- ALGO’s downtrend maxed out at 34%, but hit the key $0.40 demand zone

- Will the trend reverse itself at the support amid weak demand?

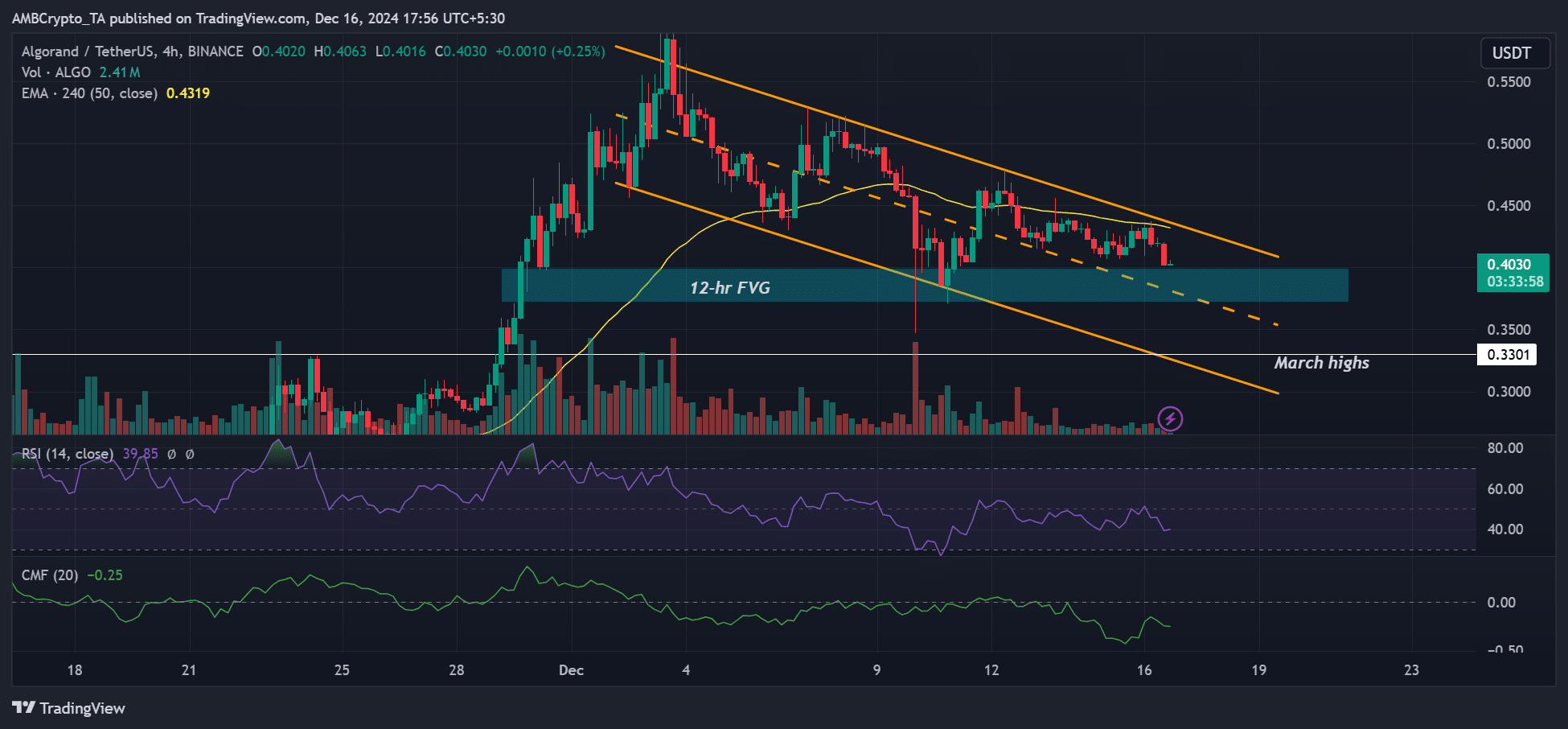

Algorand’s [ALGO] price pullback hit 34% after dropping from $0.61 to $0.40. The decline followed a slight strengthening of Bitcoin’s [BTC] dominance, pausing most of the altcoin market’s momentum, at least temporarily.

ALGO stabilized above $0.40 during the early December liquidation cascade, which massively affected the altcoin sector. Will this level reverse the ongoing downtrend?

ALGO – Will $0.40 hold?

Source: ALGO/USDT, TradingView

The $0.40 area also doubled as the price imbalance set in late November and has been a key demand zone. However, the last strong bounce from the zone, cyan, was rejected at the channel’s range high.

At press time, the price action was back at the zone and could stay at the level given the low demand, as illustrated by the below-average RSI reading.

Additionally, capital inflows improved but were still below the key level to help reverse the downtrend. In fact, inflows in December remained below zero level, as shown by the CMF (Chaikin Money Flow).

Taken together, a bounce at $0.4 might face another price rejection at the upper channel ($0.43) if these key technical indicators remain muted.

If the selling pressure extends itself and ALGO breaches the $0.40 support, the next reprieve could be at its March high of $0.33.

Will shorting yield gains?

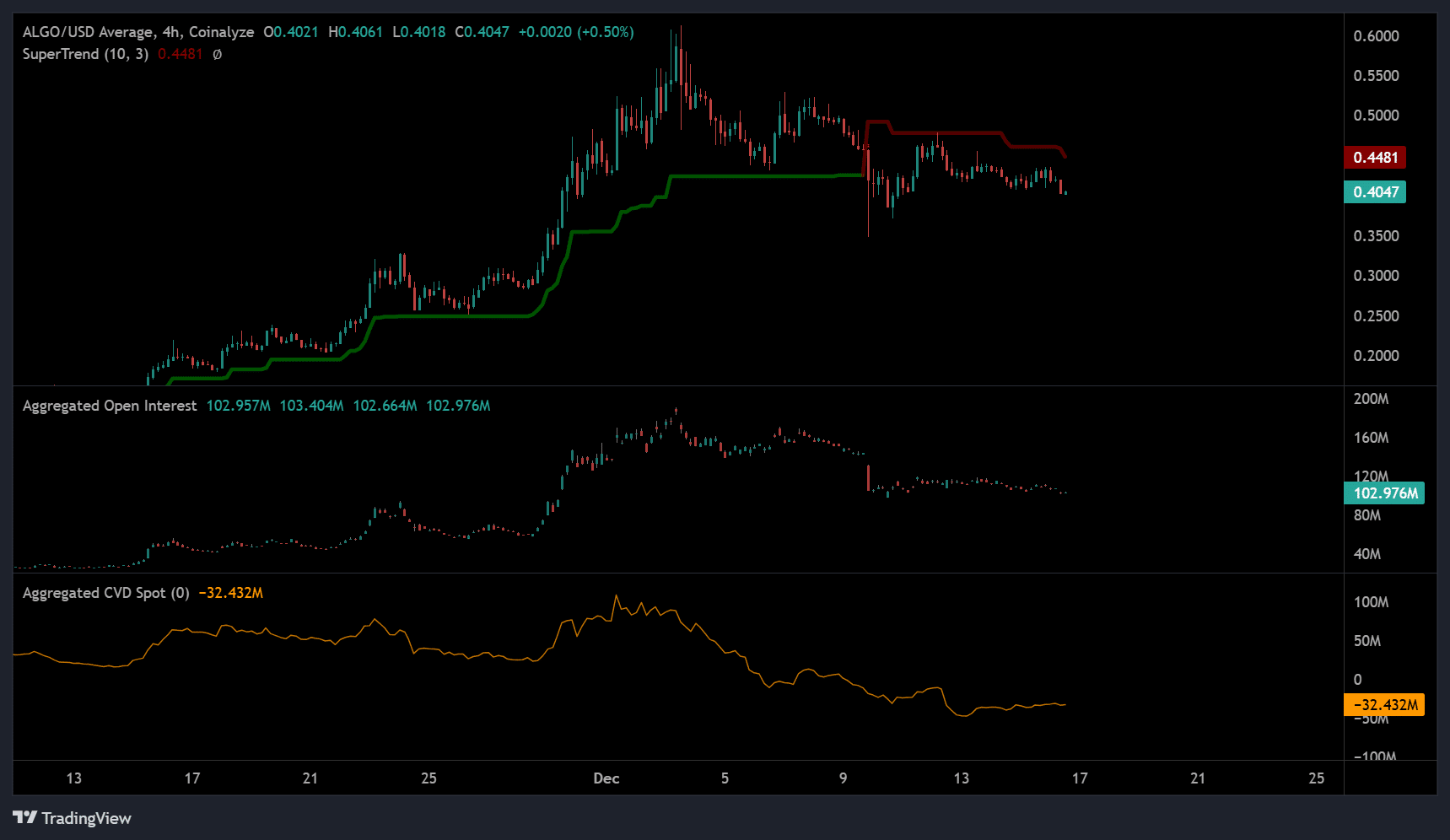

Source: Coinalyze

On the 4-hour chart, SuperTrend hasn’t reset the sell signal flagged on 9 December. It meant that shorting ALGO made more sense than going long as its downtrend extended.

The flat demand from the spot market, as reinforced by the low CVD spot, supported the short sellers’ edge in the market.

Read Algorand [ALGO] Price Prediction 2024-2025

In conclusion, ALGO weakened over the past two weeks as sellers piled into the market.

For bulls eyeing re-entry, a strong bounce at $0.40 or $0.33 could be a sign of price trend reversal. However, the bounce should be matched by strong demand, flows, and a decisive move above $0.43.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion