Alkekengi officinarum

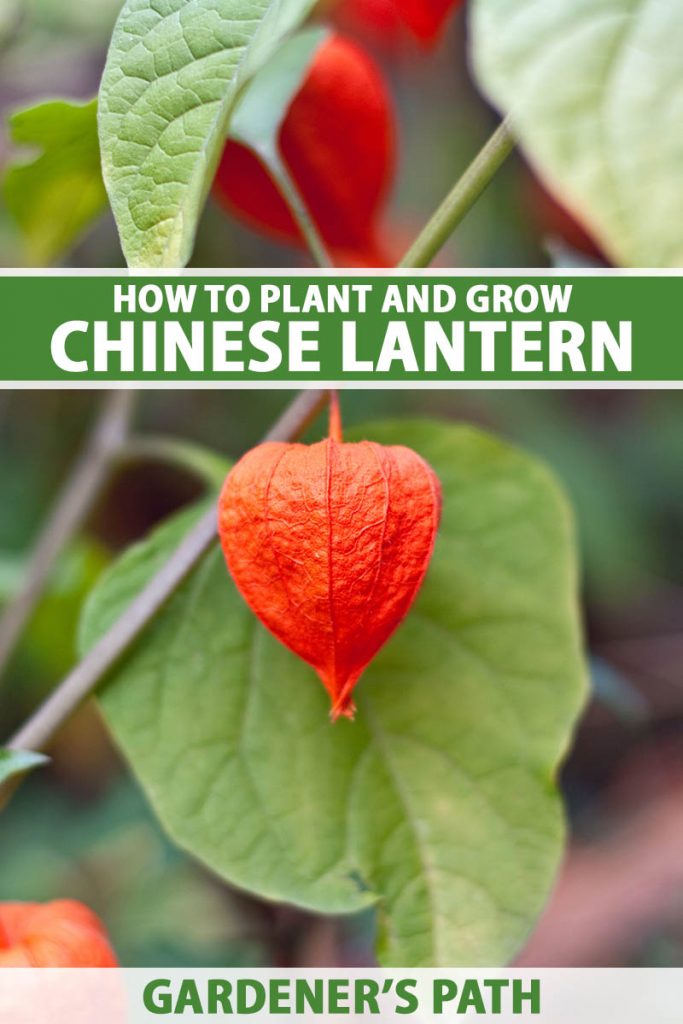

Chinese lantern is a charming ornamental plant that can bring a touch of whimsy to your garden, with its delicate red-orange husks.

Whether you grow it as a curiosity, or with the intention of using its stems for colorful autumn bouquets, this perennial will provide an unexpected source of bright fall color.

We link to vendors to help you find relevant products. If you buy from one of our links, we may earn a commission.

Ready for a sneak peek? Here’s what we’ll cover:

Alkekengi officinarum, or as it is commonly known, “Chinese lantern,” is an herbaceous perennial that is hardy in USDA Zones 3 to 9.

It was formerly known as Physalis alkekengi but has been reclassified – we’ll get to that story in a bit – and it bears a strong family resemblance to its relatives in the Physalis genus, ground cherry and tomatillo.

Quick Look

Common name(s): Chinese lantern, love in a cage, strawberry tomato,

strawberry ground cherry, Japanese lantern, bladder cherry, winter cherry.

winter lantern

Plant type: Deciduous perennial

Hardiness (USDA Zone): 3-9

Native to: Europe, Asia

Bloom time: Late summer-early fall

Exposure: Full sun, partial shade

Soil type: Sand, loam, and clay with plenty of organic material, well draining

Soil pH: 6.1-7.8, slightly acidic to alkaline

Time to maturity: 2 years

Spacing: 18-24 inches

Planting depth: 1/4 inch (seeds)

Mature size: 1-2 feet wide x 30 inches high

Water Needs: Moderate

Taxonomy

Order: Solanales

Family: Solanaceae

Genus: Alkekengi

Species: Officinarum

A member of the nightshade or Solanaceae family, Chinese lantern is also related to petunias, tomatoes, eggplants, peppers, and potatoes.

Like ground cherry and tomatillo, Chinese lantern grows its fruits enclosed within papery calyxes or husks.

Before we get to the star of the show, the husks, let’s have a look at the other features of this deciduous plant so that you’ll know what to expect.

Chinese lantern has alternate medium green leaves that are approximately three inches long. This perennial grows to be approximately 30 inches tall with a spread of two to three feet.

Common Name Confusion

Don’t confuse this “Chinese lantern” with two other plants that go by the same common name, Abutilon pictum and Sandersonia aurantiaca.

A. abutilon is an understory tree that belongs to the mallow family, and S. aurantiaca is a perennial covered with yellow flowers that is more often called “Chinese lantern lily.”

The subject of this article, on the other hand, is a small, deciduous herbaceous plant known for its papery, red-orange husks.

Its flowers are inconspicuous – they are small, yellowish white, and star-shaped.

The true visual interest in this species starts when those little white flowers begin their transformation into fruits.

Small green husks begin to grow, and within them, small fruits start to mature, hidden from view.

In late summer or early fall, the plant’s husks will turn from green to a bright reddish orange hue, giving them the appearance of miniature red paper lanterns – the inspiration behind the Chinese lantern’s common name.

The fruits inside remain hidden until the calyxes begin to disintegrate in winter.

As the husk decomposes, it leaves behind a fine latticework, revealing a brightly colored red-orange “cherry” inside, which gives this plant another of its common names, “love in a cage.” This small, round fruit is approximately a half an inch in diameter.

Chinese lantern has many other common names as well, and it is also known as “strawberry tomato,” “strawberry ground cherry,” and “Japanese lantern.”

Its former genus name, Physalis, comes from the Greek word for “bladder,” referring to the shape of its calyxes, and giving rise to another common name, “bladder cherry.”

Also called “winter cherry” and “winter lantern,” its calyx-covered stems can be dried for use in bright bouquets to be enjoyed during the autumn and winter seasons.

A native of Europe and Asia, the first known record of Chinese lantern appears in a book called the Codex Aniciae Julianae, otherwise known as the Codex Vindobonenis.

This codex is a manuscript on medicinal plants created in the sixth century, in which our subject is called simply “physalis,” from the Greek word for “bladder.”

It’s a bit ironic that bladder cherry was the original “physalis,” because it has now been booted out of the genus of the same name. While it was previously classified as Physalis alkekengi, its preferred new classification was changed to Alkekengi officinarum in 2012 after a genetic analysis of Chinese lantern and its relatives.

Not all sources have adopted this new classification yet, so you’ll often still see it called P. alkekengi. It’s sometimes referred to as P. franchetii, as well.

Although it is primarily grown as an ornamental these days, A. officinarum appeared in the Codex Aniciae Julianae for a reason – the author, Dioscorides, considered it to be a medicinal plant.

Over the long history of its medicinal use, bladder cherry fruits have been employed for treating kidney stones and other urinary ailments.

A Note of Caution:

While the small, round fruits of this bladder cherry are edible when fully ripe, unripe fruits as well as the other parts of the plant are considered highly toxic if ingested.

Medicinal uses aside, the fruit is reported as tasting either completely bland or exceedingly acidic.

Whether you plan to use A. officinarum as an ornamental plant or a medicinal one, be aware that it naturalizes easily, spreading via underground rhizomes, and is considered invasive in some areas.

If you’re concerned about winter cherry’s ability to spread, I’ll cover tips on keeping it contained in the maintenance section below.

How to Grow

Colorful love in a cage can grow without pampering, thus its ability to outgrow its intended bed.

However, when you want to ensure that you have the most beautiful autumn bouquets, it helps to follow a few growing tips.

Light

Bladder cherry grows best in full sun but can tolerate partial shade as well.

Just be sure that these plants receive at least six hours a day of sunlight. A bit of shade in the heat of the afternoon would be ideal, particularly if your summers are extremely hot.

Soil

As for soil, Chinese lantern does best in moderately rich, well-drained soil. If you’re starting with poor soil, simply work some compost into it before planting. You won’t need additional fertilizer.

These plants grow well in soil that is slightly acidic to slightly alkaline. If you aren’t sure what type of soil you have, consider having your soil tested.

Temperature and Humidity

Hardy in USDA Zones 3 to 9, Chinese lanterns are adaptable to a wide range of climates. They prefer temperate conditions but will grow well in both cool and warm zones.

High humidity typically isn’t a concern, though overly wet conditions can increase the risk of fungal issues, especially if airflow is limited.

Water

Bladder cherry likes soil that is moderately moist. While plants are getting established, they will need at least one inch of water per week. Water thoroughly and deeply rather than lightly and more frequently.

As you strive to keep your soil evenly moist, be careful not to let conditions turn soggy, which could encourage disease spread.

And if your soil tends to dry out, consider adding a layer of mulch as a means of conserving moisture.

Fertilizer

These plants generally don’t need much feeding. If your soil is especially poor, you can apply a balanced, slow-release fertilizer in the spring as new growth appears.

Avoid high-nitrogen formulas, which can encourage excessive leaf production at the expense of flowers and lanterns.

Overwintering

In colder climates, Chinese lanterns die back to the ground in winter. Cut the stems back after frost kills the foliage and apply a layer of mulch to protect the roots.

In Zone 3 and other areas with harsh winters, a thicker mulch layer—up to four inches—will offer additional insulation.

In containers, either move pots to a protected location like an unheated garage or insulate the container with bubble wrap or straw to prevent root freeze.

Where to Buy

There aren’t many cultivated varieties of bladder cherry, perhaps because the species itself is quite unique in its natural state.

In fact, this perennial species has such ornamental value that it won the Royal Horticultural Society’s Award of Garden Merit.

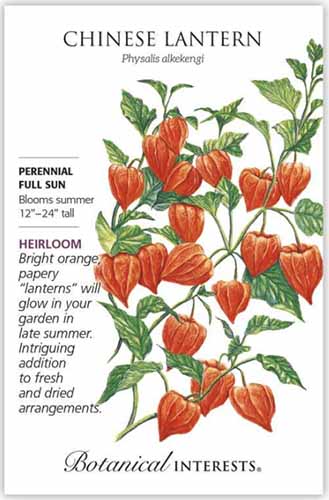

Chinese Lantern Seeds

If you’d like to try your hand at growing this award winner, you can find Chinese lantern seeds for purchase in 150-milligram packs at Botanical Interests.

Maintenance

Maintenance of these plants is simple: provide water during dry spells, divide as needed, and above all, contain them if conditions in your area allow them to become invasive.

Containment

The trickiest part of maintaining Chinese lantern may be simply containing it, since this hardy perennial can spread via underground rhizomes.

If you have an area dedicated to your bladder cherry where you don’t mind it expanding from a clump into a small thicket, you can let it spread.

Otherwise, you may want to confine it to a container, such as a terra cotta pot, a window box, or your favorite planter.

If you decide to prevent unwanted spread by relegating your winter cherry to your container garden, place the pot in a sunny location where you’ll remember to water it. It will require more frequent watering in a pot compared with one that’s growing in the ground.

Alternatively, you can plant your bladder cherries in a plain nursery pot and sink the pot into the ground. However, this method isn’t entirely foolproof since rhizomes may escape through the drainage holes in the pot.

Yet another option would be to grow your Chinese lantern in a self-contained area, such as the green space between the street and the sidewalk, where it will be more manageable.

And be aware that rhizomes are not the only option with which these plants can spread. If you leave the fruit-filled husks on your Chinese lanterns over the winter, the dried fruit can fall, or be eaten by birds, and their seeds can be dispersed, creating additional volunteers in your yard.

If you’re concerned about it spreading in your area in this way, make sure to remove the fruits before the seeds can fully mature, dry, and be dispersed.

Propagation

Chinese lantern can be propagated either by sowing seeds, or by dividing rhizomes to start new plants. Let’s discuss growing from seed first.

From Seed

If you’re growing winter cherry from seed, you can either sow the seeds directly into your soil, or start your seedlings indoors and set them out after your last frost.

If you decide to start them indoors for later transplanting, time your seed sowing for six to eight weeks prior to your last spring frost. You can start Chinese lantern in the same way that you would start annuals indoors – read more about this process in our guide.

To sow directly into your garden, wait until all danger of frost has passed in spring. While mature specimens are cold hardy, young seedlings are more vulnerable to cold weather.

Also make sure your soil has warmed to 65 to 75°F, for successful germination. A soil thermometer can be used to monitor the temperature of your soil and find the best moment for sowing your seeds.

Here’s how:

- Choose a location in full sun with well-draining soil. Prepare your soil by loosening it to about six to eight inches deep, and then working in some compost if desired.

- Spray your soil gently with your gardening hose so that the surface is moist prior to sowing.

- Sow a group of three seeds every 18 to 24 inches.

- Light is required for germination of these seeds, so either sow on the surface of the soil or cover only very lightly, with about 1/4 of an inch of soil.

- Press the seeds into the earth to ensure good contact, and then water in gently. Be patient – seedlings may take up to 21 days to emerge.

- Water the germinating seeds and young seedlings daily if there’s no rain, and continue to water as plants grow and get established.

- Once seedlings are four inches tall, thin down to one plant every 18 to 24 inches.

If you have started seedlings indoors, about a week before your last frost date, harden them off before transplanting them to their outdoor location.

To do this, place the seedlings outdoors in a protected location during the day for about an hour. The next day, increase the amount of time to two hours. Over the next several days, leave the seedlings outdoors for longer periods of time and expose them to more direct sunlight.

After about a week of this transition, your seedlings will be ready to transplant – just make sure to wait until your weather forecast is clear of frost.

When propagating bladder cherry from seeds, some plants may flower and produce their colorful husk-enclosed fruits in their first growing season, while others may require an additional year of growth.

By Division

The best time to divide your winter cherry is in spring, when there’s some green growth that’s started already.

Choose a stem and follow it down to the soil. Using a hand shovel or hori hori knife, work out a clump of the rhizomes with the stem or stems still attached.

You can relocate this clump to a new garden location, or grow it in a container. If possible, perform this operation late in the afternoon or on a cloudy day so that the plant can have some time to recover out of the intense midday sun.

To plant your divided clump into the soil, dig a hole twice as large and deep as the roots. Loosen the removed soil and place some of it back into the hole.

Place the plant’s roots into the hole, making sure the crown is neither too deep nor too high, but sits just at soil level. Backfill with soil and water in well.

Pests and Disease

Along with its unique and colorful, berry-enclosed husks, love in a cage has another advantage – deer tend to leave it alone. And it’s not much of a target for diseases or other pests, either.

If you do encounter a problem of this nature, here’s what to be on the lookout for:

Pests:

Disease:

Best Uses

Although the fruits of bladder cherry do have a history of medicinal use and they are safe to consume when ripe, though very sour, you can also reserve this plant for strictly ornamental use.

In your landscape you might use Chinese lantern as a border or in a flower bed.

Or include it as a perennial member of your cottage garden, combined with purple or blue New England asters, and white Montauk daisies, which share similar growing requirements, and will both be in flower when this orange husk cherry is coming into its full glory.

Keep in mind that love in a cage will be showing off its bright orange color in late summer or early fall, so it would be the perfect perennial to include in your plans for a spooky Halloween garden too, or a cozy autumnal garden display.

Bladder cherry is an excellent choice as a cold temperature ornamental for the fall garden and would provide a nice textural contrast to late season chrysanthemums.

And if you decide to leave the lanterns on the plant rather than harvesting them, it can also provide bright splashes of color through the doldrums of winter.

Of course, if you do decide to harvest the husk-covered branches, you will have no scarcity of options in incorporating them into either fresh bouquets or dried flower arrangements.

You might even choose to take its common name quite literally and hang a branch or two over your fairy garden, as miniature lanterns.

Alternatively, you can use them right away and let them dry in a vase, or work them into a festive autumnal wreath.

When harvesting these ornamentals to use for flower arrangements, you have options as to when you should collect the branches.

Some gardeners prefer to let all the husks on a branch mature to a deep reddish-orange hue. Others prefer to have a gradation of colors on a single stem, ranging from deep orange to green.

Whichever you choose, cut the stems back close to the ground, and remove the leaves as well as any damaged husks.

For dried arrangements, you can either hang the stems upside down, or dry them with their calyxes hanging down, naturally. In either case, allow them to dry in a cool, dark place.

Dried Chinese lanterns will retain their color for a few years if kept out of direct sun.

Light Up Your Garden with Chinese Lantern

With Chinese lantern, you’ll have a unique perennial that will offer you branches dangling with colorful, papery husks to enjoy in autumn and winter.

Have you grown love in a cage before? What is your favorite way to use the brightly colored husks? Let us know in the comments section below.

Interested in some companion plants for your winter cherry? Here are some additional flowering perennials that will grow in the same conditions and show off their color at the same time: