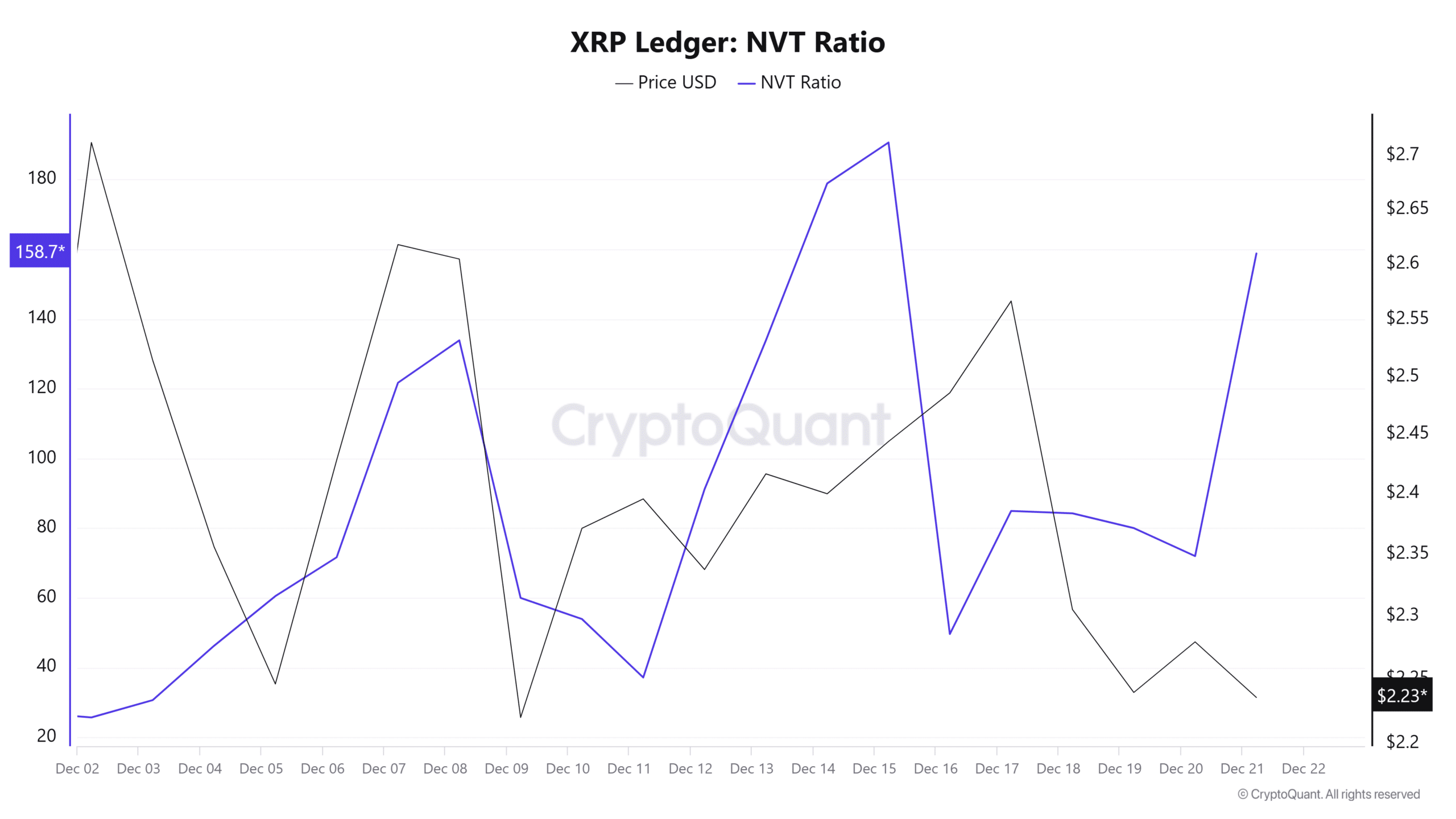

XRP’s NVT ratio signals overvaluation

The Network Value to Transaction (NVT) ratio for XRP highlights a potential risk of overvaluation despite its recent rally. The metric compares the asset’s market capitalization to its transaction volume, offering insights into whether its price is sustainable.

Source: Cryptoquant

XRP’s NVT ratio has fluctuated sharply in December, indicating instability. The current spike in the ratio reflects a disconnect between XRP’s price and the underlying transaction activity on the network.

While the price sits at $2.23, the high NVT ratio signals that market cap growth is outpacing network utility, a bearish sign. Unless transaction volumes catch up, XRP may face heightened correction risks, challenging the bullish momentum observed in recent weeks.

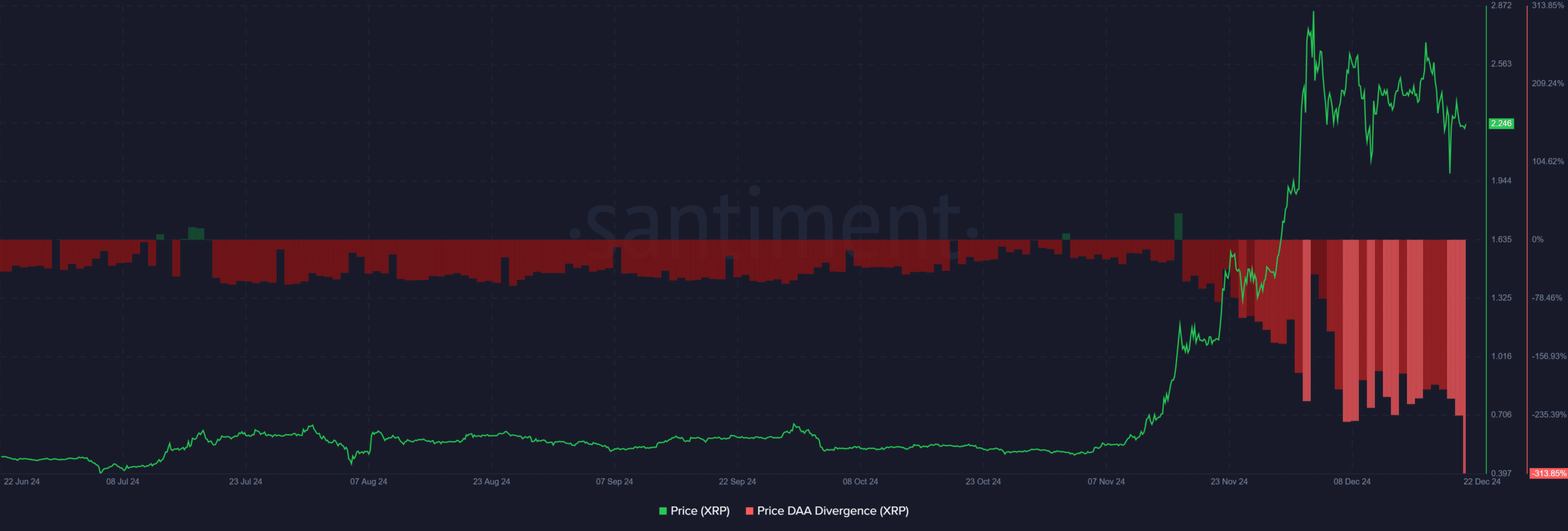

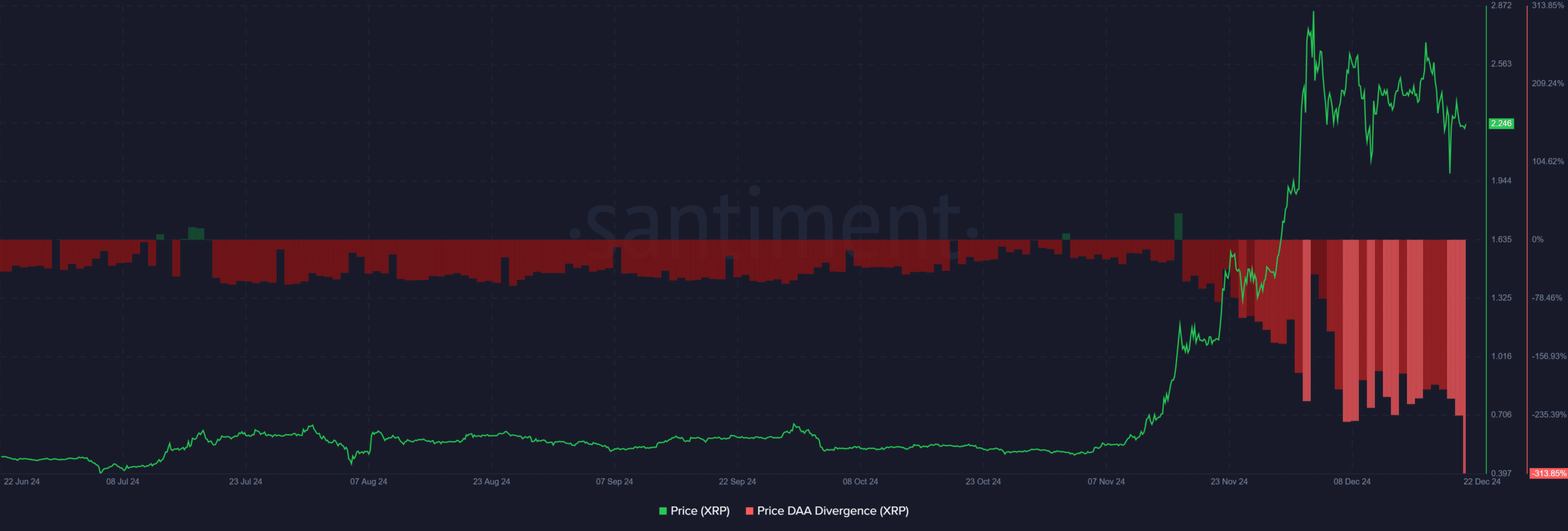

XRP: Reduced network activity?

The Price-Daily Active Addresses (DAA) divergence reveals a concerning trend for XRP’s rally. This metric assesses whether price movements align with user engagement on the network.

While XRP’s price surged to $2.23, the DAA divergence has plummeted by 326.13%. This stark decline indicates a drop in the number of active XRP wallets interacting with the token.

Source: Santiment

Such a sharp divergence suggests that the recent price spike is not being supported by robust on-chain activity.

If user engagement remains low, it could undermine XRP’s bullish momentum and increase the risk of a significant price correction, putting its current rally under pressure.

Read XRP’s Price Prediction 2024–2025