- Currently trading within a bullish ascending triangle, AXS is nearing a support zone that could spark a major price rally.

- Short-term downward pressure is anticipated as indicators suggest temporary weakness.

Axie Infinity [AXS] has underperformed in recent weeks, dipping by approximately 5.42% over the past month after reacting off a major resistance level.

As the market remains shadowed by the prevailing bearish sentiment, it’s probable that AXS’ dip will continue, as several metrics support this outlook.

A necessary dip for an upswing in AXS

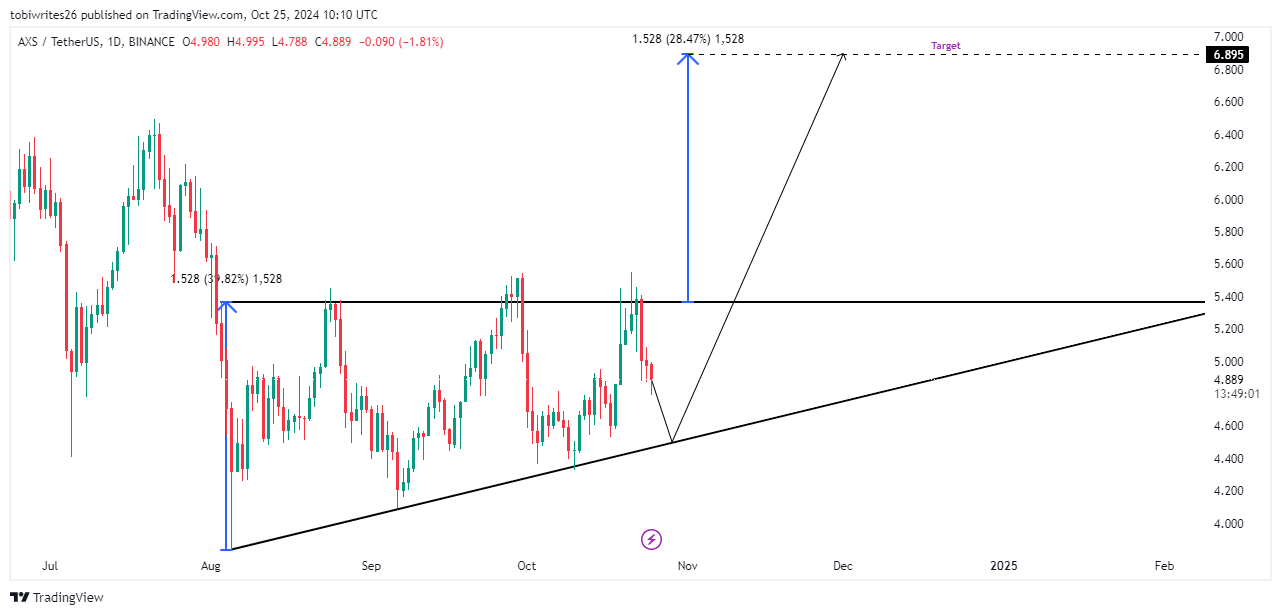

After bouncing off the resistance zone at $5.366 within its ascending triangle pattern, AXS has declined, and this downward trend may continue toward the diagonal support of the formation.

If AXS reaches this support level, it could resume its upward momentum, with an initial target at the pattern’s resistance zone.

A successful breakout above this resistance could drive an additional 28.47% surge, bringing AXS to $6.895. This projection is based on the measured distance between the resistance and support levels within the pattern as indicated in the chart below.

Source: Trading View

Traders shift to sell as AXS faces downward pressure

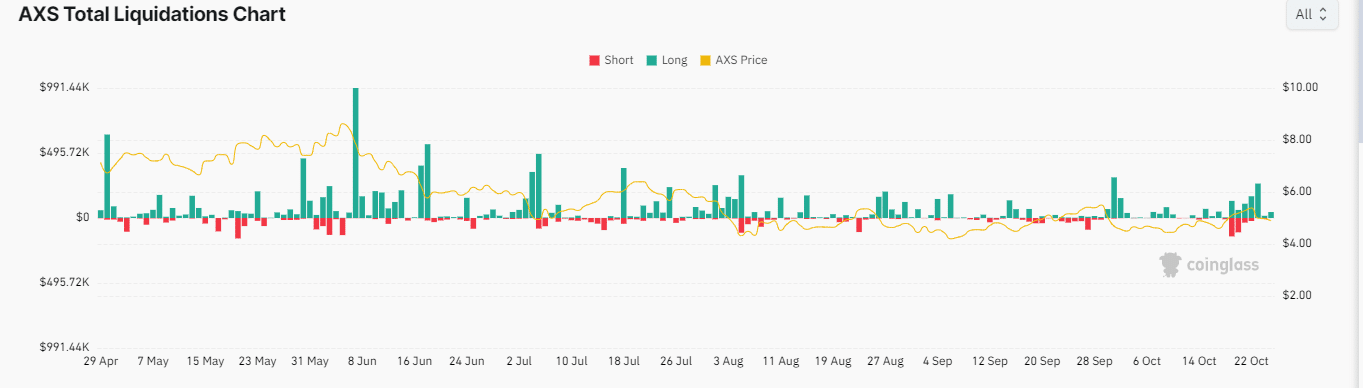

On-chain data from Coinglass analyzed by AMBCrypto reveals that traders are increasingly selling, signaling potential for further price declines.

Recent liquidation data highlights significant losses for long traders, with $50.56K out of $51.82K liquidated in the past 24 hours attributed to those betting on an AXS price rise.

This shows that short traders have gained control, successfully betting against an AXS rally and likely pushing prices lower.

Source: Coinglass

Additionally, the funding rate at press time remains negative, which reflects a higher demand for short positions as short traders are willing to pay long traders to hold their short positions, thus reinforcing the downward pressure on AXS.

If these metrics persist, AXS’s decline is likely to continue until a shift in market structure, potentially near the pattern’s historical resistance zone.

Gradual supply squeeze builds up

While AXS derivative traders are largely short, expecting a price drop, activity in the spot market reveals a different sentiment as traders prepare for a rally.

Is your portfolio green? Check the Axie Infinity Profit Calculator

According to Coinglass, $417.88K worth of AXS has been withdrawn from exchanges over the past 24 hours, reducing available supply and contributing to a potential supply squeeze.

This shift suggests that the bearish sentiment may be approaching its end, with a turning point likely on the horizon for AXS as upward momentum builds.