- Solana marks five years since its inception as a comprehensive ecosystem.

- It is now facing a major downturn, with DEX volumes plummeting and investor conviction faltering amid cooling sentiment.

Once hailed as the breakout star of the post-pandemic crypto era, Solana [SOL] now finds itself at a critical crossroads.

As it marks its fifth anniversary, the high-speed blockchain that once rivaled Ethereum [ETH] in buzz and activity is grappling with a sobering downturn.

DEX volume has cratered — from a robust $36 billion peak to a mere $988 million, the lowest so far this year.

With Open Interest also tumbling, is Solana simply experiencing a temporary lull, or is this the start of a deeper structural unraveling?

Happy birthday, Solana!

Launched in March 2020, Solana entered the scene promising unmatched speed and scalability — positioning itself as a next-gen Layer 1 chain built for mass adoption.

Backed by a strong developer community and growing DeFi interest, it quickly rose through the ranks, becoming a favorite for NFT projects and high-frequency trading platforms.

At its peak, Solana boasted billions in TVL and was dubbed as the deadly “Ethereum killer.” But five years on, the landscape has shifted.

Despite technical upgrades and ecosystem efforts, Solana is now contending with declining volumes and fading market enthusiasm, prompting a deeper look into what’s gone wrong.

DEX activity and Open Interest sink

Source: Artemis

As Solana crosses the five-year mark, its on-chain performance paints a sobering picture. Artemis data shows that DEX volumes have collapsed from a yearly high of $36 billion in January to under $1 billion in mid-March.

The decline is steep and unforgiving, with barely any hope for recovery. This sharp downturn reflects waning trading activity, diminished user engagement, and possibly liquidity migrating elsewhere.

Source: Coinglass

Futures data adds to the concern. Open interest in SOL futures has plunged from over $5 billion to just above $3 billion this March, even as SOL’s price failed to hold above $150.

This divergence signals fading investor conviction and a cooling appetite for leveraged positions.

For a network once dubbed Ethereum’s fiercest rival, the silence in its order books is becoming harder to ignore.

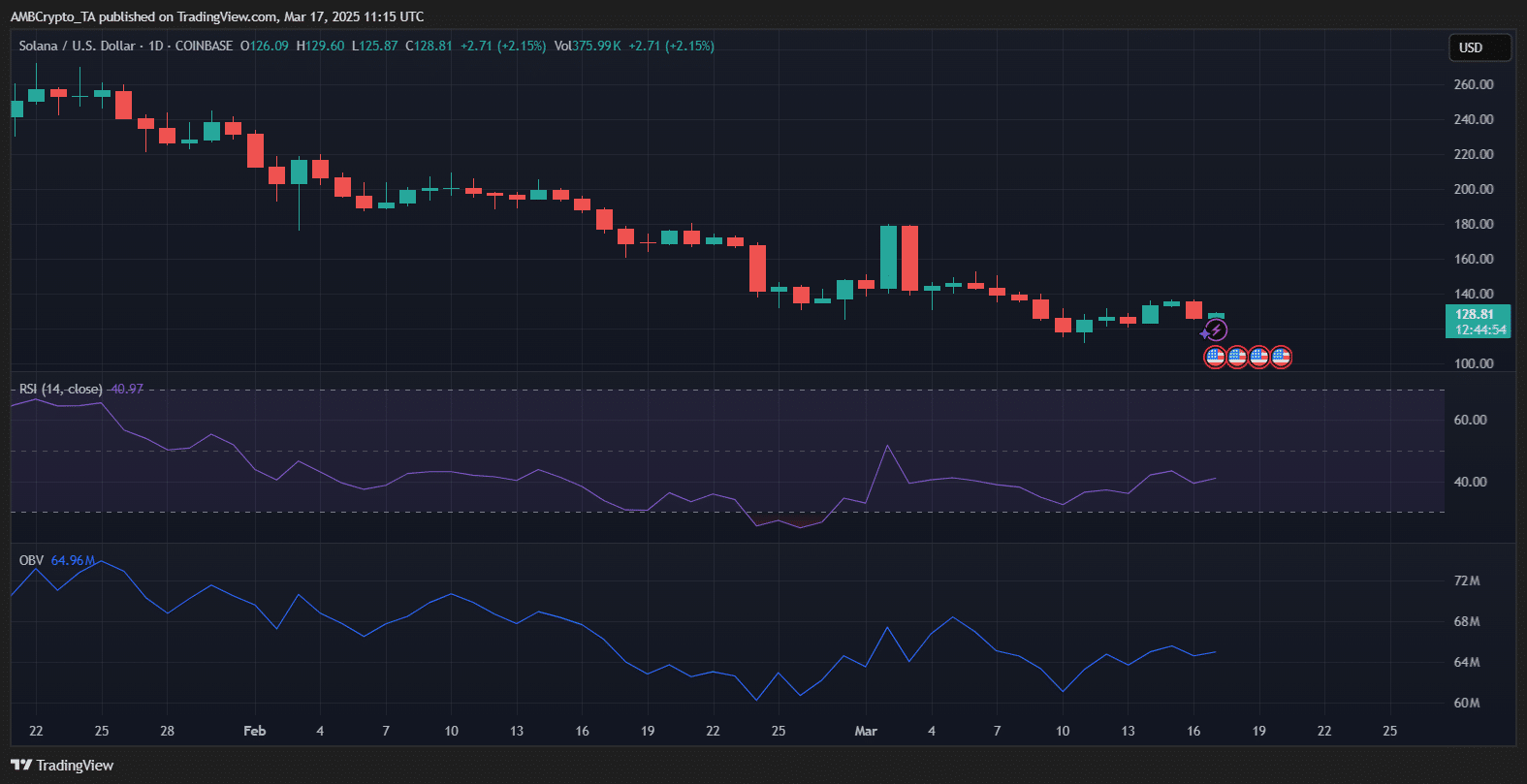

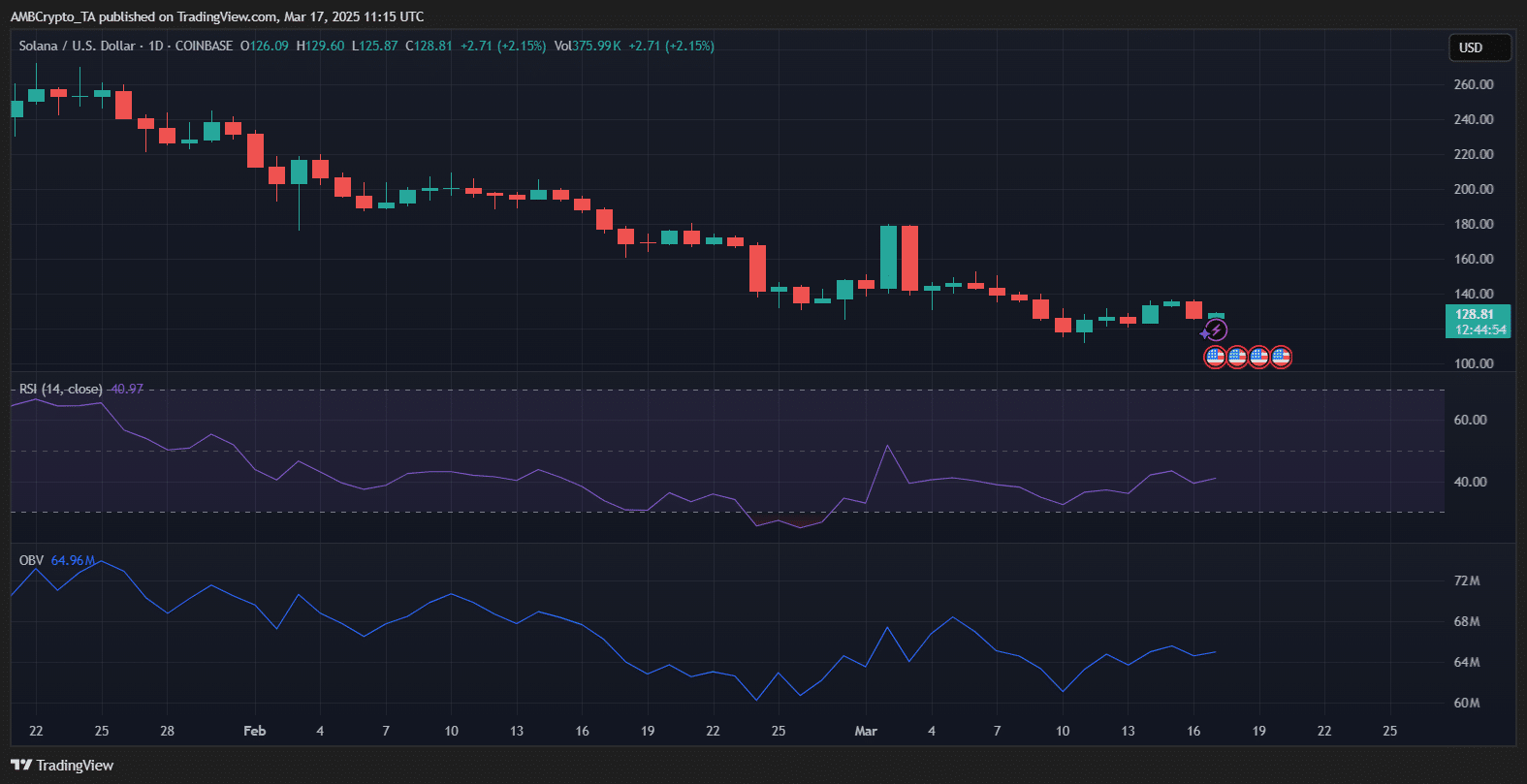

Solana price outlook

SOL was trading at $128.81 at press time, after a modest 2.15% daily gain. The RSI hovered near 41, indicating weak bullish momentum and remaining well below the neutral 50 mark.

The OBV was at 64.96 million, shows no meaningful spike in buying pressure — signaling a lack of conviction behind the rebound.

Source: TradingView

Price action also reflects a clear lower-high, lower-low structure stretching since late February, reinforcing the bearish trend. Unless bulls reclaim the $140 level convincingly, SOL risks further downside.

With volume thinning and sentiment cooling, the next key support lies near $120 — any break below that could invite a sharper correction.