- Analysts tipped SOL for a strong performance after the US elections.

- The analysts cited strong fundamentals and price chart positioning.

Solana’s [SOL] price prospect appeared great in the post-election scenario. According to analysts, the asset’s strong fundamentals and market positioning suggested that the altcoin would likely perform well after the US elections.

One of the analysts, Eugene Ng Ah Sio, cited SOL’s strong defense of $161 as support and the renewed craze for AI meme coins as key factors for the positive outlook. Part of his update read,

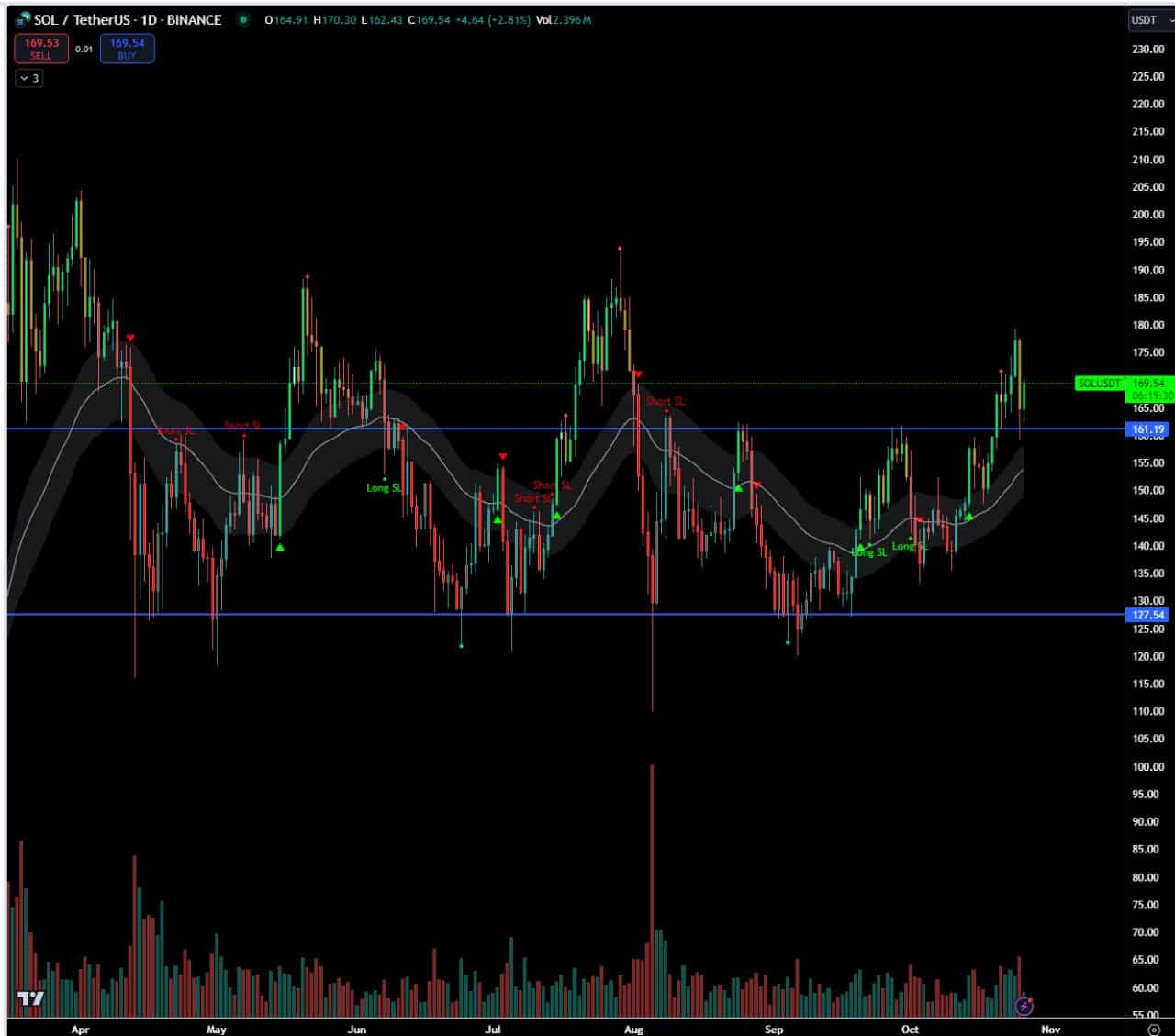

“Technical analysis wise, SOL retesting a 6-month resistance and flipping it into support after showing extreme relative strength was the spot to bid.”

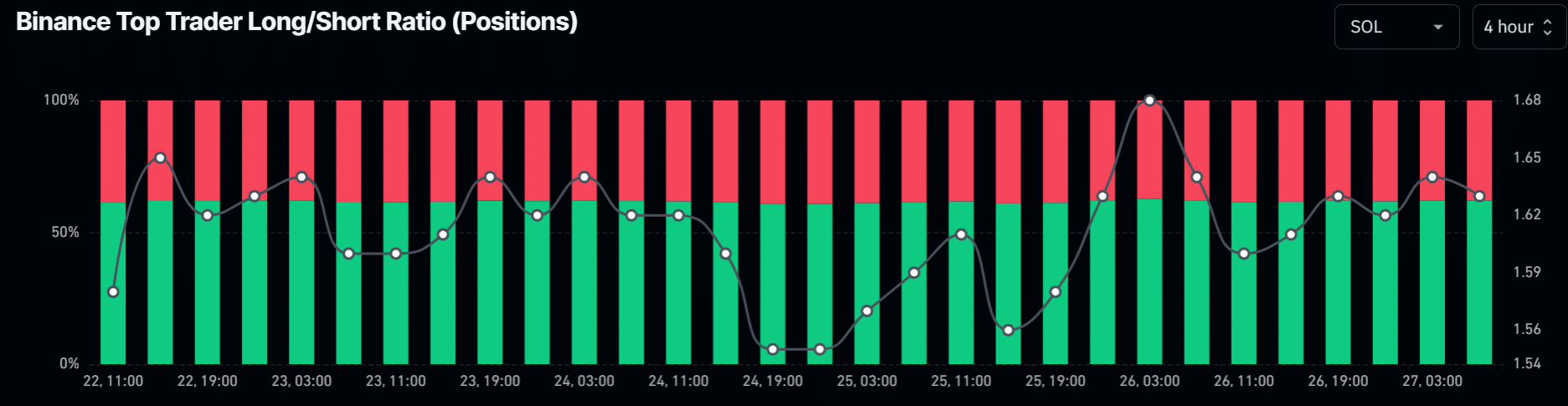

Source: SOL/USDT, TradingView

According to Eugene’s chart, SOL cleared $161, a key resistance level since April. It reclaimed it as a support level and might set the altcoin up for higher targets.

Boost from AI memecoin craze

On the fundamentals side, the recent mania around AI memecoins like Goatseus Maximus [GOAT] was a massive boon for the Solana network. Eugene added,

“$SOL has been the unquestionably clear asset choice since the AI memecoins boom, given how literally everything is happening on Solana today”

Coinbase analysts also echoed the above apparent catalyst for SOL. In their weekly market commentary, David Duong and David Han stated,

“AI agents and memecoins have returns to the spotlight, which appears to have oversized benefits for the Solana ecosystem.”

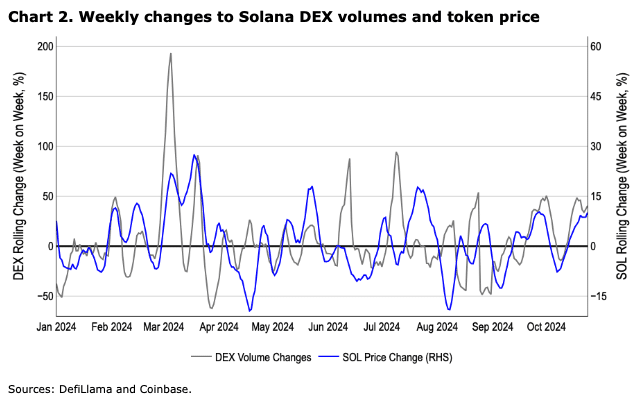

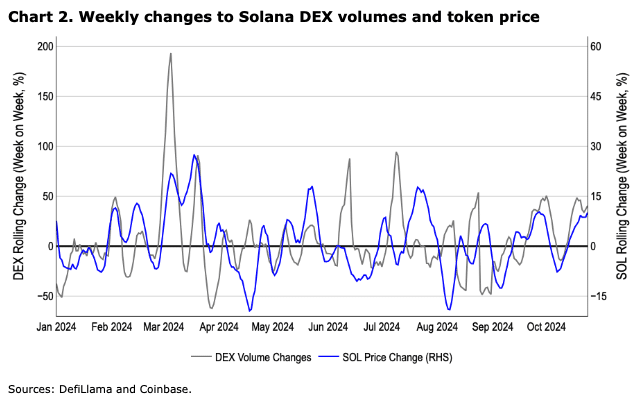

The analysts cited a surge in Solana-based DEX (decentralized exchanges ) volume, which are trading centers for the new AI memecoins.

The analysts noted that the DEX volume exploded to nearly $15 billion, doubling Ethereum’s [ETH] $7.9 billion.

Given the positive correlation between SOL’s price and DEX volume, the altcoin could benefit more if the AI memecoin hype continues after the elections.

Source: Coinbase

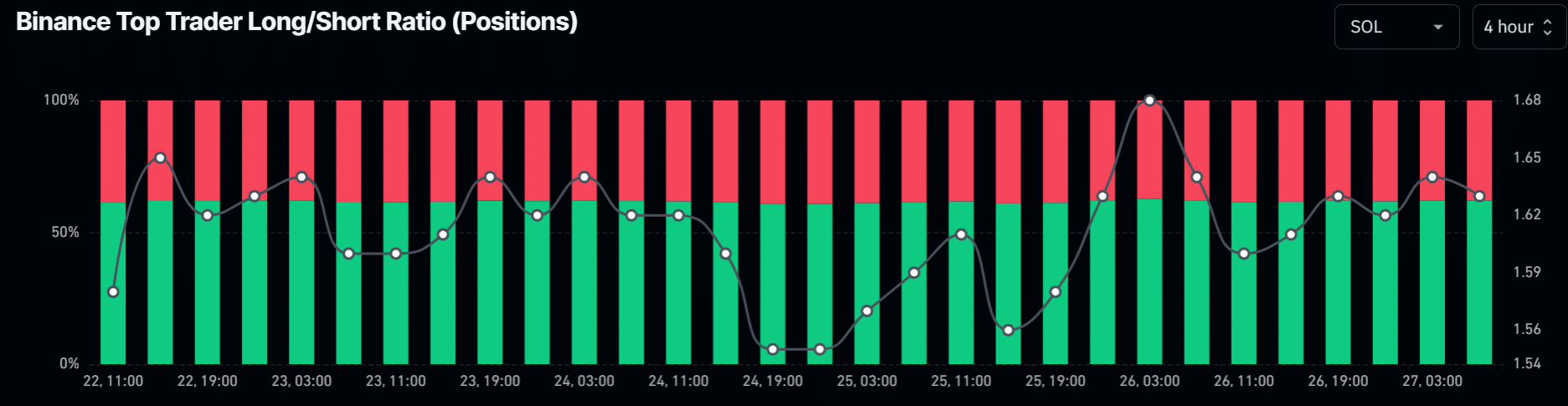

That said, the market positioning at press time was skewed towards bullish bets. According to Coinglass’ Binance Top Trader positioning, 62% of positions were net long on SOL.

This indicated a strong conviction of positive price prospects. If the trend continues, SOL could eye the $180 or $185 target in the short term.

Source: Coinglass