- Bitcoin hit a new all-time high, boosting crypto today to $3.2 trillion.

- Large liquidations impacted traders, while macroeconomic factors drove optimism.

While the performance of crypto today has seen a notable uptick in valuation, it has also registered a slight decrease.

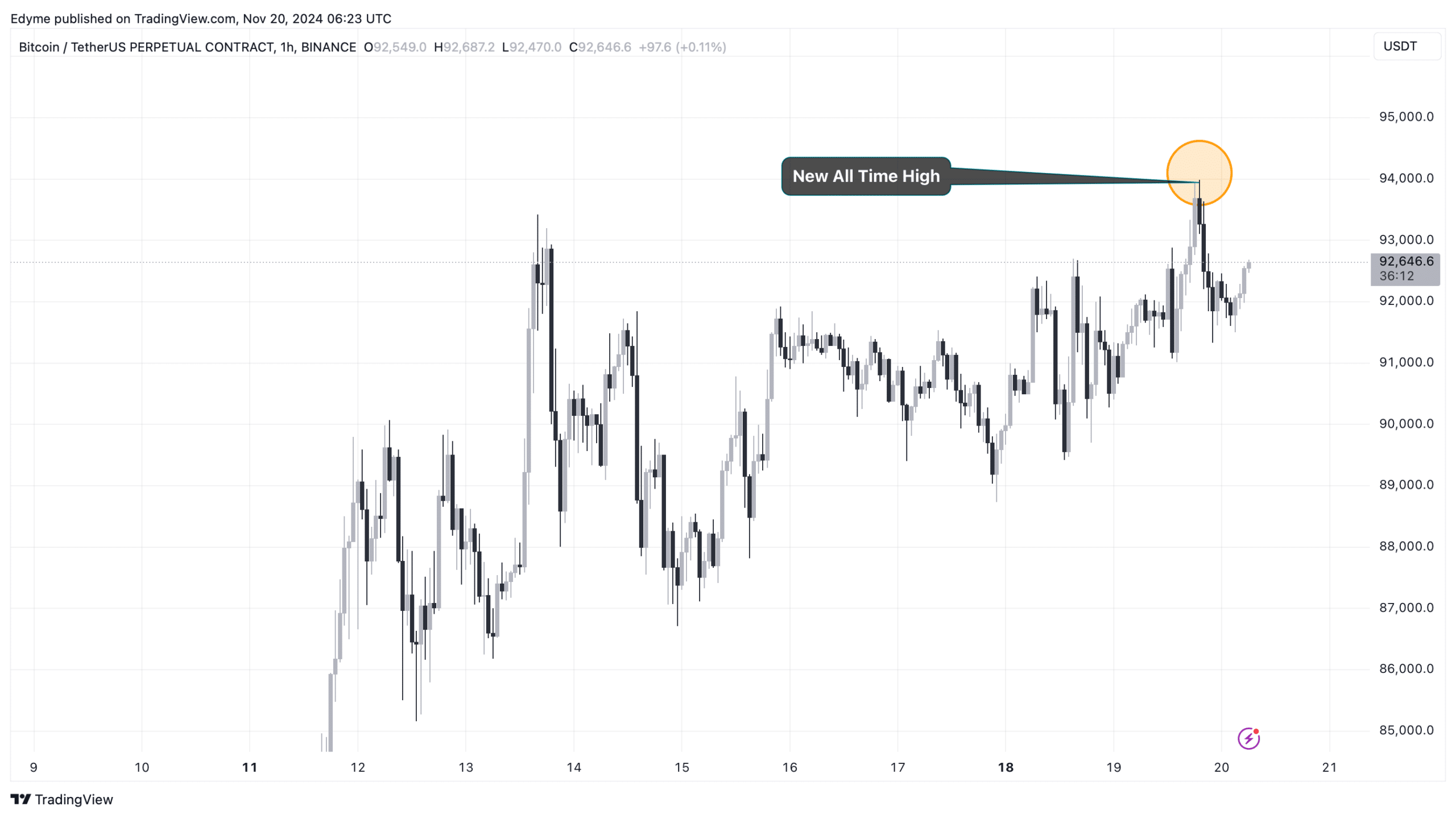

CoinGecko data showed that the global crypto market has surged to as high as $3.227 trillion in valuation earlier in the day, when Bitcoin hit a new all-time high of $94,000.

However, at the time of writing, this valuation had since reduced by 1.7% to stay at $3.21 trillion at press time.

Out of other factors that led to this boost in the global market of crypto today, the most particular one is Bitcoin itself.

As earlier mentioned, BTC, the largest cryptocurrency asset by market cap, has registered a new ATH bringing its 7-day performance to an increase of 5.9%.

Source: TradingView

At the time of writing, Bitcoin traded at a price of $92,460 up by 1% in the past day. The continuous increase in BTC’s price now draws it closer to a market capitalization of $2 trillion.

For context, as of today, the asset’s market cap is at a valuation of $1.8 trillion, which still puts the asset as one of the largest assets in the world.

Meanwhile, BTC’s daily trading volume has also seen a notable boost in valuation, rising from below $50 billion earlier this week to currently at $77.11 billion.

Market impact and liquidations in crypto today

While the performance of crypto today has generally been positive, it has not been beneficial for all participants.

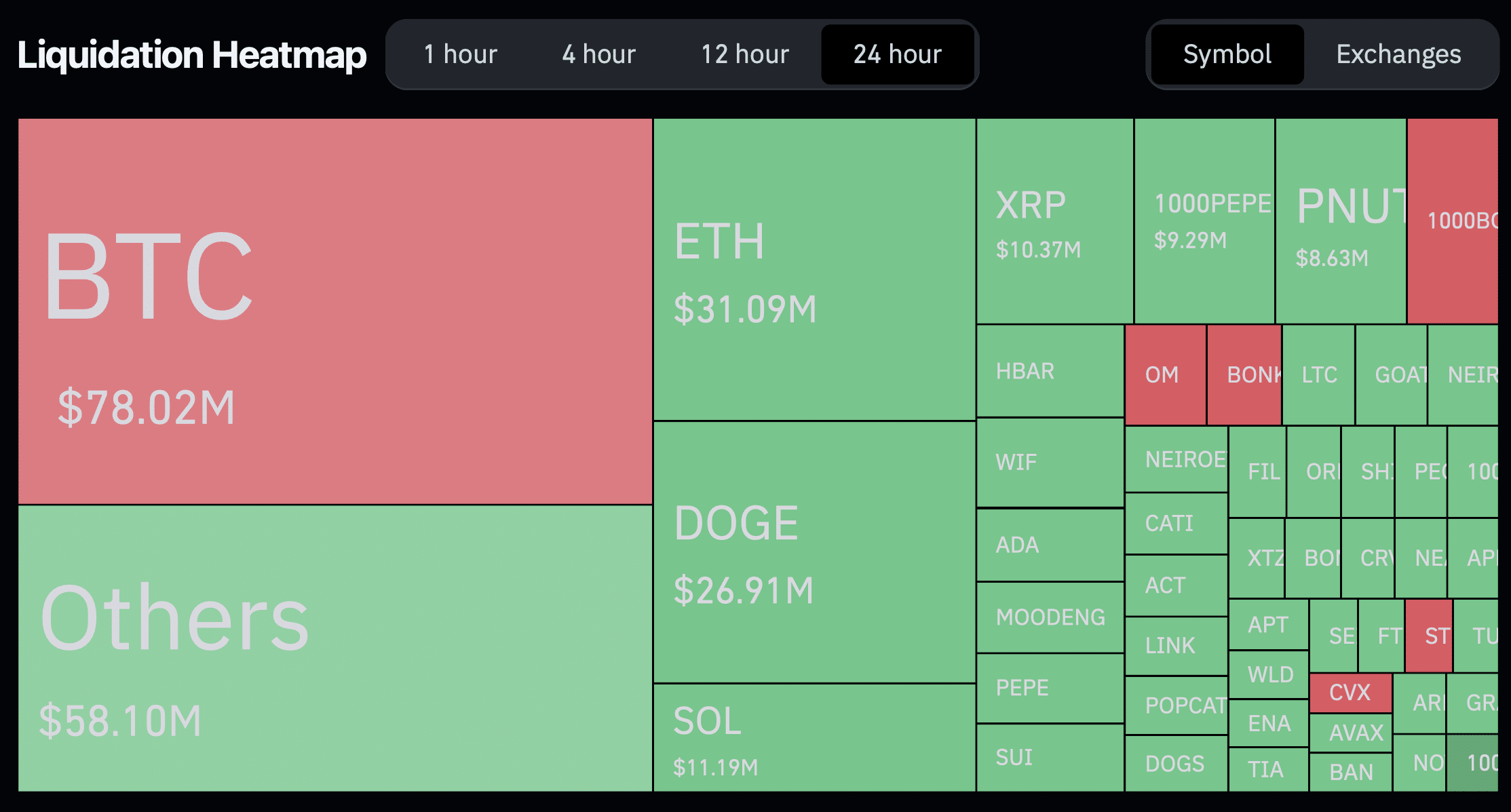

Data from Coinglass indicated that in the last 24 hours, 119,717 traders faced liquidation, with a total value of approximately $317.33 million.

Liquidation occurs when a trader’s position is forcibly closed by an exchange due to insufficient funds to maintain a leveraged position.

This often happens during high market volatility when prices move against the position a trader has taken.

Source: Coinglass

Out of the total liquidations, $78 million were attributed to Bitcoin, with short traders bearing the brunt of it, accounting for $47 million.

However, long traders were not entirely spared, contributing $31 million to Bitcoin’s total liquidations.

This trend extended to other cryptocurrencies, where major assets like Ethereum [ETH] witnessed more long positions being liquidated.

Such liquidations suggest that while Bitcoin’s surge has been a standout, not all assets in the market have experienced parallel gains.

Despite the challenges faced by some, certain cryptocurrencies managed to perform well. Cardano [ADA] recorded a 4.8% increase, while Pepe [PEPE] and Bonk [BONK] saw gains of 1.1% and 12.5%, respectively.

Macroeconomic drivers

Several macroeconomic factors have contributed to the performance of crypto today.

Notably, MicroStrategy, led by Michael Saylor, made its largest Bitcoin acquisition to date, purchasing nearly 52,000 BTC valued at over $4.6 billion.

Such high-profile acquisitions often propel market confidence, reinforcing Bitcoin’s status as a key asset.

Additionally, interest in crypto today received a boost from Rumble, a competitor to YouTube.

The platform’s CEO hinted at exploring the possibility of adding Bitcoin to Rumble’s balance sheet, which could further propel mainstream adoption.

As of the third quarter’s end, Rumble held $131 million in cash and cash equivalents, highlighting its capacity to make significant investments in cryptocurrency.

Despite widespread optimism, analysts have urged caution. Cypress Demanincor, a market analyst on X (formerly Twitter), shared insights on the broader crypto market chart, warning:

“A break below the $3-$2.9 trillion threshold and a daily close below would likely signal a shift, potentially triggering profit-taking and a “risk-off” pull back or correction of this most recent bullish move.”