- AAVE has a significant number of holders in profit, despite fall in large transactions and exchange outflows

- A potential bullish surge has been building as profit-taking addresses hold firm

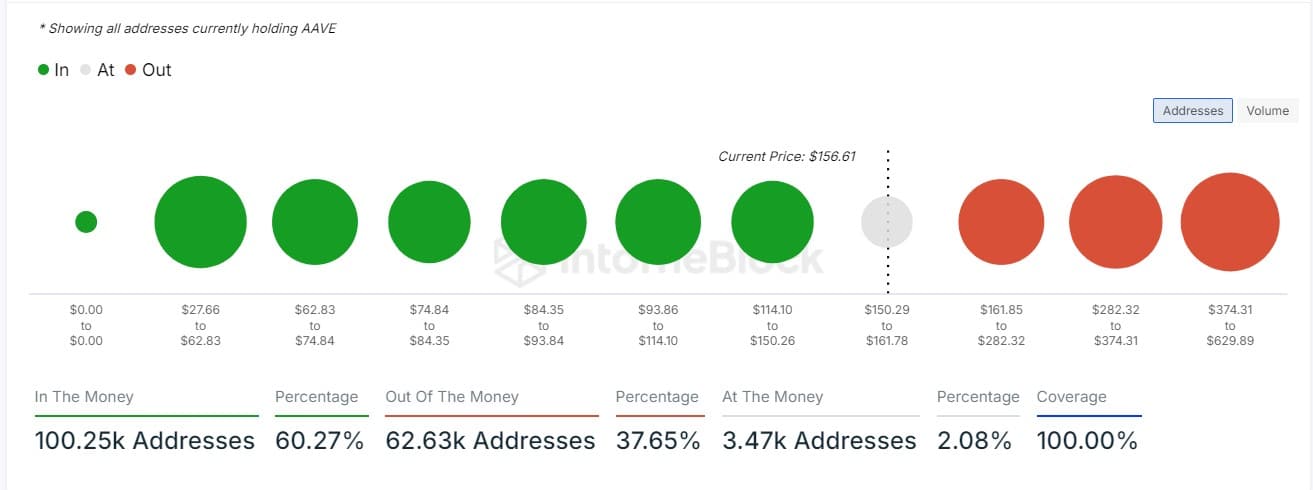

Despite recent shifts in AAVE’s transaction activity, 60% of its holders remained in profit.

Although the altcoin has indeed suffered a decline in the number of large transactions and exchange outflows in the last 24 hours, these factors may play a key role in the evolving market sentiment.

Hence, it’s worth taking a closer look at how this set of metrics could influence AAVE’s bullish momentum on the charts.

AAVE profitable holders hold strong

At the time of writing, 60% of AAVE holders were in profit – Adding an element of resilience even with the declining high-volume transactions. The resulting profitability suggests that this asset has been resilient enough to keep most holders in the green.

In most cases, when more holders are in profit, the market selling pressure diminishes as holders are still holding onto their positions.

Source: IntoTheBlock

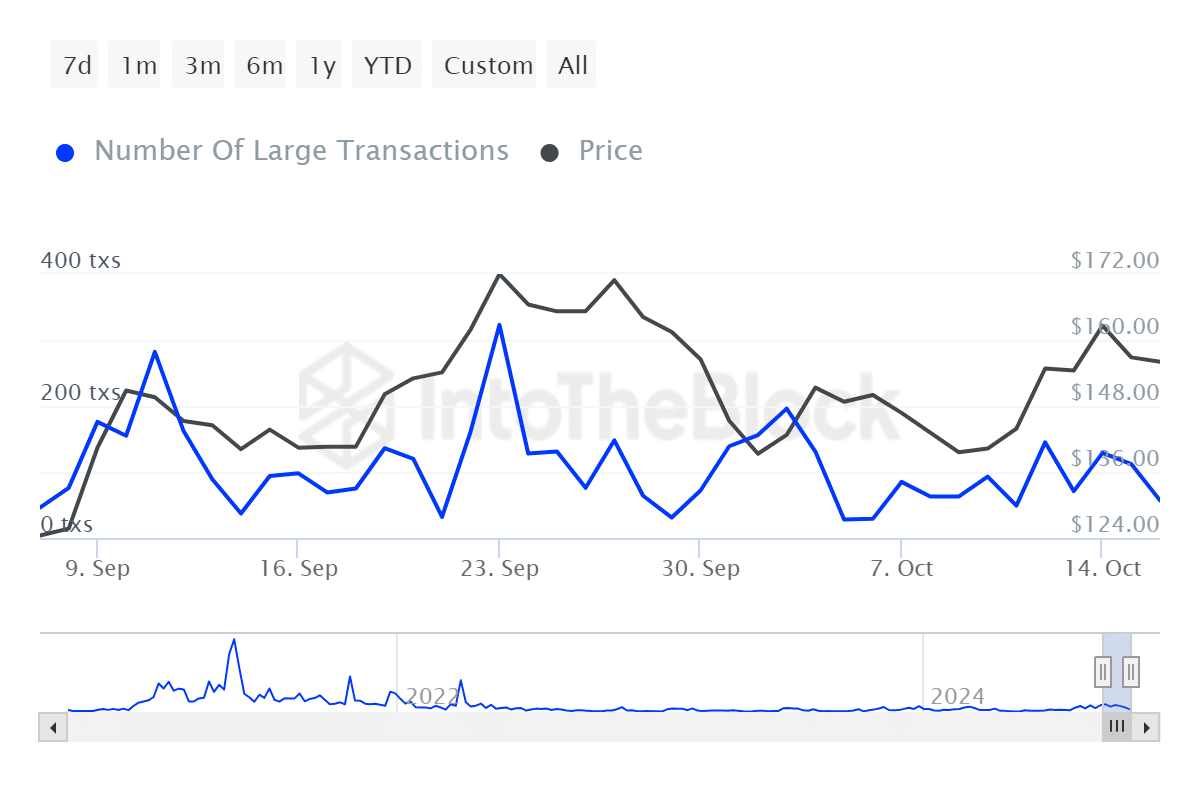

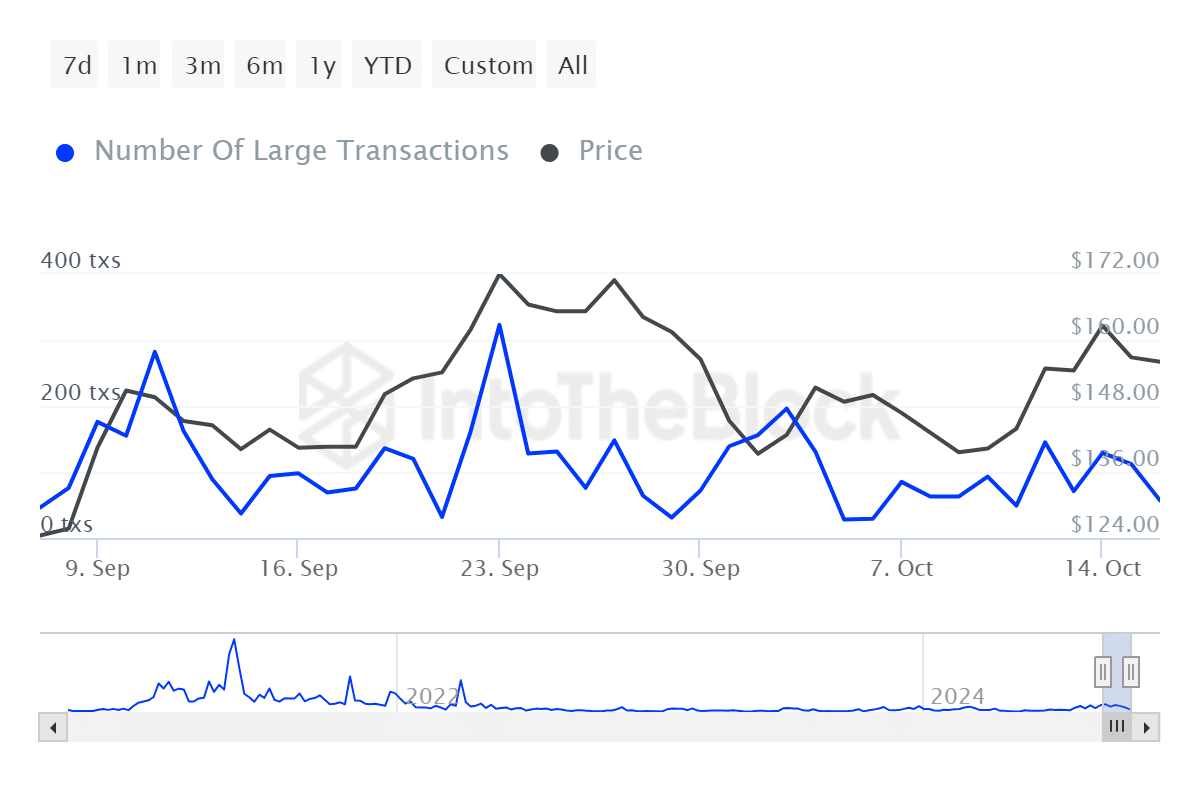

Declining large transactions – A temporary pause?

Over the last 24 hours, AAVE large transaction activity has slowed down by about 52%. This may be a sign of whales and institutional investors playing more conservatively.

Large transactions are typically the cause of great price movements, but a reduction in this activity might mean investors are taking a wait-and-see approach.

Source: IntoTheBlock

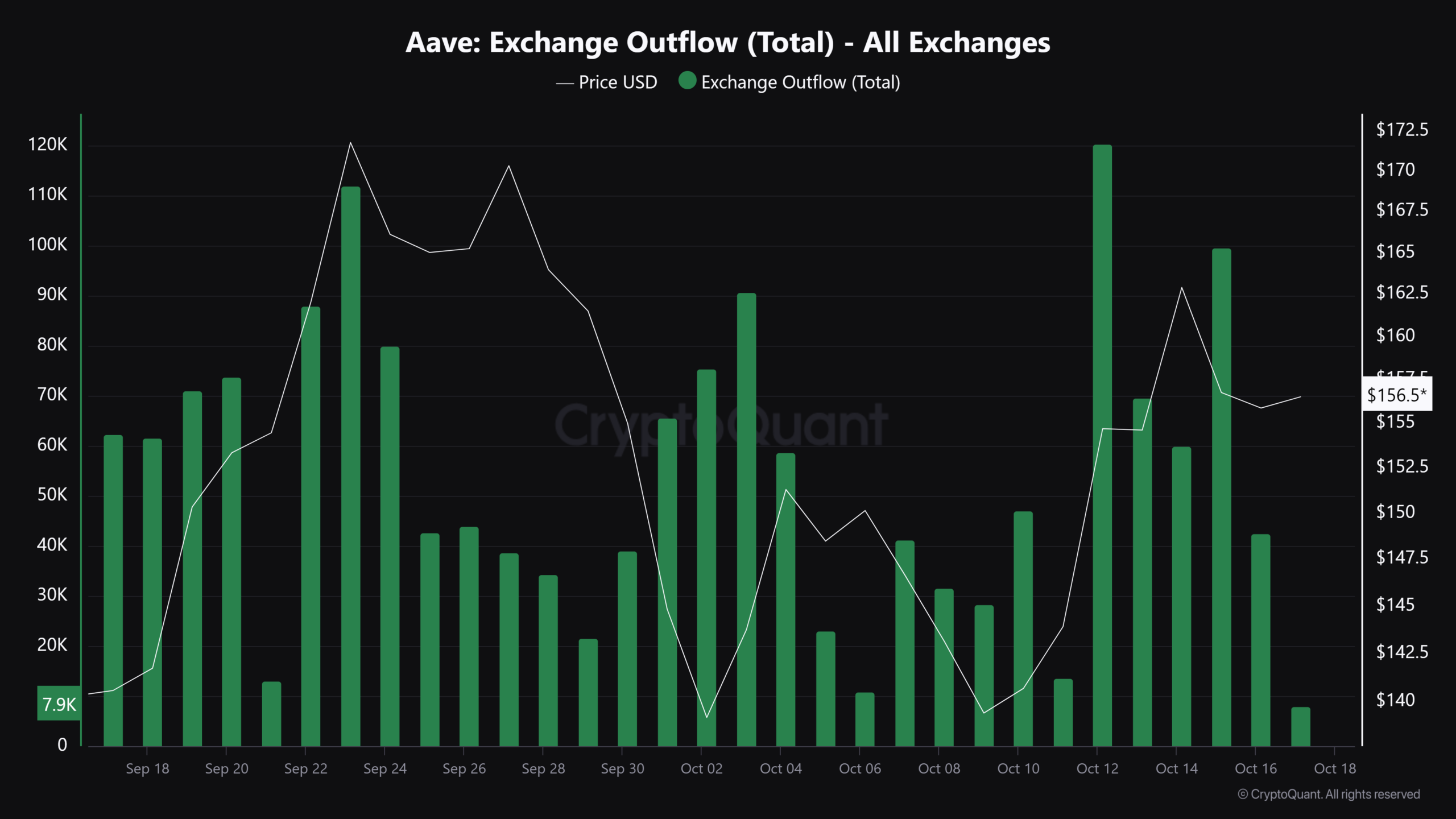

Exchange outflows slow down

Besides reduced large transactions, exchange outflows have also weakened. According to AAVE’s past experiences, high outflows mostly indicate that investors are moving their funds to cold wallets and are viewed as being positive signs for bullish investors.

Since the outflows weakened lately, this may mean that investors are turning more conservative by holding funds on exchanges in anticipation of short-term price fluctuations.

Source: CryptoQuant

Will AAVE’s bullish momentum keep growing?

With a significant number of holders still in profit and exchange outflows declining, AAVE’s market indicators do not present exclusively bullish signals.

The fall in volumes in large transactions may pause the volatility, while the remaining profitability of holders can drive optimism.

These two combined forces may set the bedrock for AAVE to continue building its bullish momentum in the near future.