- Solana sees 117% YTD growth, sparking questions about its December outlook

- A bull flag pattern suggests $300 potential, but risks and market factors remain

As we enter December 2024, Solana [SOL] has been making waves in the market with a remarkable 117% year-to-date price increase and a recent all-time high.

With such impressive performance, investors and analysts are now turning their attention to what’s next for the blockchain as the year draws to a close. Will Solana maintain its upward momentum, or are there challenges ahead?

Solana’s 2024 performance

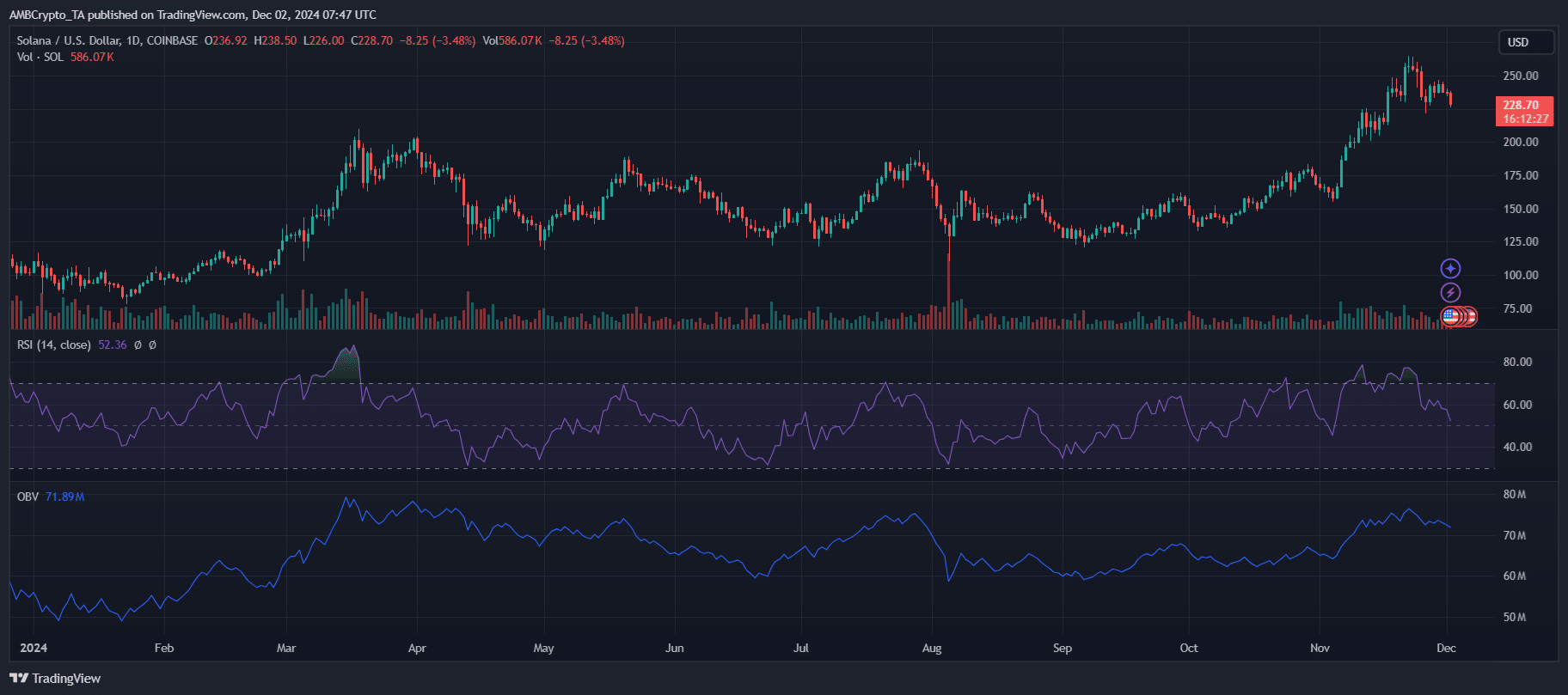

Solana’s explosive 117% YTD growth and its recent peak underscore its resilience amidst volatile market conditions. The price actions reveal consistent higher highs since Q1, with the RSI now signaling moderation near 52, hinting at reduced bullish momentum.

Meanwhile, Solana’s social dominance at 6.09% highlights its prominence in crypto discourse, often preceding price swings.

Source: TradingView

Historically, spikes in social engagement align with market optimism, yet sustained dominance without corresponding price gains could indicate speculative fatigue. The relationship between investor sentiment and Solana’s on-chain growth will be pivotal as 2024 concludes.

Solana December outlook

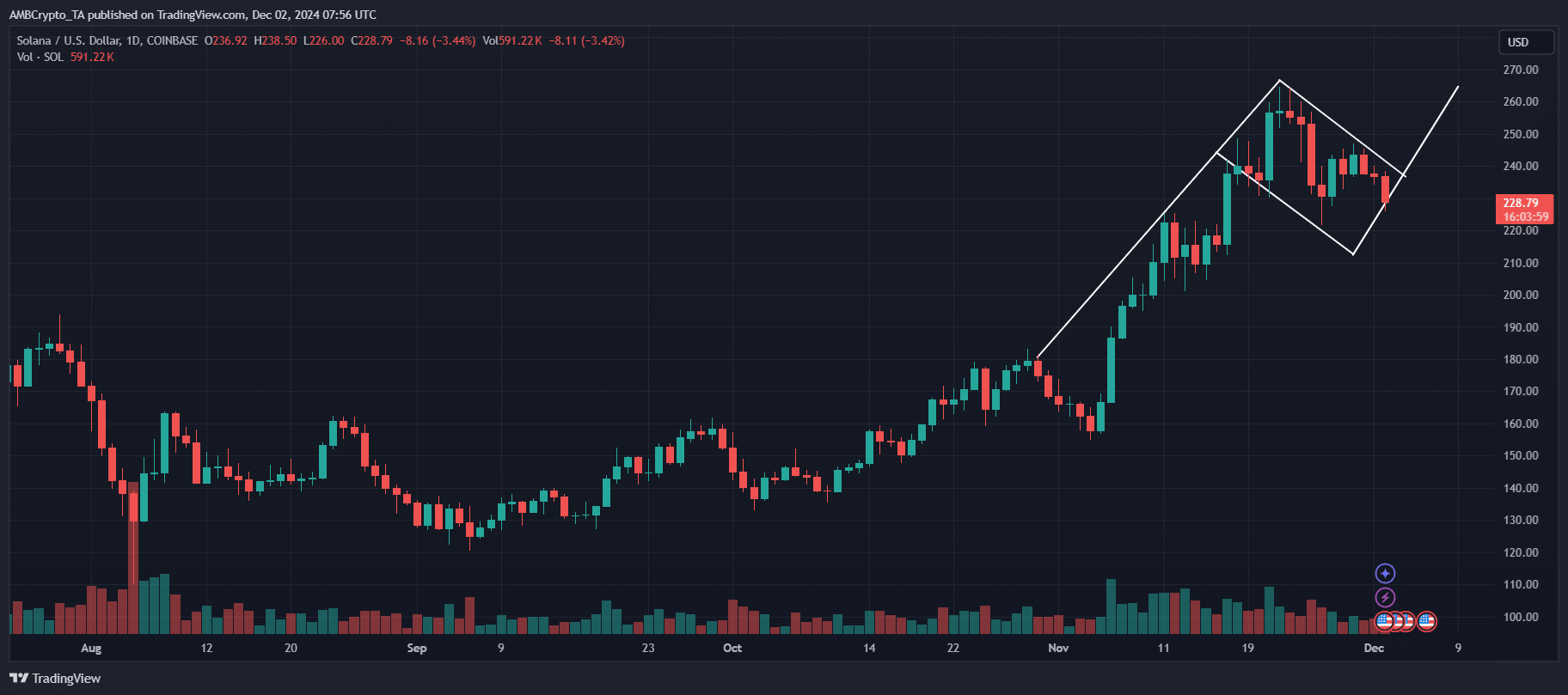

On the daily chart, Solana exhibits a classic bull flag—a continuation pattern marked by a steep rally (“flagpole”) followed by consolidation within parallel trendlines (“flag”).

This setup often precedes another upward breakout, suggesting Solana could target $300 in December if bullish momentum holds. However, this prediction hinges on broader market dynamics.

Source: TradingView

Bitcoin’s [BTC] ability to sustain above $94,000 will be crucial for maintaining market-wide bullish sentiment. Failure to do so could dampen optimism, pushing Solana toward a potential support at $214.99.

As market sentiment remains cautiously optimistic, Solana’s price trajectory will depend on the interplay between its technical setup and macro factors driving the crypto market.

Analysts express mixed sentiments

Brian Quinlivan, lead Analyst at Santiment, highlighted a notable decline in sentiment around Solana, suggesting it could shape the cryptocurrency’s performance in December.

Interestingly, Quinlivan viewed this trader skepticism as a potential catalyst for a rebound, provided Bitcoin sustains a price of at least $96,000.

Raoul Pal echoed this optimism, predicting Solana is poised for a new all-time high if market conditions remain favorable. Supporting this view, crypto analyst Rekt Capital recently noted a “historic Weekly Close” above the critical $250 resistance level.

He emphasized that if $250 is confirmed as a new support, Solana could break out into uncharted territory. “A historic retest is in progress,” Rekt Capital wrote, further underscoring the potential for a rally in the coming weeks.

Risks that could derail Solana’s momentum

Despite bullish signals, Solana faces significant risks. A failure to confirm $250 as support could invalidate its breakout potential, exposing the price to sharp corrections.

Broader market challenges, including Bitcoin dropping below $94,000, may erode confidence across altcoins, SOL included.

Read Solana’s [SOL] Price Prediction 2024–2025

Moreover, declining sentiment, as highlighted by analysts, could dampen buying pressure if skepticism turns into broader sell-offs. Regulatory uncertainties and network vulnerabilities, such as outages or scalability issues, remain persistent concerns.

These factors collectively pose challenges to Solana sustaining its upward trajectory through December.