- Zcash has rallied by 12% in 24 hours, amid a surge in buying activity.

- Zcash could hit a $1 billion market cap by year-end as bullish signals align.

Zcash [ZEC] stood among the top market gainers at press time after a 12% gain in 24 hours to trade at $54.40. The altcoin’s market capitalization had also reached $886 million and was fast approaching the crucial $1 billion milestone.

In the last 30 days, ZEC has risen by 48%, mirroring the November gains recorded by Bitcoin [BTC] and most altcoins. However, with the broader market showing signs of retracing, will Zcash extend its gains or succumb to the bearish sentiment?

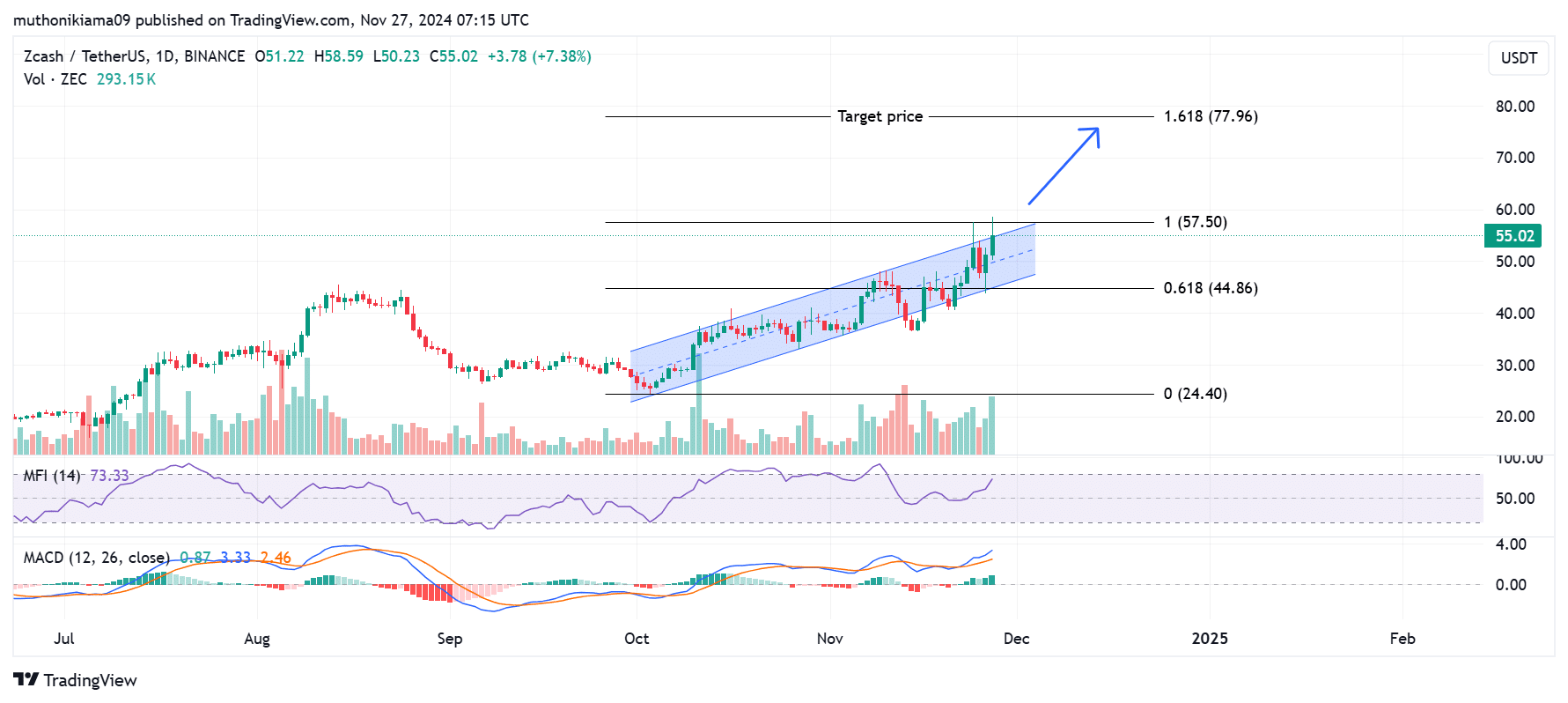

Analyzing ZEC’s parallel ascending channel

Zcash, on its one-day chart, has attempted another breakout from an ascending parallel channel. The token is facing strong resistance at the upper boundary of this channel, but a rise in trading volumes, as depicted in the volume histogram bars, could sustain the uptrend.

The Money Flow Index (MFI) with a value of 73 confirms this bullish thesis. It indicates that buying pressure is strong and driving ZEC’s uptrend. Moreover, despite being on an upward slope, the MFI has not reached overbought levels suggesting there is room for more gains.

A bullish MFI and a breakout from the ascending parallel channel could see traders hold or add to their positions.

Source: Tradingview

More bullish trends can also be seen in the Moving Average Convergence Divergence (MACD) indicator as the MACD line continues to trend above the signal line. The positive MACD histogram bars further confirm the uptrend.

With these bullish signs aligning, the next target price for Zcash is the 1.618 Fibonacci level ($77). There is also a strong support level at $44, and if ZEC fails to break resistance at the upper boundary of the ascending channel, the price could drop to test this support.

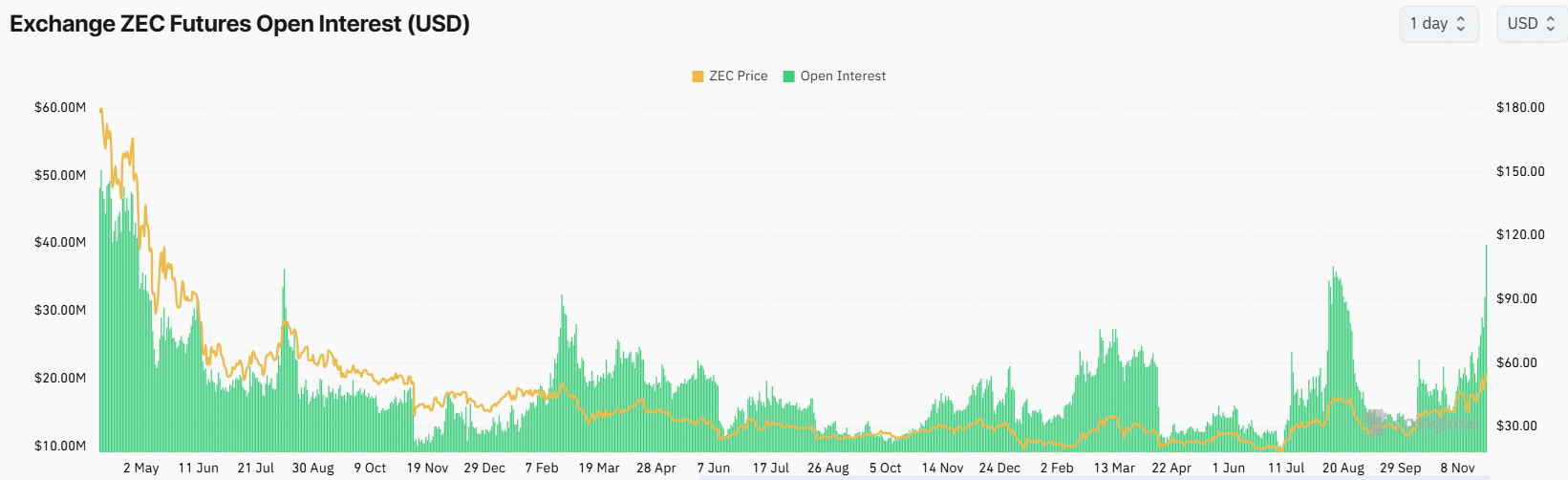

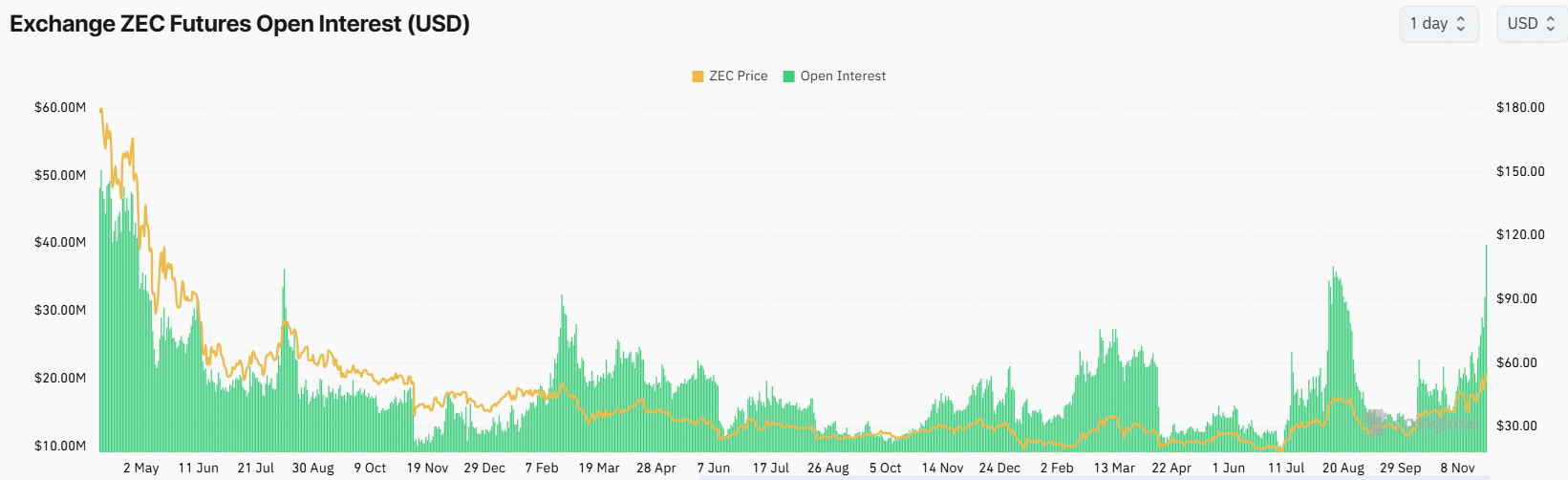

Zcash open interest hits record highs

Zcash’s recent gains have spurred interest in the token from derivative traders as seen in the rising open interest. In 24 hours, ZEC’s open interest has risen by 47% to $39 million at press time, its highest level since April 2022.

Source: Coinglass

Rising open interest shows more traders are opening new positions on Zcash. This is bullish as it aligns with the gains in price.

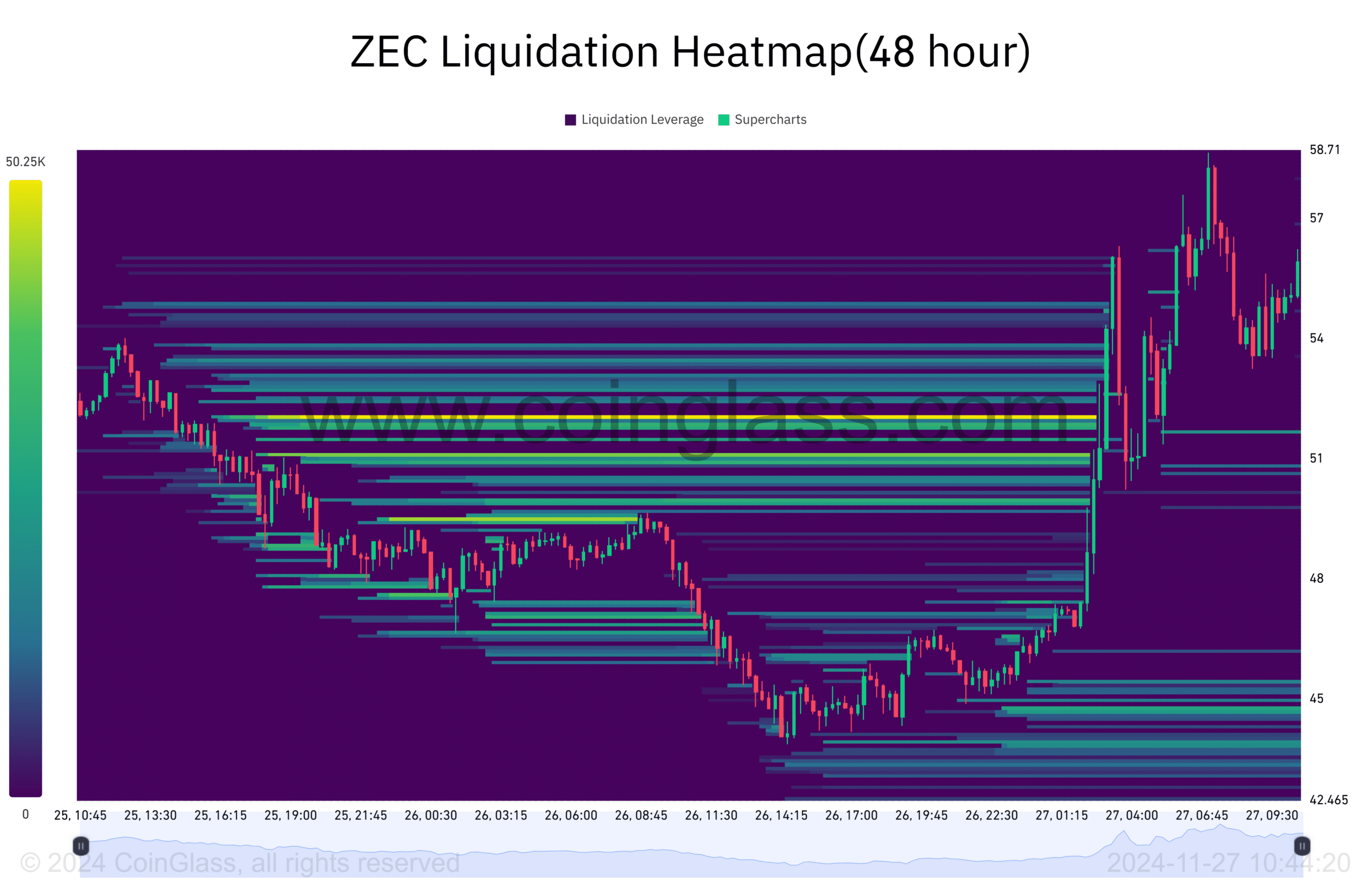

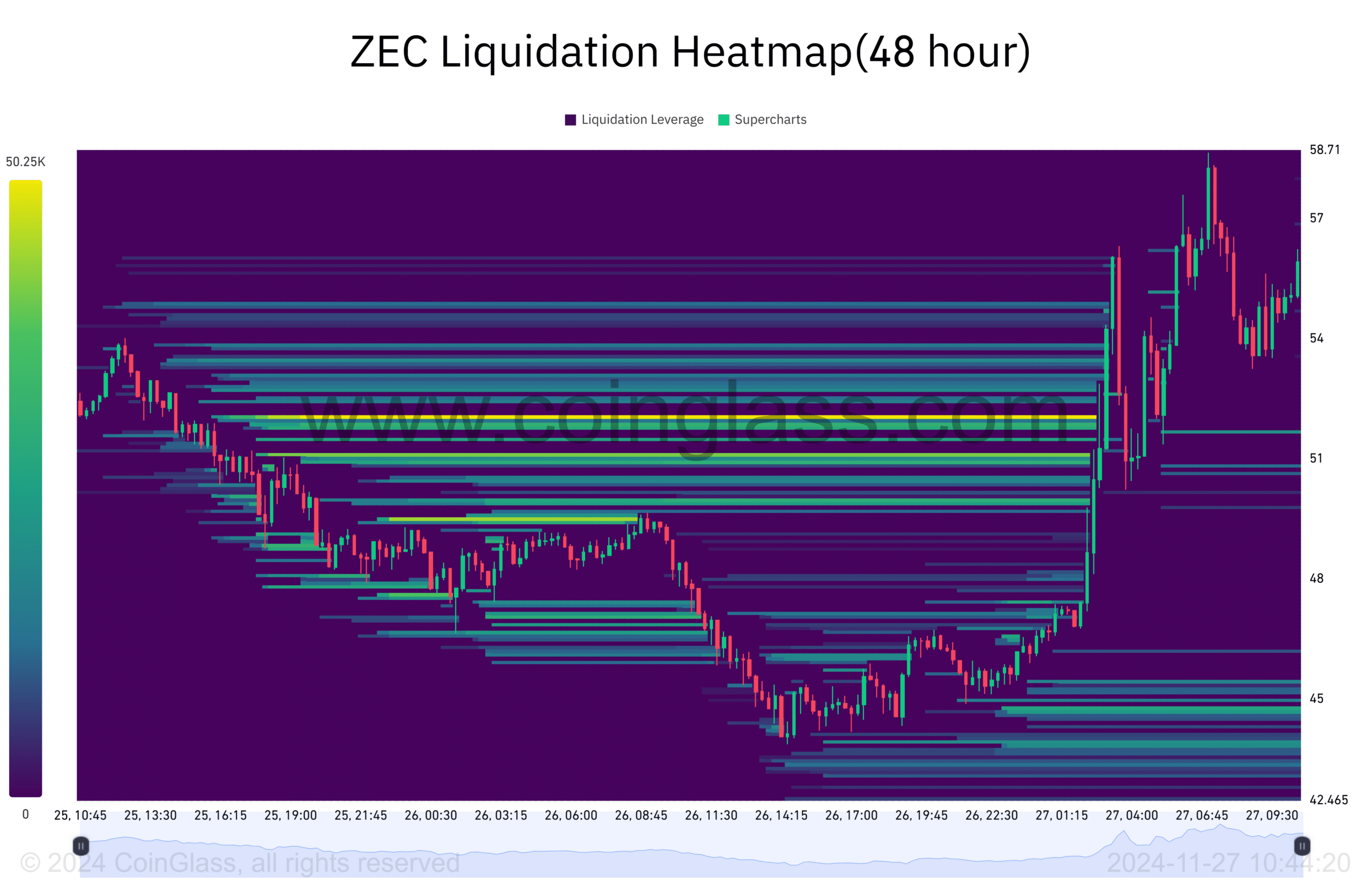

Liquidation heatmap shows THIS

Zcash’s liquidation heatmap shows a buildup of liquidations as the price increased. The forced closure of leveraged short positions accelerated buying activity, which fuelled the uptrend.

After these short positions were wiped out, the closest liquidation zone has moved to below the current price at $51. If ZEC drops to this zone, it could trigger further dips due to forced selling from long liquidations.

Source: Coinglass

However, if more buyers step in before ZEC drops to this level and defend this support zone, it could lead to a sustained uptrend.