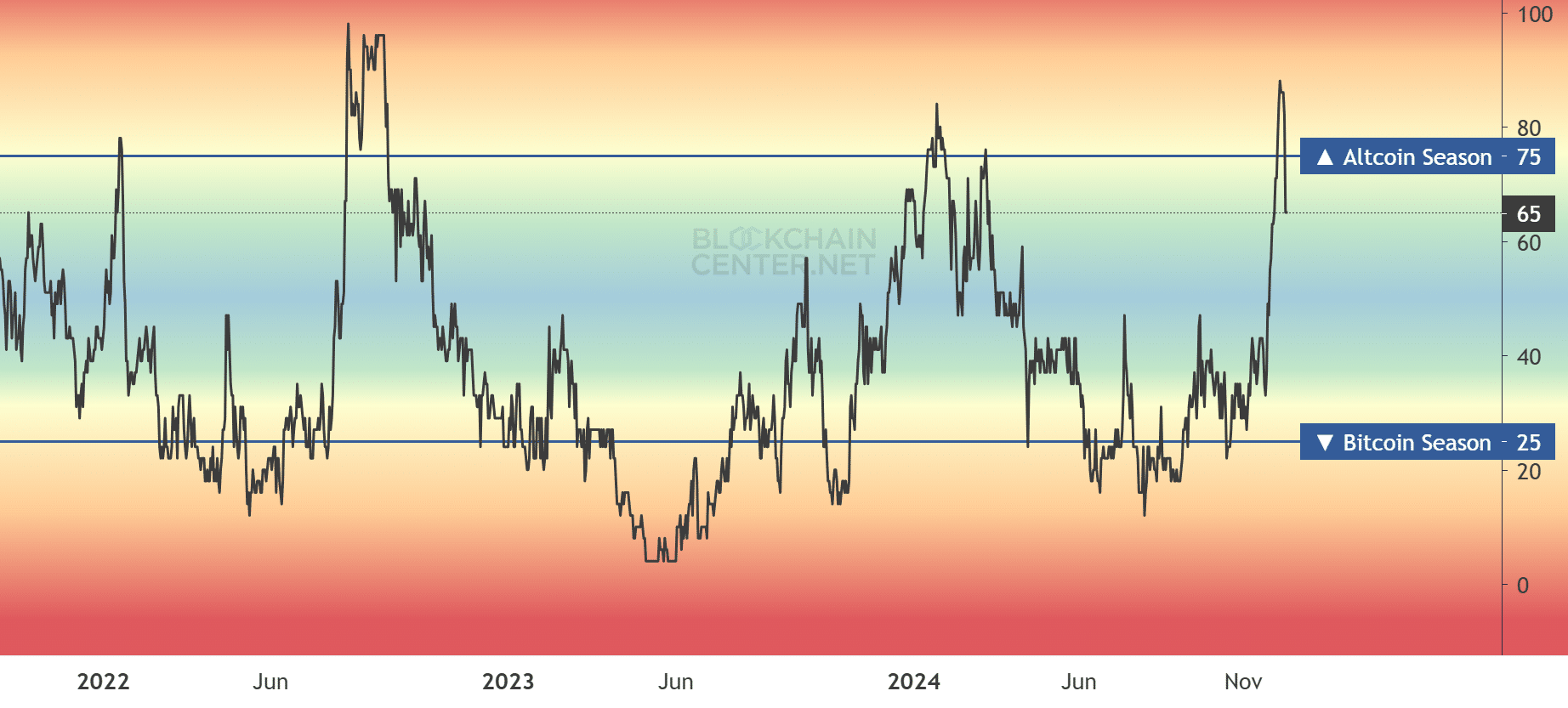

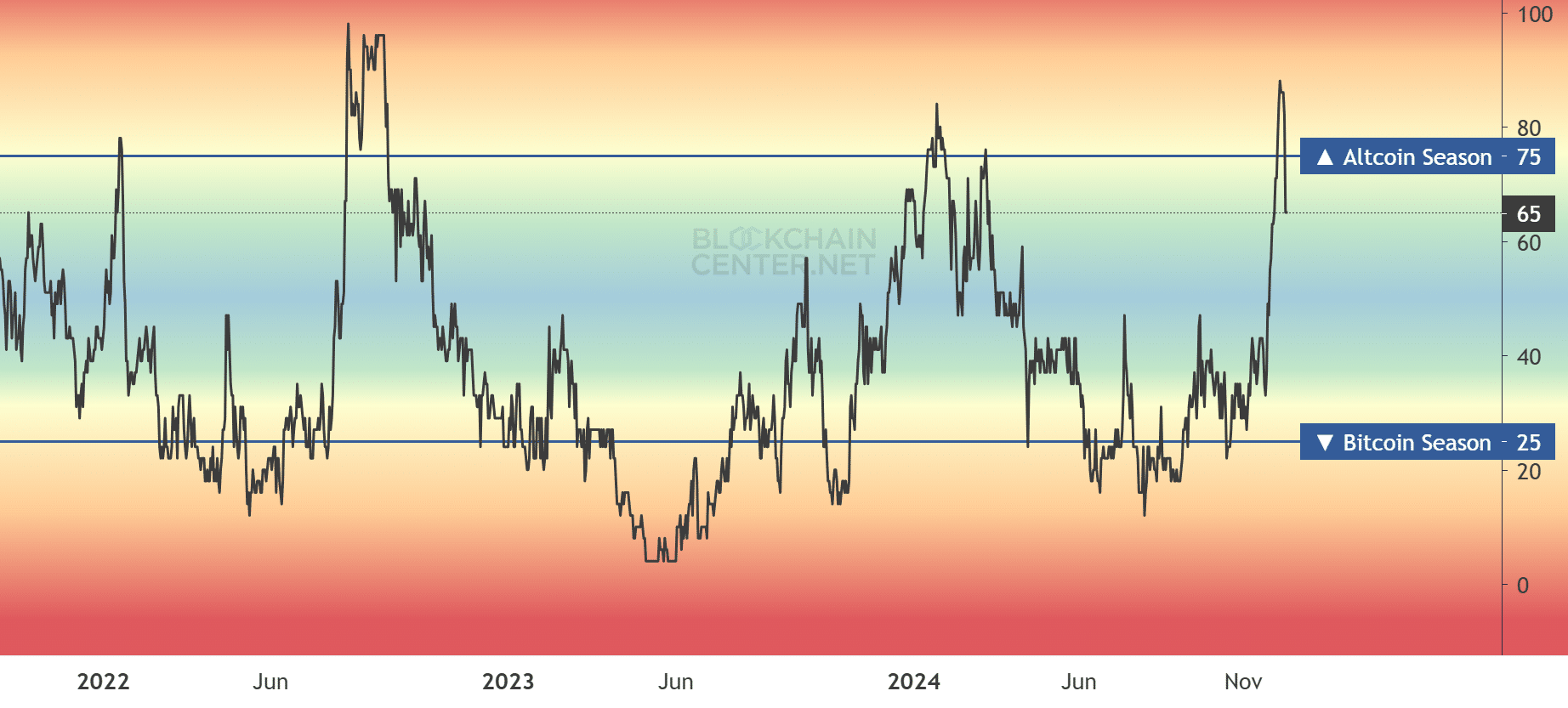

Over the same period, the altcoin season index declined from 88 to 65, indicating the alt season momentum slowed.

Source: Blockchain center

What’s next for altcoins?

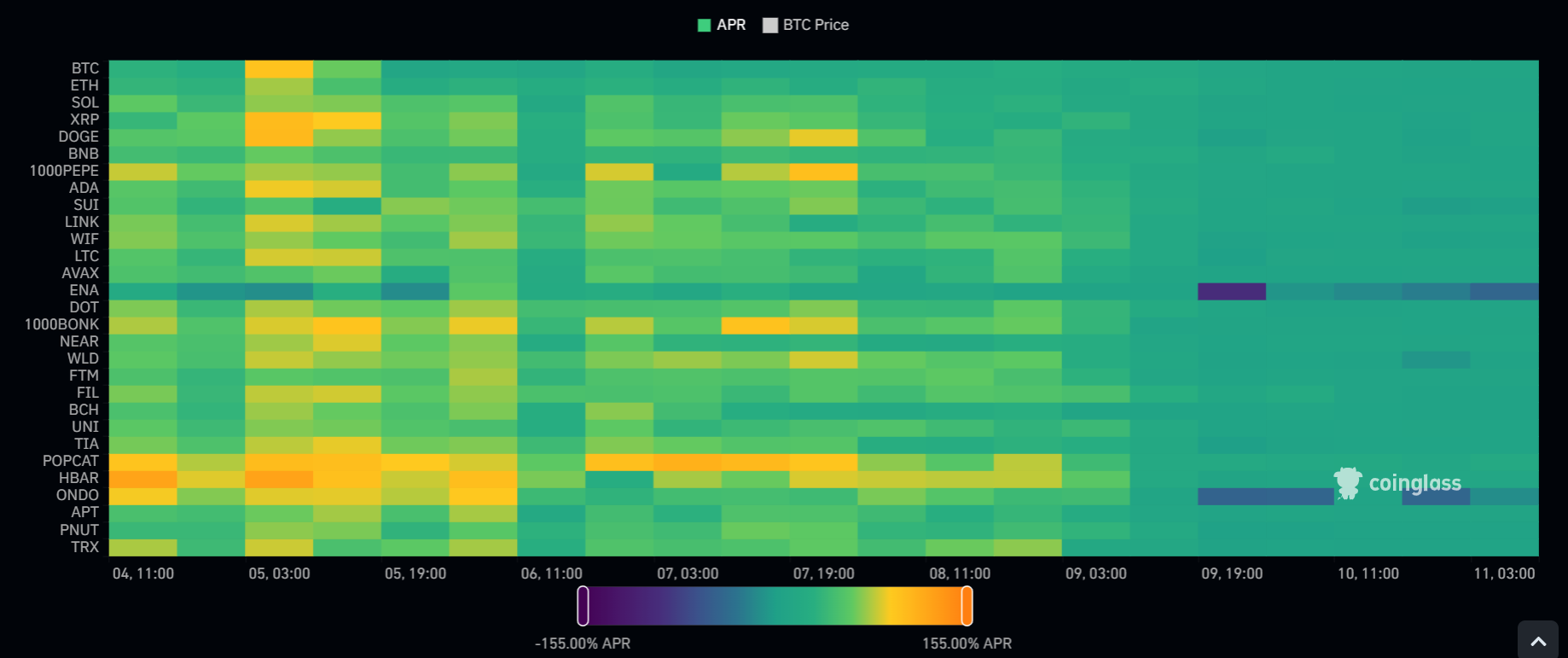

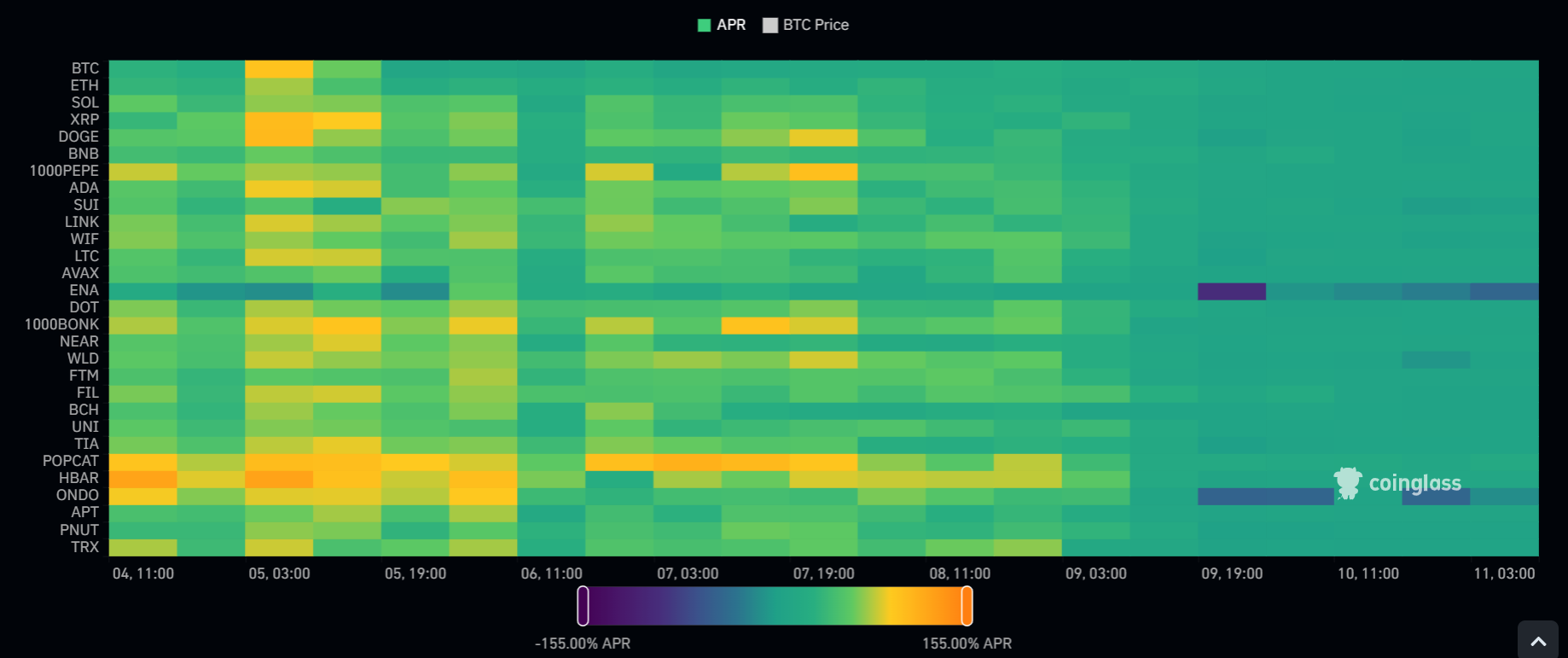

The sell-off and ensuing liquidation wasn’t surprising given last week’s overheated market, as funding rates hit a 9-month high.

But the shake-out had reset the altcoins funding rates; a scenario analysts believed was great for a potential rebound.

Source: Coinglass

Unlike last week’s funding rates, which spiked to double digits (orange levels), the rate has slipped below 10% in the past two days. This meant leverage (using borrowed funds) to bet on altcoins decreased significantly, which is a typical bullish setup.

Despite the potential catalyst from healthy funding rates, Bitcoin [BTC] Dominance (BTC.D), another key factor in altcoin momentum, could be a caveat.

The explosive altcoin season of recent weeks was partly driven by a decline in BTC.D from over 60% to below 55%.

As of this writing, BTC.D has climbed above 55%. This suggests investors opted for BTC instead of altcoins during the recent massive alt sell-off.

Source: X

Reacting to the development, analyst Benjamin Cowen noted that altcoins were fine unless the BTC.D climbed back to its compression range. In short, continued strengthening of BTC dominance could stall the altcoin rally.

That said, Ethereum [ETH], another barometer of the altcoin health, defended the $3.5K support as analysts remain hopeful that a strong rebound was likely. If so, the altcoin season could see renewed momentum.

Read Ethereum [ETH] Price Prediction 2024-2024

In the meantime, some top performers in the sectors, such as Hedera [HBAR] and Ripple [XRP], were down double digits on the weekly charts.

HBAR was down 13% to $0.28, while XRP shed 12% and briefly slipped below $2. Tron [TRX] was the hardest hit, with a 30% drop over the same period.