- SpaceX is going to leverage Hedera’s blockchain for efficient space data management

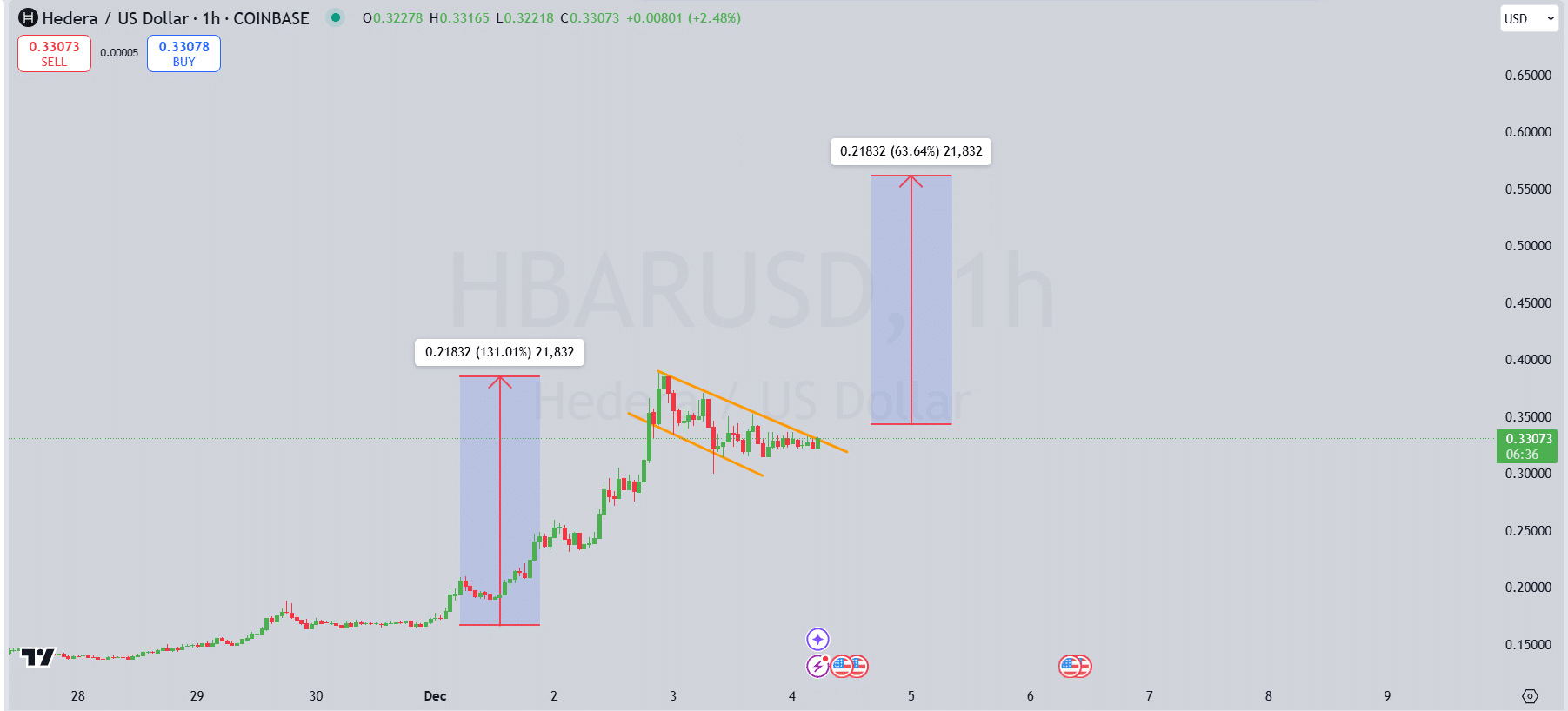

- A flag pattern Signals on the altcoin’s chart signalled more upside for HBAR

Despite the rest of the broader market hiking on the back of Bitcoin’s performance, HBAR’s price went the opposite way. In fact, HBAR dropped by 8.29% on the charts to $0.3163. However, all may not be lost. And, this cooldown could indicate a period of price accumulation before another potential move north.

Despite the recent fall in its value, positive market sentiment has remained strong though. This has been driven by developments like Hedera’s collaboration with Dropp, with the same making a big difference in the future of instant payments.

HBAR’s flag pattern suggests more upside ahead

A significant upward momentum followed by a consolidation pattern can be seen on Hedera’s chart against the U.S Dollar.

In fact, HBAR surged by 131.01% during its initial rally, climbing from $0.15 to $0.35. Following the rally, however, the price entered a flag-like consolidation phase, one defined by descending parallel trend lines – Often considered a bullish continuation pattern.

Source: Tradingview

AMBCrypto’s analysis further projected another potential upward breakout of 63.64%, mirroring the prior rally’s magnitude, with a target near $0.6 based on the pattern’s structure.

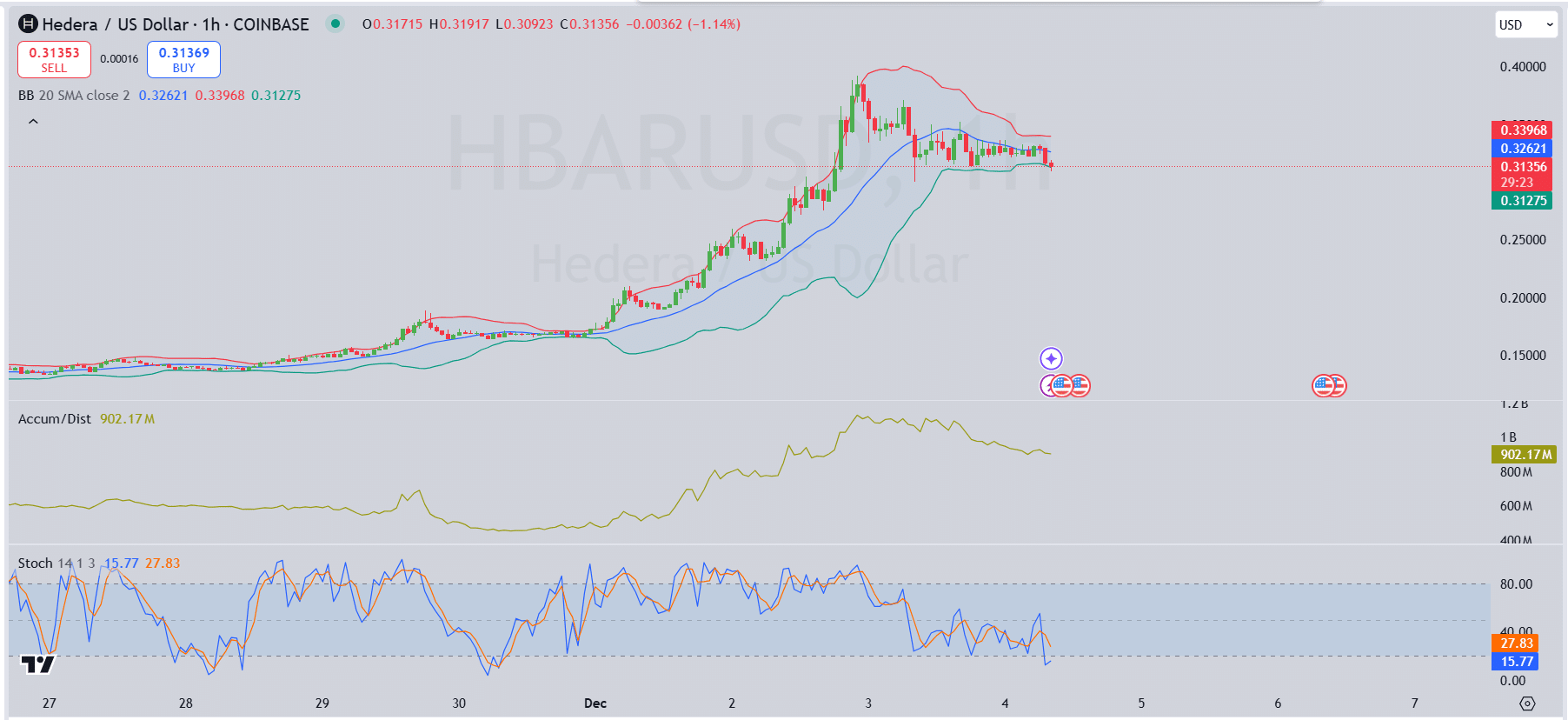

Additionally, the Bollinger Bands revealed that after touching the upper band, the price was consolidating around the middle band, indicating support. On the contrary, a break below it could signal further downside.

The Acc/Dist line, which initially reflected strong buying pressure during the recent uptrend, flattened too – A sign of waning accumulation and a possible shift towards selling pressure.

Source: Tradingview

Finally, the Stochastic Oscillator was in the oversold region, with the same hinting at sustained bearish momentum. However, a bullish crossover in this zone could signal a potential rebound.

Hedera overtakes Solana in 24-hour transaction volume

Hedera is in the news today for other reasons too, after it surpassed Solana in 24-hour transaction volume for the first time. According to the report, Hedera recorded a 24-hour volume of 7.26 billion transactions, edging past Solana’s 7.04 billion.

This achievement is a sign of growing activity and interest in the Hedera network, highlighting greater adoption or network utilization compared to its competitor – Solana.

Additionally, key statistics revealed that Hedera’s market cap was $12.42 billion at press time, with a fully diluted market cap of $16.25 billion.

In comparison, Solana held a significantly higher market cap of $107.48 billion. And yet, despite Solana’s larger market presence, Hedera’s transaction surge alluded to its increasing traction, possibly driven by recent network improvements, partnerships, and ecosystem growth.

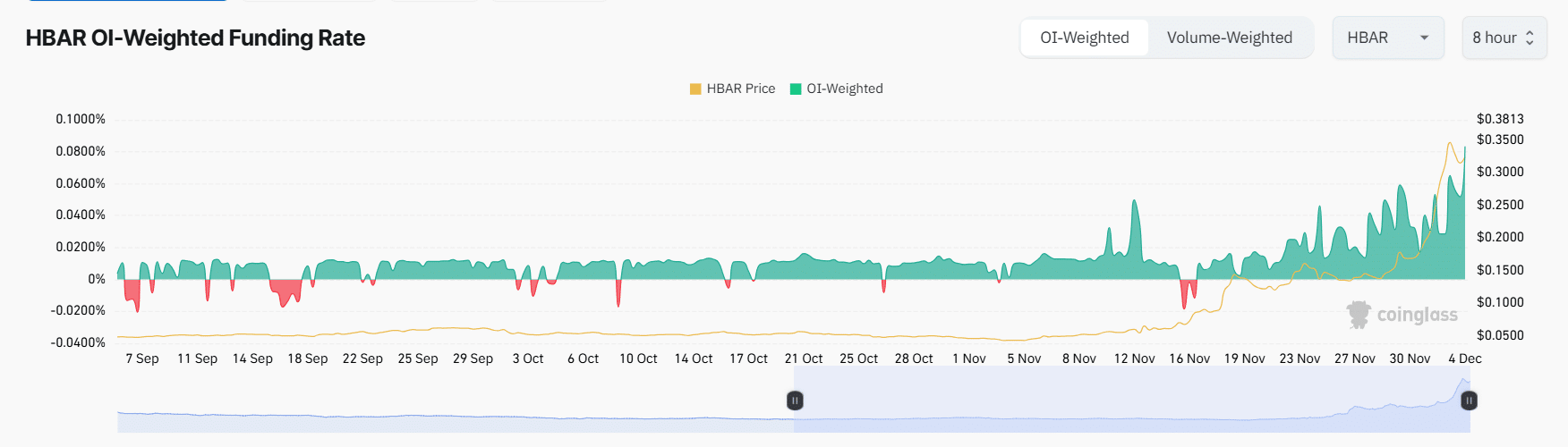

Funding rates climb again

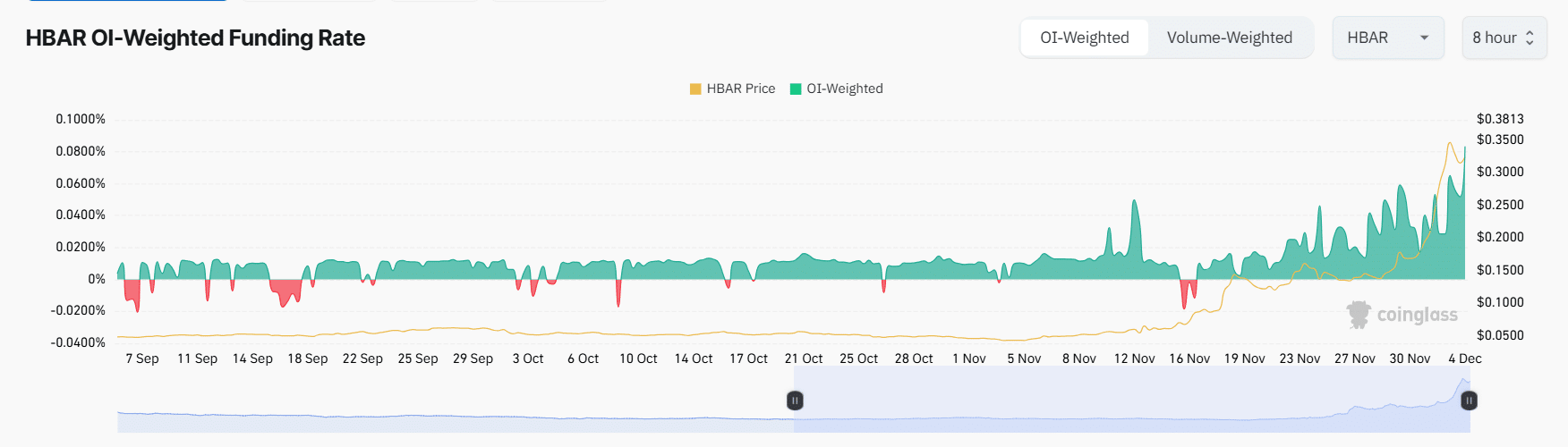

There has also been a consistent hike in HBAR’s OI-weighted funding rate, with the same peaking at around 0.08% as the price surged from $0.15 to over $0.30 in early December.

HBAR Weighted funding rate | Source: Coinglass

Its sustained positive funding rate highlighted traders’ bullish sentiment, with long positions dominating the market. The hike in Open Interest seemed to be in line with this trend too, reinforcing strong market confidence.

A partnership with SpaceX for blockchain in space

Hedera’s latest collaboration with SpaceX will integrate its blockchain technology into the latter’s space missions for advanced data tracking. This will mark a significant milestone in both the blockchain and aerospace industries.

Such a move will not only boost HBAR’s credibility, but also position it as a key player in the rapidly expanding space tech sector.