- Current support level of Toncoin appears to offer a favorable risk/reward profile.

- The price action of TON targets the $10 mark.

Toncoin [TON] recently displayed a significant shift in price action, catching the attention of investors and analysts alike.

Historical data suggests TON’s price rarely falls below its one-year moving average, typically doing so only during bear markets.

With the overall crypto market in a bullish phase, the one-year moving average might present a favorable entry point, offering a strong risk/reward profile for long-term holders.

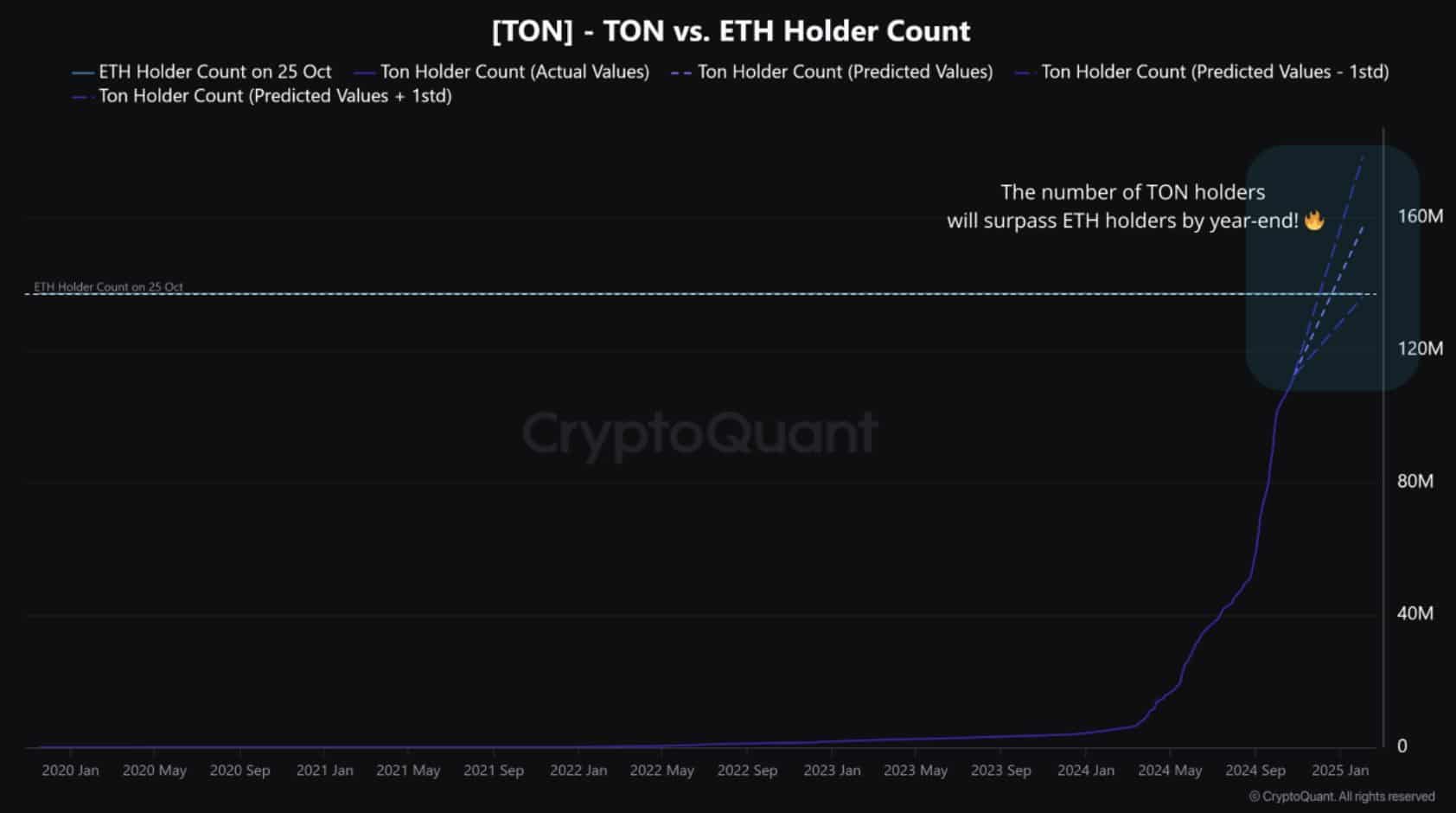

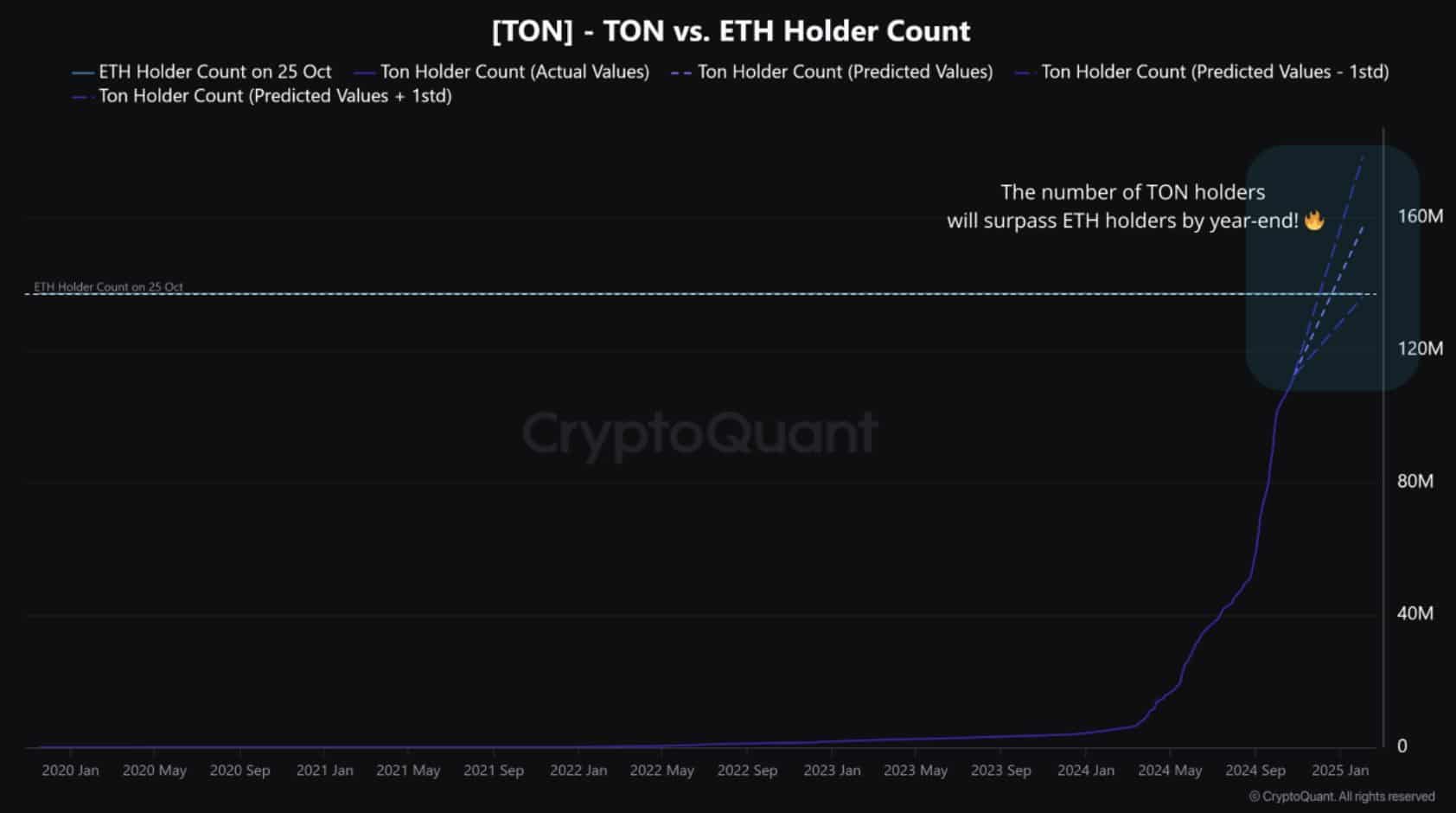

Source: CryptoQuant

The question on many minds is whether TON will experience a substantial breakout as its holder base continues to expand.

Prediction amid growing holder count

The current TON support level suggests a promising outlook for long-term investments. Alongside price action, the rapid growth in Toncoin’s holder count stands out.

Recent trends indicate TON may soon surpass Ethereum in the number of holders. With ETH currently boasting 137 million holders, TON has reached 112 million, adding about 500,000 new holders daily over the past month.

Should this growth rate persist, TON could surpass ETH holders by late December. However, if growth decelerates, this milestone might push to early 2025.

Source: CryptoQuant

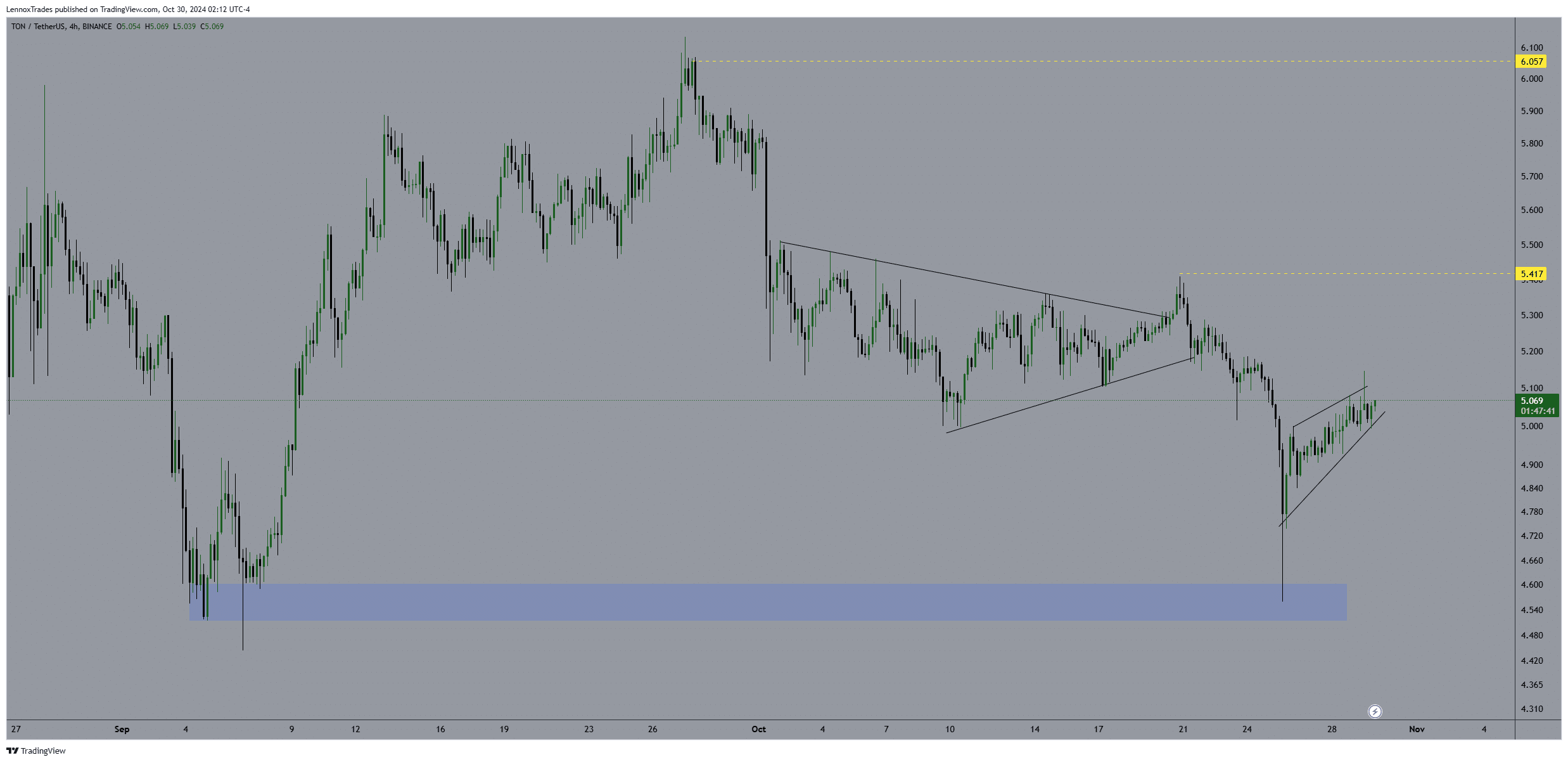

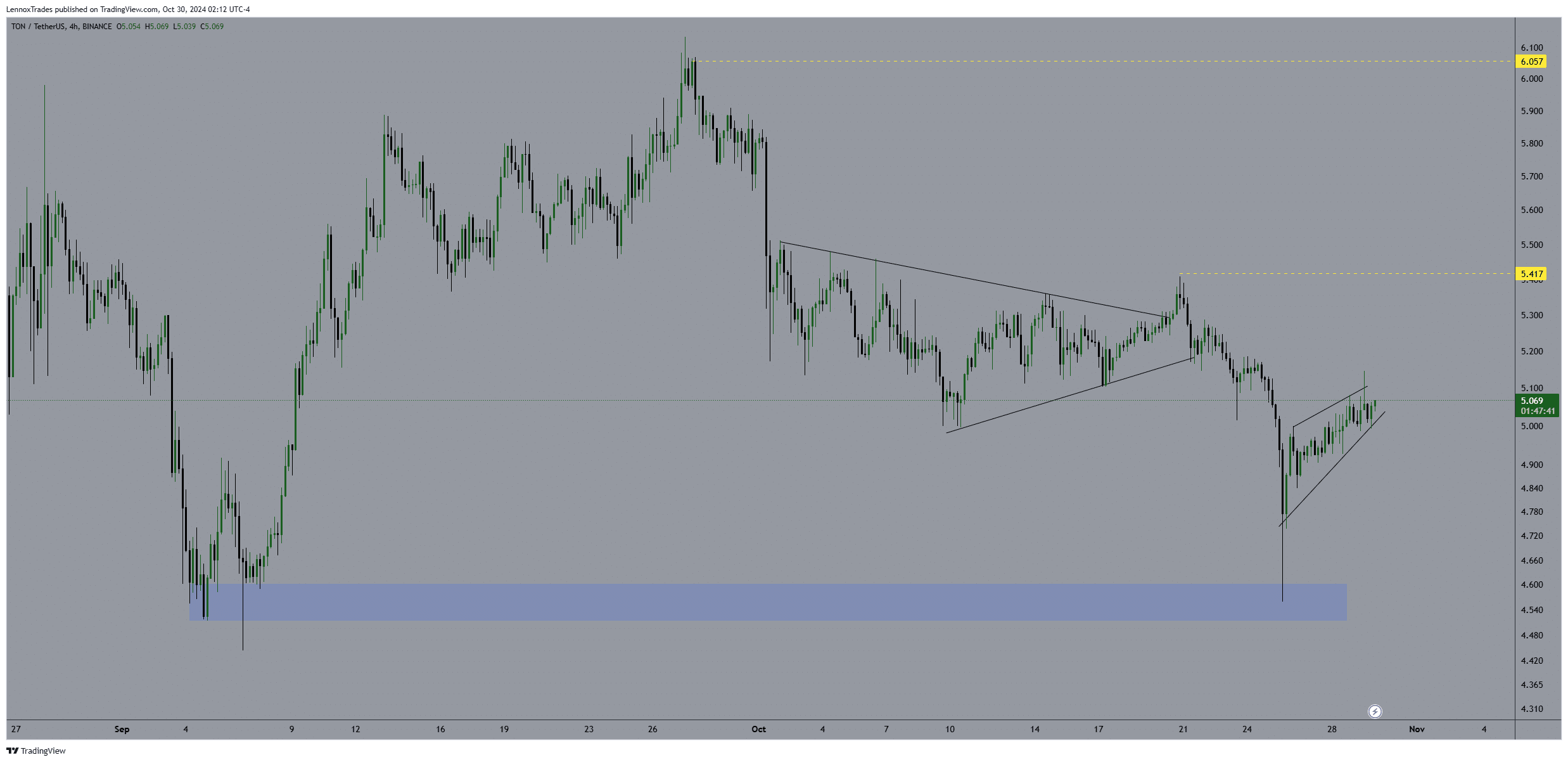

In terms of price movement, TON’s recent performance has been mixed. The price chart for TON/USDT on the 4-hour timeframe revealed a clear downtrend after breaking out from a descending triangle.

This pattern established a support level around $4.50, serving as a critical base. Following this dip, TON rebounded and formed a rising wedge, generally seen as a bearish setup, suggesting possible downward pressure.

Source: Trading View

Key resistance for TON lies around $5.41, a point it has struggled to sustain. If TON breaks above this level, it could target the next significant resistance at $6.05.

However, should TON fail to break out, it may drop back to the $4.50 support level. As of press time, TON is trading around $5.15, with momentum suggesting a potential climb to $5.71. If TON breaks past $5.71, it could aim for a major move toward $10.

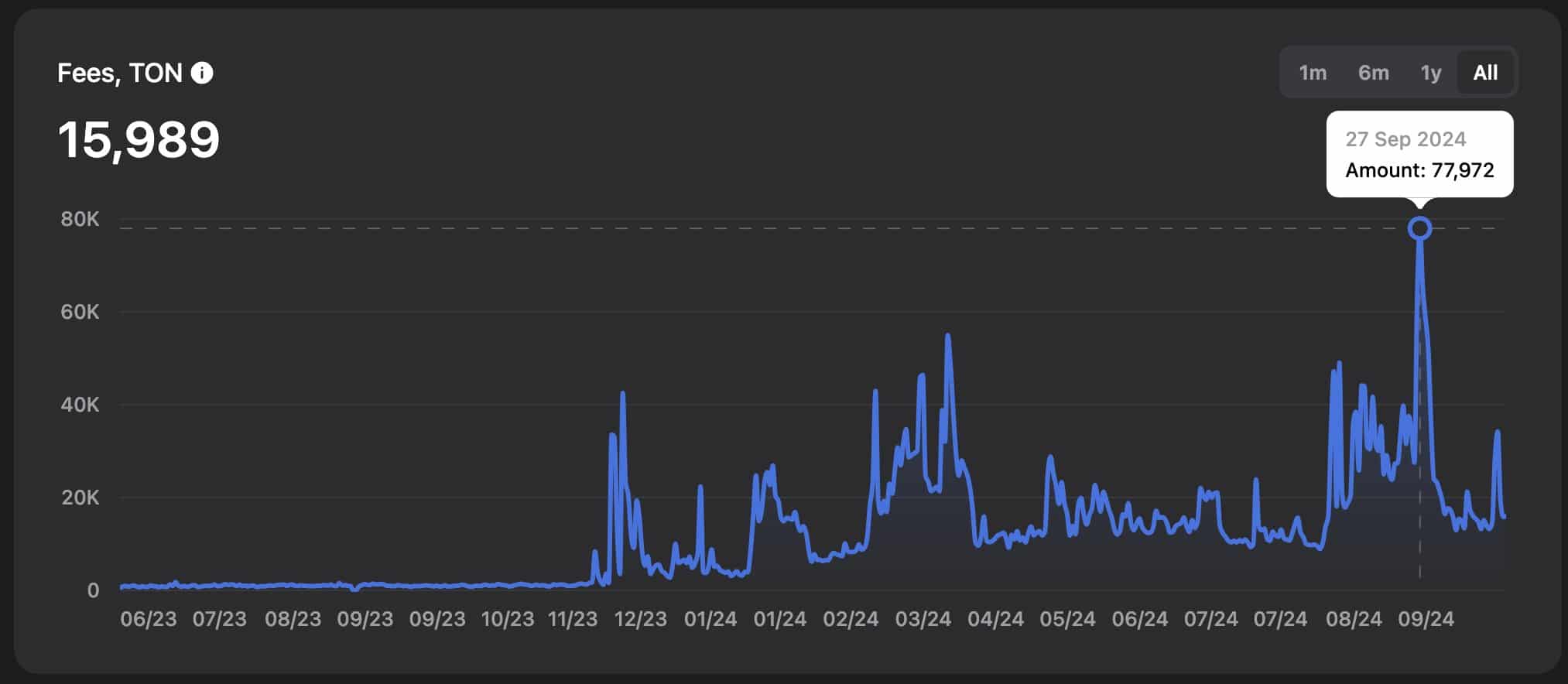

TON fees and supply

Meanwhile, September 27th marked a notable moment in Toncoin’s blockchain history, with users paying a record aggregate fee of 77,972 TON, equating to roughly $451,457 at a price of $5.79.

This highlights an increasing demand for Toncoin’s blockchain services, supporting its long-term growth potential.

Currently, TON has a total supply of 5.11 billion, which contrasts with Solana’s supply of 587.38 million. If TON’s fully diluted valuation (FDV) eventually matches Solana’s, its price could reach $20.47.

Is your portfolio green? Check out the Toncoin Profit Calculator

Source: X

Toncoin’s growing user base and favorable support levels may offer an appealing opportunity for investors.

While current trends look optimistic, sustained buying pressure and a breakout above resistance levels would be essential for a significant upward trajectory.