- The drop in price has been largely attributed to retail traders offloading the asset, anticipating a continued downtrend.

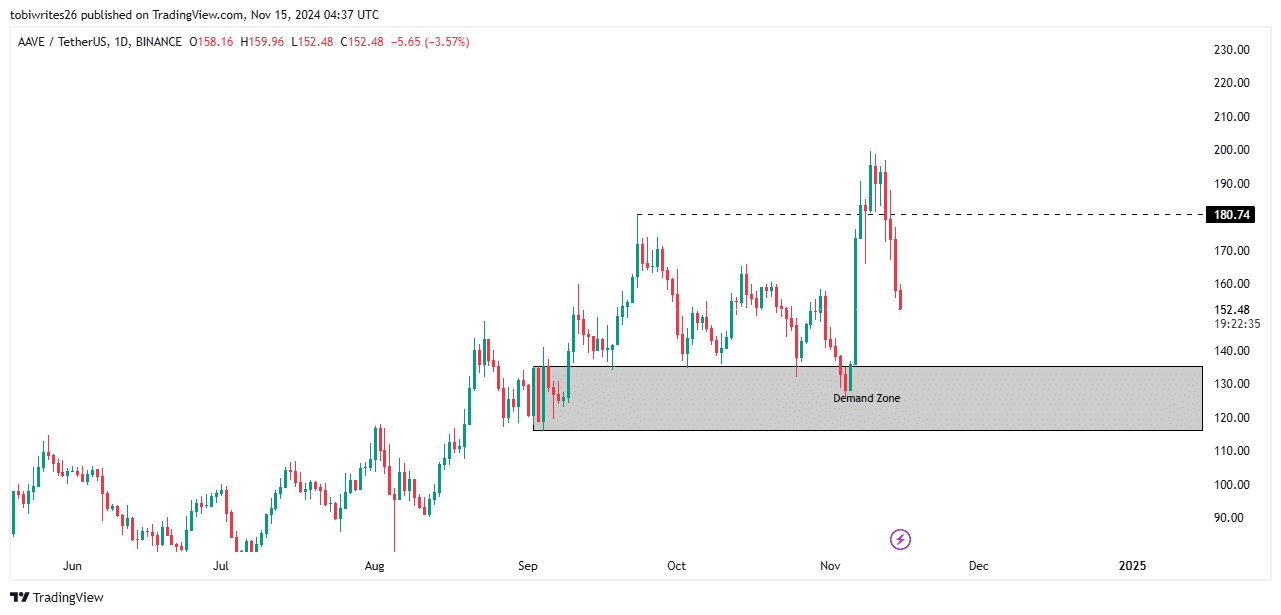

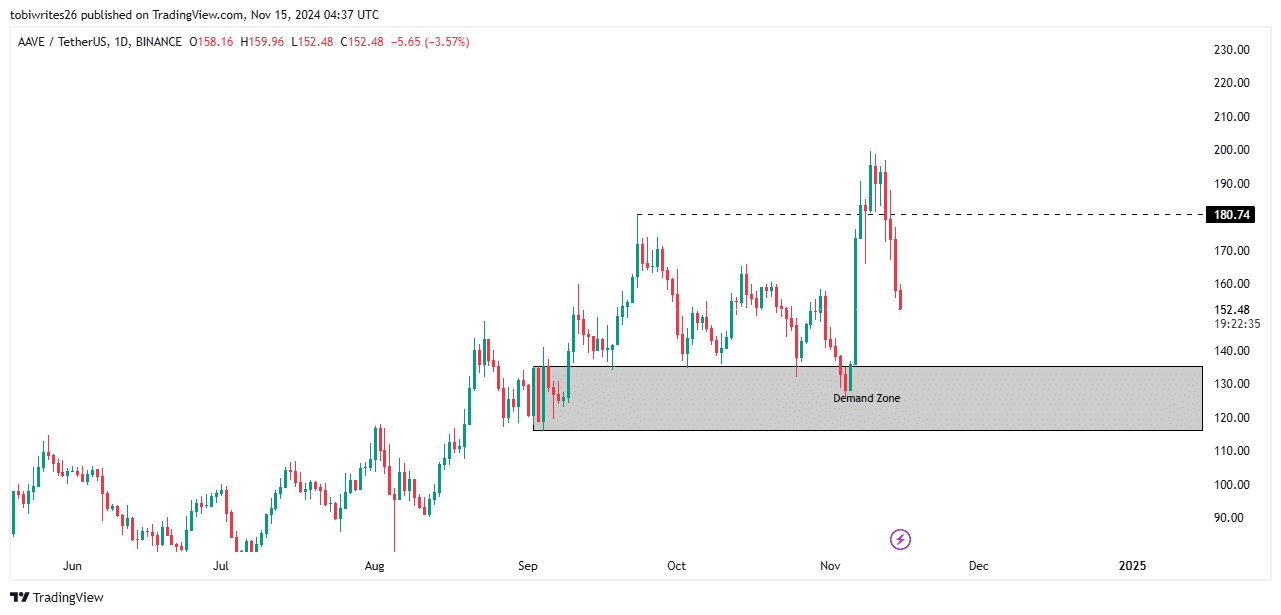

- Technical chart data indicates that AAVE’s next target lies within a demand zone at a lower price level.

Despite being a top market mover in previous months, Aave [AAVE] has recently struggled to make notable gains. Over the past week, the token has lost 14.01%, and it has continued on this downward trajectory, shedding an additional 11.89% in the last 24 hours.

This downturn is not expected to end soon. According to AMBCrypto’s analysis, AAVE remains in a lagging position, with further declines anticipated before potential recovery.

AAVE searches for new demand zone in downturn

The coin is currently in decline, experiencing a significant drop that is expected to continue until it reaches a level with sufficient liquidity to either stabilize or shift market direction.

At the time of writing, this potential demand zone is projected to fall between $135.34 and $116.21, as marked on the chart.

Source: Trading View

If this level holds, AAVE may chart a path back to its previous high, potentially reaching the $200 mark. Further market momentum could support the asset’s movement toward even higher levels.

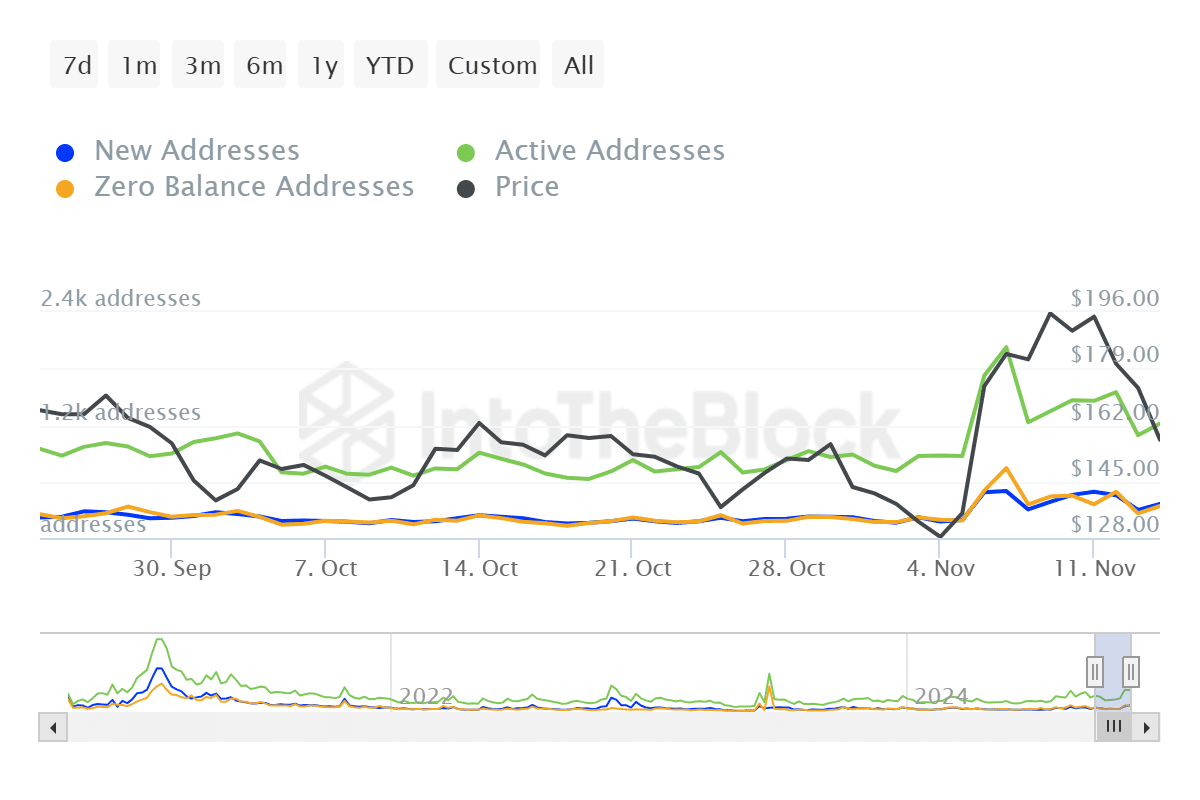

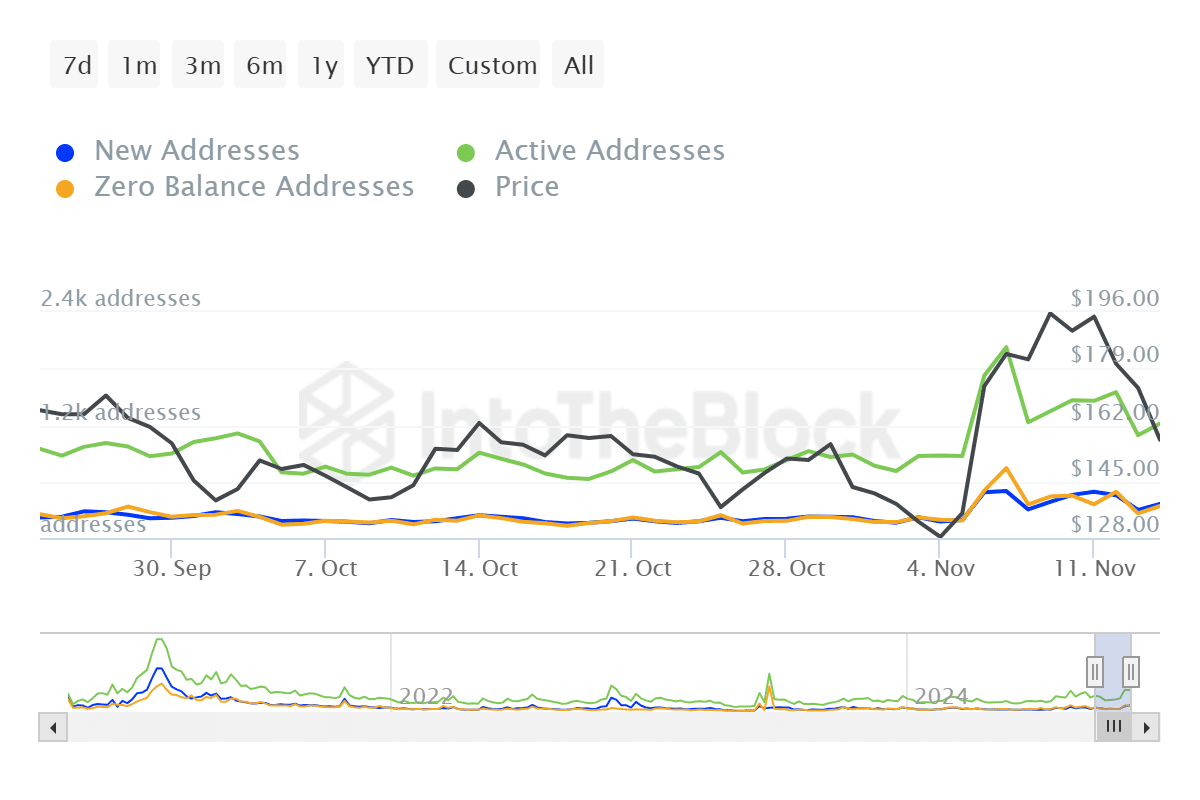

Retail traders drive AAVE market drop

The recent decline in AAVE’s market value has been largely driven by retail traders actively selling the asset.

According to data from IntoTheBlock, the number of active addresses surged in the last 24 hours, reaching 1,220 at the time of analysis.

Source: IntoTheBlock

A sharp increase in active addresses, coupled with a prolonged market decline, suggests that market participants are more inclined to sell than to buy.

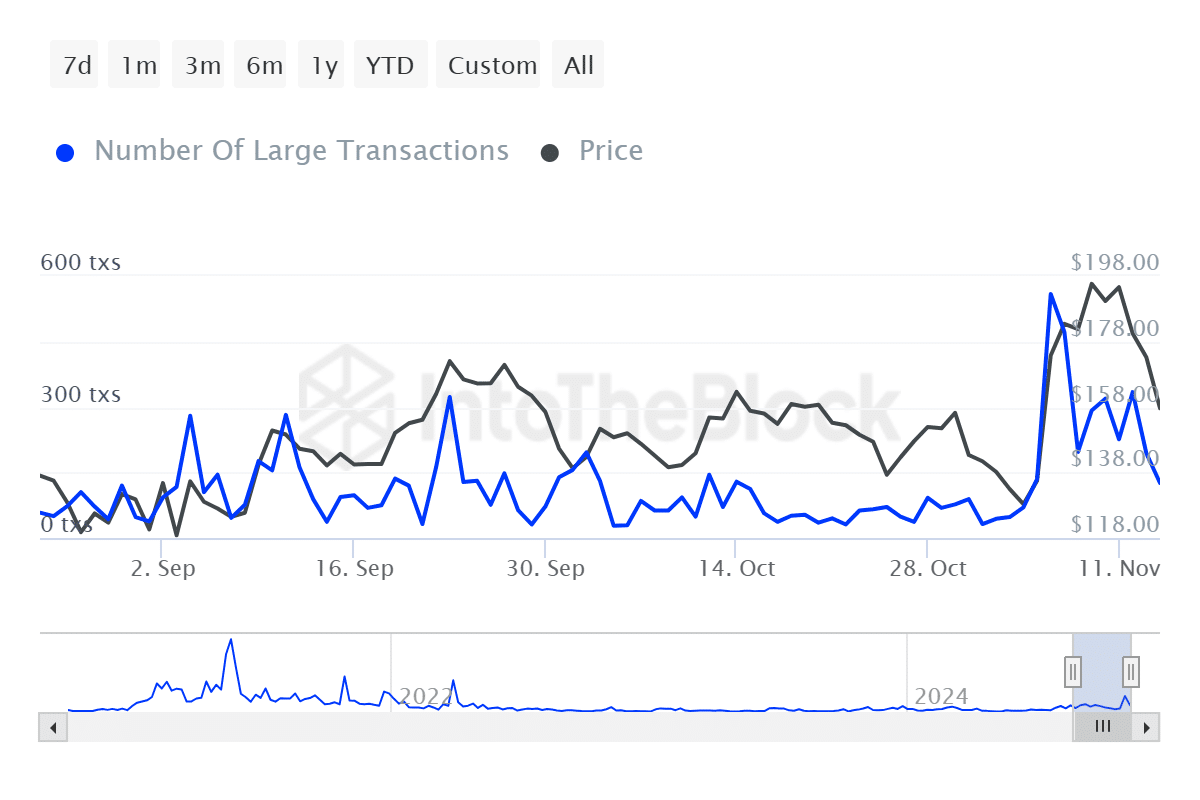

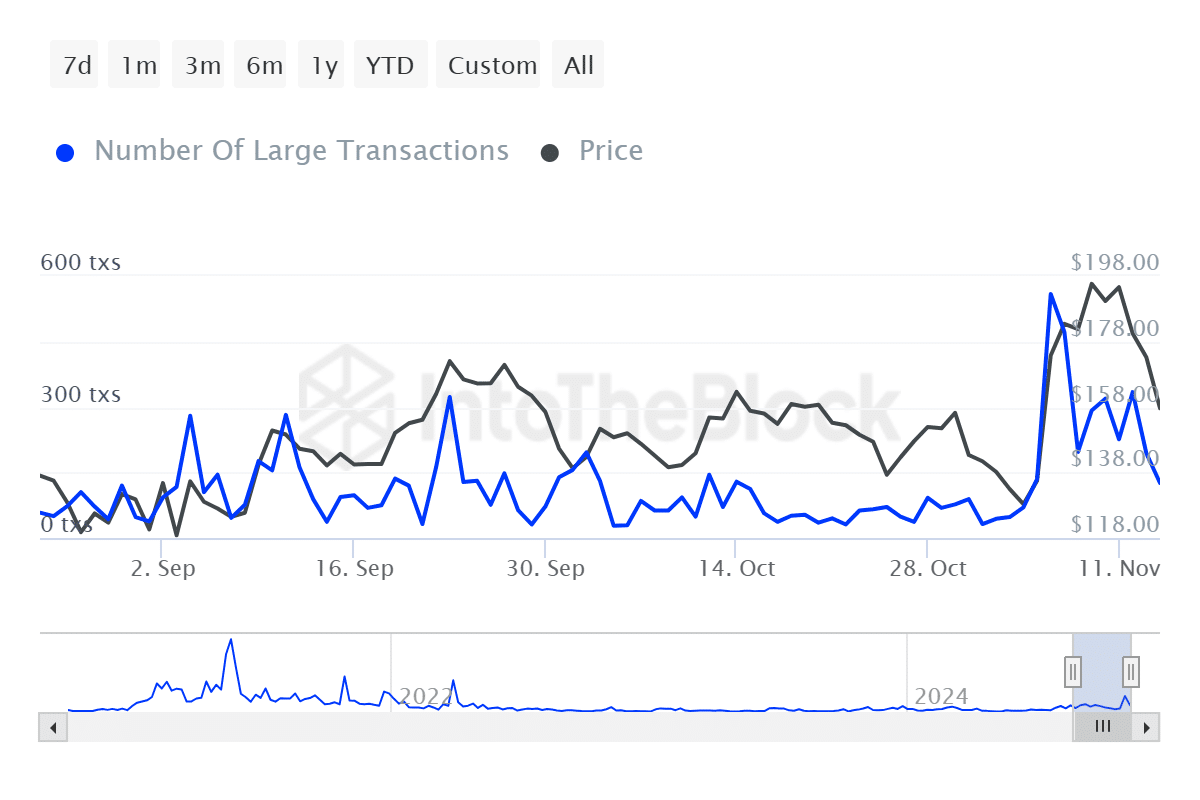

Meanwhile, large holders, or “whales,” have taken a neutral stance. The number of large transactions has decreased significantly, dropping from a high of 334 on November 12 to 126 at the time of writing.

Source: IntoTheBlock

This whale inactivity may change if AAVE reaches a price level that these larger investors consider favorable, potentially within a demand zone where buying activity could increase.

Traders shift to long-term holding

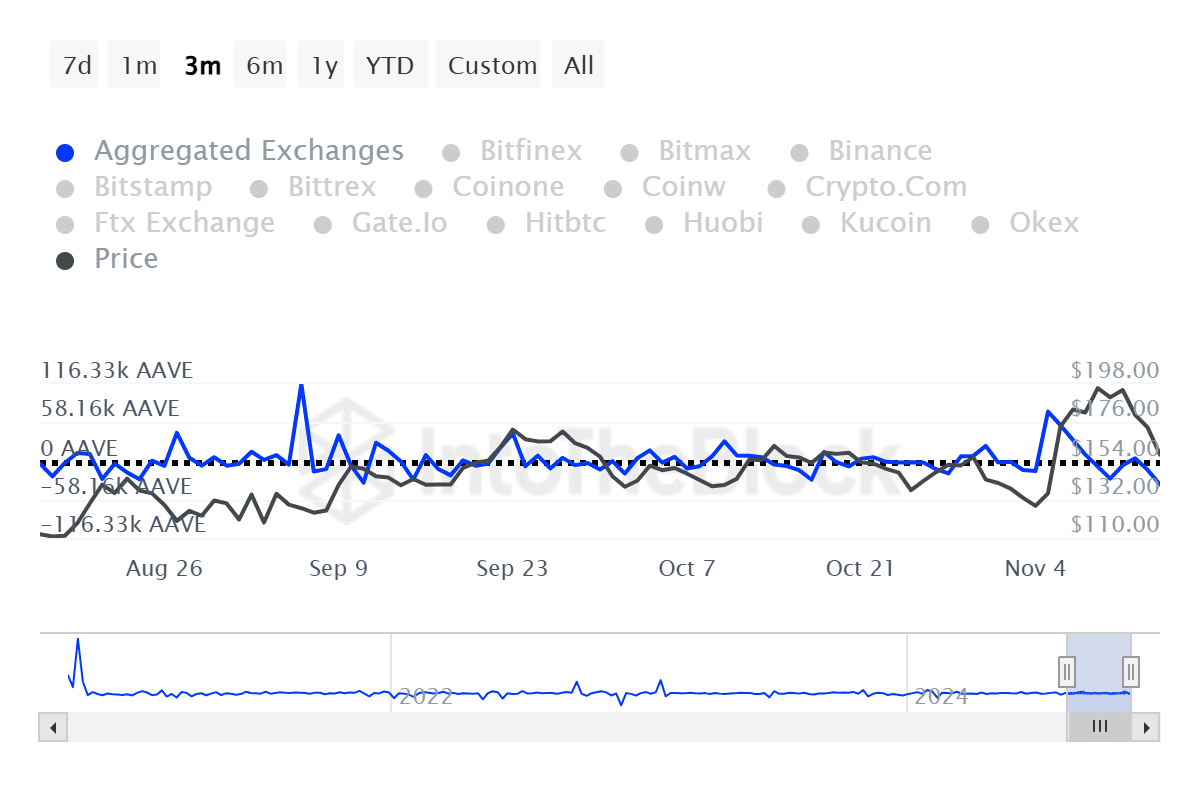

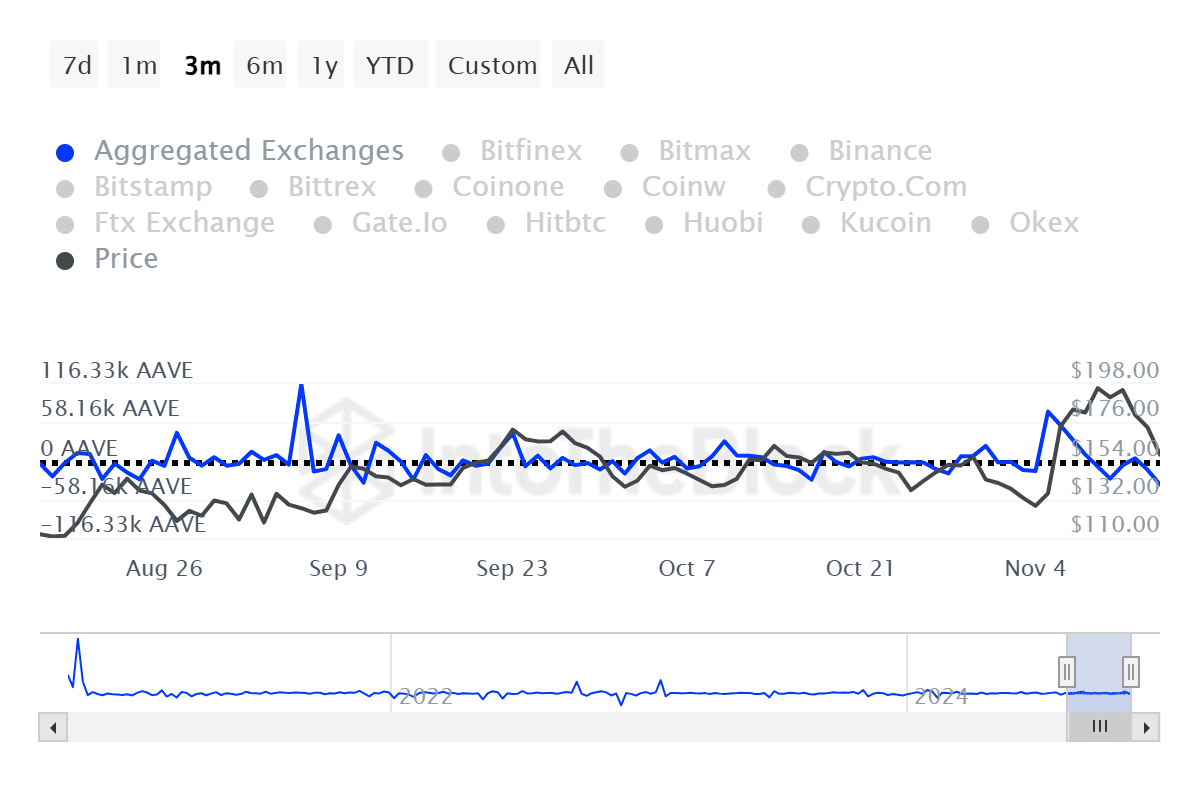

Further analysis indicates that the overall market sentiment for AAVE remains bullish, as spot traders are increasingly moving their holdings off exchanges for long-term storage.

Read Aave’s [AAVE] Price Prediction 2024–2025

Exchange Netflow data from IntoTheBlock reveals that, over the past 24 hours and 7 days, 22.09 thousand and 67.46 thousand AAVE, respectively, have been withdrawn from exchanges.

Source: IntoTheBlock

This trend of removing AAVE from exchanges reduces the circulating supply available for immediate sale, which can support demand and signals a broadly bullish outlook for the asset.