- Lido’s staking expansion is a boost for decentralization, while driving adoption and investor confidence

- Whale accumulation and rising addresses can strengthen LDO’s bullish outlook

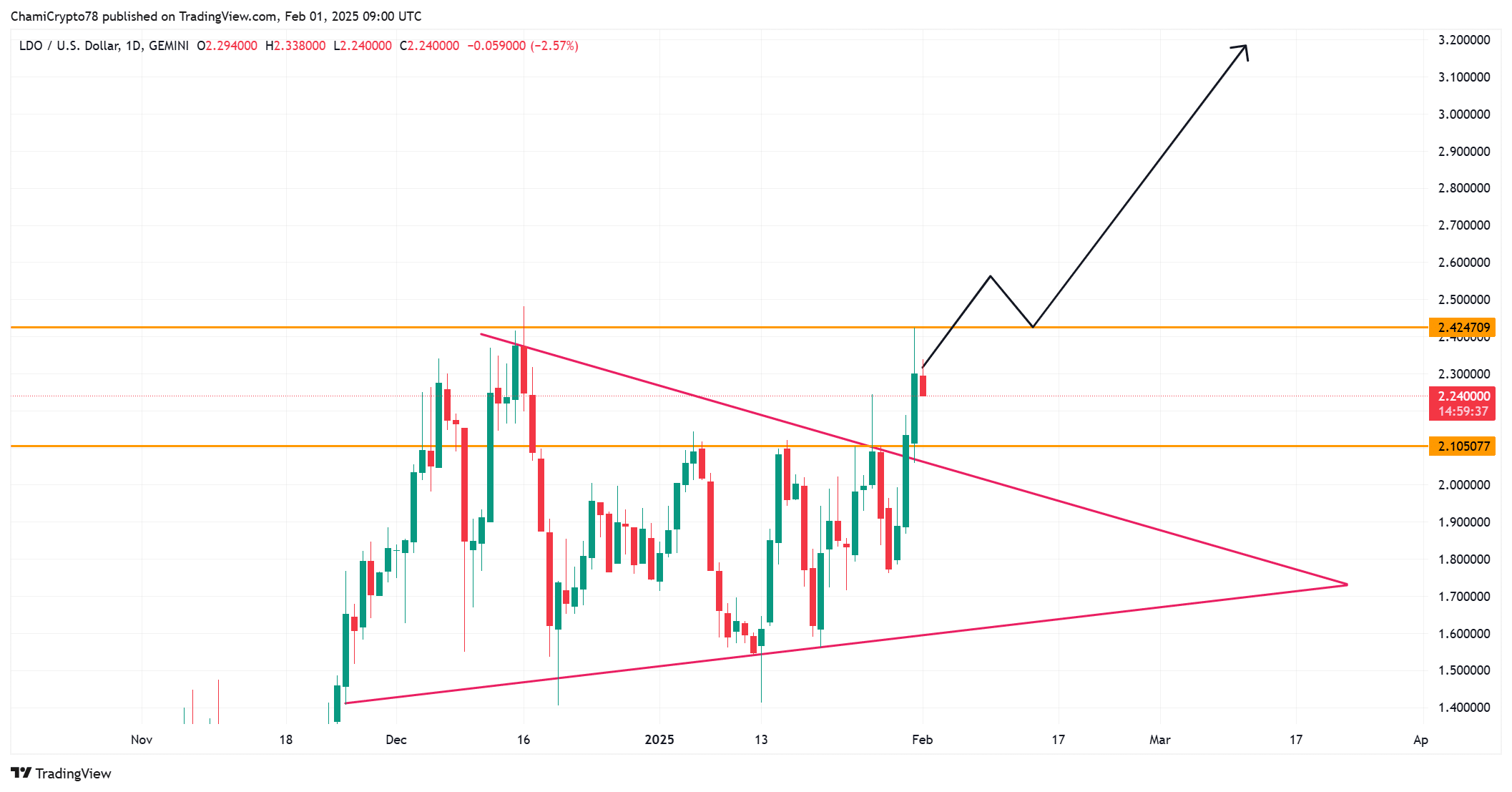

Lido DAO [LDO] has successfully broken above its descending triangle, fueling optimism among traders. This breakout is a confirmation of strong buying pressure, with price targets set around $2.80 and possibly $3.20, if momentum continues.

At press time, LDO was trading at $2.29, reflecting a 6.95% hike in the last 24 hours. With resistance levels still ahead, will the bullish momentum push LDO higher, or is a correction on the charts imminent?

How Lido’s permissionless staking is changing Ethereum

Lido’s permissionless home staking is revolutionizing Ethereum’s staking landscape. Unlike traditional models that require 32 ETH, Lido allows users to stake smaller amounts without relying on centralized validators. This approach increases decentralization while enhancing accessibility for smaller investors.

Additionally, permissionless staking broadens Ethereum’s security by distributing validation power across a wider network. As Ethereum moves towards a fully decentralized staking ecosystem, Lido continues to lead the charge. Therefore, growing adoption of this system could significantly boost LDO’s value in the long run.

Is LDO ready for a bigger breakout?

LDO has successfully broken out of a descending triangle, a pattern that often signals a trend reversal. The immediate challenge lies at $2.42 – A key resistance level that bulls must clear. If buyers push past this zone, LDO could quickly rally towards $2.80 and eventually, $3.20.

However, if the price fails to hold above this breakout level, a retest of $2.10 remains possible. Additionally, increasing trading volume may be a sign that momentum is building, making the next few days crucial for LDO’s short-term trajectory.

Source: TradingView

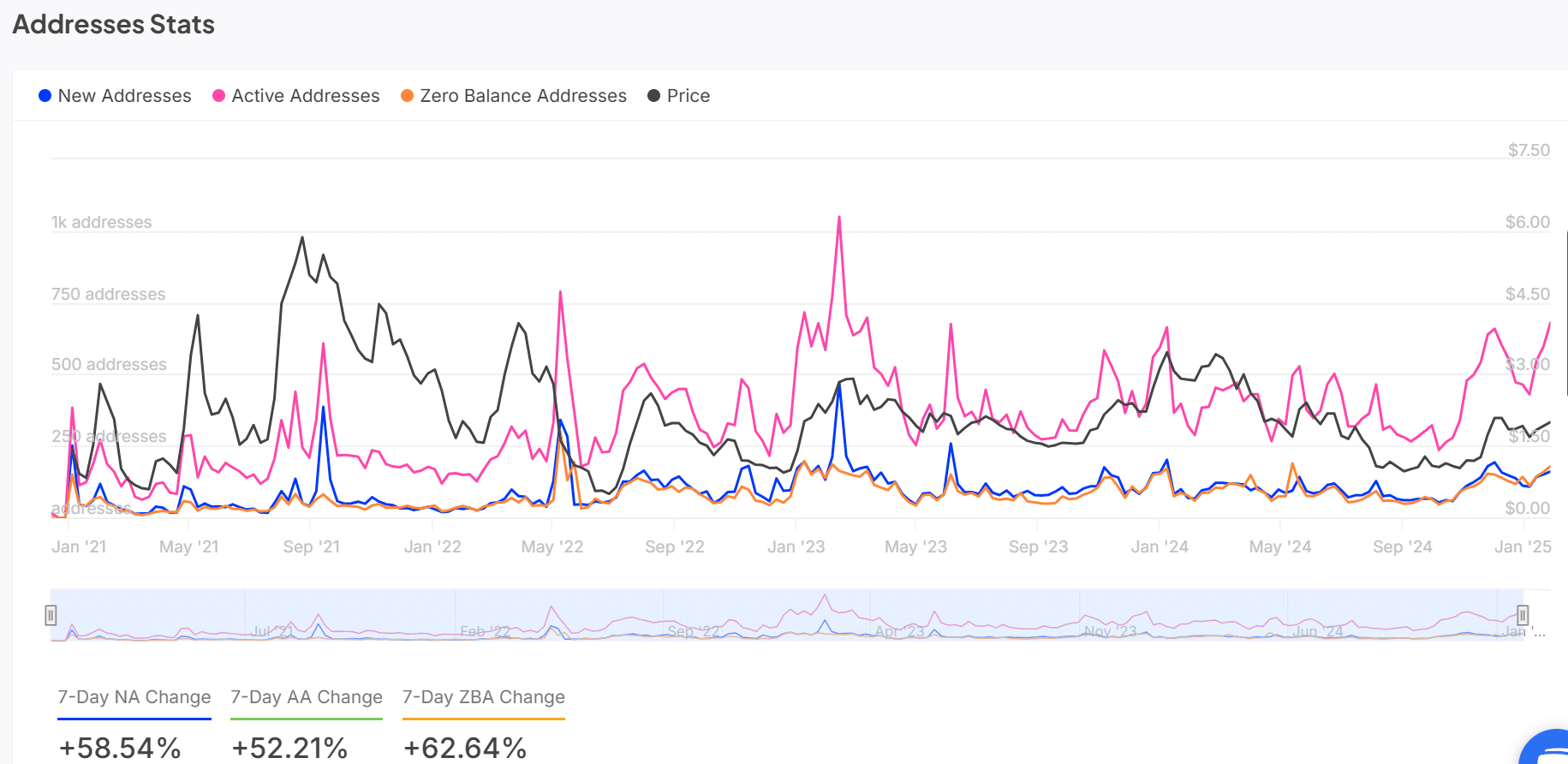

Address growth signals strong investor interest

On-chain data revealed a 58.54% spike in new addresses, signaling growing retail participation. Moreover, active addresses surged by 52.21%, indicating that more traders are engaging with LDO. Historically, rising address activity has correlated with bullish price action.

Furthermore, such a hike in adoption can also mean rising confidence in Lido’s staking ecosystem. Therefore, if address growth continues at this pace, it could support further price appreciation.

Source: IntoTheBlock

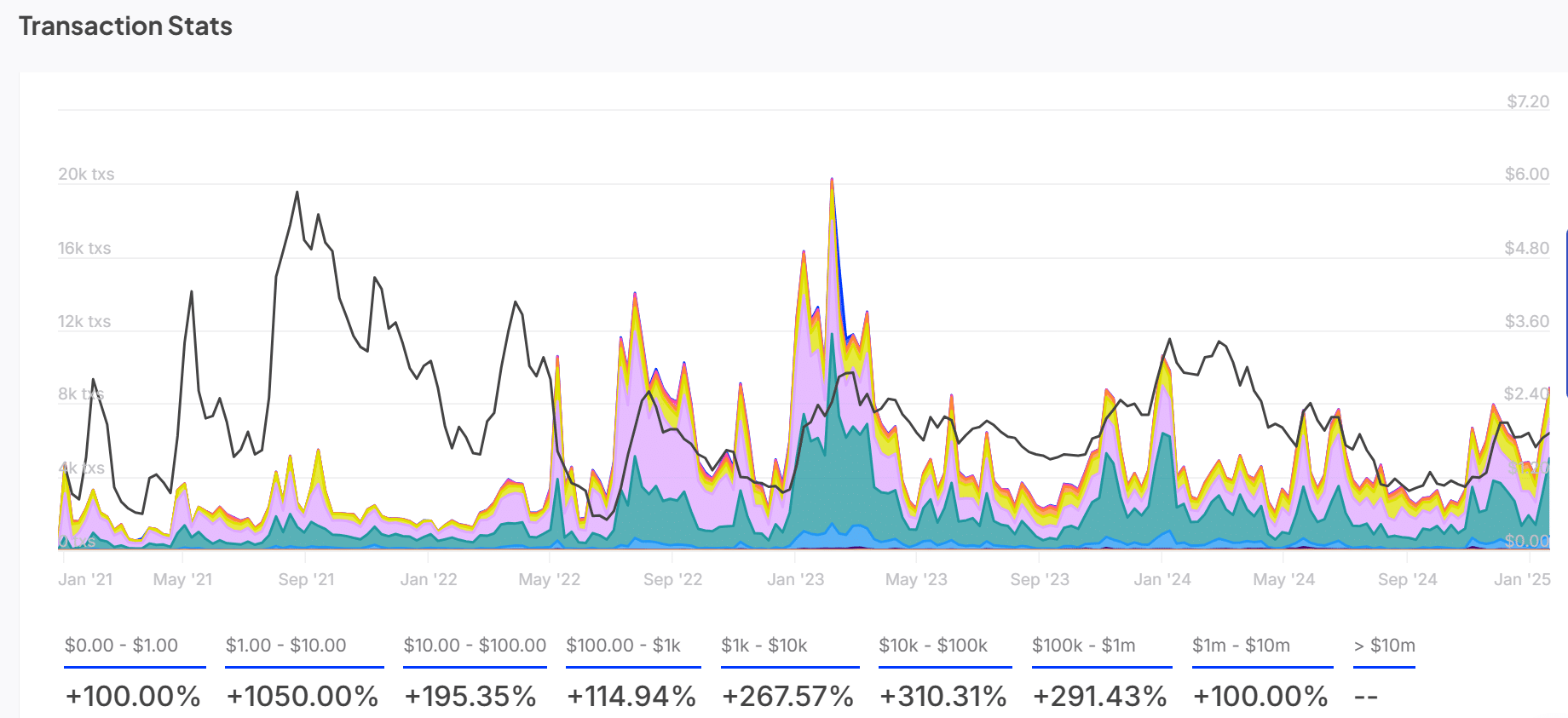

Whales are accumulating – What does it mean for LDO?

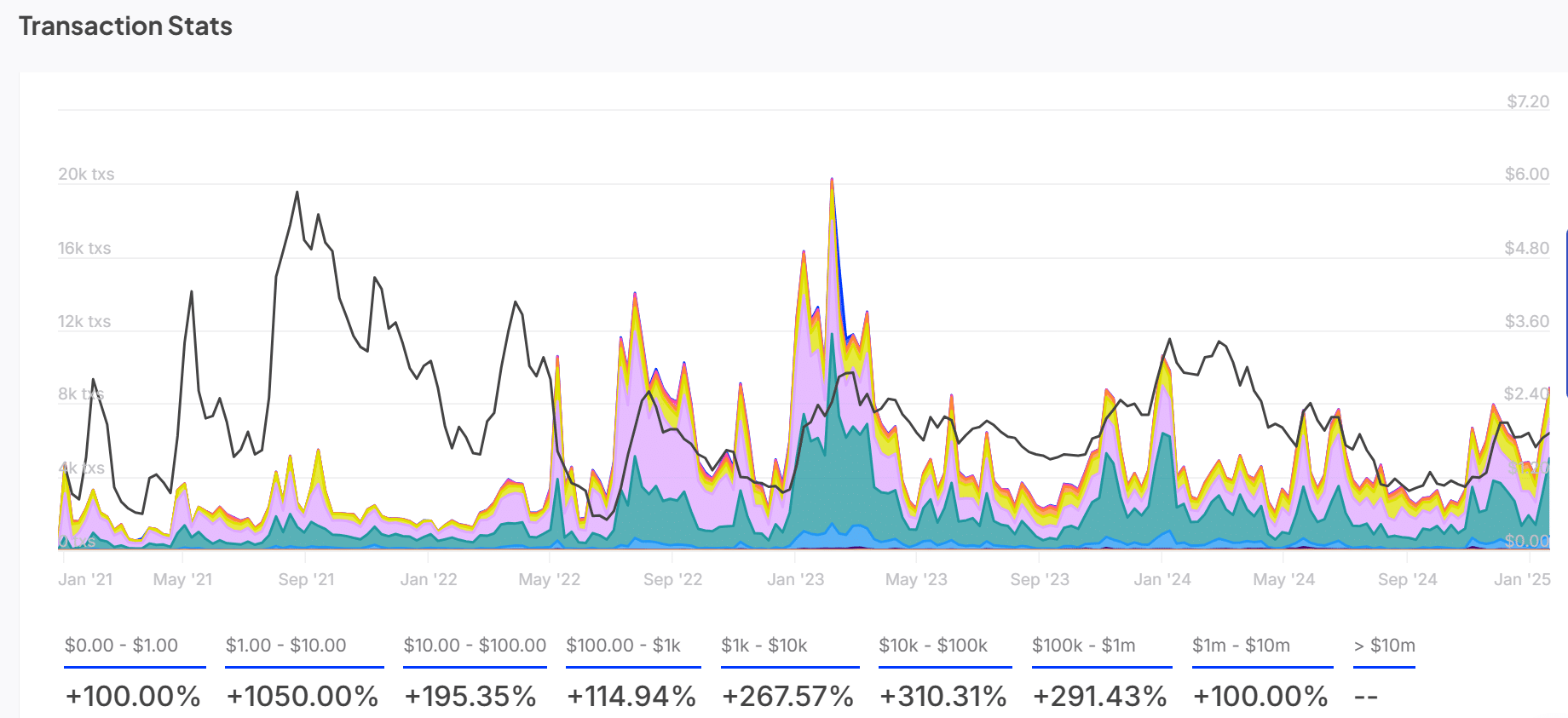

Transaction data highlighted a significant hike in large transfers. Notably, $100k-$1M transactions rose by 291.43% – A sign that institutional players and whales have been accumulating.

Additionally, mid-sized holders have been increasing their exposure too, further reinforcing bullish sentiment. Higher accumulation from deep-pocketed investors often leads to price stability and potential breakouts.

Source: IntoTheBlock

Is LDO’s price divergence pointing to another rally?

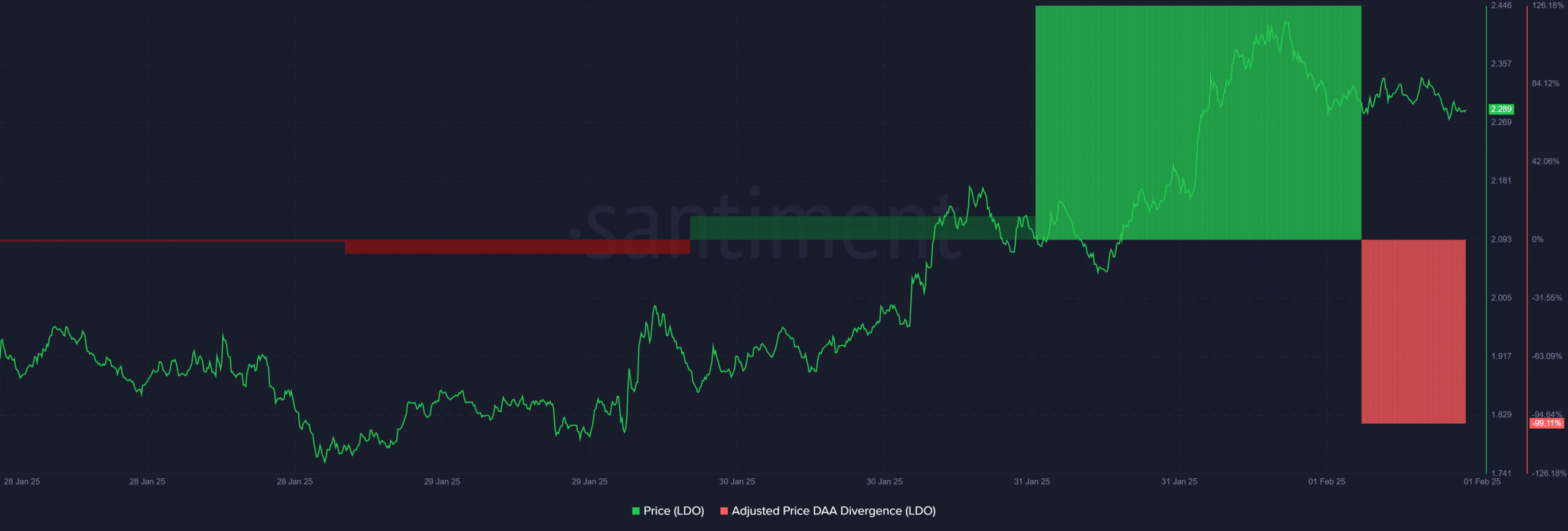

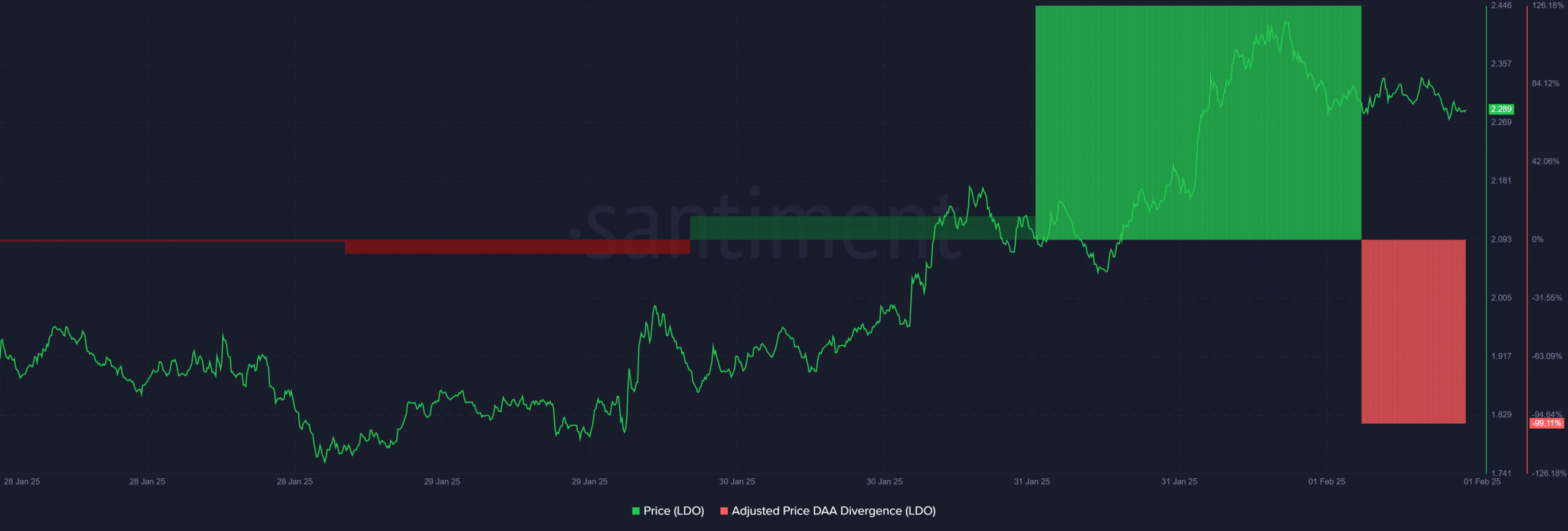

Despite LDO’s bullish breakout, the Price DAA divergence dropped sharply to -99.11% – A sign of weakening network activity, relative to price movement.

A steep negative divergence usually means that price growth is not being supported by increasing active addresses. This could potentially signal a slowdown.

Source: Santiment

Read Lido DAO’s [LDO] Price Prediction 2024-25

Given Lido’s bullish breakout, increasing address activity, and rising institutional accumulation, LDO has a strong chance of hitting $3.20.

However, breaking $2.42 remains crucial for confirming further upside. If bulls sustain momentum, higher price targets may be likely. Therefore, LDO’s next move will depend on whether buyers can push past its resistance or face a temporary pullback.