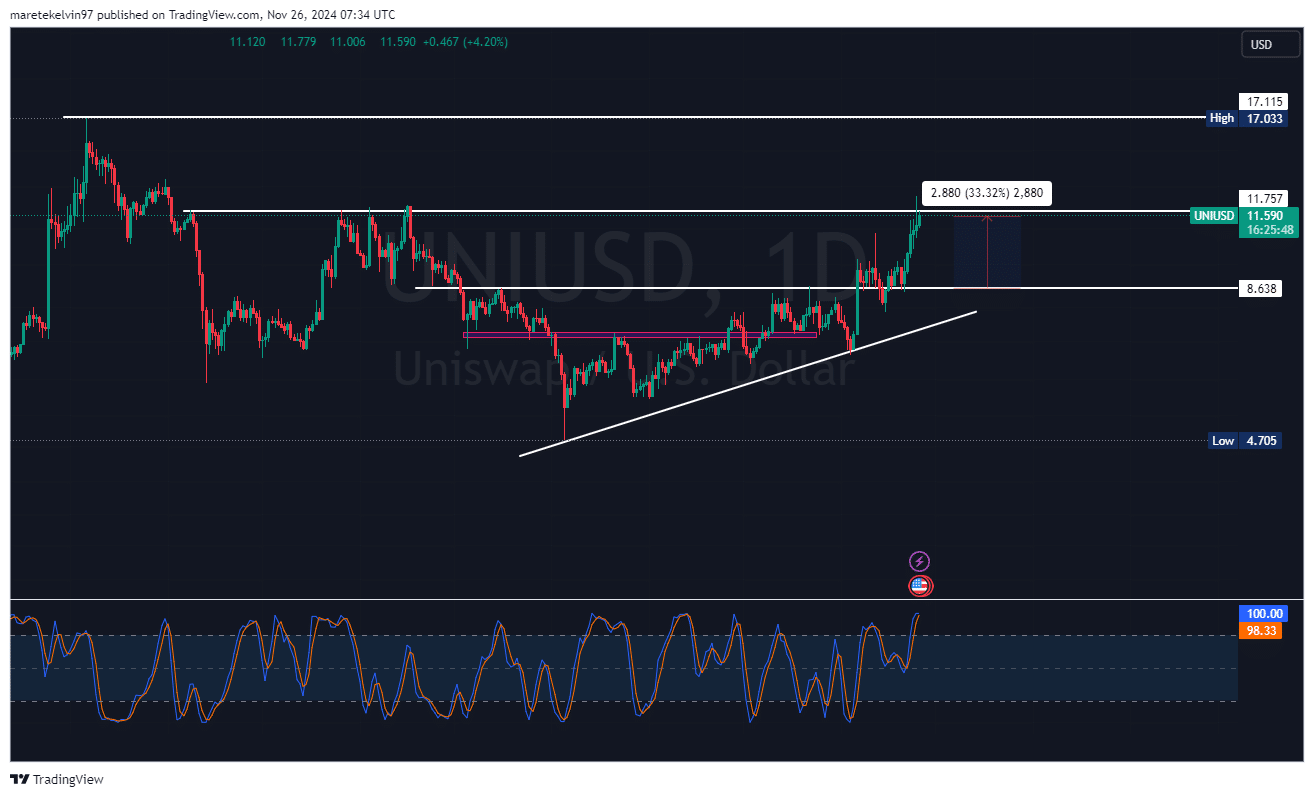

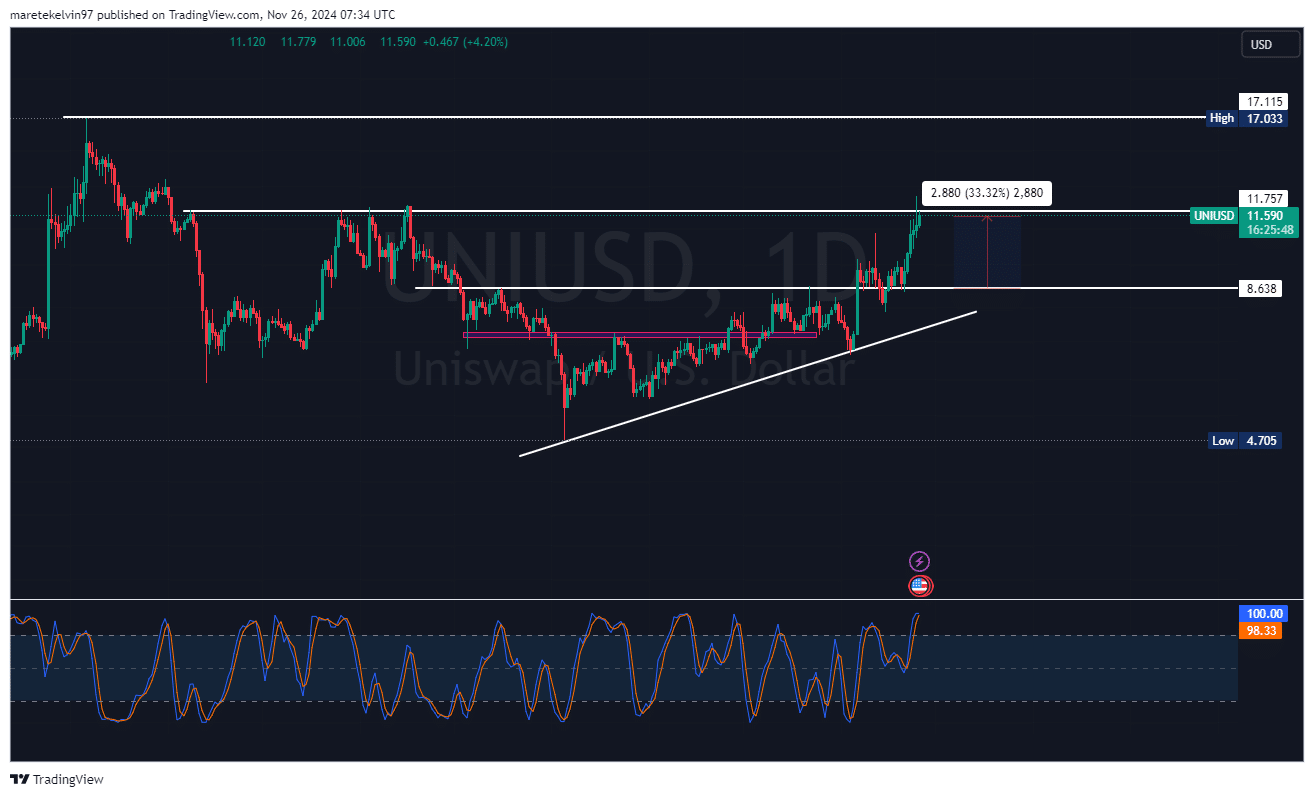

- UNI has rebounded strongly from the key support level of $8.64.

- On-chain metrics suggested increased institutional and whale interest.

While the majority of altcoins have been struggling to hold their ground within the current bear-dominated market, Uniswap [UNI] has been acting contrary to that trend.

After rebounding from a critical support level at $8.64, UNI has extended its gains by over 30%, testing a local high at $11.50 at press time.

The key question is whether UNI can accumulate the strength to break through this crucial resistance level and extend its rally towards higher targets.

At press time, Uniswap’s technical setup seemed to suggest a potential breakout for the token.

Source: TradingView

Notably, Uniswap stochastic RSI was signaling an overbought market condition at press time — historically, this signals a bearish run.

However, in the context of UNI’s current uptrend, it may actually be an overall bullish sign with just a short-term correction on cards.

Overbought conditions in a bull market can often precede further price appreciation as the momentum builds.

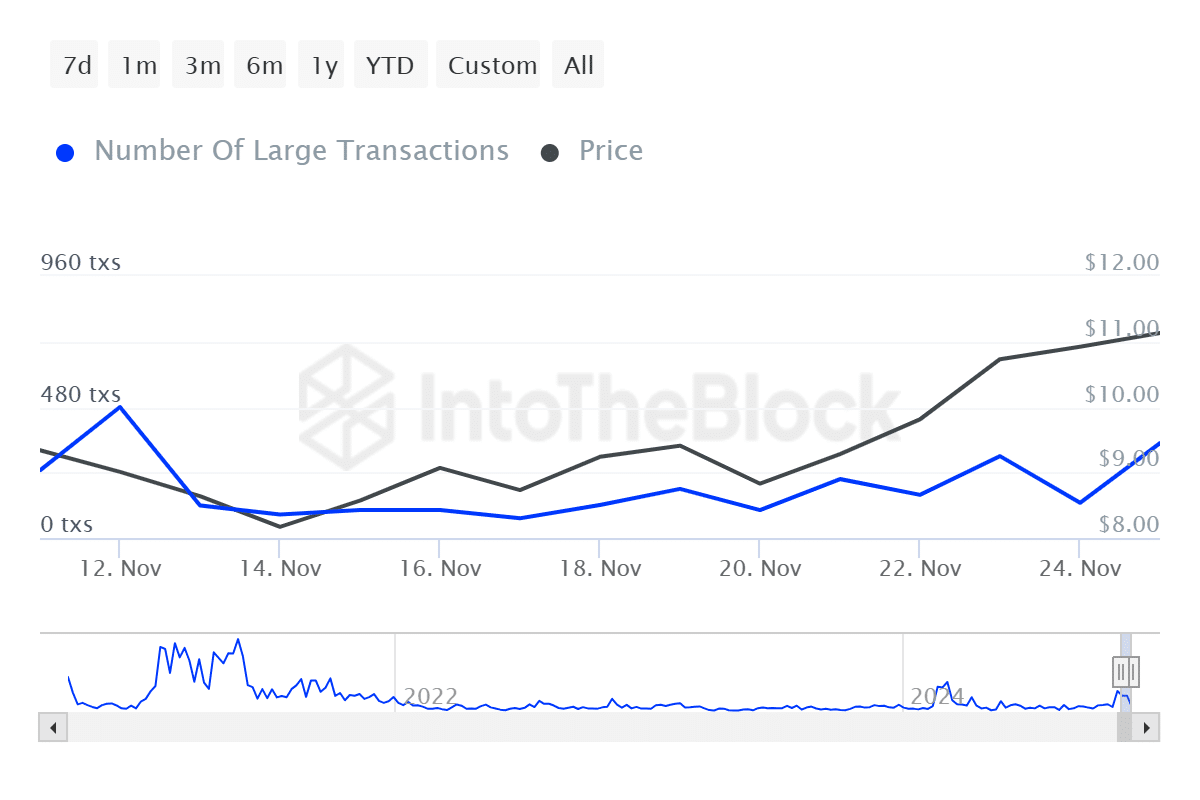

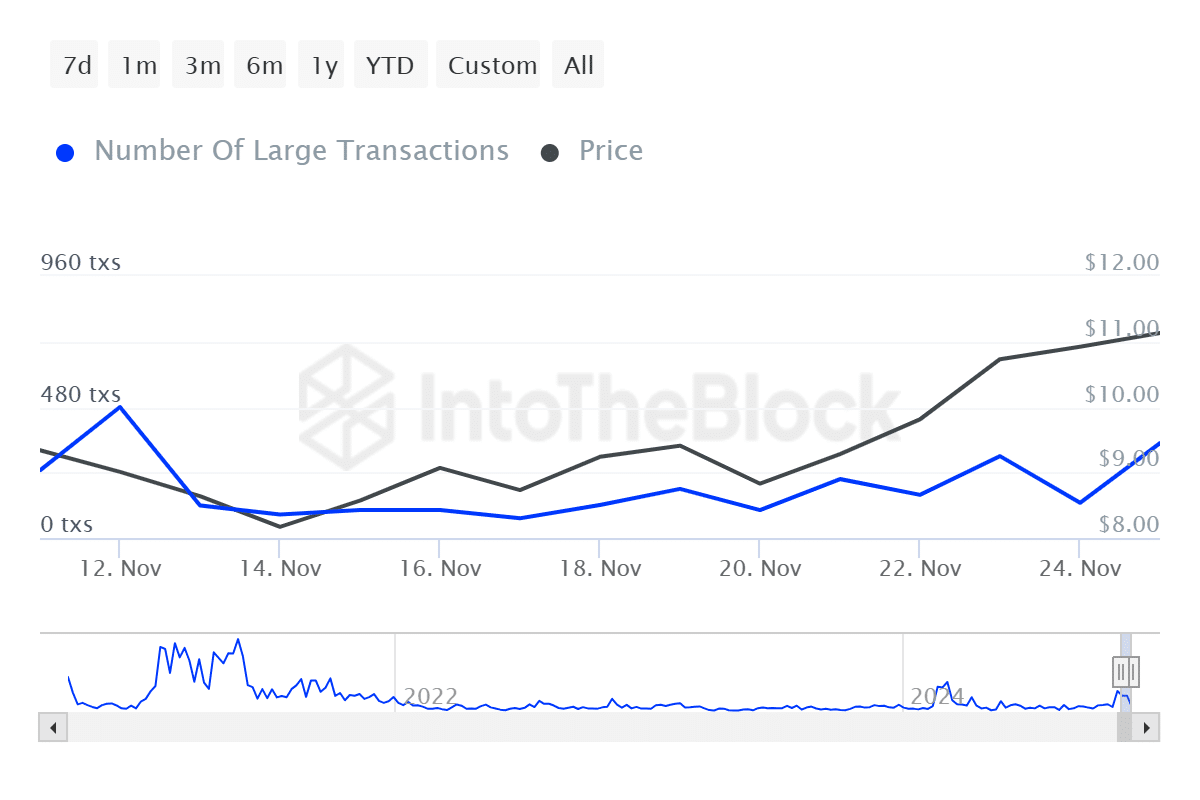

Whales and institutions flock to UNI

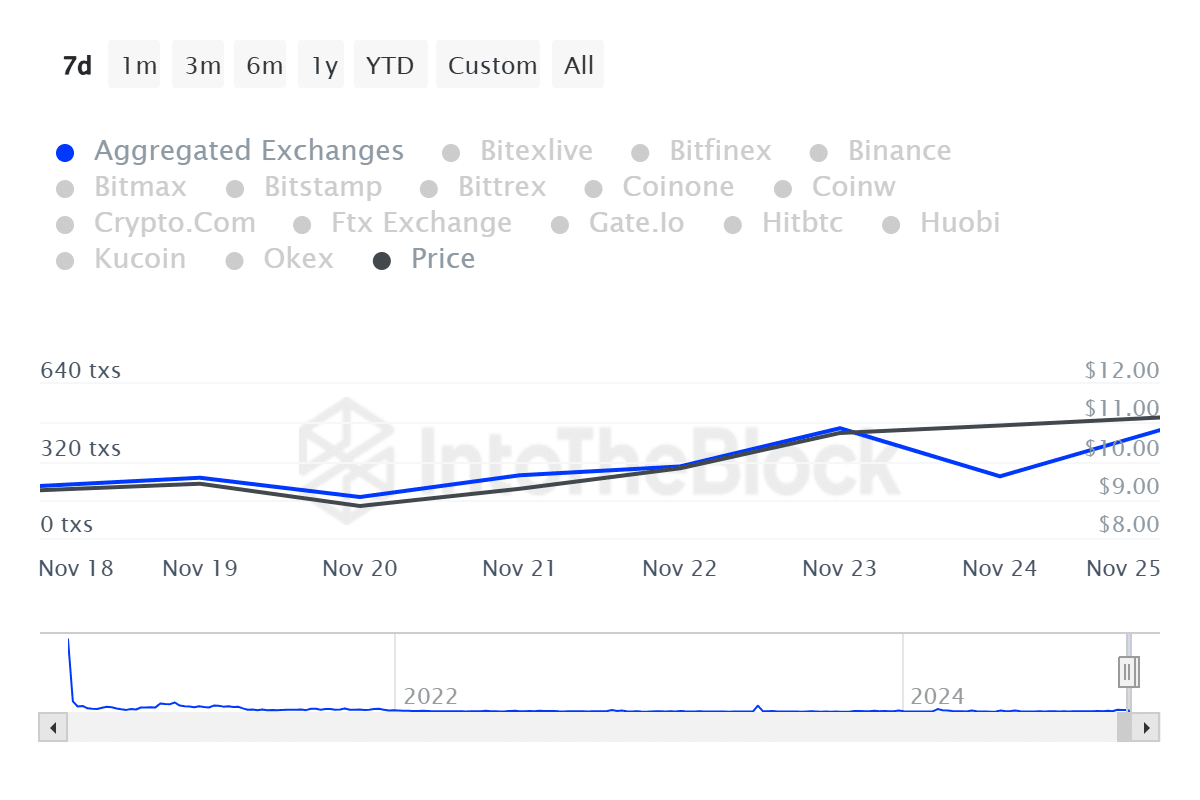

AMBCypto’s analysis of the altcoin’s whale activity revealed a surge in UNI’s large transactions, with an over 255% increase in the last 24 hours.

This indicated heightened interest from institutional investors and whales, who are likely positioning themselves for the next leg of the token’s rally.

Source: IntoTheBlock

Short-term pullback or deeper correction?

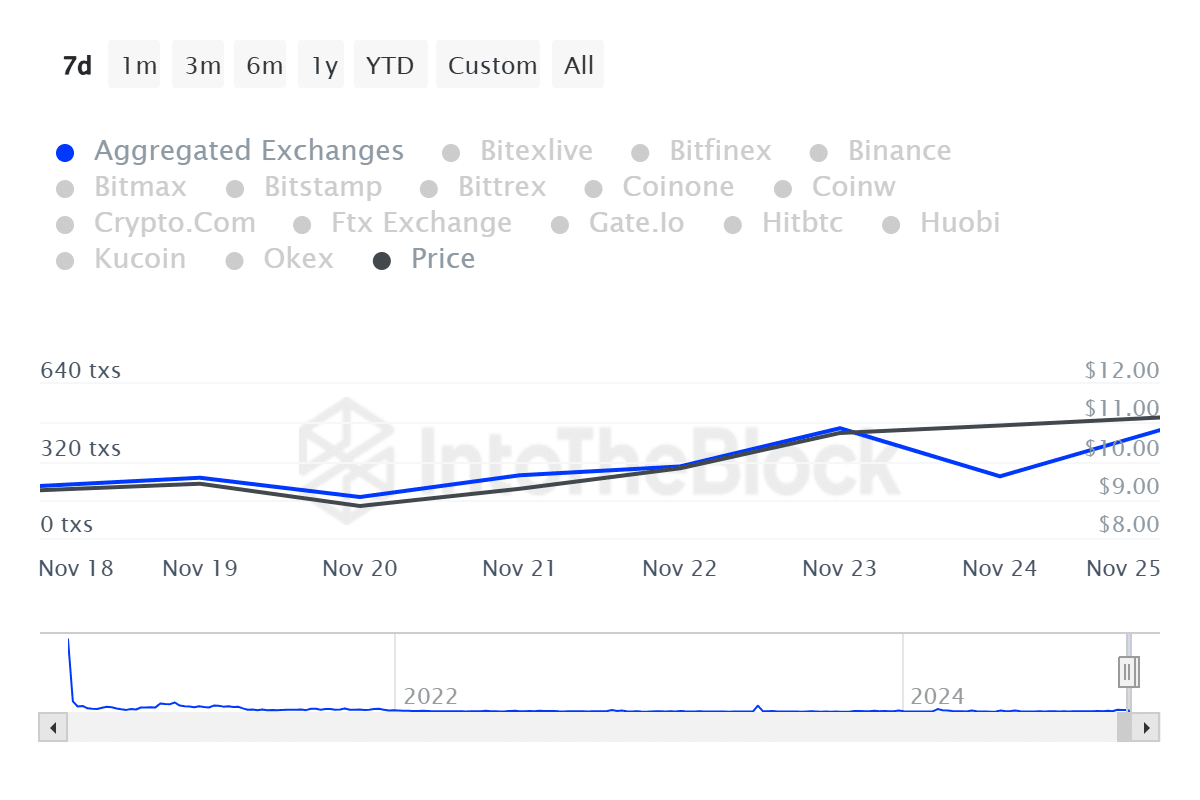

Interestingly, Uniswap exchange inflows have increased in the past 24 hours, as per IntoTheblock data.

This may hint that market participants are positioning themselves for a potential breakout, a factor that may add more bullish sentiment to UNI.

Source: IntoTheBlock

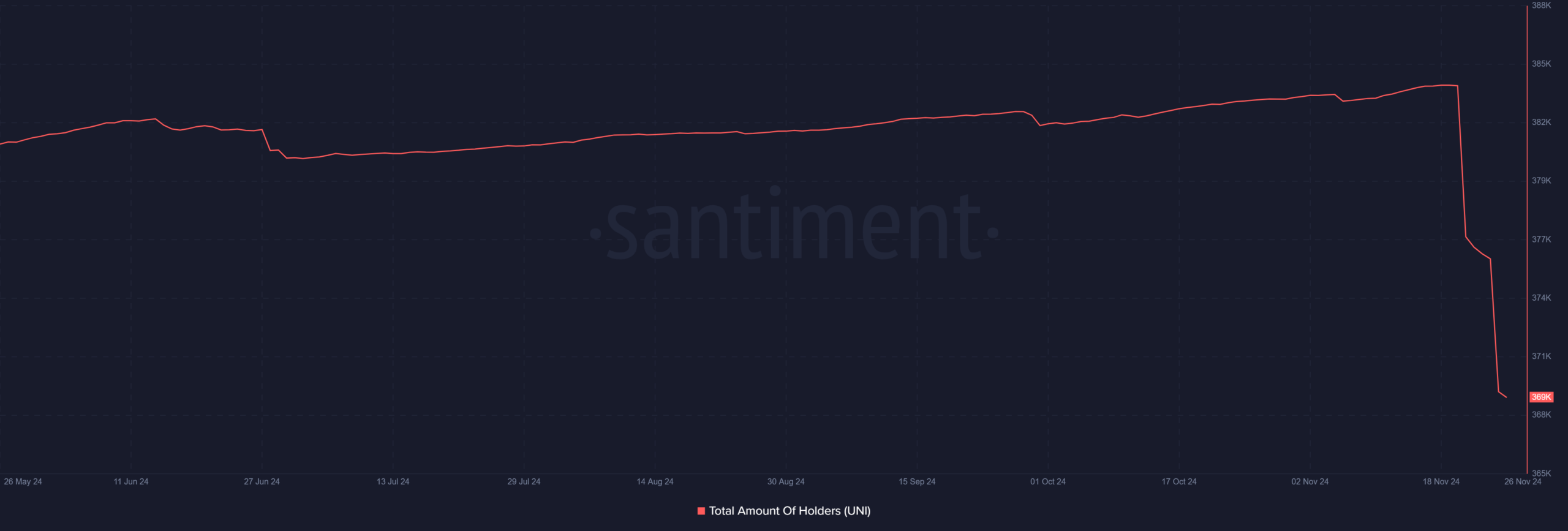

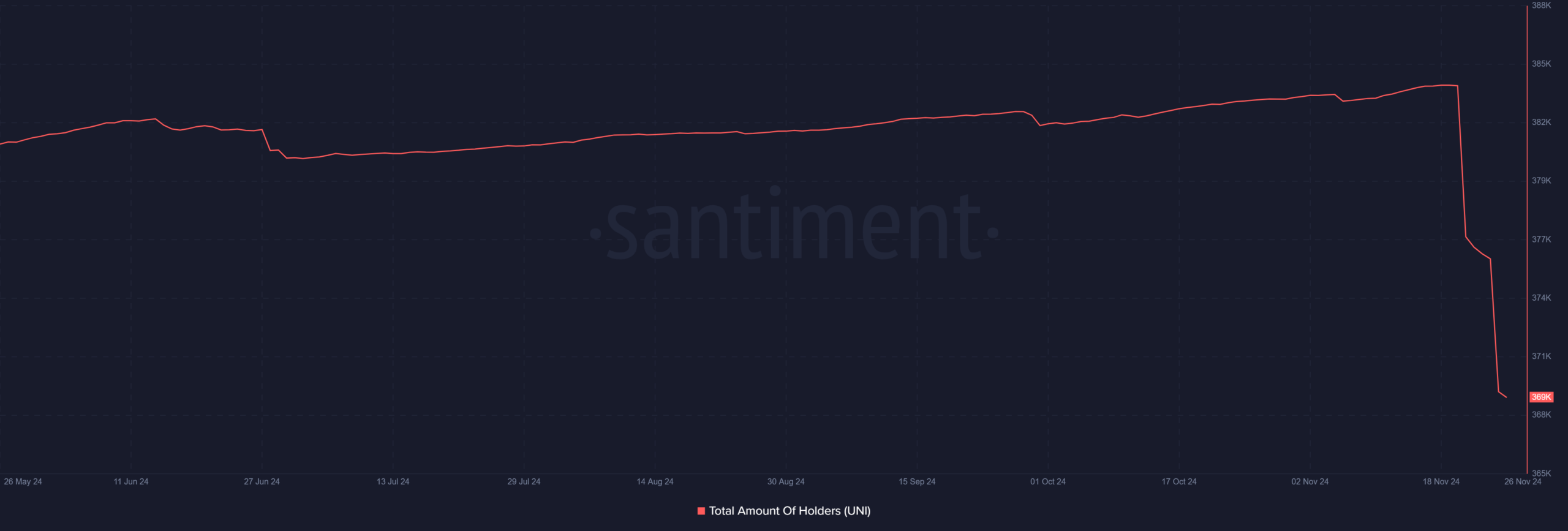

However, the Santiment’s data also revealed a sharp decline in the number of UNI holders since the 20th of November.

This could signal a temporary pullback or profit-taking by some investors, which, in most cases, is a healthy sign during a bull run.

Source: Santiment

Read Uniswap’s [UNI] Price Prediction 2024–2025

The combination of technical analysis and on-chain metrics sets up a captivating case for UNI’s future price action.

With the altcoin’s resilience to broader market weakness and the sharp surge in its whale and institutional activity, this could be the precursor to a long-awaited breakout.