- SHIB has remained below its short-moving average.

- RSI is indicating pending seller exhaustion.

Shiba Inu [SHIB] has been navigating a period of heightened volatility, with its price retracing from recent highs and on-chain metrics reflecting mixed signals.

Despite the short-term bearish sentiment, whale accumulation and a potential bottoming phase have emerged as pivotal themes. With the token trading near critical support levels, market participants are watching closely for signs of a reversal.

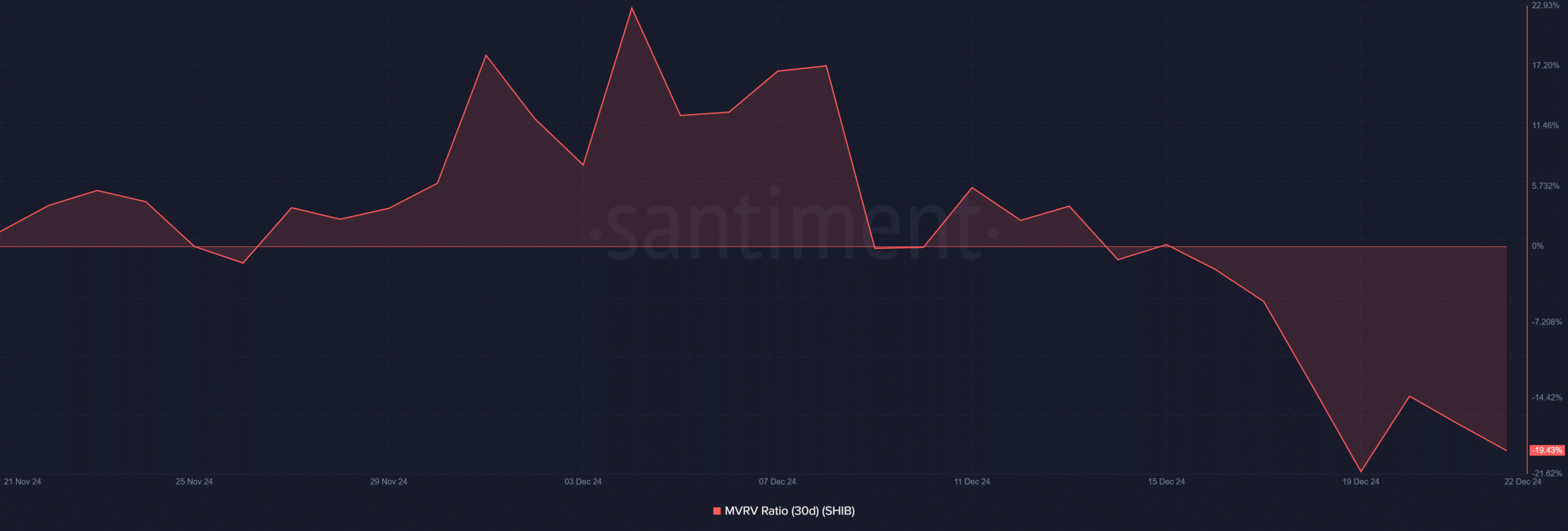

MVRV Ratio signals reduced selling pressure

According to the analysis of the Santiment chart, the 30-day Market Value to Realized Value Ratio (MVRV) for Shiba Inu has plunged to -19.43%.

The current level indicates that most recent holders are operating at a significant loss. Historically, such deeply negative MVRV ratios have marked periods of accumulation, as holders are less likely to sell at a loss, reducing overall sell pressure.

Source: Santiment

This trend suggests that SHIB is approaching a potential local bottom. If the MVRV begins to recover, it could signal an accumulation phase, laying the groundwork for a future price rebound.

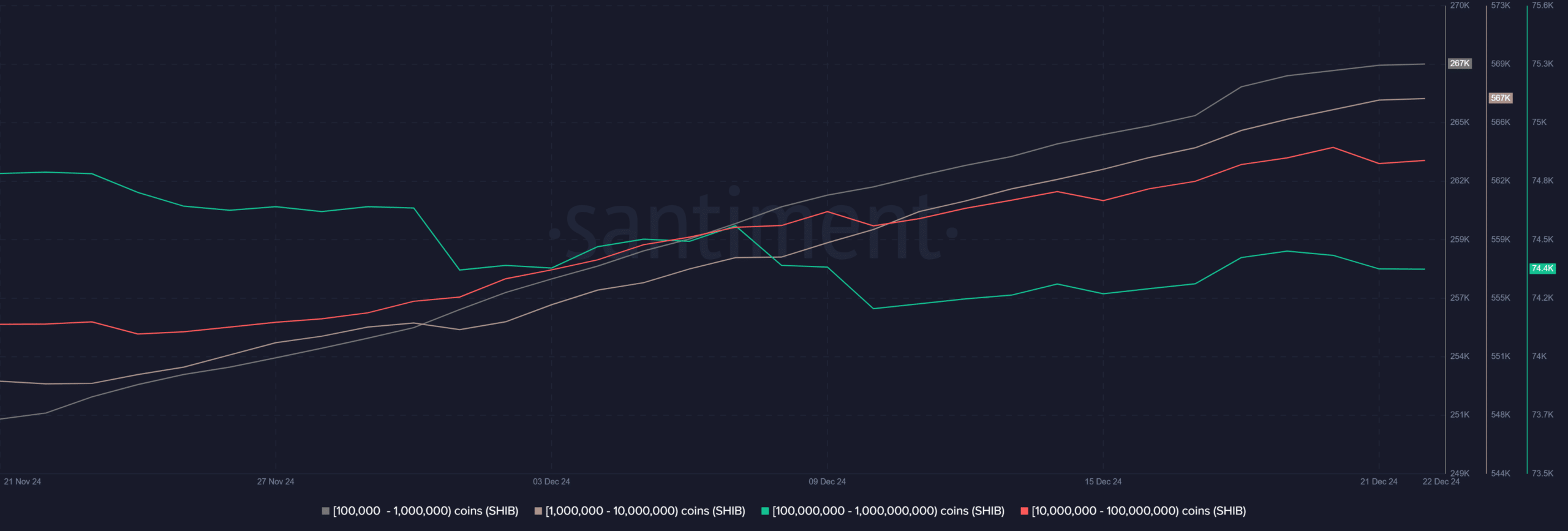

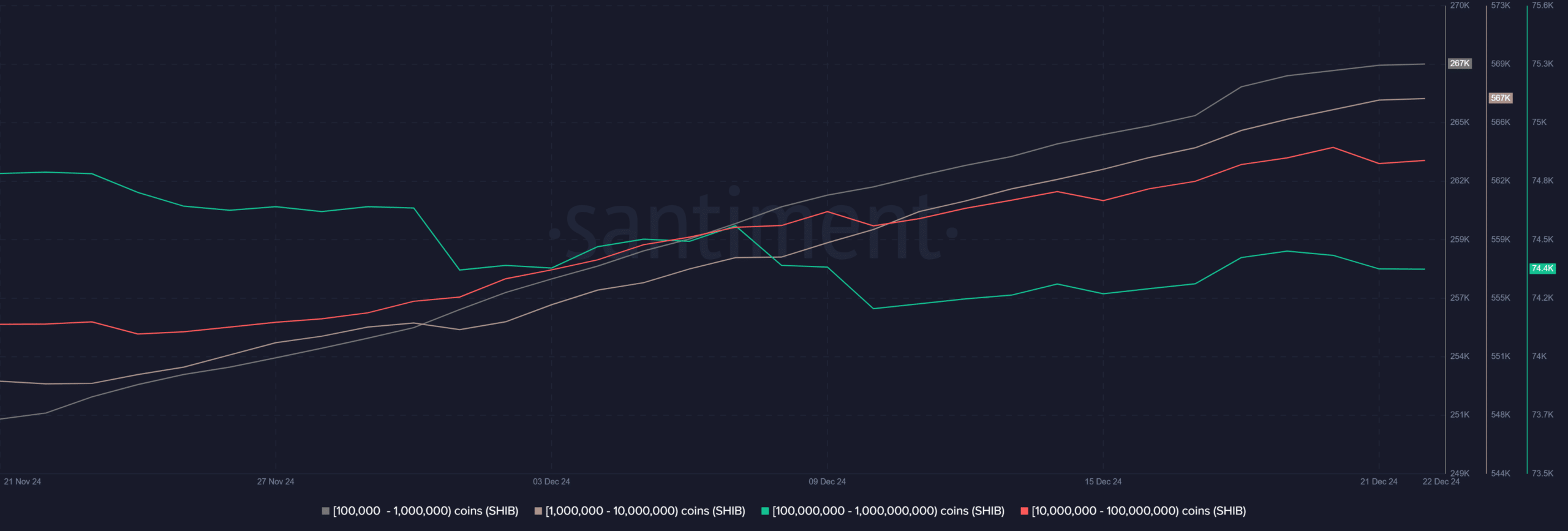

Whales dominate as large wallets accumulate

Analysis of the holder distribution chart reveals a steady increase in large wallet balances, particularly among wallets holding 10 billion to 100 billion SHIB.

This category of investors, often called whales, has been actively accumulating during SHIB’s price downturn.

Source: Santiment

In contrast, smaller wallets holding 100 million to 1 billion SHIB have remained stable, indicating minimal activity from retail investors. This divergence underscores the confidence of large holders, who are positioning themselves for long-term gains.

Shiba Inu price holds critical support levels

AMBCrypto’s price chart analysis shows Shiba Inu trading at $0.00002149. This level is below its 50-day moving average (MA) of $0.00002542 but above the 200-day MA of $0.00001873.

Also, this positioning reflects short-term bearish momentum but a relatively stable longer-term trend.

Source: TradingView

The Relative Strength Index (RSI) is currently at 36.02, nearing oversold territory. This indicates that the selling pressure may be nearing exhaustion, potentially attracting buyers at discounted levels.

SHIB has established strong support at $0.00002000, aligned with its 200-day MA, while the immediate resistance lies at $0.00002542. A breakout above the resistance could reignite bullish momentum.

Outlook for SHIB

The technical and on-chain metrics convergence suggests that Shiba Inu is in an accumulation phase. The reduced selling pressure highlighted by the MVRV ratio indicates limited downside risk, while whale accumulation reflects confidence in SHIB’s long-term potential.

Support at $0.00002000 provides a stable foundation, and a breakout above $0.00002542 could signal the start of a recovery.

Is your portfolio green? Check out the Shiba Inu Profit Calculator

While the short-term outlook remains uncertain, these indicators point to a token consolidating and preparing for its next price phase.

Traders and investors should closely monitor changes in whale activity and technical levels to anticipate SHIB’s direction.