- BNB rallied closer to $600 amid positive funding rate transition

- Significant liquidation leverage and technical indicators backed market’s bullish momentum

Binance Coin (BNB) has been moving decisively lately, with its most recent gains pushing the altcoin closer to $600 at press time. This uptick in price came on the back of market participants seeing a remarkable change of trend in market sentiment, with funding rates flipping positive after an extended bearish period.

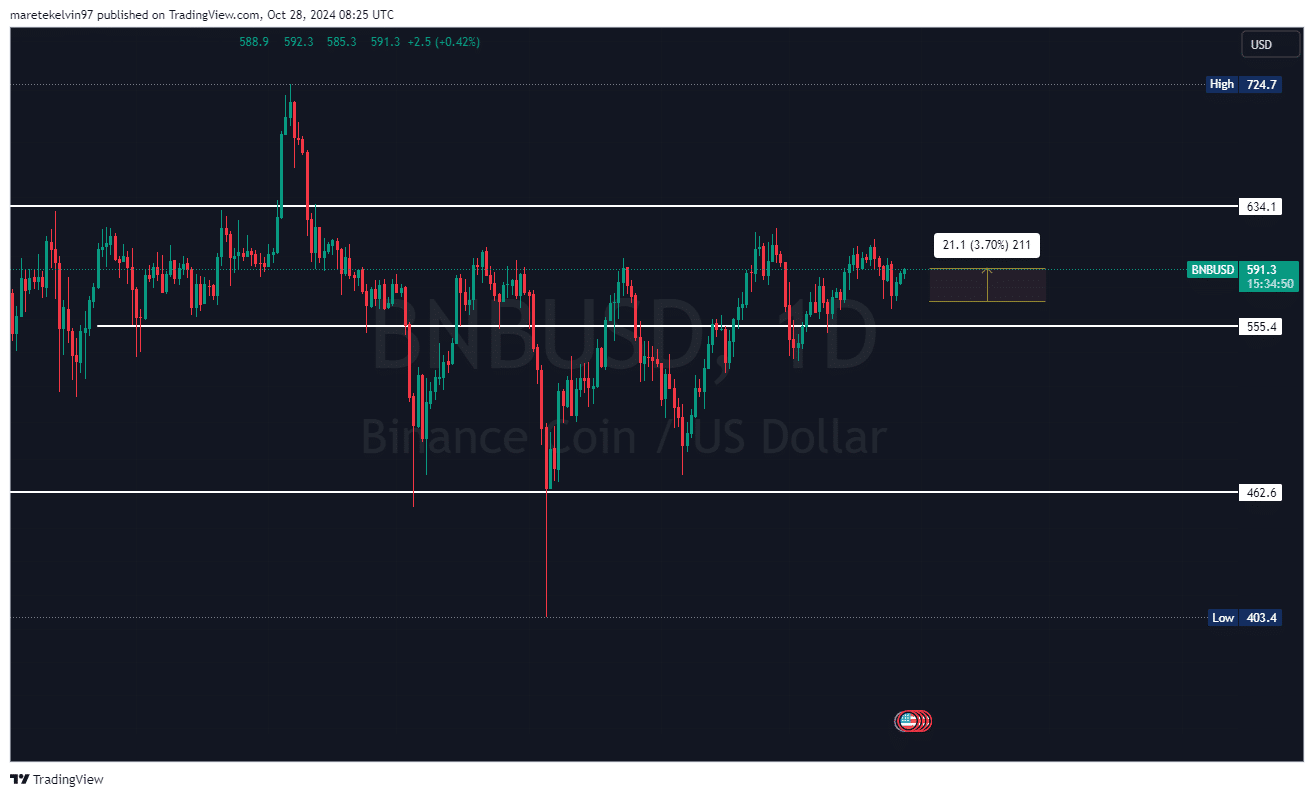

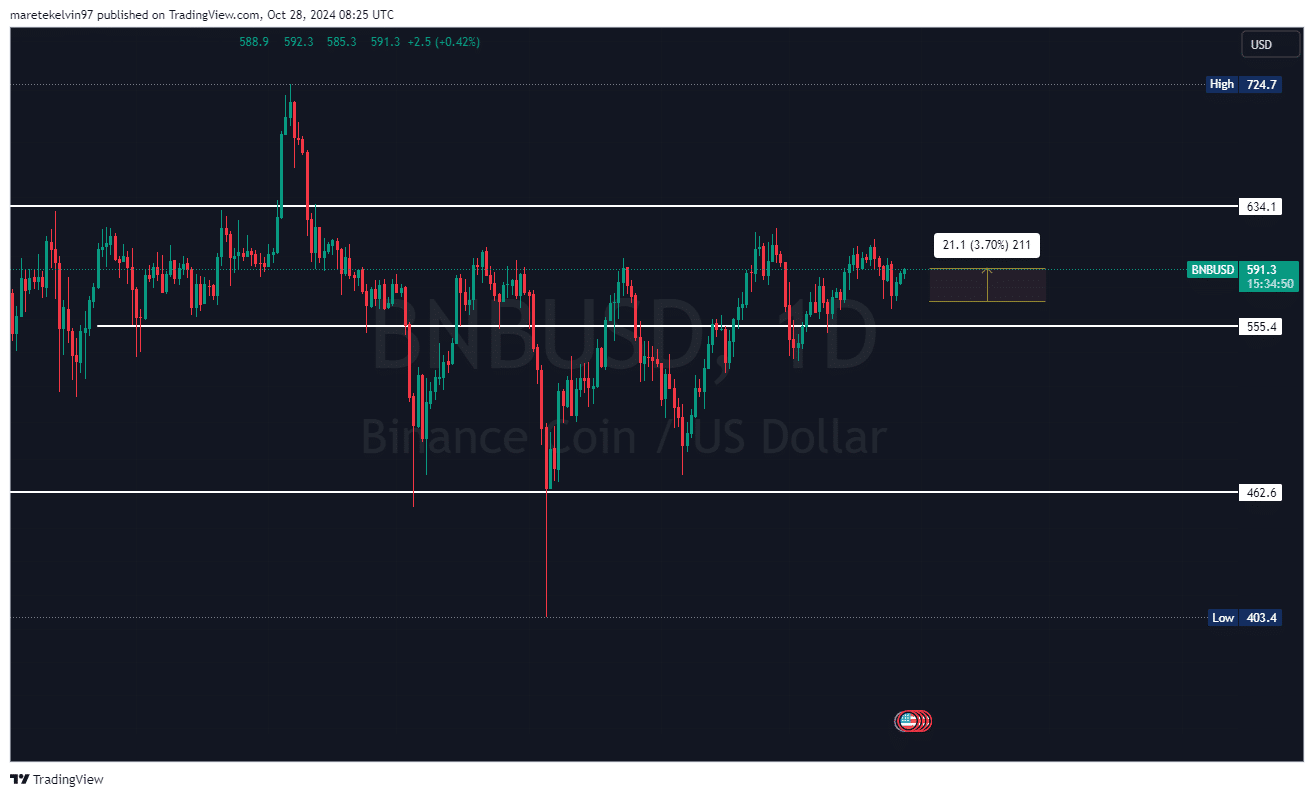

Also, the technical landscape underlined a strengthened market structure. BNB has established firm support at $555.4 while maintaining a strategic spot above its historical $462.6 levels. Both price levels are significant and have faced rejection several times recently.

BNB’s metrics flash green

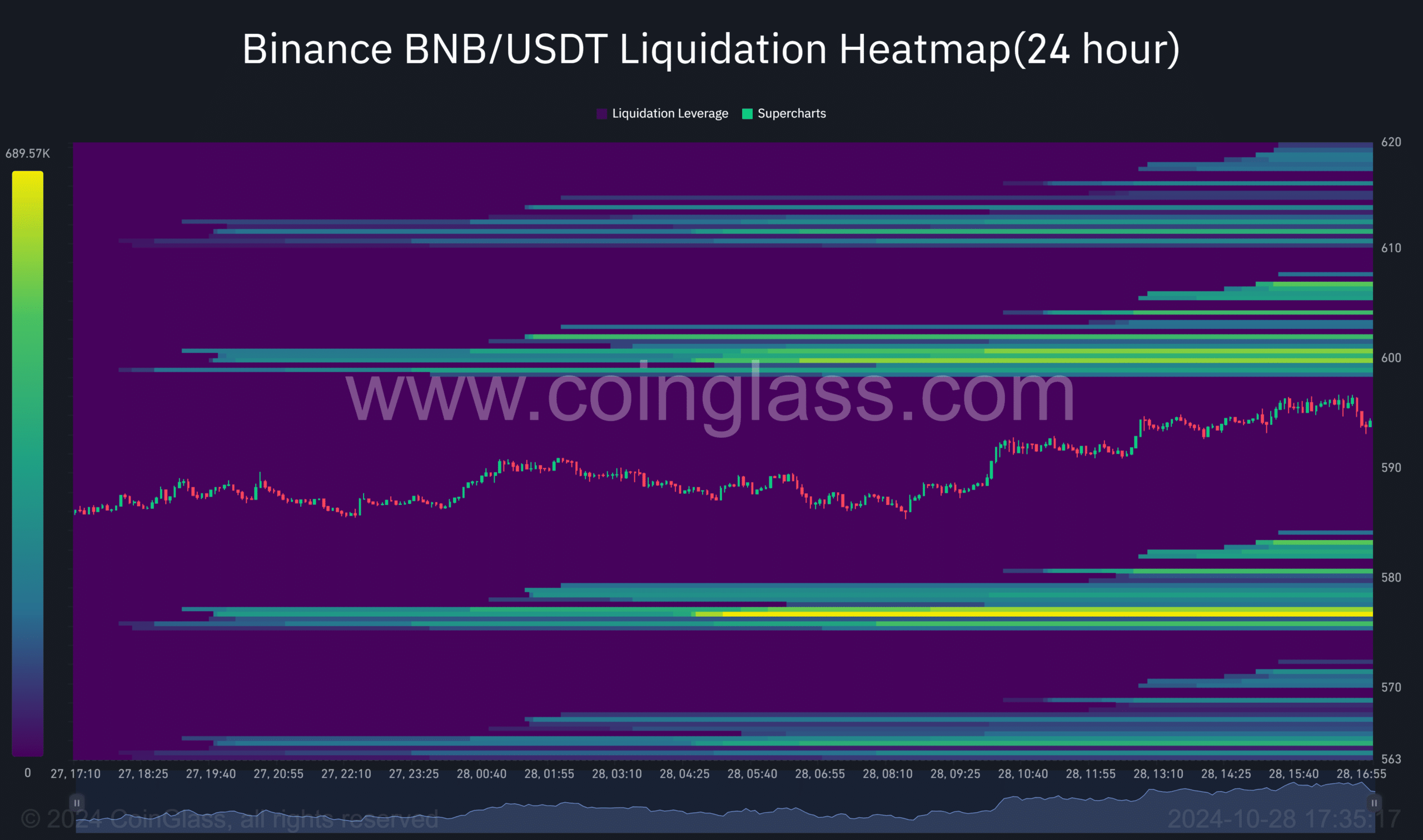

Besides, the liquidation leverage also pressed higher to over 2M – A sign that confidence is still high among the market’s participants.

BNB’s market, hence, seemed to have a bullish bias with a significant liquidation pool at around $600. This could further pull the altcoin’s price north. Here, it’s also worth pointing out that the recent bullish momentum that has been accumulating is directly correlated to liquidity pull from the pool.

Source: Coinglass

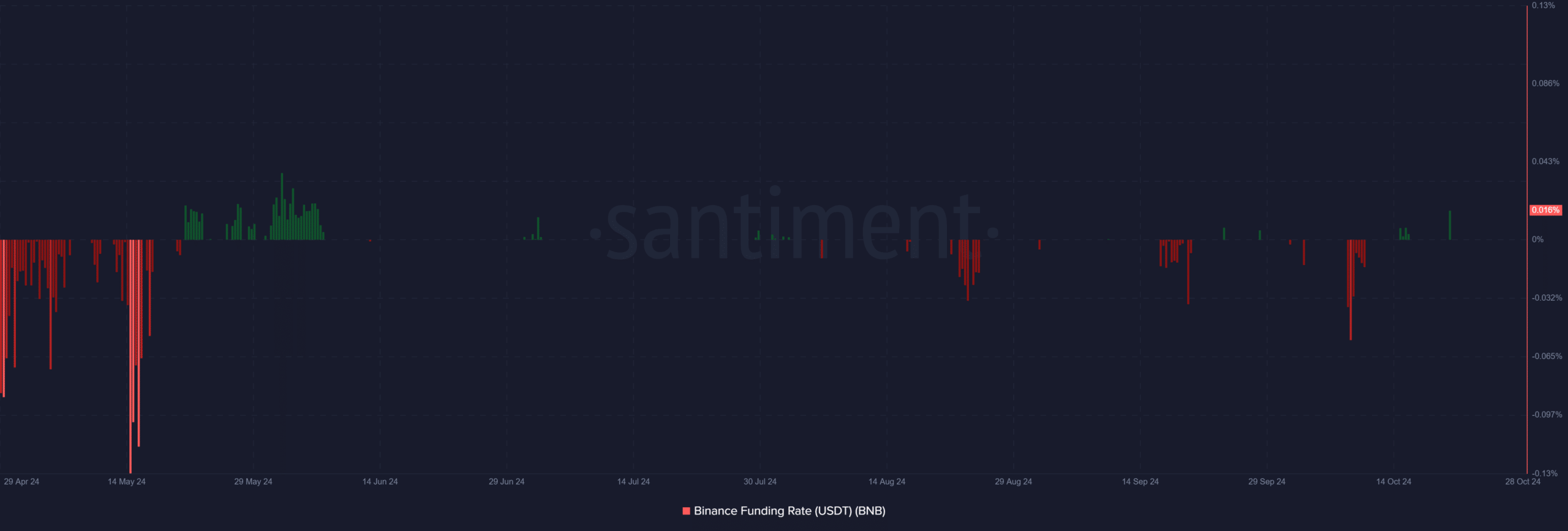

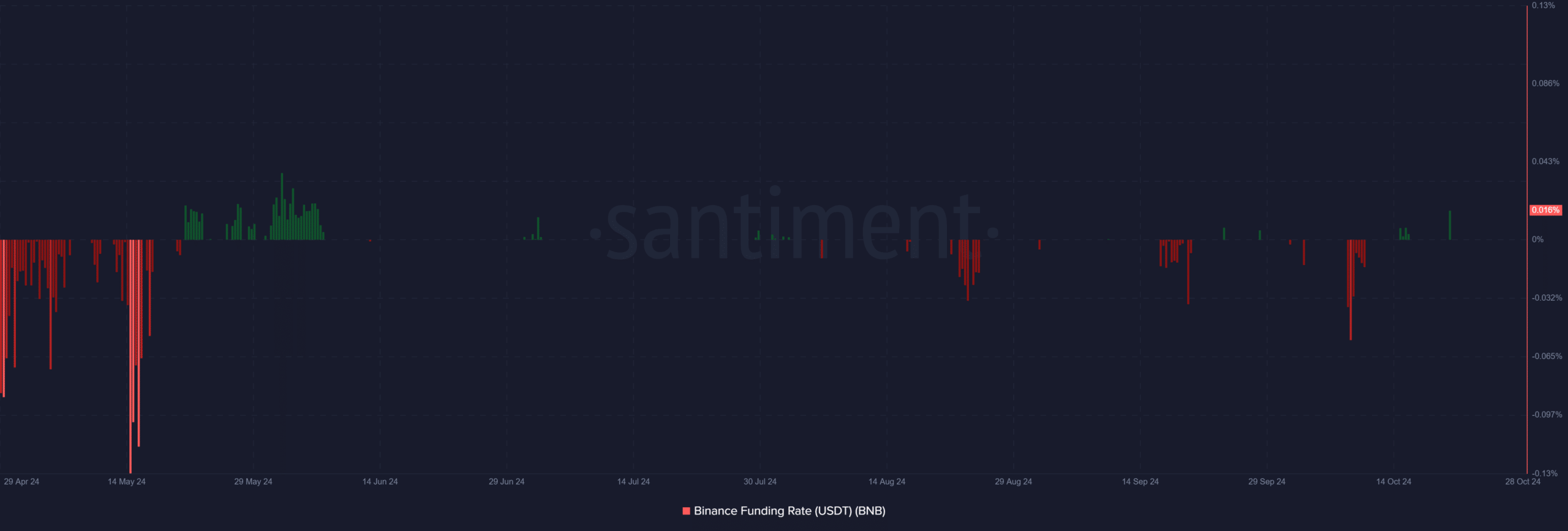

Meanwhile, the shift in funding rates added significant weight to the market’s bullish sentiment. BNB’s transition from negative to positive territory signalled a potential trend reversal, particularly significant when combined with the elevated liquidation metrics.

Such a confluence of indicators typically precedes major price movements.

Source: Santiment

Strategic price levels shape the trading landscape

Consequently, all eyes are now fixed on the critical $634.1 resistance level, which historically has stood as the final barrier to further gains. This level has been historically significant since it has seen several rejections in the past.

However, the strong support at $555.4 can provide a clear foundation for any upcoming uptrend, creating a well-defined trading range. With bullish momentum starting to accumulate for BNB, the resistance level at $634 is now clearly within the sights of the market’s bulls.

The positive funding environment further seemed to reinforce the potential for upward continuation.

Source: TradingView

A clear path forward emerges for BNB

BNB’s bullish market structure, backed by improving funding rates and major liquidation leverage, painted a compelling picture for sustained upside on the charts.

While the $634.1 resistance remains a crucial hurdle, the alignment of positive indicators underlined growing momentum in the near term.