- Dogecoin has struggled on its price charts, dropping by 1.32% in 24 hours.

- Despite price struggles, Futures markets are more active than ever, signaling growing speculation.

While Dogecoin [DOGE] has struggled on its price charts, the memecoin’s Futures markets are more active than ever.

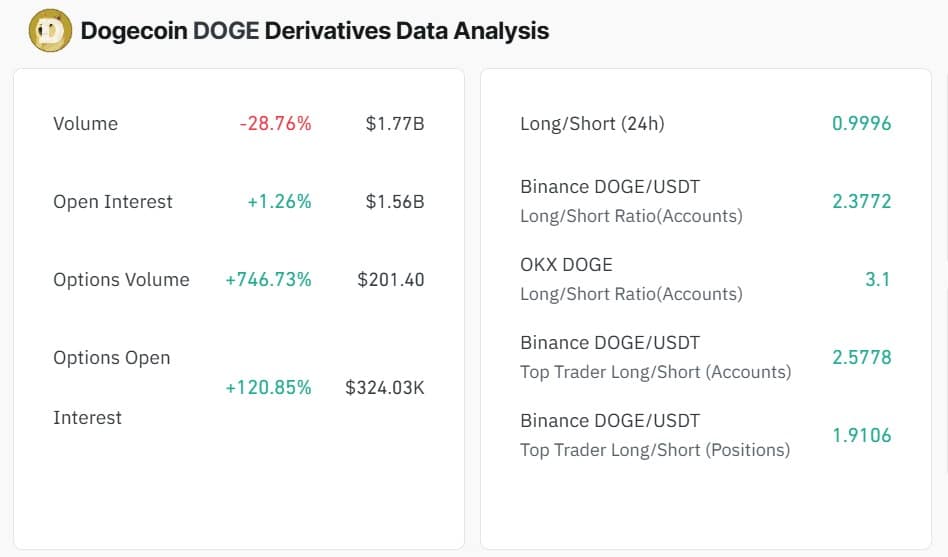

According to data from Coinglass, Dogecoin Options Volume has surged by 772.4%, hitting $201.

Over the same period, Options Open Interest rose 12.27% to $324.9K. Moreover, Dogecoin’s total Open Interest climbed 1.26% in 24 hours to $1.55 billion.

Source: CoinGlass

On top of that, Aggregated Open Interest surged from $698 million to $713 million. Naturally, this spike reflected growing leverage and rising trader confidence in a potential price rebound.

Of course, prices hadn’t reacted yet. However, increased speculation often hinted at smart money positioning ahead of major directional moves.

Is Dogecoin set for a breakout?

Looking at the Futures market performance, it suggests that investors are anticipating a major move. The question is: will DOGE see a downward move or an upswing?

According to AMBCrypto’s analysis, these investors are mostly optimistic and expect a move to the upside.

For starters, Dogecoin is seeing an increase in buying pressure.

Looking at order imbalance, the positive index has made a bullish crossover on the daily charts. This shows that there are more buy orders executed in the market than sell orders.

Thus, buyers are in control of the market, reflecting growing demand.

Source: MobChart

Additionally, Dogecoin’s traders are mostly getting into the market and taking long positions. As such, the Long/Short Ratio stood at 68.9% longs vs. 31% shorts, per Coinalyze.

When longs dominate, it suggests that investors are bullish and expect prices to appreciate in the near term.

Source: Coinalyze

With buyers dominating the market while futures are spiking, Doge is seeing an upward momentum start to build up.

We can see this build-up as the memecoin’s Stoch RSI has made a bullish crossover over the past day. A bullish crossover here signals a potential move to the upside as momentum strengthens.

Source: TradingView

The prevailing market conditions position Dogecoin for gains on its price charts.

If the shift in momentum holds, Doge will reclaim $0.164. Subsequently, if the attempt to the upside fails and becomes a breakdown, the memecoin could drop to $0.50.