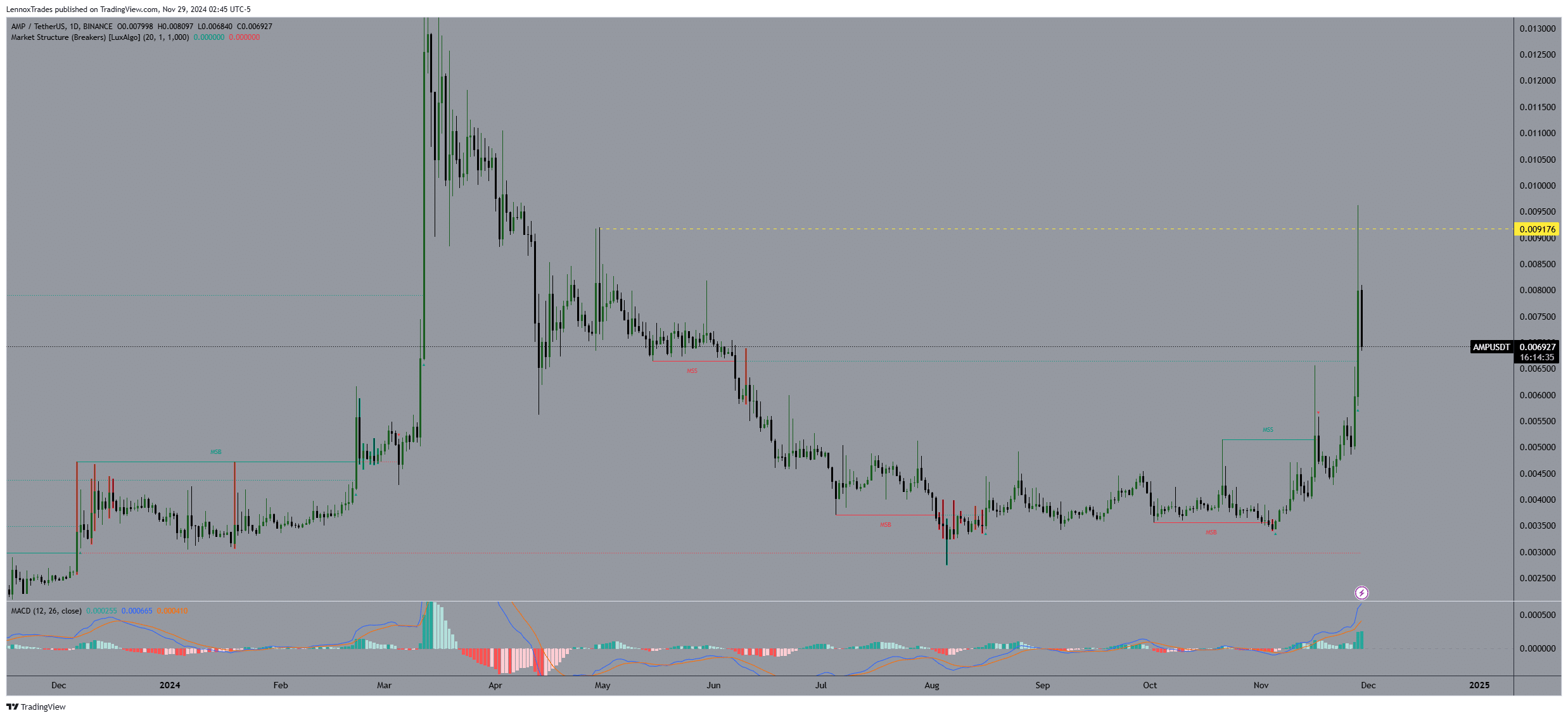

- AMP to continue its ascent if it cements its status above the $0.009176 level.

- Despite AMP’s active addresses hitting new highs since May, 72% of the holders still in loss.

Amp crypto [AMP] saw a price surge of more than 30% in the last 24 hours as of press time, with daily trading volume replicating similar success with a 5X surge as per CoinMarketCap.

The price of AMP crossed a crucial resistance level at $0.009176, signaling a strong buying interest and potential shift toward bullish dominance in the market.

This breakthrough coincided with a clear LuxAlgo Market Structure Breaks signal that turned bullish, indicating that AMP’s market structure on the daily timeframe has transitioned from bearish to bullish.

This was a key moment for AMP as it suggested a sustained upward movement could be on the horizon if the price maintains above this level.

Source: Trading View

The MACD further supported this optimistic outlook. The MACD line decisively crossed above the signal line, and the histogram reflected growing bullish momentum. This was evident as the bars extend further above the zero line.

Moreover, the recent spike in price pushed AMP’s valuation closer to the $1 Billion market cap making it the next target if it continues to hold above the $0.009176 level.

The next logical target according to the current momentum and market sentiment could well be higher price zones, potentially leading to a retest of previous highs or even setting new records.

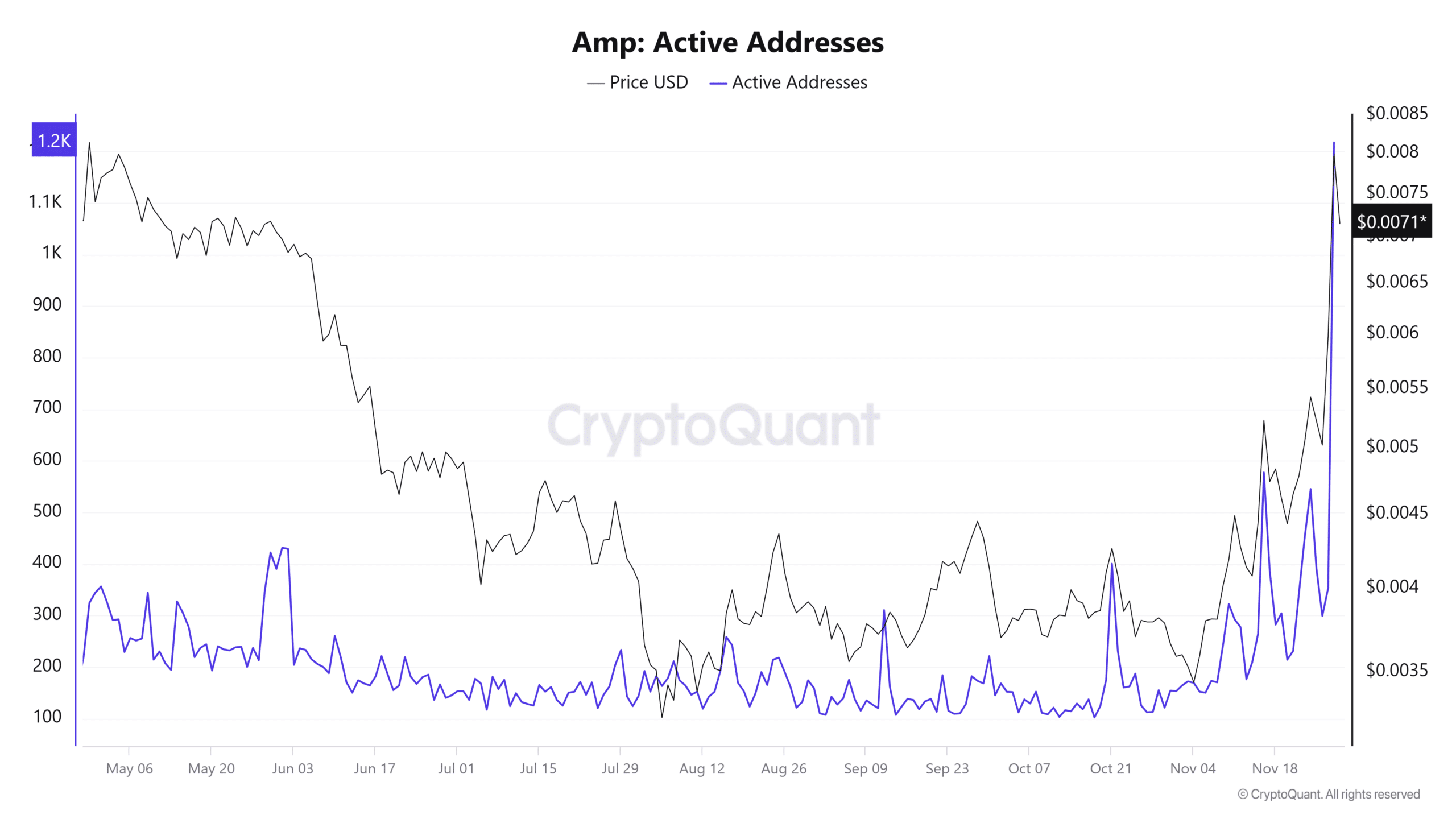

Active addresses reach new highs

Tracking AMP’s active addresses and price revealed a noteworthy surge in user engagement, with active addresses reaching levels not seen since early May.

This increase in active addresses correlated strongly with a sharp rise in AMP’s price, suggesting a heightened market interest and possibly speculative activity.

Source: CryptoQuant

The recent spike in active addresses, reaching a peak alongside the price, indicated a robust engagement from traders and investors, potentially driven by new developments or increasing utility within its network.

This trend was a positive signal for AMP’s ecosystem, reflecting growing user adoption and interest.

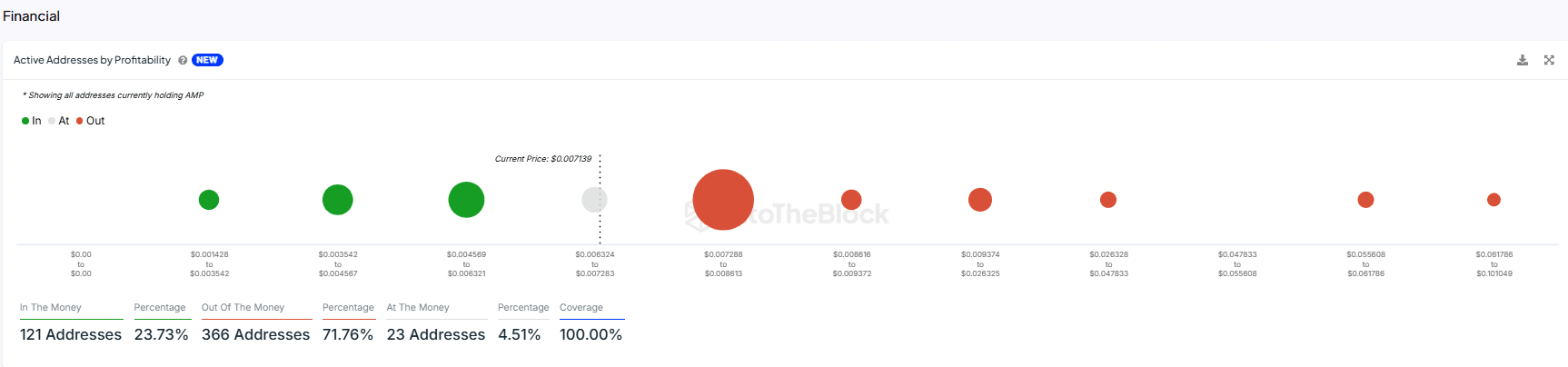

Active AMP holders profitability

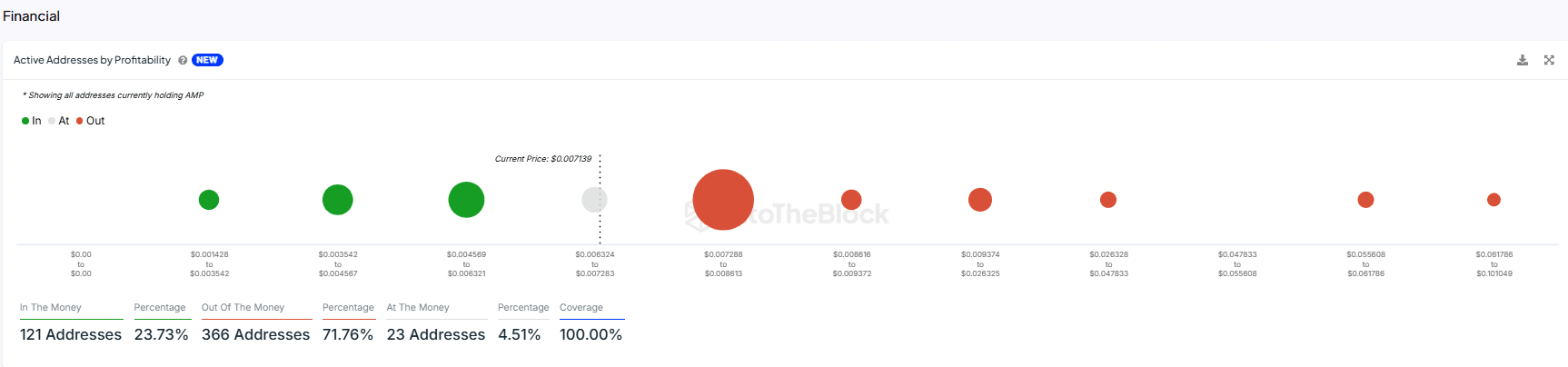

Analysis of the number of active addresses showed 71.76% or 366 addresses were “Out of the Money” (experiencing losses), reflecting its volatile nature and how AMP has been been in the drawdown for long but its holders were resilient.

The profitability of AMP holders broken down in positions relative to their cost basis further noted only 23.73% of addresses were “In the Money” (profiting from their holdings), encompassing 121 addresses.

Source: IntoTheBlock

Additionally, a small fraction, 4.51% which amounted to 23 addresses, were “At the Money,” indicating their purchase price aligned closely with the current AMP price of $0.007139.

This distribution suggested that despite the recent surge in active addresses since early May, most holders were facing losses, which might affect sentiment and future trading behavior.