- Weekly altcoin trading volume surged as Cardano saw a shift in dynamics.

- Most of active addresses holding ADA were “At the Money” despite the price surge.

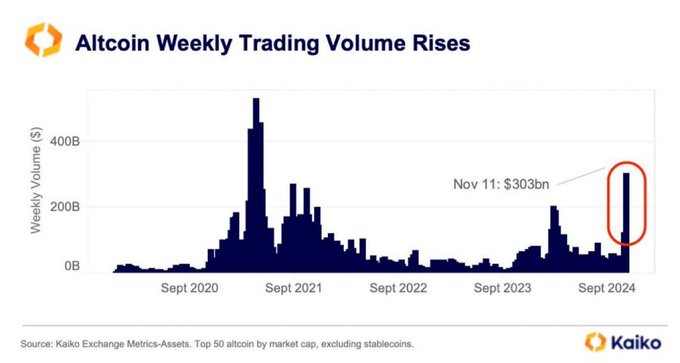

The weekly altcoin trading volume soared to its highest point since 2021, marking a significant milestone.

In November, weekly trading volumes have reached above $303 Billion, signaling a resurgence in investor interest in altcoins.

This surge not only reflected growing liquidity but also coincided with a notable increase in altcoin prices like Ethereum [ETH], Cardano [ADA] and Ripple [XRP].

Source: Kaiko

Investors are diversifying their portfolios beyond Bitcoin [BTC], attracted by promising technological advancements and potential high returns among top altcoins.

This heightened activity suggested that the altcoin market was gaining substantial traction, positioning it as a vibrant component of the broader cryptocurrency landscape.

ADA volume surge and price prediction

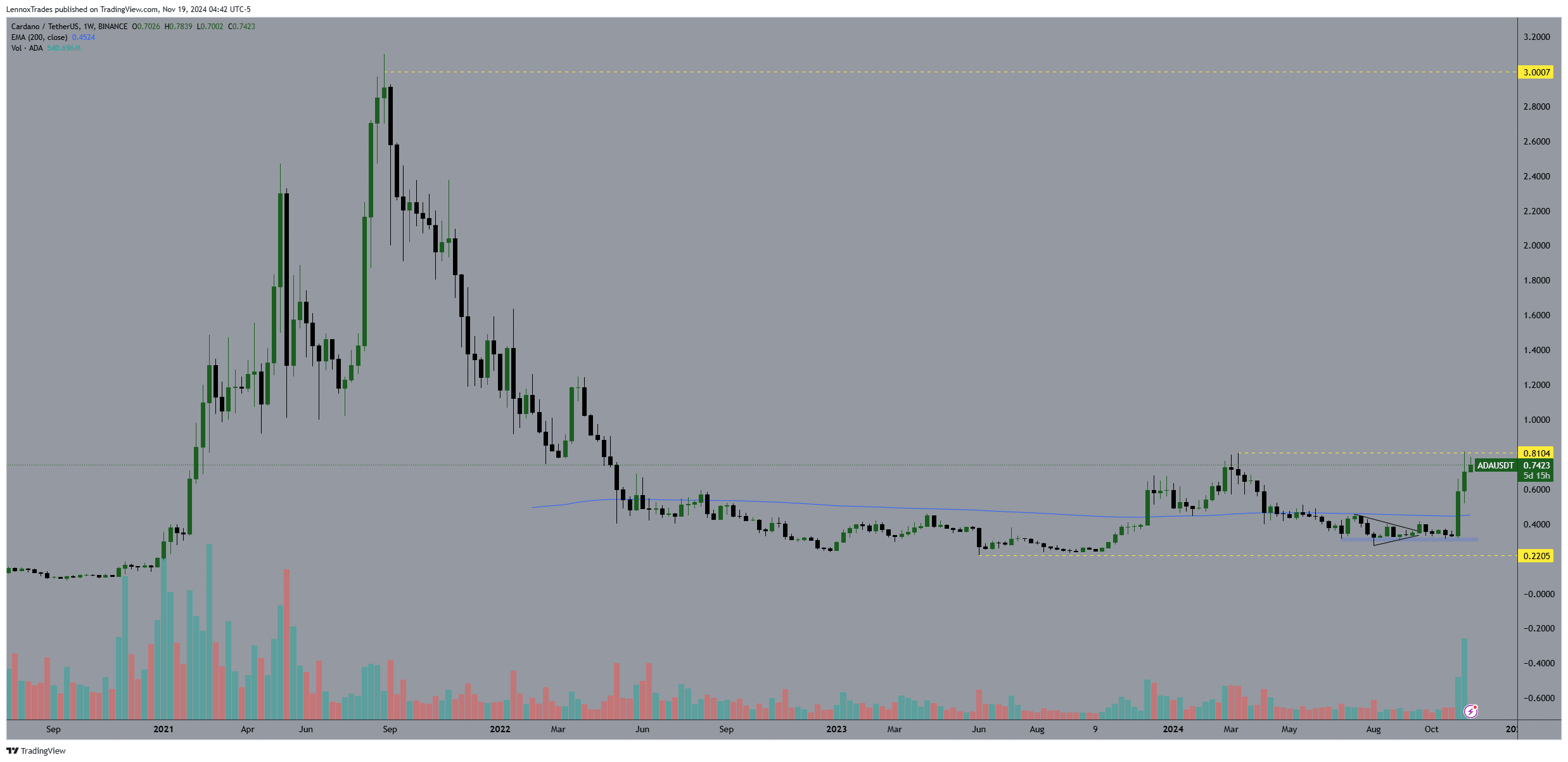

Cardano’s trading volume has surged alongside the broader altcoin market, echoing a similar momentum last seen during the 2021 bull market. This weekly volume spike reflected increased investor interest and trading activity.

The surge indicated a wider shift in market dynamics, suggesting a shift in speculation in the altcoin space.

Investors appear to be regaining confidence in altcoins like ADA, which could herald further gains, as the price actions indicated.

Source: TradingView

ADA’s surge recently reclaimed a critical resistance level. The ADA/USDT weekly price action showed a breakthrough from the consolidation phase, signaling strong upward momentum.

With ADA’s price now approaching the previous resistance at $0.8, a break and hold above it could see Cardano target the next level at around $3, a price last seen during the peak in 2021.

This recent breakout suggested potential for further gains if ADA can maintain its current trajectory, supported by fundamental improvements within the Cardano network and increased adoption rates.

As ADA approached the $1 mark, the focus shifts to sustained volume and market support to fuel the ascent towards $3.

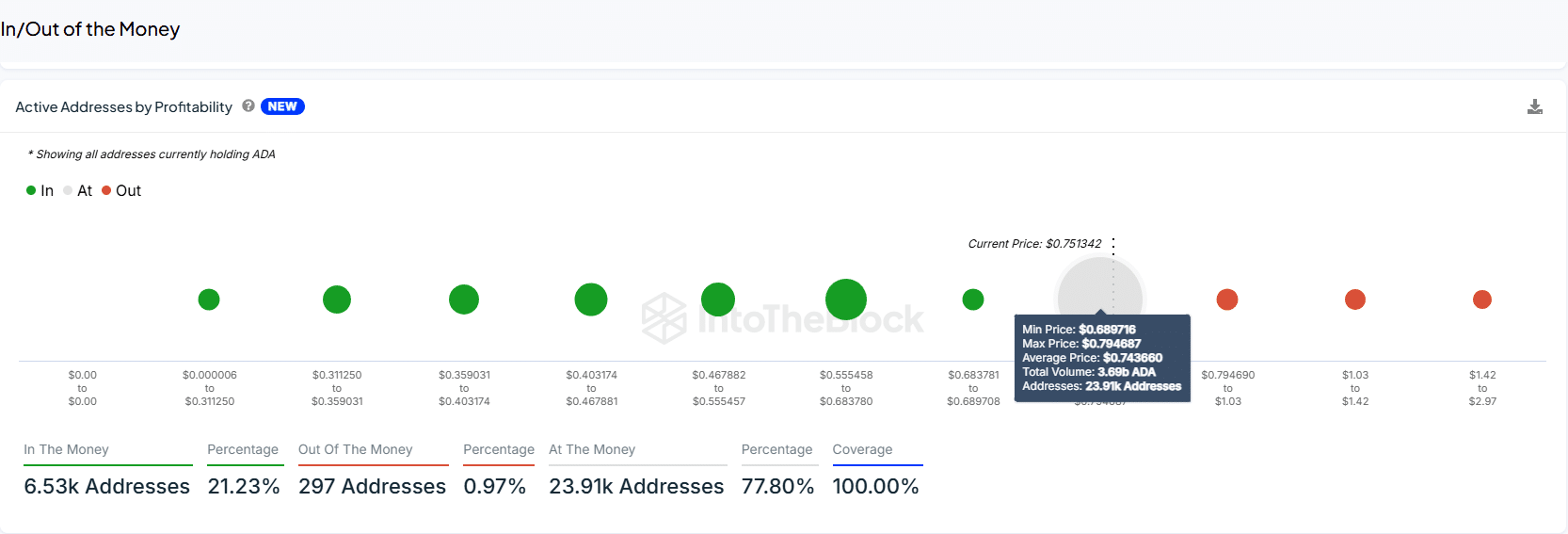

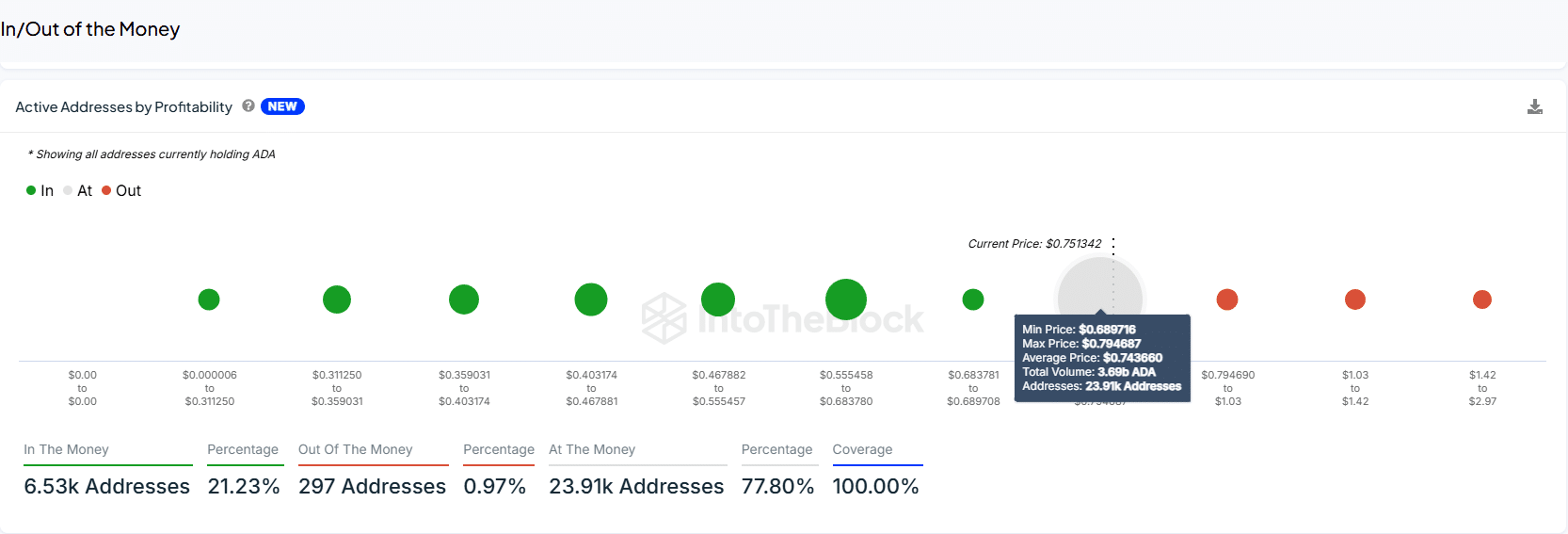

Profitability of active addresses

Assessing the profitability of ADA holders showed that majority holders were currently positioned near the breakeven point. The addresses were 23.91K, accounting for 77.80% of the total.

The addresses were largely clustered around the $0.689 to $0.795 price range. This reflected a substantial accumulation zone that aligned with the current ADA price of $0.751342.

Only 297 addresses, which make up less than 1% of total ADA active holder addresses, were out of the money.

Source: IntoTheBlock

Read Cardano’s [ADA] Price Prediction 2024–2025

Additionally, 21.23% of addresses were in the money, indicating that a small fraction of active addresses were positioned in profits.

This distribution showed a predominant sentiment of profitability within the Cardano market.