With just over 20 days left until 2025, Bitcoin has made a strong rally as the year-end approaches, surpassing the $100,000 mark for the first time and setting a new all-time high. Driven by the price surge, Bitcoin’s network hashrate recently peaked at 949.98 EH/s and is now stable in the high range of 750–850 EH/s.

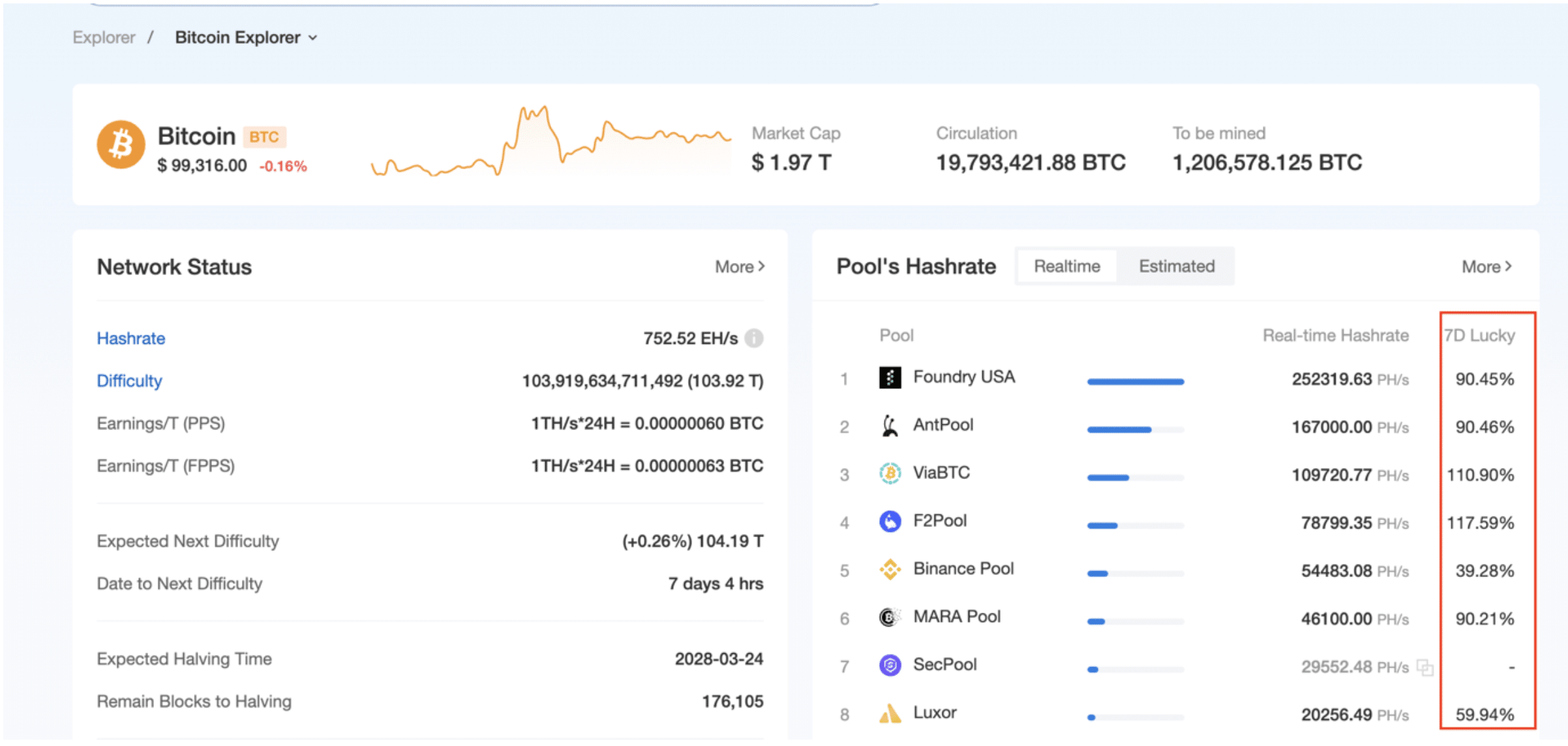

The rapid growth in network hashrate can largely be attributed to increased capacity from major mining pools. According to data from CoinEx Explorer, the top three Bitcoin mining pools — Foundry, AntPool, and ViaBTC — account for 67.07% of the total hashrate. Expanding this to the top ten pools, the share rises to 87.73%. Clearly, as more participants join the mining process and competition increases, mining pools have become an indispensable part of the mining ecosystem for most miners.

But how can new miners select a reliable mining pool as their go-to “partner”? Read on to gain valuable insights and advice.

What factors lead to differences in miner earnings across pools?

When choosing a mining pool, mining earnings are often the most important factor for miners. However, many miners have noticed in practice that earnings can vary significantly between mining pools. What exactly causes these differences?

In general, four key factors impact mining pool earnings: payment methods, technical performance, reward distribution, and mining fees.

How does the payment method affect earnings?

The payment method defines how mining pools calculate and distribute earnings to miners. Common methods in Bitcoin mining include PPS, PPS+, FPPS, PPLNS, and SOLO. These methods significantly influence both the stability and risk of miners’ earnings.

- PPS (Pay Per Share): Pays miners a fixed Coinbase reward based on the proportion of hashrate they contribute.

- PPS+ (Pay Per Share Plus): An enhanced payment method developed by ViaBTC based on traditional PPS. In this method, miners receive Coinbase rewards calculated via PPS and transaction fee earnings calculated via PPLNS.

- FPPS (Full Pay Per Share): An extension of PPS that includes transaction fee earnings. Both Coinbase rewards and transaction fees are settled using the PPS method.

- PPLNS (Pay Per Last N Shares): Rewards miners based on the last N shares of work submitted. Earnings depend on the actual number of blocks mined by the pool on a given day.

- SOLO: Operates like independent mining. Miners keep the full block reward (after deducting the mining fees) if they successfully mine a block.

Different methods suit miners with varying needs. For example, PPS+ and FPPS allocate Coinbase rewards based on miners’ hashrate contribution, providing lower risk and more stable returns. Conversely, PPLNS considers both hashrate and the pool’s actual block production, offering higher potential rewards but at greater risk. These variations are a major reason for the differences in miners’ earnings across mining pools.

How do a mining pool’s technical capabilities affect earnings?

As mentioned above, in the PPLNS method, miners’ earnings depend heavily on the pool’s actual block production. The industry often uses “luck” to measure block production performance, which is the ratio of the pool’s actual blocks produced to the expected theoretical value. When luck exceeds 100%, miners using PPLNS earn more than the theoretical value; when luck falls below 100%, miners earn less.

Sourced from CloverPool

Luck is closely related to a pool’s technical capabilities. In the short term, fluctuations around 100% are normal, but if a pool consistently stays below 100%, it may indicate issues with its node deployment or underlying technology reliability.

How does reward distribution influence earnings?

In the early days, Dogecoin (DOGE) was merged with Litecoin (LTC) for mining, allowing miners to earn DOGE rewards while mining LTC. In hindsight, this was undoubtedly a win-win choice. Merged mining refers to combining one or more low-value coins with a high-value coin under the same algorithm, enabling miners to use the same hashrate to mine both simultaneously, thereby increasing overall earnings.

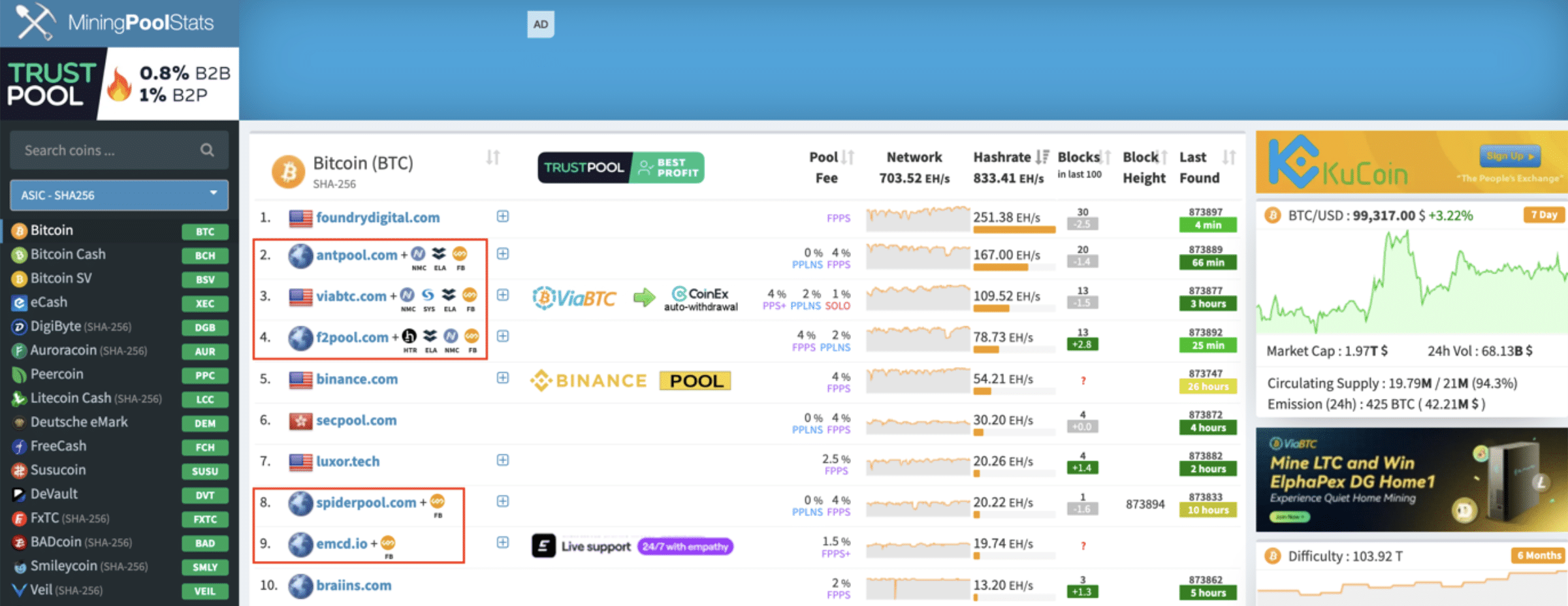

The top 10 BTC mining pools supporting FB merged mining, according to MiningPoolStats.

Merged mining is no longer exclusive to Scrypt algorithm-based projects. Today, certain mining pools like ViaBTC, F2 Pool, and Binance Pool offer merged mining for BTC and FB. This allows miners to earn FB rewards while mining BTC. At current FB prices, FB accounts for approximately 0.6% of total earnings in BTC+FB merged mining. Over the long term, mining pools that offer additional FB rewards will provide slightly higher earnings than those that don’t.

How do mining pool fees affect earnings?

Mining pools, as platforms that provide mining services, take a percentage of miners’ earnings as fees to support operations. In theory, lower fees mean higher actual profits for miners. However, miners should remain cautious with low or even zero-fee pools, as they may compromise on service quality, mining stability, or hashrate scale, or even hide additional charges. Therefore, judging a mining pool solely by fee rates is not a comprehensive approach.

The chart above highlights past zero-fee mining promotions offered by ViaBTC

When a new coin is first launched, some mining pools may offer short-term zero-fee mining promotions to attract more miners. These promotions are usually genuine and come with a low risk of hidden fees. Miners should pay attention to announcements on mining pools’ websites and social media to seize such opportunities, reducing mining costs and boosting returns.

How can miners choose the best BTC mining pool? Which is the best BTC mining pool?

At this point, it should be clear that asking “Which is the best BTC mining pool?” is inherently a flawed question. Even the most reliable pools may occasionally experience low luck values, leading to reduced earnings for PPLNS miners and dissatisfaction among newcomers during such periods.

In reality, as long as you follow the selection criteria outlined below, it’s difficult to end up choosing a truly poor mining pool.

Identify your mining requirements

Which payment method are you planning to choose? How large is your hashrate? Once you have clear answers to these two questions, you can better define your criteria for selecting a mining pool. If you prefer the PPLNS payment method, it is recommended to review the historical block production data of various pools and eliminate those with consistently low luck values (below 100%). Additionally, some pools offer extra fee discounts for large-scale miners. If your hashrate is substantial, you might leverage this as a bargaining chip to secure better mining policies.

Pay attention to the mining pool’s reputation

Focusing on a pool’s reputation and credibility is an essential step when selecting one. The long-term stability, block production capability, and quality of support and services provided by a pool contribute to its reputation within the industry. Reliable pools offer miners a more secure mining environment. You can check pool data on block explorers like mempool.space or CoinEx Explorer, or visit mining communities such as Bitcoin Forum and Reddit, as well as third-party industry reports, to identify pools with a strong reputation and credibility.

Compare mining fees and earnings

Consider both pool fees and actual earnings, rather than just focusing on fee rates. Experienced miners understand that even if fees are low, poor block production or insufficient rewards can result in suboptimal actual earnings.

Miners are advised to perform earnings simulations and comparisons using profitability calculators or third-party data platforms. By setting parameters like hashrate, difficulty, and electricity costs, you can preliminarily identify pools with potential advantages based on theoretical estimates.

The most reliable method is to allocate a portion of your hashrate to the target pool for testing. Run the pool for a period to observe actual earnings, payment timeliness, hashrate stability, and whether there are network fluctuations or settlement delays.

Look for available supporting services

A great mining pool not only has technical expertise but also offers miners comprehensive support in terms of user experience. This may include robust wallet services for easier crypto asset management, 24/7 customer support to address mining issues, and diverse tools like profitability calculators, transaction accelerators, and hashrate alerts.

Choosing such pools allows miners to avoid the hassle of technical configurations and tool integrations, saving time and energy. This way, you can focus more on optimizing your mining strategies.

Finally, we hope everyone finds a mining pool that suits them and enjoys abundant mining rewards!

Disclaimer: This is a paid post and should not be treated as news/advice.