- Whales acquired 130M ADA at $0.30, reinforcing support and fueling a rally toward $1.00.

- On-chain data showed 70% of ADA holders in profit as whale activity boosts confidence.

Whales recently acquired over 130 million Cardano [ADA] during a price correction. This accumulation occurred as the price dropped to approximately $0.30, a level that has now strengthened as critical support.

Following the buying activity, ADA rebounded and is trading near $0.99, suggesting whale accumulation contributed to price recovery and stability.

Whale accumulation and key price levels

Crypto analyst Ali reported that whales purchased over 130 million ADA during the recent dip, signaling confidence in the asset’s long-term potential.

This level of accumulation during downturns often serves as a bullish indicator for retail investors, as large-scale buyers tend to act with a long-term perspective.

Source: X

The $0.30 support level, where accumulation occurred, now appears reinforced, with ADA’s price stabilizing and recovering above $0.35.

Resistance near the $0.36–$0.38 range could determine the next critical price movement, while the psychological barrier at $1.00 is the next milestone for the token.

Current market performance and trends

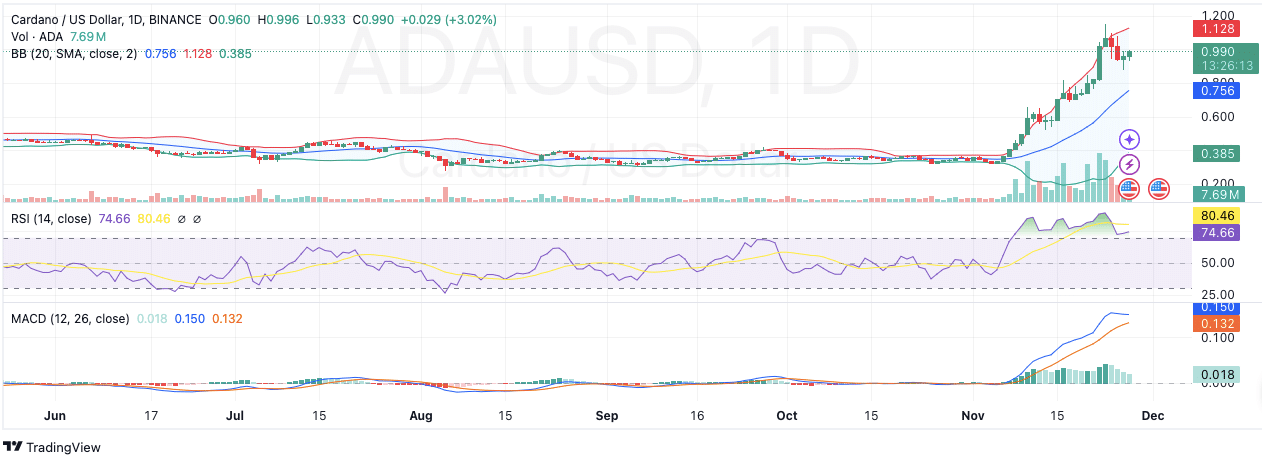

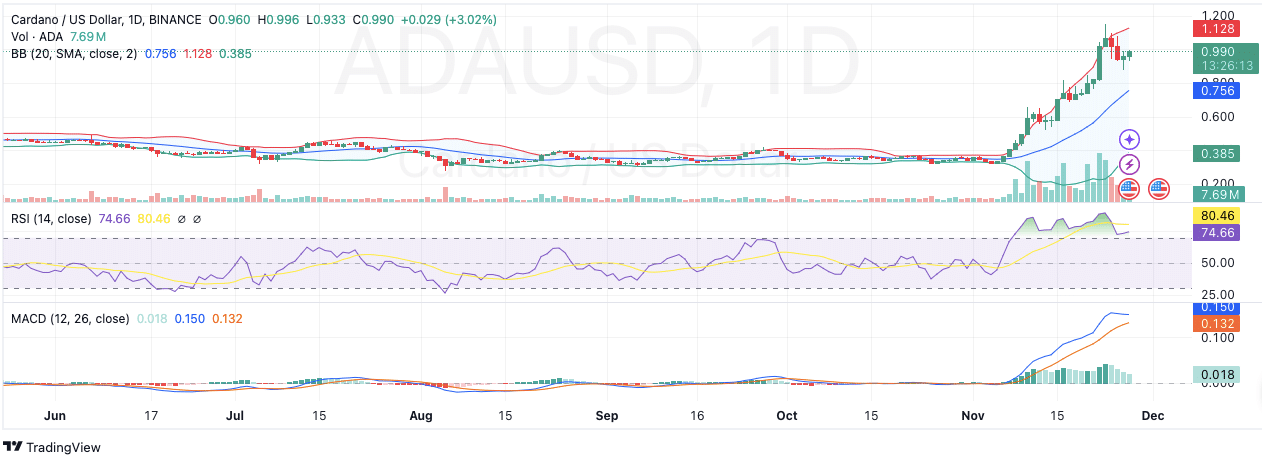

ADA was priced at $0.9898, at press time, reflecting a 6.19% increase in the last 24 hours and an 18.47% increase over the past seven days. Its 24-hour trading volume stood at $3.11 billion, and with a circulating supply of 36 billion tokens, ADA’s market capitalization was approximately $35.39 billion.

Recent price data shows that ADA’s seven-day range extended from $0.773 to $1.12.

This performance reflects strong demand and trading interest, supported by technical indicators that show sustained bullish momentum.

Technical indicators signal bullish momentum

The daily chart reveals ADA is holding above the 20-day Simple Moving Average (SMA) at $0.756, which serves as a dynamic support level.

Bollinger Bands are widening, pointing to increased volatility as ADA approaches the key resistance at $1.00.

The Relative Strength Index (RSI) was at 74.66, placing ADA in the overbought zone. While this suggests potential short-term resistance due to profit-taking, the RSI above 70 also signals continued bullish momentum.

Source: TradingView

Meanwhile, the MACD showed a bullish crossover, with the MACD line above the signal line and a positive histogram confirming upward momentum.

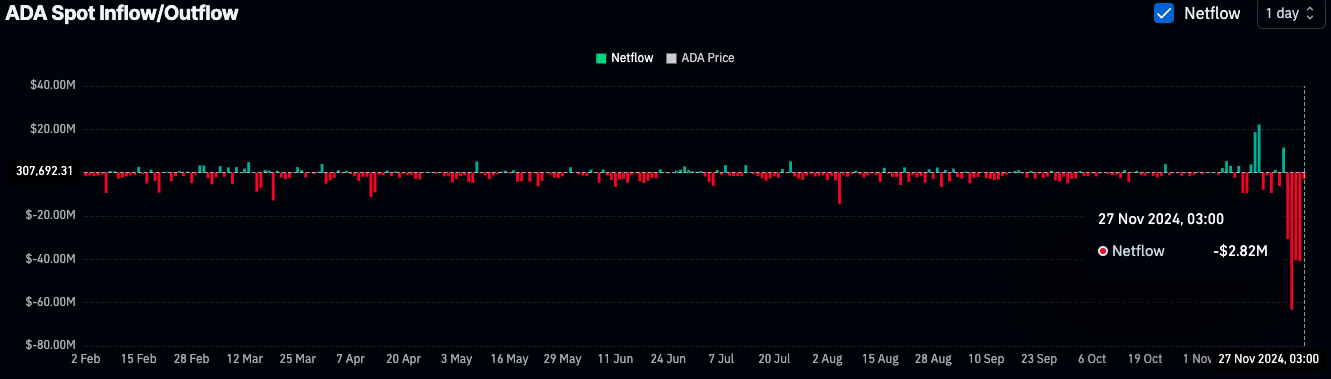

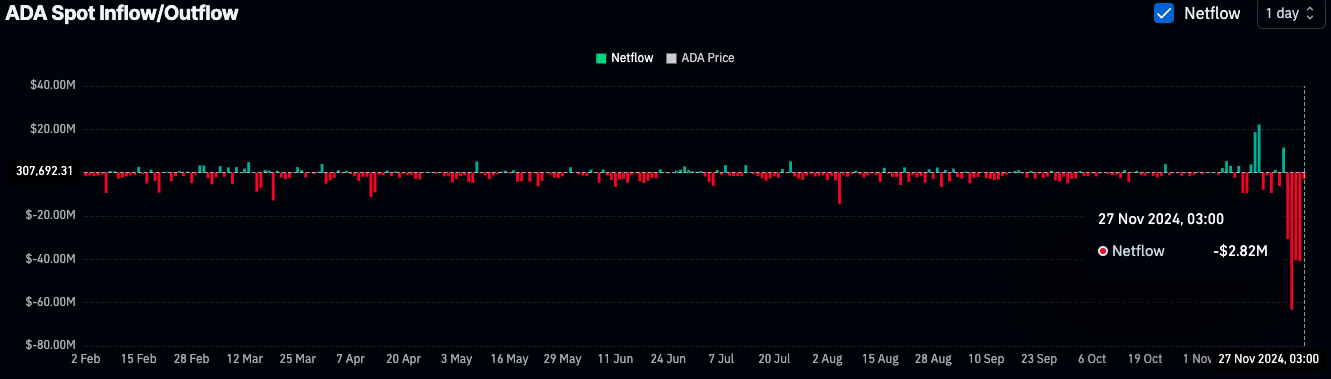

On-chain metrics reflect market confidence

According to Coinglass, ADA experienced a net outflow of $2.82 million on the 27th of November 2024, as more tokens left exchanges than entered. This indicates increased accumulation by investors moving funds to private wallets, reducing potential selling pressure.

Source: Coinglass

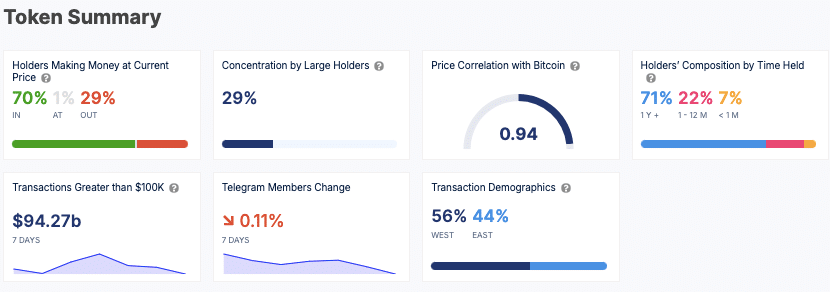

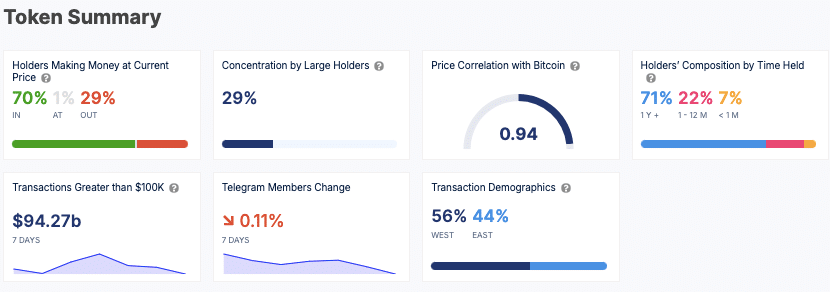

Data from IntoTheBlock shows that 70% of ADA holders are in profit, while only 29% are at a loss. Additionally, 71% of holders have held ADA for over a year, suggesting long-term commitment.

Source: IntoTheBlock

Read Cardano’s [ADA] Price Prediction 2023-24

With a 0.94 correlation to Bitcoin, ADA’s price closely follows broader market trends, further influencing its upward movement.